Money, money, money.

It’s a rich man’s world.

Or so sang ABBA on their 1976 pop banger.

You might think that price is the most important factor in life insurance.

Sure, you’ve filled in your details and used an online quote calculator for Life Insurance, and you’ve got a list of insurers with prices listed from cheapest to most expensive.

You’re probably thinking it’s just a case of picking the cheapest quote.

As it happens, it’s not just a case of picking whichever life insurance provider is cheaper.

So what else do you need to consider?

If you’ve landed on this page, you either clicked out of curiosity or desperation.

Either way, if you’re looking for guidance on choosing the best life insurance, you’ve come to the right place.

Whether you’re a first-time buyer without a clue where to start or a frazzled parent is looking at cover to protect your nearest and dearest, everything you need to choose the perfect provider is right here.

If you’re considering buying life insurance cover, you’ve done some web research and probably encountered some discussions about which insurer is the best.

Can I let you in on a little secret?

There is no “best”.

You see, the best life insurance company for me may not be the one for you…because we have different needs to protect (unless you also have three kids under 12 and a Celtic Tiger mortgage!)

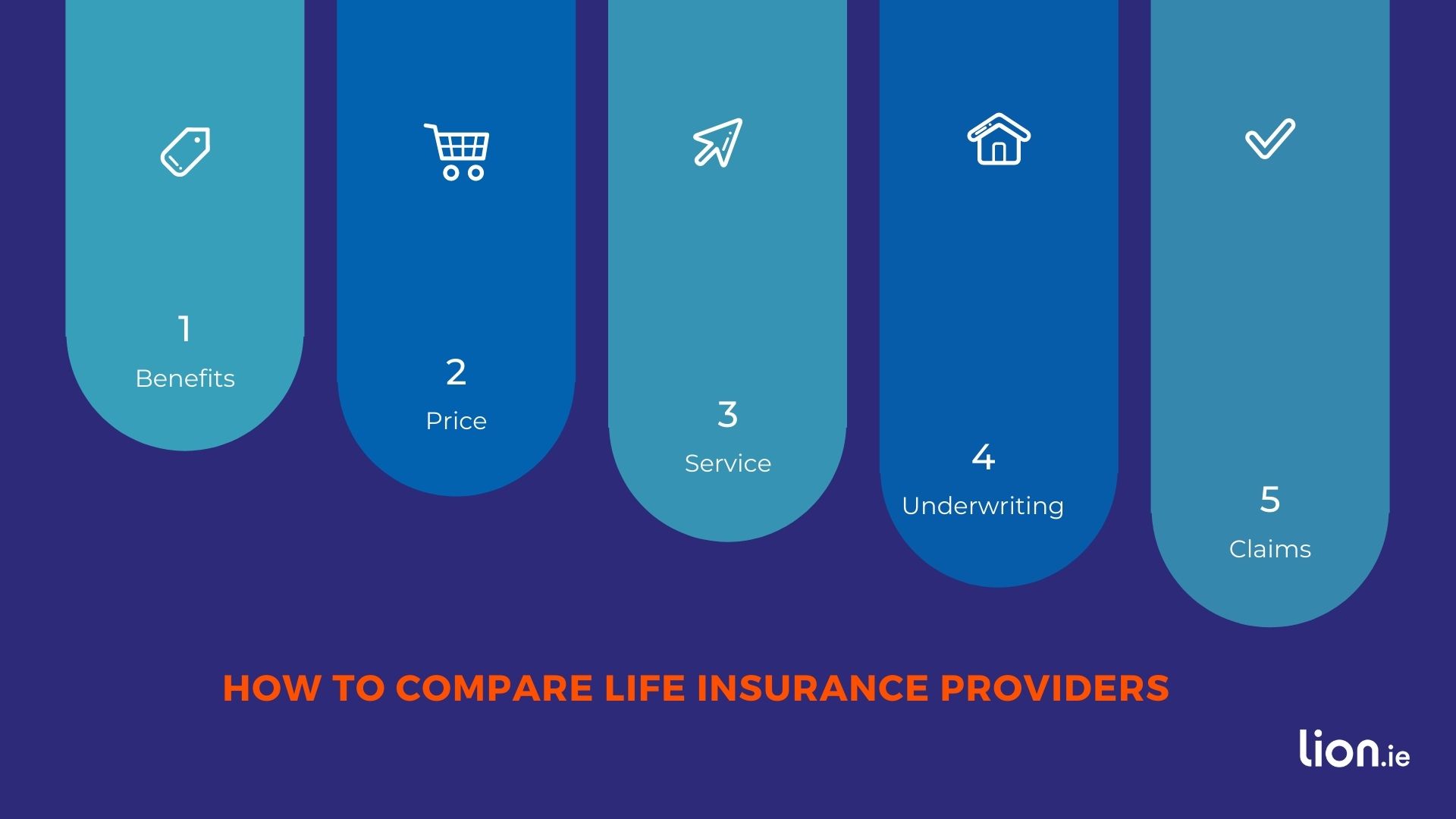

The purpose of this article is to examine the five life insurance providers in Ireland under five headings:

Once you have read our comprehensive review of Irish life insurance providers, you’ll be well on your way to deciding which insurer is best for you and your family.

Each insurer tries to differentiate itself on the benefits it offers.

Aviva – Access to Best Doctors

Royal London- Best serious illness cover

Irish Life – Best for children’s cover

New Ireland – Free whole of life cover

Zurich Life – Offers Cancer-only Cover

Acorn Life – We don’t deal with them

Standard Life – Some brokers mention Standard Life on their website, but this is misleading. Standard Life doesn’t offer protection products. Standard Life is an investment manager. If you see a broker promoting them in connection with a life insurance product, you should tread carefully.

Some insurers will now match the lowest price available in the market and offer further discounts.

Since 2020, Aviva, Irish Life and Zurich Life do not price match, although Zurich Life offers discounted premiums to brokers.

Discounts change constantly, but we keep on top of them.

You can get a quote (including the latest discounts) here.

Zurich and Royal London are the most efficient insurers currently (Jan 2024 – but this can change, so check in with us).

They are the quickest at approving your application and issuing your policy.

If the insurer requires a PMAR, your timeline will depend on how long your GP takes to complete and send back the report.

On average, it takes four weeks for the GP to return the report to the insurer.

This is important, so listen carefully at the back!

Usually, the insurers will instantly offer you cover if you have a clean bill of health – no medical issues and no family history of medical issues.

Sometimes, however, even in cases of perfect health, the insurance company may insist on further medical information due to your age or the amount of coverage you need.

In summary, if you feel that your age (40+) or level of cover (€500k+) will be a factor, please get in touch, and we can recommend the insurer with the least demanding medical requirements.

Always run it by us first if you have a medical condition. Some insurers are more lenient for certain illnesses than others.

e.g. one insurer would increase your premium substantially for being overweight while another may offer you the normal price.

For me, life insurance is all about the claim.

Getting cover with great benefits, at a good price, with impeccable service and sympathetic underwriting counts for nought if the insurer doesn’t pay your claim.

Claims are so important; they deserve an article of their own.

It’s the dreaded “it depends”.

It depends on, among other things:

As I said at the start, no “best” insurer exists, especially if you have any pre-existing conditions.

I have to hand it to Royal London, they vastly improved their mortgage protection a while back, and it’s still the best in class.

The big change they made is to offer dual-life mortgage protection for the same price as joint-life mortgage protection. In effect, you get double the cover with dual life.

But what if you’re single, do I still recommend Royal London?

Yes, because they also offer a conversion option on their mortgage protection policies.

A conversion option lets you

-turn your mortgage protection (a policy where your cover reduces over time)

-into a life insurance policy (a policy where your cover doesn’t reduce)

-in the future without answering health questions.

Why is this important?

Let’s say you buy a house now but want to trade it up in five years. And the term on the new mortgage is longer than the remaining term on your existing policy.

You may have to reread that before it sinks in.

Still with me?

Good.

Usually, this isn’t an issue. You apply for a new policy over the longer term. But what if you have suffered a health issue since you took out your policy, and now you can’t get a new one?

Are your dreams of a new home over?

No, because the conversion option rides in to save the day

You can convert your current mortgage protection to a life insurance policy with a longer term without answering medical questions. If you need additional coverage, you can exercise the guaranteed insurability option.

However…if you have a medical issue, Royal London may not be your best provider. Always check with me before you apply, and I can advise whether you should apply to a more sympathetic insurer for your condition.

By the way, I’m not knocking Royal London for their underwriting; this is true for all insurers.

Insurer A may be best for you if you have a high BMI, insurer B best for you if you have mental health issues, and insurer C best for you if you have heart issues.

That’s just the way it is.

No insurer is best for ALL medical issues.

Zurich has an excellent life insurance product but let’s be honest. They also have the largest discounts on life insurance premiums. When all other benefits are equal, price is usually the deciding factor.

Unlike the other providers, Zurich also offers discounts when you add specified illness cover to their life insurance, making them very competitive and hard not to ignore.

Let’s take the price off the table and move on to the most important benefit life insurance offers – the claim, i.e. the probability of your policy paying out. Zurich has a very fair claims philosophy; only in the worst cases of non-disclosure or fraud will they decline a claim. Therefore I’m comfortable recommending them as the last thing I want is to have an issue should you have to make a claim.

Aviva is our favourite income protection provider for the fourth year. And I can’t see that changing until I can vouch for how the other providers deal with claims. Some other providers are new to the personal income protection market, so they have only paid a handful of claims.

In 2022, Aviva paid €48,000,000 (up from €46m in 2021) and invested nearly €200,000 in rehabilitation and retraining programmes, benefiting close to 100 claimants.

Unlike the other providers who offer discounts to make their products more attractive, Aviva doesn’t, and I applaud them for that.

Their income protection product stands alone and is worth a few extra quid per month. To be fair to them, they usually offer the lowest premium in most cases.

You also get access to Aviva Care with all Aviva policies – yet another reason to recommend them.

However…and this is important, Aviva can be quite strict regarding occupation classes. Your occupation affects the price of your income protection. There are four occupation classes, one being the lowest risk and four being the highest. You may do better at another insurer if you are classed as a 2, 3 or 4 with Aviva. Let me know.

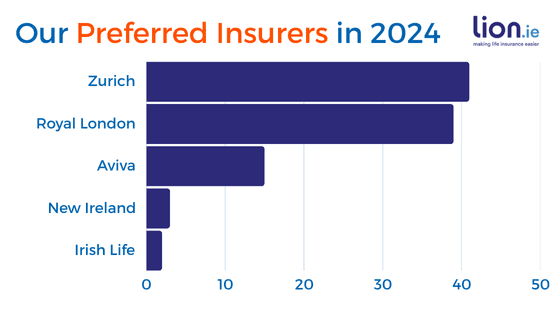

Here’s the breakdown of where we insured our clients last year:

Did you know we’re the only life insurance broker that publishes these figures annually?

What have the others got to hide?

Hmmm…

I’m just a broker standing in front of a potential customer asking you to love me.

That probably works better for Julia Roberts and Hugh Grant.

In all seriousness, if you want someone to crunch the numbers, weigh the benefits, explain what each policy offers, or do it all for you, call me on 057 93 20836 or complete this questionnaire.

Life Insurance is never as complicated or expensive as you think.

Talk soon!

Nick

Editor’s note. We first published this blog in 2018 and we have updated it rgularly since.

057 93 20836

Ask a question

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video