Table of Contents

Complete this questionnaire and I’ll send you a quote taking your Haemochromatosis into account.

As with all medical issues, the life insurance companies will look at your personal medical history before deciding whether they can offer you cover or not.

When reviewing an application for life insurance with haemochromatosis, the following factors are the most relevant:

Treatment is most effective once started early and will stop or prevent any organ damage. Where damage has already occurred, treatment will stop any further damage.

You have a better chance of cover at the standard price if you start treatment soon after diagnosis.

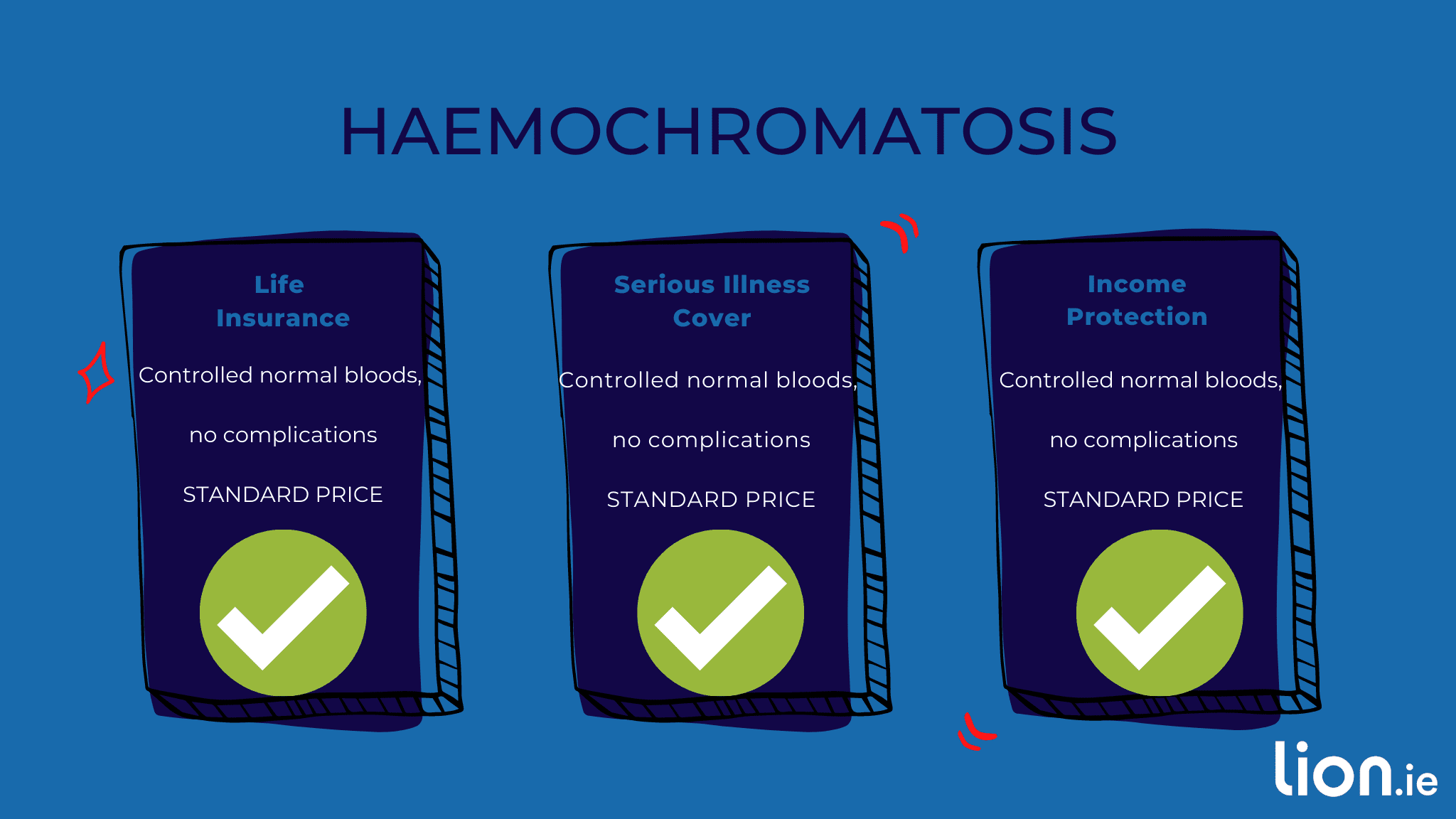

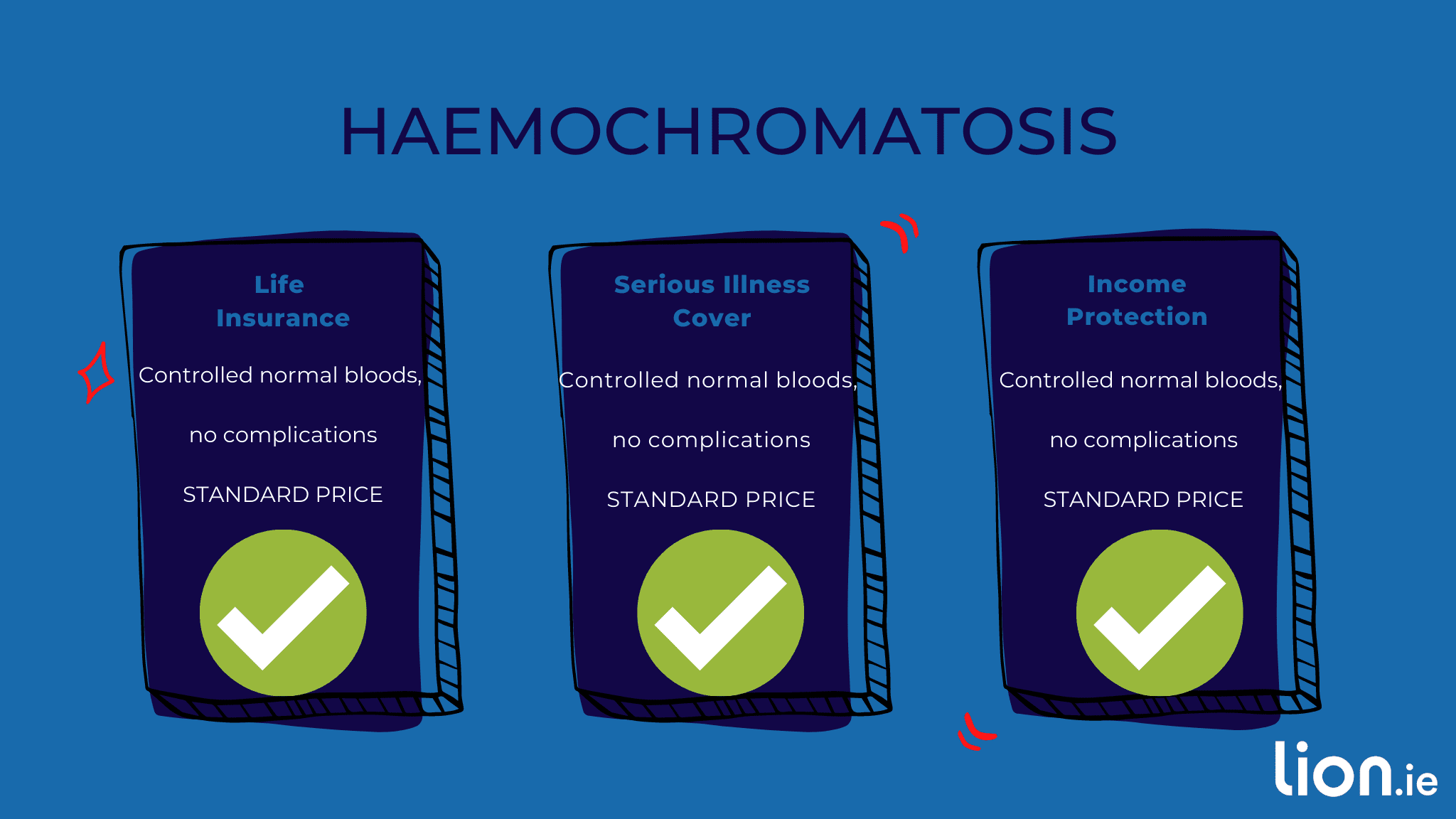

As the graphic shows, it should be straightforward getting cove if you have hemochromatosis.

However, if you’re in the middle of a course of venesections and your ferritin levels are stubbornly high, you may find yourself in a similar situation to Peter:

Peter came to me in a bit of a panic.

He was about to close on his first home but had applied for a mortgage protection policy through his bank.

As he readily admits, he signed the documents without even thinking about it – he just wanted a mortgage.

But it didn’t turn out well.

The bank postponed Peter – they wouldn’t offer him cover, and without cover, he couldn’t buy his new home.

Frantic, Peter searched the internet for a solution.

Fortunately, he found us, and we got him cover at the normal price within 48 hours.

He was so delighted he left us this lovely review.

Having dealt with other insurance brokers, lion.ie showed considerable expertise in haemochromatosis cases. This ensured I got hassle free insurance at the best price.

Haemochromatosis is an iron overload disorder.

It’s a genetic condition that causes people to absorb excessive amounts of dietary iron.

The iron becomes deposited in the various organs, mainly the liver, pancreas, heart and joints, as the body has no way of disposing of the excess iron.

Symptoms can include chronic fatigue, abdominal pain, impotence and arthritis.

Diagnosis is by a blood test.

Treatment is by the removal of blood, known as venesection or phlebotomy therapy.

Once the initial treatment has been completed, iron levels should return to normal, but regular monitoring will continue.

You won’t need to do a medical if your condition is under control (ferritin and iron levels within the normal range).

If your condition is under control, your ferritin levels are normal, and there are no complications, you will pay the same price as somebody without haemochromatosis.

You will pay the standard price for life insurance, serious illness cover and income protection.

However, if your ferritin levels are abnormal or there are complications, you could face a higher premium.

If you would like further information on applying for life insurance with haemochromatosis, please don’t hesitate to get in touch.

Complete this haemochromatosis questionnaire, and I’ll be right back.

Or you can schedule a call here

I look forward to hearing from you.

Nick

Editor’s Note | We published this blog in 2016 and updated it since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video