Table of Contents

So those scoundrels at Aviva, Irish Life, Royal London, New Ireland or Zurich Life have increased your premium, eh?

And you’re wondering why?

Let me explain:

There are a variety of reasons why your life assurance premium has been loaded/increased, such as

Because of these “pre-existing conditions”, the underwriters believe there’s a greater risk of you claiming on your policy than someone in perfect health so they increase your premium to account for that risk.

You see, life insurance providers have access to massive amounts of data on all types of illnesses and how many claims each illness causes.

Don’t take it personally.

To them, you’re just an entity with a certain set of characteristics that they slot into a specific risk category e.g.

On average, the chances of a claim (the risk) will be higher in the first group.

For this simple reason, people in this group will pay a higher premium to make up for this risk.

Someone in perfect health will pay the normal price or what’s known as the ordinary/standard rate.

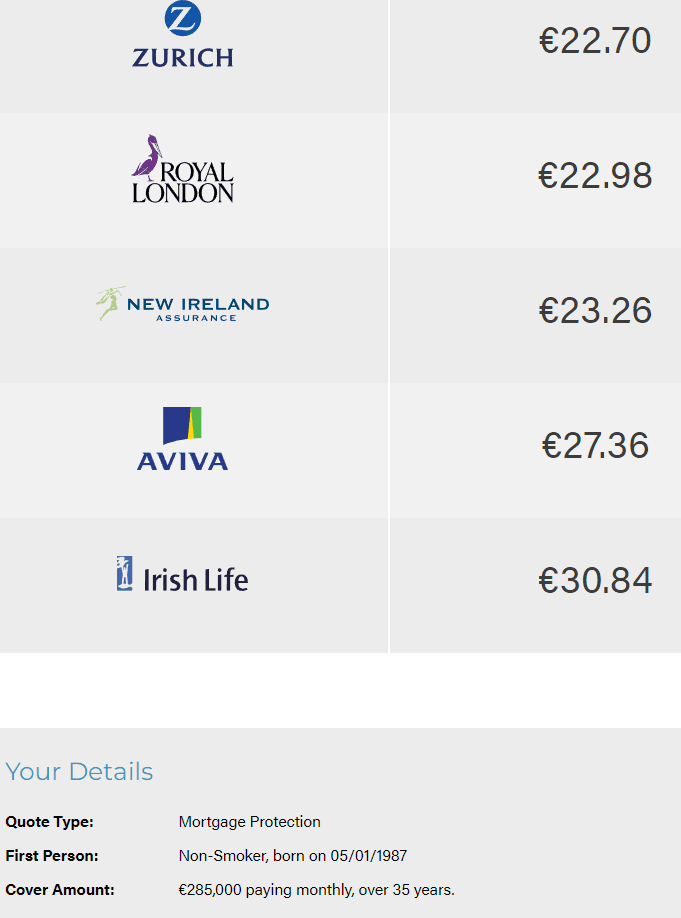

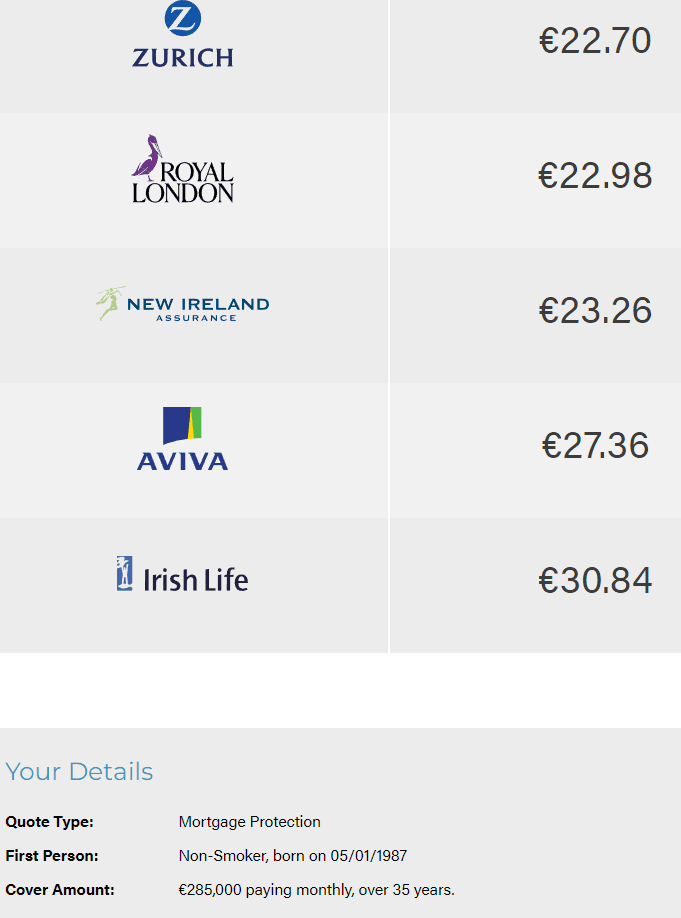

We’ll show you this ordinary rate if you get a life insurance quote on our website.

However, if you have a health condition, the insurer’s underwriting team may decide to load your policy or increase your premiums.

The minimum permanent loading a life insurer will add to your policy is +50%; the maximum it will apply is +400%.

If the insurer believes your health issues would result in a loading of over +400%, they will decline.

In real terms, how do loadings work?

A life insurance loading of +100% means the insurer will add around 100% to the normal price.

So if the normal price is €31.87 and you receive a loading of 100%, you will pay €31.87 + (100% x €31.87) = €63.74

A 150% loading would mean a final premium of around €31.87 + (150% x €31.87) = €79.67.

Alternatively, the insurers add a per mille loading, which is usually temporary but high.

The insurer will add a per mille loading for a number of years.

At the end of this period, the insurer removes the loading, and your premium is reduced back to the ordinary rate.

A recent example may help clear this up:

Sarah had a GIST (Gastro-Intestinal Stromal Tumour) with a total Gastrectomy four years ago. Sarah’s bank declined her application. However, three of my insurers could quote, but those quotes varied enormously:

Sarah needed €300,000 cover, so her additional premium was €7.5 per mille / per thousand euro of cover = €7.5 x 300 = €2,250 extra per year for the next three years.

In 3 years, her premium will reduce to the standard rate of €27 per month.

My grandfather was a smoker and lived until 87.

If he had life insurance, as a smoker, he would have paid higher premiums all his life but, in the end, would have outlived his policy, and the insurer would have trousered his premiums.

On the other hand, a friend of his, who didn’t smoke, could have died at 60, and received a payout after paying lower life assurance premiums than my grandfather.

Is that fair?

No.

However, mortality data will prove that my grandfather should have died at a younger age than his non-smoking friend.

Statistically, smokers die at a younger age than non-smokers.

And insurers base everything on data, but there are outliers like my Woodbine smoking Grandad Pat!

It might not be fair that you’re classed as a bigger risk just because you have a certain illness, but for now, that’s the way it is.

Each life insurance company has a base premium – they cannot offer you a price lower than this.

e.g

Royal London – the base premium of €15 per month

Zurich Life – the base premium of €10 per month.

Let’s say you apply for €50,000 life insurance.

Royal London will charge €15 as this is their lowest monthly price.

However, Zurich Life can give it to you for just €10 – as this is their lowest monthly price.

Suppose you have serious health issues, so your premium is loaded by 300%.

Royal London will increase your premium to €60 (base premium x4), while the Zurich premium increases to €40 (base premium x4)

If an insurer has increased your premium, ensure that the insurer is the most sympathetic for your health issue.

For example, if you have a BMI of 34, one insurer will offer you the normal price, whereas others will load your premium.

As always, shop around or use a specialist broker who knows which insurer is best for your health issue

Even worse, have they declined you for life assurance?

You’re not alone.

Loads of our customers have quirky health issues, so they get screwed by certain insurers.

We’re here to help you pay as little as possible for your cover.

We might not be able to get you the standard price, but we’ll get as close to it as possible.

I’d guess that you have applied through your bank or a tied agent of one insurer.

Banks only have access to one insurance provider, and if that provider doesn’t like the sound of your health issue, you’ll pay through the nose.

But don’t despair, I’m sure I can find you a more sympathetic insurer.

We arrange life insurance with a lower premium increase for:

Here’s a recent case study:

36-year-old female in good health

Diagnosed with a blood disorder 13 years ago

No symptoms save occasional bruising if she knocked off something.

Annual check-ups

Platelet Level 54,000 (moderate ITP)

Before she came to me, she’d been postponed by her bank due to her platelet count.

I discussed her case anonymously with my insurers. All of them could offer cover, but some of the loadings were ludicrous!

This was a 25-year policy, so the €40 monthly savings amounted to €12,000 over the life of her policy.

If you’d like me to discuss your particular case anonymously with my underwriters, please complete this short questionnaire, and I’ll get back to you as soon as possible.

Thanks for reading

Nick

Editor’s Note | We published this blog in

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video