Table of Contents

Meet Bob.

Bob is 25.

He likes to drink pale ale and enjoys taking me-time to moisturise his beard with special oils he buys off the internet.

Bob also really likes Nickelback and Coldplay, but he can’t admit that out loud because it’s not cool.

Bob’s been doing some reading and has decided to get his personal finances in order.

He found a listicle online.

Bob loves a listicle almost as much as his beard.

“What every 25-year-old should know about financial planning.”

At number 4 on that list is “take out life insurance.”

Bob has considered his options and has decided that Term Life Insurance makes sense.

You might think Bob is a bit mad to be getting Life Insurance at his age, but he plans to propose to his long-term partner, settle down, and have kids.

He reckons now is the time to sort it out.

And he’s not wrong: getting Life Insurance when you’re young could potentially save you a lot of money in the long term.

Life Insurance (and insurance in general) is all about risk.

Essentially, you submit an application form, and the insurer considers your chances of dying while insured.

Based on that, they set your premium (how much you pay).

You’ll pay more if you’re a smoker, you’re older, or if your health isn’t the best – because all these things drive up the chances of you dying during the term of the policy.

You see, the insurers don’t actually want you to die (sound of them).

Instead, they want you to outlive your policy so they can collect your premiums without actually paying out the insurance bleed you dry.

Now, it’s quite unusual for 25-year-olds to have Life Insurance.

Life Insurance is only useful if you have dependents, and most people in that bracket are too busy raising pets and plants to consider actual children.

A note: We’re talking about Term Life Insurance, which means you get insured for a certain time.

In this instance, once your term is up, you’re no longer covered.

The alternative is Whole of Life Insurance, where you’re covered for your whole life.

Just like Ronseal, it does exactly what it says on the tin.

Whole of Life is considerably more expensive than Term Life because it’s guaranteed to payout.

The insurers will lose their bet that you’ll outlive your policy.

In this case, they’ll charge you enough via premiums to make it worthwhile.

Remember: insurance is a business whose main goal is to make money for its corporate overlords, who may or may not be lizards in suits, depending on the conspiracy theories you read online.

Now, there’s a little insurance broker secret trick that will come in very useful here if you’re someone who is considering Term Life Insurance.

It’s called a conversion option and is a way to sneak in under the door so you can renew your policy when your term expires without answering medical questions.

Let’s look at Bob again.

Bob is still 25 and has decided to get a 30-year Term Life Insurance policy, covering him until he’s 55.

Maths, eh?

He also opts into the conversion option.

At 25, Bob is in perfect health with the most lustrous beard you’ll ever see.

At 55, Bob has developed a dodgy heart and had a minor stroke in his forties.

If Bob were to disclose this medical information when re-applying for additional Life Insurance, these medical issues would be a big red flag for the insurers when they process his application.

However, with the conversion option in his back pocket, Bob can get more cover without a massive price hike.

So you see, Bob’s being smart.

Term Life Insurance + conversion option = the bee’s knee.

Again, Bob is sound and has agreed to be our guinea pig.

So he fills in his details and requests a quote using lion.ie’s Life Insurance quoteymajig.

We’ve already established that Bob is a smart guy, albeit with a questionable taste in music.

Going with a good broker like those legends at lion.ie will help him get the best policy for him and his family.

We’d also be able to guide him so that he gets additional benefits with his policy, like Free Digital GP consultations.

So, Bob wants his kids to be millionaires if he departs before his 55th birthday so he takes out a cool milly in cover.

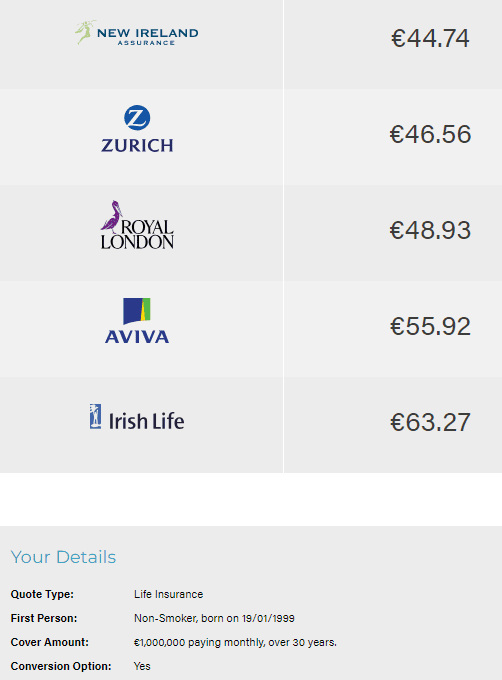

At 25, Bob’s premium looks like this every month.

Let’s say he goes with New Ireland, and he lives to be 54 and passes away suddenly with a heart attack while oiling his beard.

He’ll have paid €15,570 into his policy.

The insurer will pay out €1m.

It’s not a bad way to make your offspring millionaires (apart from the whole having to die part)

That’s the spirit; I’m with you, and so is Bob since this happened:

Bob’s fiancée left him for Sven, a sexy yoga instructor.

Bob finds love again in his forties – only for her to also leave him for sexy Sven.

In a dramatic reveal, everyone will discover that Sven is Bob’s long-lost brother.

He’s been haunting him for years out of jealousy for being abandoned as a child.

It’s all very elaborate.

Really, Eastenders should hire me to write for them.

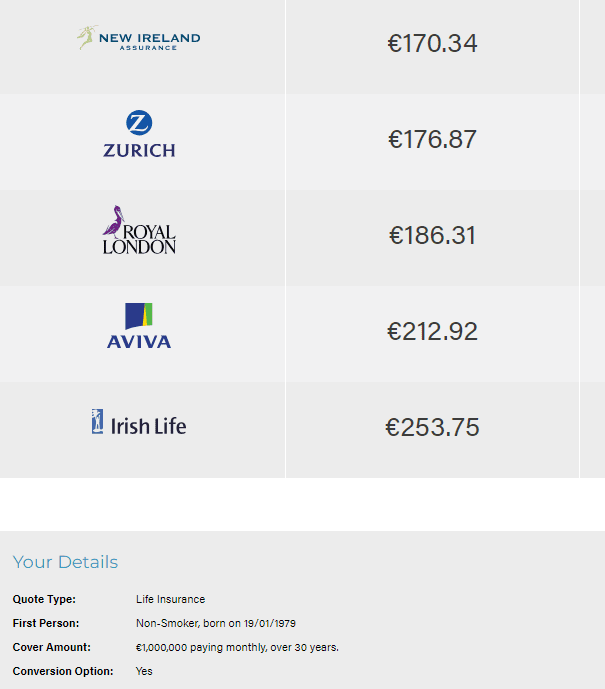

So. Bob. now 55 wants €250,000 Term Life Insurance for 30 years.

His quote looks like this:

So if Bob doesn’t reach 85 (life expectancy for males in Ireland is 82), the policy will pay out €1,000,000.

The most he will pay in premiums is €61,200

You might be thinking, how is that possible – how do the insurers not go bust?

If you are, go here to see how life insurance providers make money.

Looking for more insider secrets to get the best Life Insurance deal for you?

I can point you in the right direction.

Fill in the form below or schedule a callback to get started.

Also, if you’d like to know about the people we’ve helped get Life Insurance, head over to our 1,700+ testimonials from people in all situations all over Ireland.

Well done for getting to the end!

Have a gold star ⭐

Nick

Editor’s Note: We first published this blog in 2020 and have regularly updated it since

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video