Table of Contents

We understand if you prefer not to discuss your health over the phone. That’s why we don’t ask for your phone number. We can arrange your policy over email only. But if you’d prefer to discuss your options with us, we’re only a phone call away.

I’ve written dozens of blog posts on the illnesses that affect getting mortgage protection, life insurance and income protection. If you’d like to know how your condition will affect your application, the blogs are the best place to start.

I’d be stunned (and intrigued) if you have a condition that we haven’t encountered before. If we haven’t, we’ll find you an insurer who has.

Remember that one time you had a headache, and you googled it, and WebMD told you that you were gonna die because you had an incurable brain parasite from Brazil?

And even though you knew it was probably just a tension headache, there was that one second where you thought it’d be kinda funny if they played ‘Highway to Hell’ at your funeral.

Googling your symptoms never does any good – especially if you’ve recently been diagnosed with a chronic illness. Every little thing seems to come with a massive ‘DANGER’ warning.

But don’t worry: there’s hope. Doing these few things will give you peace of mind.

If you don’t have Life Insurance yet, it’s not all doom and gloom. There’s no need to abandon all hope, ye who enter.

Now you’ve been diagnosed, it makes sense to think about getting Life Insurance – but don’t worry: an illness doesn’t mean the insurer will automatically turn you down for cover.

So the process at a run-of-the-mill life insurance broker will look something like this:

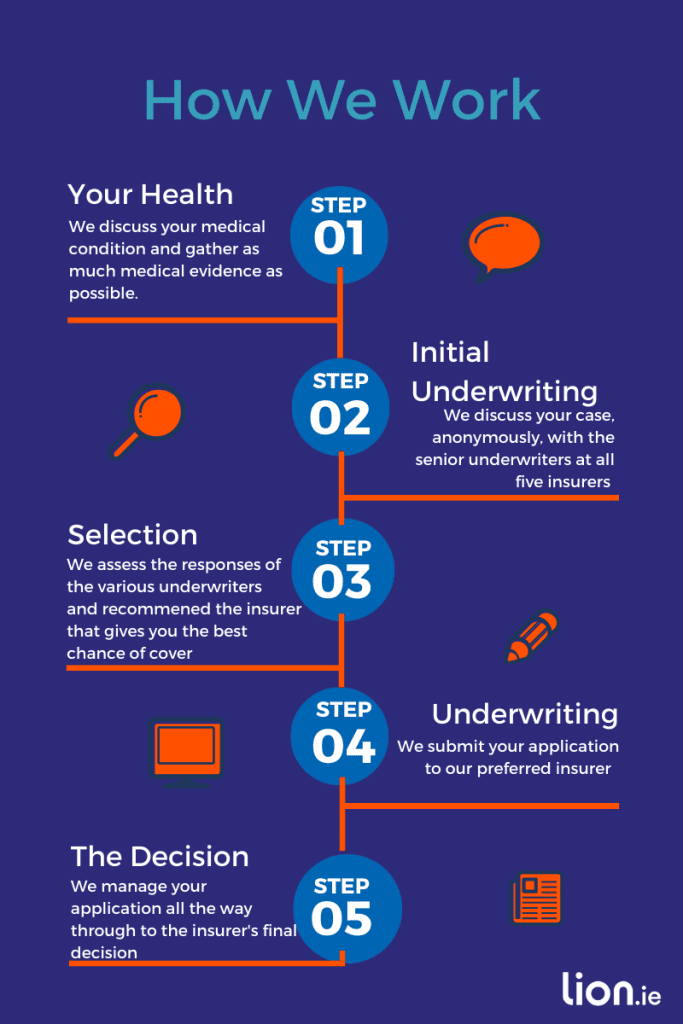

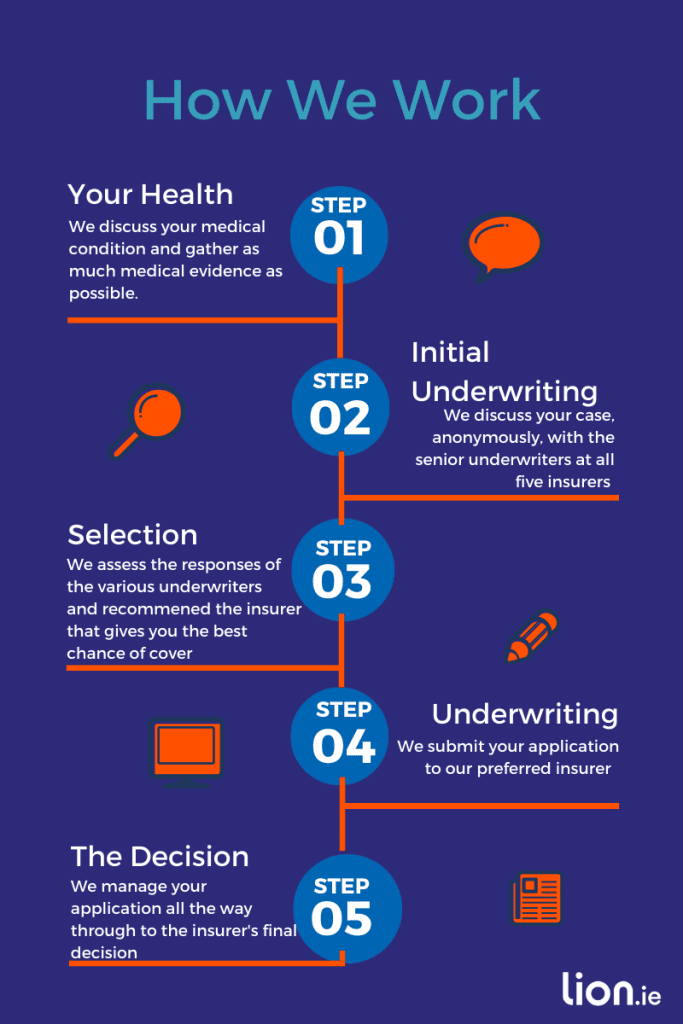

We’re not normal brokers, we’re life insurance nerds ? so we do a lot more groundwork to make sure you don’t just get cover but you get it at the lowest price.

How do we work such wizardry?

When you get a mortgage in Ireland, you have to get Mortgage Protection which will clear your mortgage when you shuffle off.

If you’re in the mortgage process and you have a chronic illness, give your advisor (or me) a buzz and let us know about your illness so they can apply to the most sympathetic insurer.

In most cases, chronic illness won’t affect your ability to get Mortgage Protection unless you’ve recently been diagnosed or your medication isn’t keeping your condition under control.

That said, it’s super rare, but the insurer can refuse cover if the condition isn’t under control, for example, if you have diabetes with a high HbA1c reading – that’s typically 9+, FYI.

Should you use a specialist broker or the bank to arrange your mortgage protection?

If you plan on staying at work, you should look into Serious Illness or Income Protection. With Serious Illness, you’ll get a payout if you get sick with any of a list of specific illnesses – usually the really bad ones like cancer or a stroke.

I prefer income protection:

Income Protection kicks in if you can’t work for any reason for longer than a certain length of time and will pay you up to 75 per cent of your income – which you’ll be glad of if you end up out of work for more than your measly work-allotted three days.

If you’re young and healthy, applying for insurance is handy. You use a quote calculator online, get in touch with a broker/bank/insurer and away you go.

If you’re unwell, you can request the same quote with no bother, but you’ll have to disclose your medical issue – which is where it starts to get messy.

How much your health will affect your price will depend on your illness. If it’s mild, you might get away without having to pay extra. If it’s moderate, you may have to pay an increase. If it’s a severe case, you’ll face a premium increase – or the insurer may decline or postpone your application.

Sometimes, the insurers will essentially hedge their bets to see how you respond to any treatment or how you’re doing six months down the line.

The insurer will also probably request a PMAR (Private Medical Attendants Report), a medical questionnaire that they send to your GP.

The questions ask:

It’s so the insurer can get an accurate look at your health – and the odds of anything happening to you.

The insurer asking for a PMAR doesn’t necessarily mean you’ll have to pay a higher premium; it could just be that they want to make sure the information you’ve given is accurate.

Once they have the form, the underwriters (the dudes in the depths of the dungeon who fight dragons and do the statistical analysis on applications) will do the maths, and your insurer will send a quote back to you.

Just a heads up, though: GPs can be woeful with the PMAR, so it might take them a few weeks to send it back to the insurer. Sometimes it can take them so long that you might think your PMAR has been nicked by the same lads who stole Shergar, so don’t be afraid to get onto your GP if it’s been more than a week or five.

Life Insurance companies can already feel like a “me vs them” situation, which worsens if you’re not in perfect health.

If you have some health issues, they see you as more likely to claim.

It’s what they call risk.

They make billions of euros by managing this risk very well.

If they see you as more likely to make a claim/riskier, they’ll charge you more.

But some insurers will charge you more than others

And who wants to pay more than they have to?

You gotta fight for your right to party get the best price…by making sure you apply to the most suitable insurer for your health condition.

It can feel like one long cod. And I get it, I do, but you can beat the insurers at their own game if you have the right knowledge.

A specialist life insurance broker is handy to have in your corner but make sure they work with all five insurers;

They will know how each insurer underwriters various illnesses so they can match you up with the insurer that takes the most understanding view of your health condition.

Stack the odds in your favour, and get a professional on board.

So I’m a specialist life insurance broker. Hello there, pleased to meet you. ?

And I arrange four main types of insurance: Life Insurance, Mortgage Protection, Serious Illness Cover, and Income Protection.

Suppose you’ve got a fairly serious health condition, chronic illness, or issues with your health.

In that case, you’re already over a barrel in that getting full Income Protection or Serious Illness Cover won’t be a runner although you may get cover excluding your pre-existing condition.

Income Protection is super useful, even if it won’t cover the illness you already have.

It’s usually an illness that blindsides you out of nowhere that causes the problem, not the one that you are aware of and taking steps to control.

Moving on to Life Insurance and Mortgage Protection.

Life Insurance exists to protect your family financially if the worst were to happen, and Mortgage Protection covers the bank’s arse when you’re getting a home loan from them. If you die, it pays off your debt,

Let me say this again: it’s crap that the insurers and the banks make it harder for you to get Mortgage Protection or Life Insurance if you have an underlying health condition. No doubt, it can feel unfair. It’s not your fault that you have bad health – but you do have options.

Sometimes the insurers might turn you down or postpone offering cover.

It could even be that you’ve spoken to someone in the bank, and they’ve scared the bejesus out of you about your chances of getting insurance.

But here’s the thing.

If your bank turns you down, it doesn’t mean the other insurers will too (regardless of what your bank might say)

See, the banks work with just one insurer (many of them work with the same insurer). They’re not going to recommend you apply to one of their competitors based on your health condition.

So what you need is the option to go to all five insurers with your case. Remember what I said about working with a specialist life insurance broker? It’s particularly true for people with quirky health conditions.

Blowing our own trumpet (read the 1450+ reviews), we’ve worked with hundreds of clients with health issues and got them covered.

It’s what we do here at Lion HQ.

We work with five insurers giving you the best possible chance of coverage.

Don’t let your health condition discourage you from applying for Life Insurance or Mortgage Protection. It’s possible if you do your homework and nab a specialist broker.

That’s why I’m here, to guide you through the whole journey, from beginning to end.

There are quite a few insurers in Ireland, which means that if you go it alone, you could spend your days stuck on the phone, pressing one for this, two for that, feeling your life ebb away.

When you finally speak with someone (let’s call them Johnny), they haven’t a clue about how your condition will affect your application. Johnny will send you a 20-page form to complete, cross their fingers and hope for the best.

Instead, let us do all of that grunt work for you.

Calling us is like contacting all five insurers at once. Where else can you get this kind of service?

We’re here to help YOU. The next step is to either fill out this questionnaire or arrange a call back here.

Talk soon!

Nick McGowan

lion.ie | making life insurance easier

This page was first published in 2018 and has been updated regularly since then.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video