Table of Contents

10-second summary: You can still get life insurance or mortgage protection if you’re living with Chronic Fatigue Syndrome (CFS/ME). Insurers mainly look for stability — flare-ups, work history, and how the condition affects your day-to-day life — but most people get cover somewhere once things have settled.

Editor’s note: First published 2015 | Fully refreshed in 2025 with updated underwriting rules, GP report timelines and insurer criteria for CFS/ME.

If you’re living with CFS/ME, you don’t need me to tell you how frustrating it is.

Some days you’re grand, other days you feel an-tuirseach — wiped out, foggy, sore, and unable to function properly.

CFS can follow viral infections or stressful periods. It comes in waves, affects people differently, and doesn’t follow neat rules. That makes it frustrating for doctors and even more frustrating for sufferers.

But there’s good news: insurers see CFS/ME all the time.

You’re not an outlier.

Let’s go through the questions people ask me most often.

Yes.

Once CFS/ME has been diagnosed and other causes have been ruled out, it’s possible to get life insurance and mortgage protection.

If you need a deeper explanation of how life insurance works in general, see Life Insurance Explained.

Better again — if your symptoms are stable, you’re working, and you apply to the correct insurer, the price can be the same as everyone else.

Often, no.

If your symptoms are well controlled and your day-to-day life is reasonably stable, cover can be standard price.

You may see a loading if:

If mental health is part of your story, you might find this helpful: Depression & Life Insurance.

Different insurers take very different views on CFS, so going direct to just one can backfire.

That’s where matching you with the right insurer first time makes a massive difference.

No.

Life insurance and mortgage protection don’t contain exclusions (other than suicide in the first 12 months).

The insurer will either:

If you died due to CFS, the policy would still pay — full stop.

You’re covered.

Your health is locked in from the day the insurer activates your policy.

You don’t have to tell them if:

They can’t review, raise your price, or cancel your policy because of changes after you’re covered.

Sometimes — but only in mild, long-term-stable cases.

If approved, the insurer may exclude Total Permanent Disability or Loss of Independent Living.

It’s still worth checking because you’d be covered for big conditions like cancer, heart attack or stroke.

If you want to understand Serious Illness Cover better, see Serious Illness Cover Explained.

Short answer: rarely.

If your CFS was extremely mild, fully resolved for over 5 years, and you’ve had zero symptoms, some insurers may consider income protection without exclusions. But that’s the exception, not the rule.

Most of the time:

That’s why I prefer to take a look privately first before running any applications — so you avoid unnecessary declines.

If you want a clear, realistic breakdown of icnome protection, here’s the main guide: How to Choose the Right Income Protection Policy.

Expect questions about:

They may request a GP medical report (PMAR). Insurers always cover the cost.

I’ll match you with the insurer most open to your situation.

They all see CFS differently, so order of application matters — a lot.

Fill in this short questionnaire and I’ll take a look myself:

Life Insurance & Mortgage Protection — Health Questionnaire

I’ll come back with straight answers — no waffle, no sugar coating.

Thanks for reading

Nick

Written by Nick McGowan, QFA RPA APA

Nick is a qualified financial advisor and founder of Lion.ie, an independent Irish life insurance and income protection brokerage based in Tullamore. He’s been helping people get fair, transparent cover for over 15 years — and was named Protection Broker of the Year 2022.

If you’d like straight answers (without the sales pitch), learn more about Nick here.

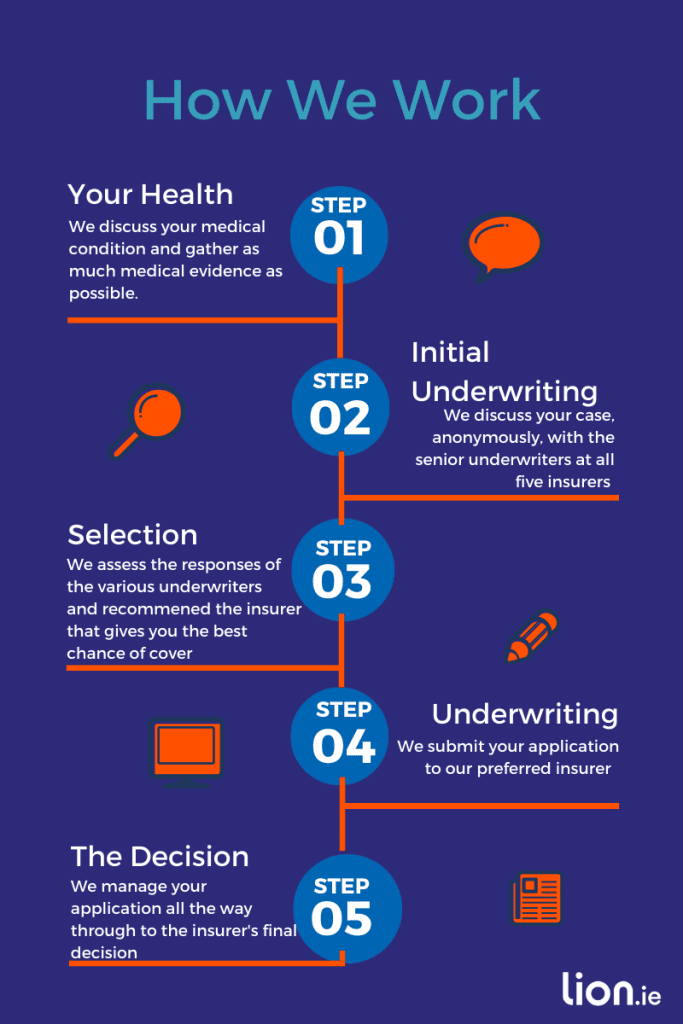

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video