Table of Contents

Complete this questionnaire and I’ll send you a quote taking your CFS into account

From speaking to clients with CFS, I know it’s an awfully frustrating condition that can really wear you down.

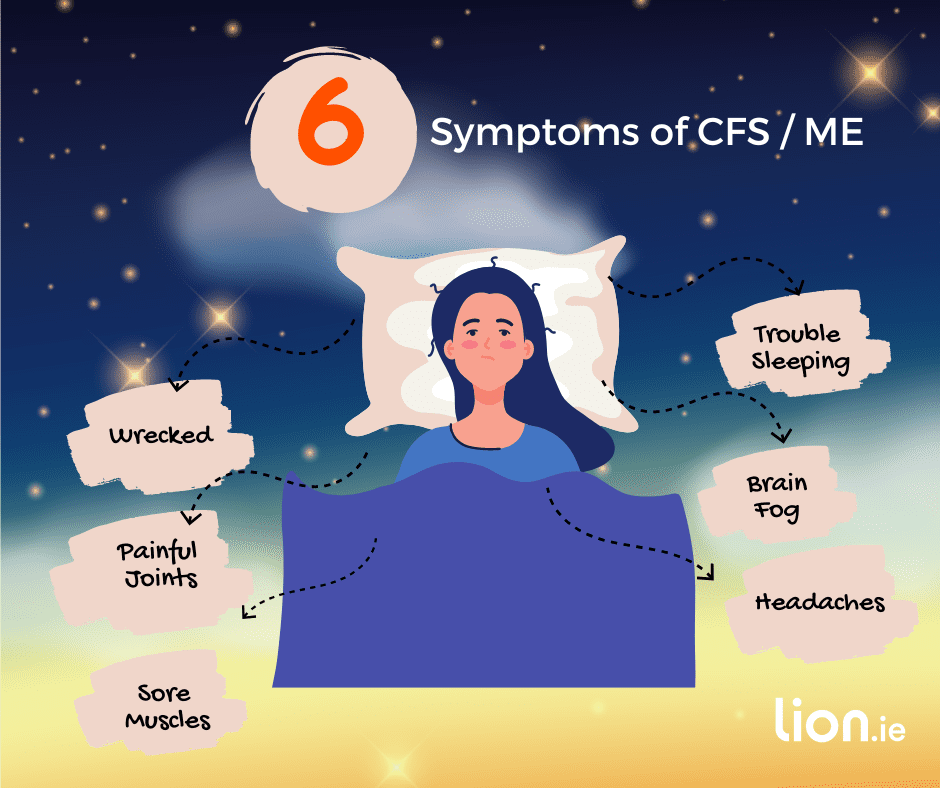

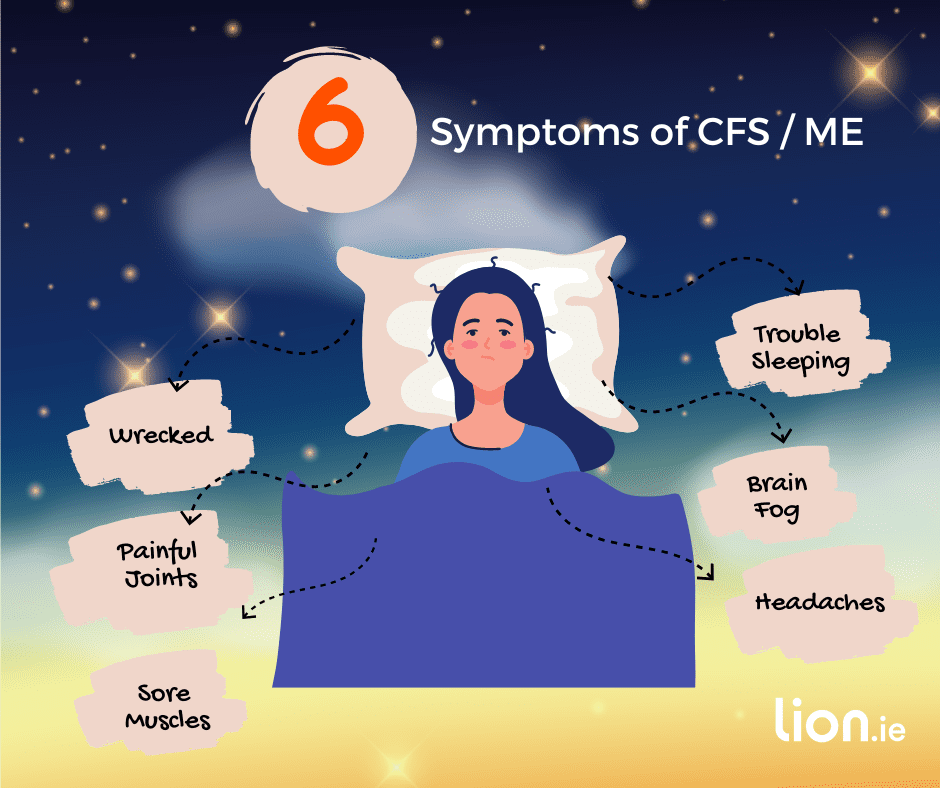

You feel an-tuirseach all the time, your muscles and joints ache, and you can experience total brain fog, headaches, and trouble sleeping.

Unfortunately, doctors can’t say what causes it, but it seems like some viral infections (like that fecker COVID) or stressful situations can trigger it.

The thing with CFS is that it’s different for everyone – you might just have it for a time while others deal with it for years (so it’s getting lumped in with long COVID).

And even for the same person, it can come and go in unpredictable ways. You’ll be glad to hear that some people do make a full recovery, but the bad news is that there’s no magic bullet.

Rest seems to be the best medicine.

CFS is also known as ME, which stands for Myalgic (muscle pain) Encephalomyelitis (inflammation of the brain and spinal cord)

I use CFS and ME interchangeably in this article.

I’m sure you stumbled upon this article to find out more about getting life insurance, mortgage protection or income protection if you have CFS so let’s look at the most common questions I get asked (and you may be wondering about)

The quick answer is yes.

Once your diagnosis of CFS or ME has been confirmed and all other causes have been excluded, you will be able to get life insurance and mortgage protection.

And even better news, if you apply to the correct insurer, you will get the normal price!

Provided your condition is well controlled (and you choose the correct insurer) your cover won’t be more expensive due to CFS

You can plug your details in here to get an idea of how much it will cost

However, if you suffer from any related mental health issues such as depression, the insures will need more information from you before they can make a decision.

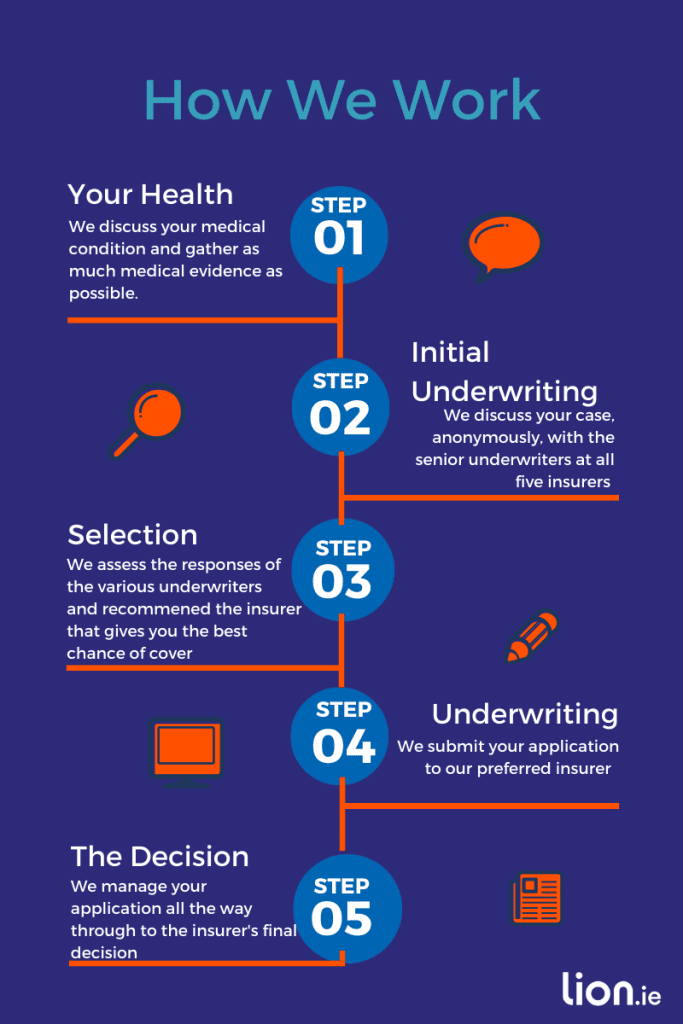

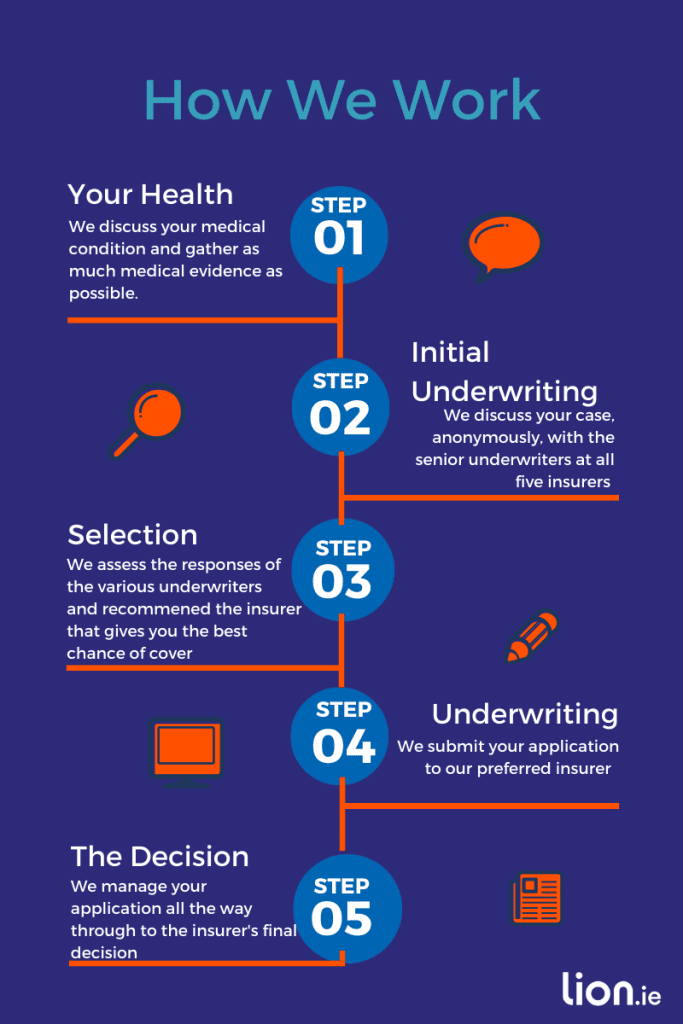

You may have to pay extra depending on the insurer, that’s why it’s so important to speak with all five insurers

There are no exclusions on death cover policies (life insurance or mortgage protection) except death by suicide in the first 12 months of the policy.

The insurer will offer you full cover or will refuse cover so even if you die because of CFS, the insurer will pay your claim

Your health is fixed from the date the insurer activates your policy so you do not have to tell them of any new or worsening health issues that may happen after that date.

Don’t worry, the insurer can’t review or cancel your policy if your condition goes downhill.

You can get serious illness cover if your condition is mild and there have been no recent symptoms.

But the insurers may exclude claims under Total Permanent Disability or Loss of Independent Living.

The insurer will cover you for all other conditions such as cancer, heart attack, stroke etc.

If you had mild CFS and you have been symptom-free for over 5 years, it’s possible to get income protection without any exclusions.

Otherwise, the insurer will apply a mental health and chronic fatigue exclusion to your policy meaning you won’t be able to claim if you’re unable to work due to those conditions.

Unfortunately, if your CFS is on the severe end of the spectrum, the providers will not offer you income protection.

The insurer will need the following:

No, but the insurer may request a PMAR (medical report) from your GP.

And don’t worry about the cost of the medical report because the insurer will pick up the bill.

If you suffer from chronic fatigue syndrome and need life insurance or mortgage protection, I’d love to lend a helping hand.

The good news is that the normal price for our clients is well, normal – we’re the experts at getting cover for people with health issues.

If you’d like me to find the best insurer for you, please complete this questionnaire and I’ll be right back.

Thanks for reading

Nick

lion.ie | Protection Broker of The Year ?

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video