10-second summary: You can’t buy a standalone life or serious illness policy for a child in Ireland, but all adult policies automatically include free children’s cover. This guide explains what’s covered, what’s not, and which insurers treat families the fairest.

Editor’s note: First published in 2017 | Refreshed in 2025 with updated insurer limits, children’s definitions, and Guaranteed Insurability rules.

Table of Contents

Strictly speaking, no.

You see, life insurance exists to replace the income of a breadwinner.

And if your kids are anything like mine, they certainly aren’t winning any bread.

Eating it, yes.

Slowly bleeding you dry.

Please, Daddy, can I have a new pair of trainers.

Please Daddy, can I have a new phone.

Please Daddy, can I have a PS5.

How about you get a job, you bum!

But Daddy, I’m only 12.

Pfff, always with the excuses!

Nope — you can’t buy a separate policy.

But when you buy life insurance, children’s cover is usually included automatically.

Here’s what each insurer includes:

Most people don’t realise this, but not all insurers treat children’s life cover the same way.

Here’s how it actually works in Ireland:

This stuff only comes to light at the worst possible time. One of my clients lost his little boy at just three weeks old, and the insurer refused the claim because of their survival-period rule. After a battle, they changed their mind but we shouldn’t have had to go to war for that child.

So yes — Irish Life is the fairest insurer on this benefit because they’ll pay from birth.

No — you can’t buy a standalone serious illness policy for a child.

But if you buy adult Serious Illness Cover, children are covered automatically.

All insurers cover the lesser of:

Some cover up to age 21, some up to 25. Always check the small print… or let me check it for you.

If you’ve recently had a baby — congratulations!

If it was in the last three months, you may be able to buy extra cover without answering any medical questions using the Guaranteed Insurability Option.

Guaranteed Insurability lets you increase your cover without medical underwriting when certain life events occurs (e.g marriage, birth of a chld, new mortgage, new job)

The insurer will offer you cover regardless of any new health issues since the policy started.

More details here:

Guaranteed Insurability explained.

If your child is diagnosed with something serious, most insurers provide access to a global second-opinion service.

Aviva’s Best Doctors vs Royal London’s Helping Hand — TL;DR Aviva’s is better.

If you have hospital cash cover, your child usually gets €30–€60 per day free.

Did you read any of this blog? 😅

I’ll repeat:

You can’t buy life insurance for a child. It’s included for free on your own life insurance policy.

Ah here. 🙈

You can’t buy serious illness cover for a child. It’s included for free on your serious illness policy.

If you have children but no idea how much or what type of cover you need, let me help.

Simply complete this short questionnaire and I’ll email you a no-obligation recommendation:

Thanks for reading,

Nick

lion.ie | Protection Broker of the Year

Written by Nick McGowan, QFA RPA APA

Nick is a qualified financial advisor and founder of

Lion.ie, an independent Irish life insurance and income protection brokerage based in Tullamore. He’s been helping people get fair, transparent cover for over 15 years — and was named Protection Broker of the Year 2022.

If you’d like straight answers (without the sales pitch),

learn more about Nick here.

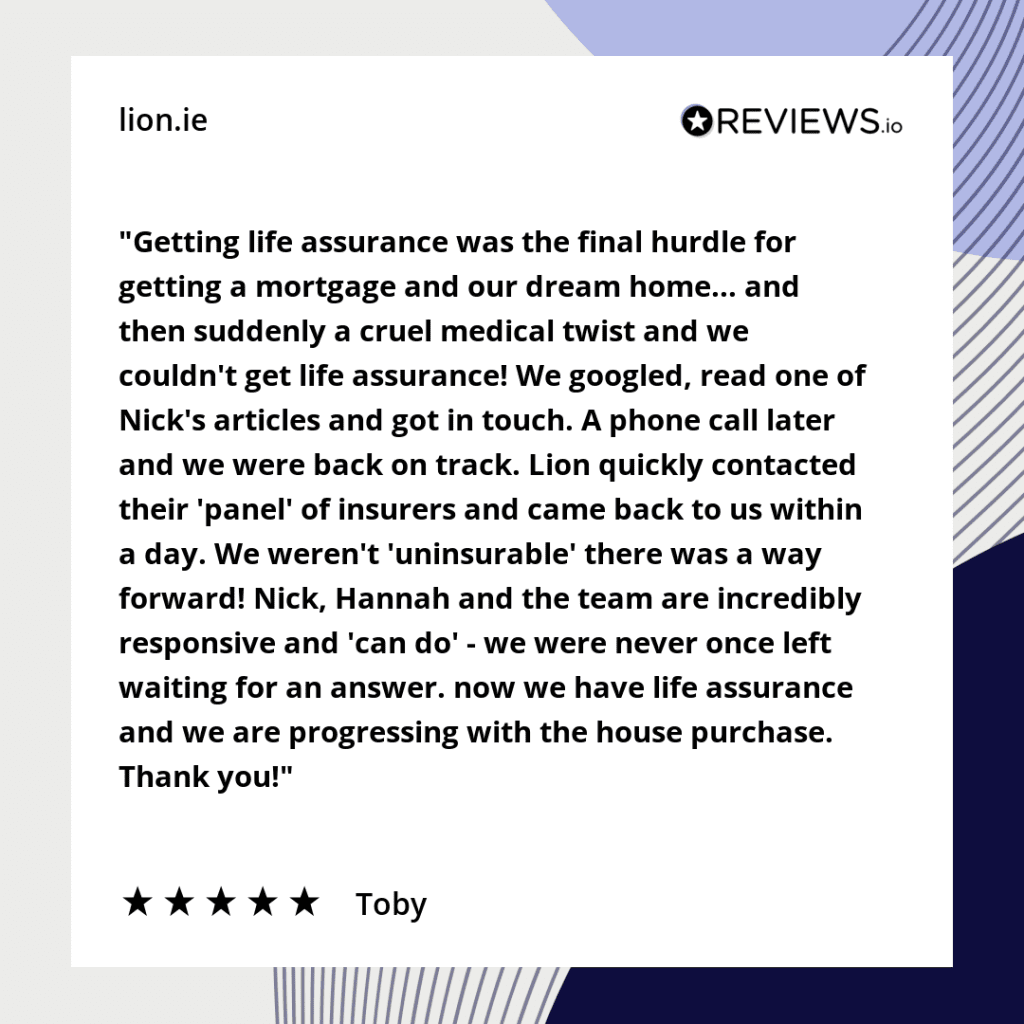

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video