February 2023 Update: Unless you have been hospitalised, once you test negative, we can get you covered.

Yes, we know… another article about Covid-19.

We’re as sick of reading about it as you are.

But it has been nine months since our last one, so we thought it’s time for an update.

And that’s why we are making this article a little bit different.

Instead of warning against Covid’s potential ills, we’re going to assume that you already have or are going to contract THE VIRUS.

Yes, for a second, let’s assume that you are licking lampposts, having parties with your coughy mates, and ignoring the advice bombarding you from every direction.

Of course, you can catch the virus if you do none of those things and live your normal day-to-day life.

However, it is far, FAR more fun to imagine you’re a pure eejit.

Please note, this article is hypothetical, and we love you regardless ?

We also know that you are as tired of the pandemic as we are.

That being said, we also know that you probably have a few questions about Covid about life insurance like “what’s the bleedin story?”

Thankfully, we are here to answer those questions.

So, let’s assume that you have caught the dreaded Covid, or you will shortly.

Here are a few of the questions that you might have about life insurance…

Assuming you weren’t hospitalised, with one of our insurers, you can get cover as soon as you are fully recovered and back to your day to day activities.

You will get a life insurance quote as per normal pre-Covid times.

Remember that, a time before Covid?

No, me neither.

However, some insurers have an arbitrary 30 days post recovery.

As above, once you’re back to living your best life, you can get mortgage protection with one of our insurers on the condition that you weren’t hospitalised.

Well, this is awkward.

The good news is that we can get you cover as soon as you’re back to your normal self.

The bad news is that we would prefer it if you didn’t call over for that dinner party on Saturday night.

Apologies.

The same is actually true for your mortgage protection.

Go, get yourself better, then start that application process. Once you are fit and healthy, there won’t be an issue with either your life insurance or mortgage protection application.

Of course, other factors come into play, so the best thing you can do is get in touch with us, and we’ll talk you through it.

Scheiße.

You’re going to have to go back to the insurer and tell them.

Unfortunately, depending on the insurer, they will revoke your cover and postpone offering insurance until you’re recovered for 30 days.

Of course, you could forget to tell the insurer, but if you’re unfortunate enough to have a claim, they will refuse to pay it.

No, once your policy is in place, you don’t have to tell your insurer about any new health conditions that arise, including COVID.

That’s why you should start your policy asap, especially if it’s a mortgage protection policy and you’re due to close shortly.

At the start of the pandemic, the insurers pretty much stopped taking on any risk.

However, soon it was apparent that Covid primarily caused deaths in older people and those who had underlying health problems.

Of course, there are exceptions, but numbers-wise, those are the unfortunate people it hit the hardest.

Consequently, the insurers didn’t offer cover to older adults or those with certain underlying health conditions. This restriction lasted for around three months.

But fast forward 18 months, and they are considering cover for everyone, including the elderly or those with a co-morbidity (e.g. high BMI, diabetes, heart issues).

We haven’t received advice from any of the underwriting departments about an imminent change due to the new variant.

Insurers don’t treat unvaccinated people any differently.

They assess the risk of the underlying condition rather than whether someone is vaccinated.

So a person with T1D will be underwritten in the same way as someone with T1D who is unvaccinated.

Covid has changed many things, but it doesn’t change how your application works as a healthcare worker.

You will still be treated just the same as you were previously. After all, you healthcare workers have plenty of other difficult issues to deal with daily, Covid aside.

Thank you. ?

Here at lion.ie, we are optimists… an optimistic life insurance advisor seems paradoxical, but there you go.

So we hope that the impact of Covid-19 will lessen even further over time.

Any restrictions relating to it in the life insurance space will likely disappear.

It is an ever-changing sphere and one that the insurers constantly review, so all we can say for now is to watch this space.

It depends on which vaccine kills you.

A bit of gallows humour there to lighten the mood because we’re all so sick of vax-chat.

Firstly, it is unlikely (in fact, make that ‘extremely unlikely’) that the vaccine will kill you. If you are medically at risk from the vaccine, your doctor will insist that you do not take it.

*However, to answer your question, you are covered in the unlikely case that taking the vaccine results in your death.

Em, there’s hasn’t really been a peep about Long Covid from the insurers.

**It’s the one condition I was sure they would exclude from income protection policies, but no, the insurers are still happy to pay your claim if you cannot do your job due to Long Covid.

However, getting a medical practitioner to confirm a diagnosis of Long Covid may be an issue ?

Of course.

It may take a little longer than usual. You may even need to supply more details about your medical situation than before.

Even so, Aviva, Irish Life, New Ireland, Royal London and Zurich Life would be only delighted to take your hard-earned!

If you’re currently in isolation after a positive test or arriving back from a foreign country, then maybe hold off until you get the all-clear.

But apart from that, if you need life insurance, mortgage protection or income protection, we’d love to help.

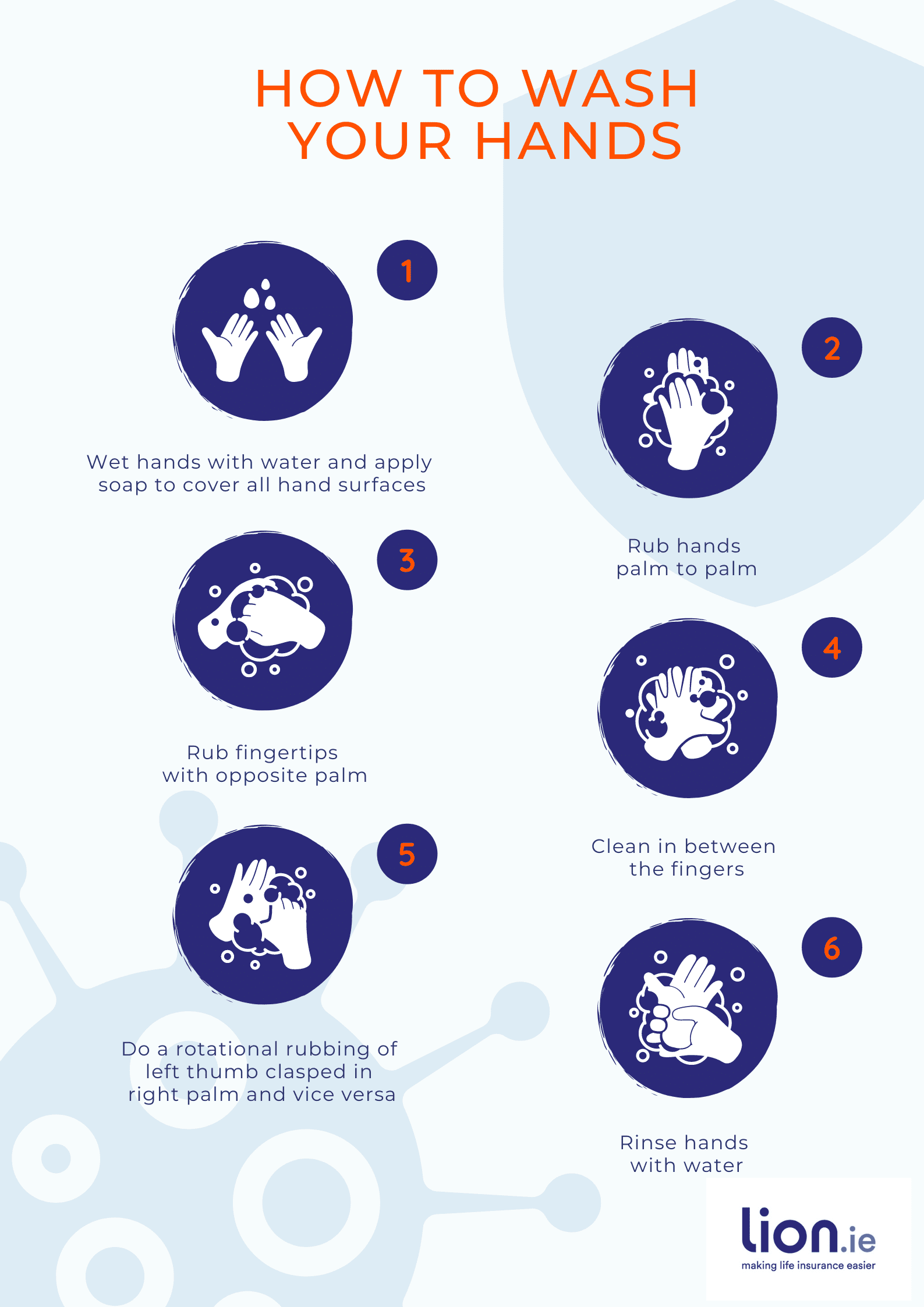

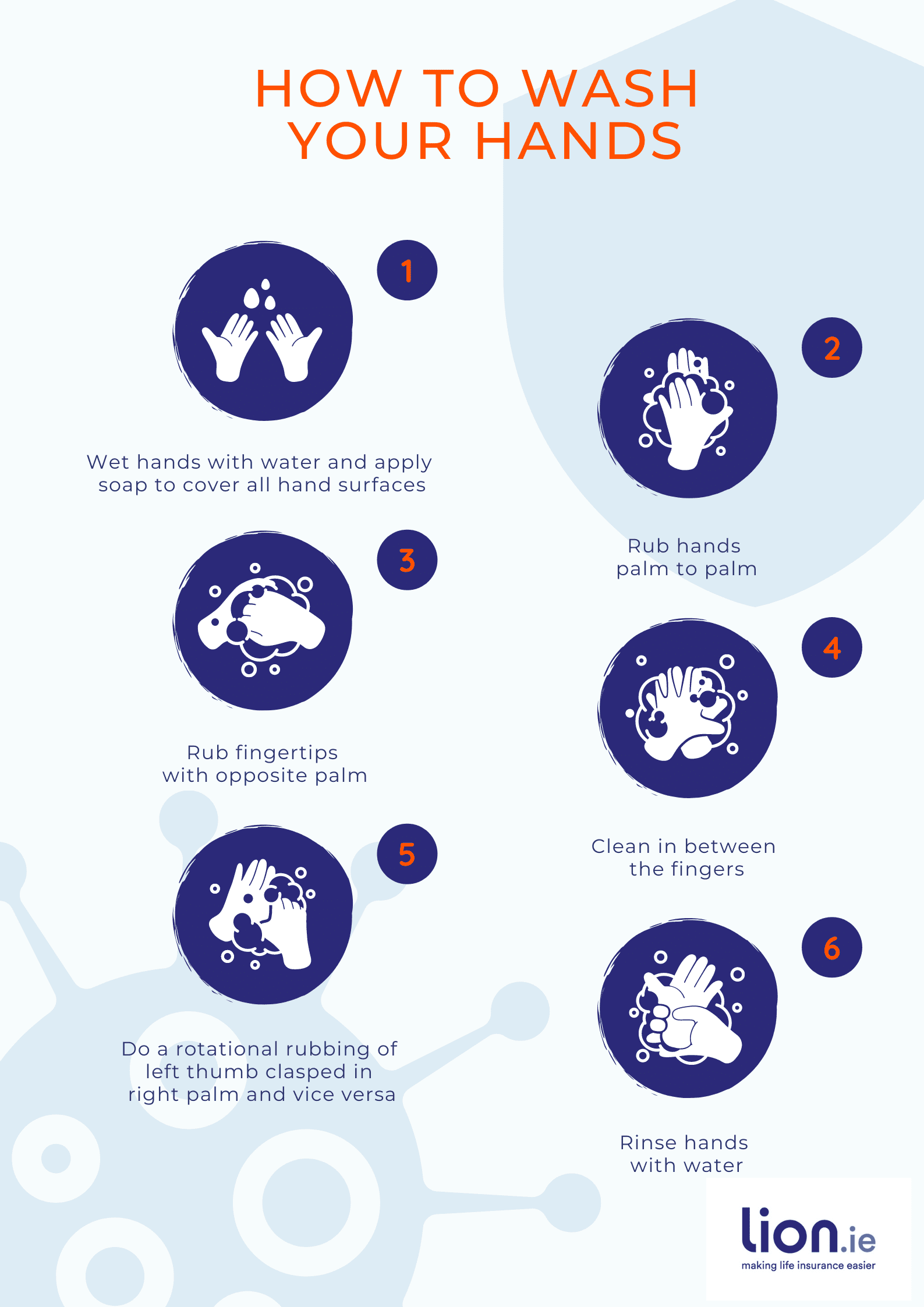

Complete this short questionnaire, and I’ll be back in less time than it takes you to wash your hands.

Thanks for reading!

Nick

Ph 05793 20836

e: nick at lion dot ie

Sources:

*https://www.zurich.co.uk/insurance/coronavirus/life-and-critical-illness-insurance-customers

**https://www.newireland.ie/faqs/

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video