Table of Contents

Some things will make you sit back and take stock of everything.

Getting married.

Having kids.

Those are the good ones.

But the flip side is correct, too: getting fired, a sudden death, cancer, or an accident can leave you reeling.

Especially if it’s something like a car crash that can hit so entirely out of the blue.

It comes up more often than you think: people who have been in a car accident and come out of the other side going,

Jesus, maybe I should look into sorting out the financial stuff.

Doing their will, sorting their insurances – that kind of thing.

It’s a natural response to such a significant trauma: staring death in the face can really make you consider what might happen if you weren’t here anymore.

So, today, I will look into the realities of getting Life Insurance after a car crash.

Whether you were in a car crash, know someone who was, or are still traumatised by that RSA ad with the Samantha Mumba song, you’re right to consider Life Insurance.

Life Insurance is always a good shout if you have dependents (an other half, kids, fur babies, a belligerent Tamagotchi, you name it).

It’s pretty simple: if you shuffled off this mortal coil, would the aforementioned dependents be able to pay the mortgage or rent or bills or whatever life stuff you cover?

The Tamagotchi would be fine, but the others?

Which is why Life Insurance makes sense.

It’s a tax-free lump sum paid out to your dependents if the worst were to happen to you.

Which all sounds good, but the big question then is ‘how much does it cost?’

This article is specifically for people who have been in car crashes. (I’m sorry to hear that—I hope you’re doing okay!).

An underwriter determines the cost of Life Insurance.

That might sound like boring information, but it’s essential to know before I discuss costs.

So, underwriting is a mix of math and science performed by perpetually bored people in the dungeons of Life Insurance buildings.

They do the math to determine the risk of your dying, which, in turn, reflects the chance the insurer would actually have to pay out on your claim.

The higher your chance of dying, the higher the cost of your insurance.

It’s bleak, but it is what it is.

Your age, the type of work you do, any medical history, and your general health are factors that raise your chances of dying (in the insurer’s eyes).

You can see where a car accident slots in here.

To illustrate the point, we’re going to look at two examples.

Mary is 40.

She was in otherwise good health when she was in a car crash.

A driver hit her car, and she walked away with a broken arm but no other injuries.

Mary’s arm healed, and she’s in perfect nick otherwise.

She suffered no lasting damage, so she should be able to get the standard price for life insurance after a car accident.

She needs to get €250,000 Mortgage Protection coverage over 25 years because she’s getting a mortgage.

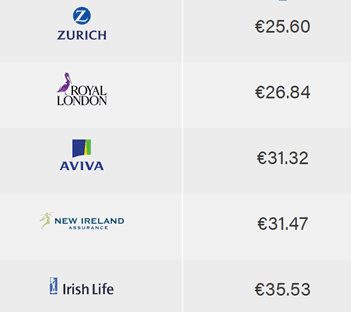

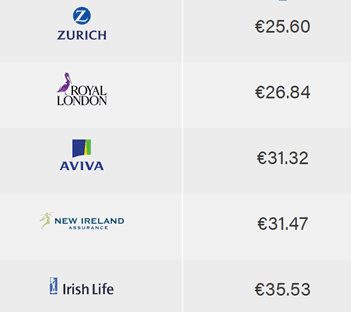

Mary’s quote looks like this:

Mary is lucky in that she can still get a decent amount of cover at a reasonable price.

However, Peter is also 40.

He’s in the same boat as Mary: they both work in marketing and are non-smokers.

Peter was in a car crash, but it’s not great.

He wasn’t wearing his seatbelt, so his head took most of the damage.

He spends a couple of weeks in a coma and comes out of it with some long-lasting injuries.

Peter finishes all treatment two years later.

He has surgery on one eye for cosmetic reasons, damaged a couple of discs in his neck and needs a hearing aid.

No brain damage, thankfully.

Peter might be thinking that insurers won’t come near him.

But it depends on one big thing: when it happened.

If Peter had the crash in the last two years and had just finished his various surgeries, the insurer would still consider him high-risk.

Getting insurance could be dicey for a while.

The insurers would likely postpone cover.

However, if Peter’s crash was a while ago, it’s a different story, especially if his treatment is all done and he’s fully recovered.

Let’s say the crash was 2004, and he finished treatment in 2007.

If this is the case, he should be able to get the standard price for Life Cover.

However, the trick is knowing which insurer to apply to because some are more lenient.

And the same advice goes for serious illness cover and income protection:

Let’s look at Mary’s case:

Car accident, broken arm, full recovery.

She will get serious illness cover at the normal price, and if she hasn’t had any arm pain in the last 12 months, she will also get income protection.

Both at the normal price without any exclusions.

What about Peter?

Car accident, sight loss, hearing loss, neck injury.

It’s going to be trickier for Peter to get cover, especially income protection.

Assuming he’s back on his feet with no lasting damage, he should be able to get serious illness cover but there may be some exclusions.

For income protection, it’s all down to whether there are any ongoing complications.

Epilepsy or ‘post-concussion syndrome’ is fairly common after major accidents, and there’s a whole range of neuro and psychological complications that could occur.

Assuming no complications, Peter has a good shot at getting cover.

The insurer is likely to add a back exclusion meaning if he can’t work due to a back disorder, he won’t be able to claim.

Some insurers love adding exclusions for pre-existing conditions, while others are more understanding.

That’s why it’s so important to shop around.

If you’re buying a car, you’d likely go online or to a car salesman and see what’s available.

You categorically would not buy the first car you see.

Or at least I hope you wouldn’t because that’s how you end up with a banger that will give you grief every time the NCT is due.

It’s the same when you buy clothes, a computer, or whatever your soul desires.

So why would you go into an insurer or bank and take the very first policy they offer you?

If your answer is ‘because it’s confusing’, I one hundred per cent feel your pain.

It is confusing.

Insurers have invented all manners of baffling jargon and tricky terms and conditions.

The internet is your friend though: I have an entire trove of blogs about insurance that’s written for actual people to understand.

That’s an excellent place to start.

Learn as much as you can.

Talk to friends and family who have Life Insurance – but don’t just take their word for it – especially if you, like Peter, have a complicated medical history.

Your best bet is to go to a good broker who knows his or her onions.

All insurance underwriters are not created equally, and each one works a little differently.

Some are much harsher towards certain conditions or medical issues, while others are more sympathetic.

The key is to find the insurer most sensitive to your plight and who will give you the best cover at the right price.

If you choose an insurer and they decline you, postpone you or accept you with a loading fee (this means your premiums will cost more), you don’t need to presume that that’s all you can get.

Shopping around could make all the difference to how much you pay and the amount of coverage you get – or maybe even getting coverage at all.

A car crash is debilitating enough without having to worry about insurers trying to swindle you.

Looking after your family financially is a smart move.

So your next intelligent step should be to pair with a straightforward insurance broker who can help you get the best deal for you.

We can help you get Life Insurance after a car accident.

Over the years, we’ve become experts in helping people with tricky cases get covered.

For example:

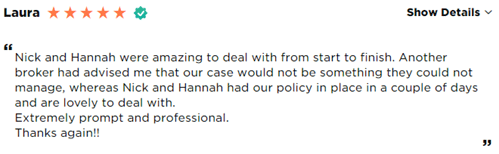

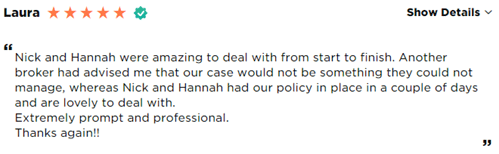

That testimonial is from Laura, who had a tricky case and had had no luck with another broker.

You can check out our other 1372 genuine testimonials here.

If you take anything from this article, let it be this: shop around.

I’m here to help if you’d like a recommendation.

Click the button below, complete the questionnaire, and I’ll be back.

Thanks for reading

Nick

Editor’s Note: We first published this blog in 2020 and have updated it since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video