Table of Contents

*Disclaimer – we do not arrange policies through Laya life insurance

Laya life insurance markets itself as “no-frills” life insurance, but is it a viable alternative to what’s already on the life insurance market?

That sounds great.

You may think:

I don’t like answering medical questions, I’ve had a few health issues in the past, sign me up!

Whoa, there, horsey.

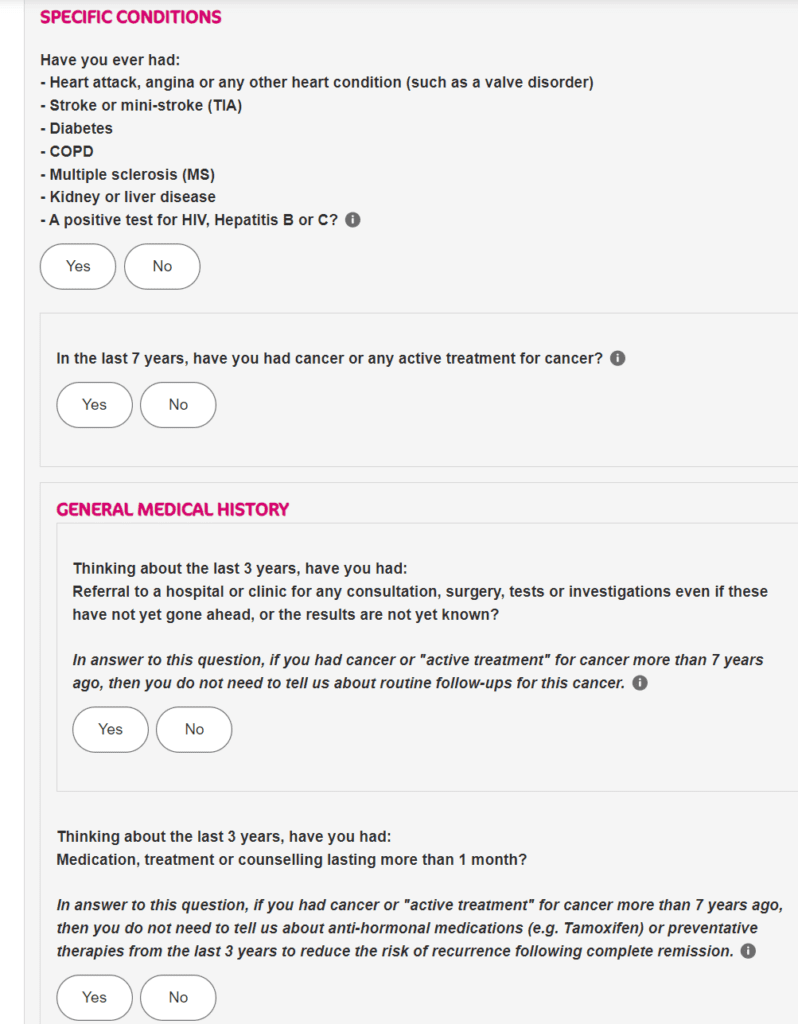

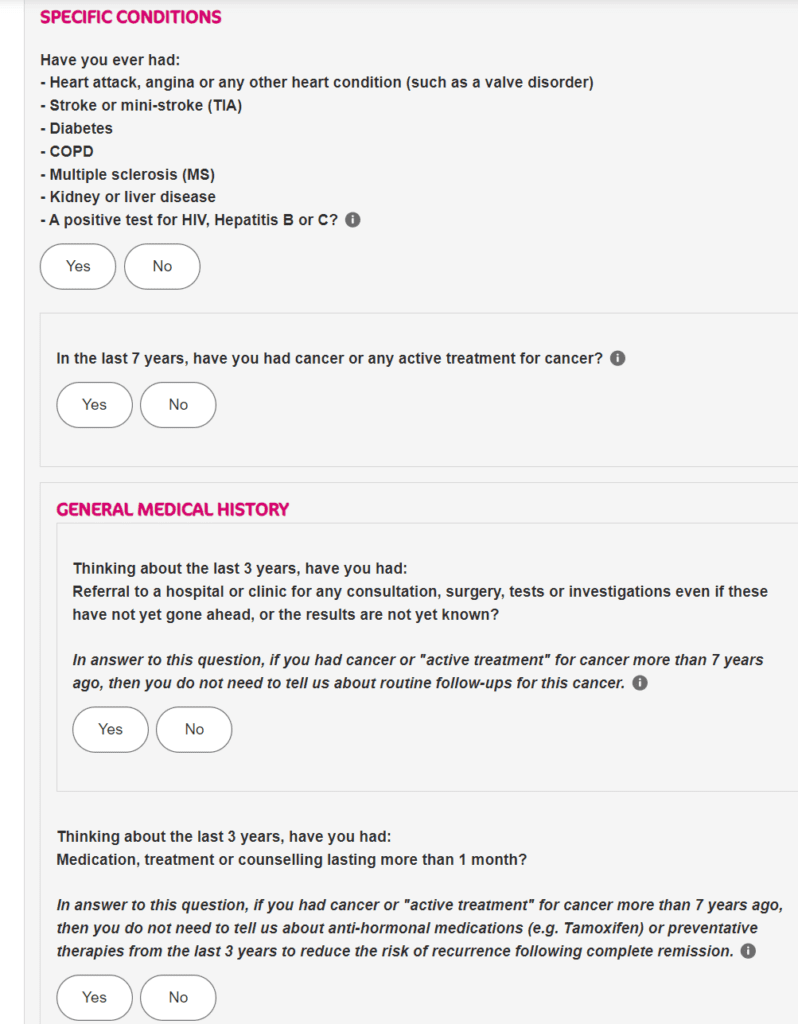

Just like Aviva, Irish Life, New Ireland, Royal London and Zurich – Laya also ask health questions.

Nothing new here.

I know of one website, not a million miles from here, where you can quickly and easily compare life insurance quotes online from 5 insurers, pick the one you want and complete your application form online.

In fairness to Laya, they can issue your policy documents immediately, so if you are in a crazy rush and money isn’t an issue, then they are a good shout.

Hopefully, the other insurers will take note and speed up their application process for applicants with no health issues.

Okay, this sounds promising…assuming the price of Laya Life Insurance is competitive to begin with

We’ll look at prices later.

Again, not a bad offer if you already have Laya health cover.

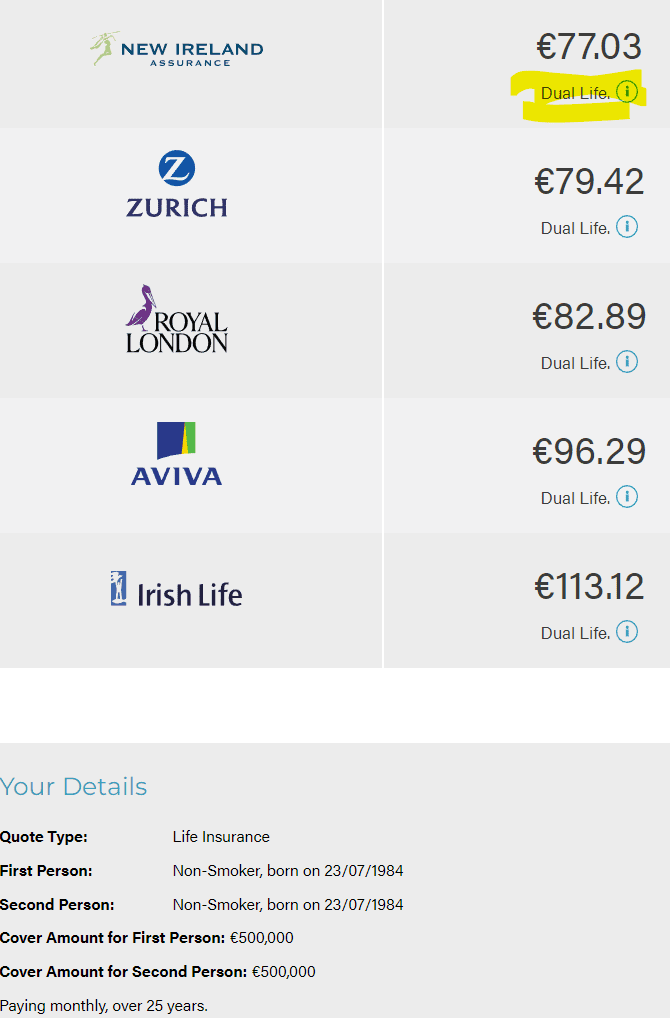

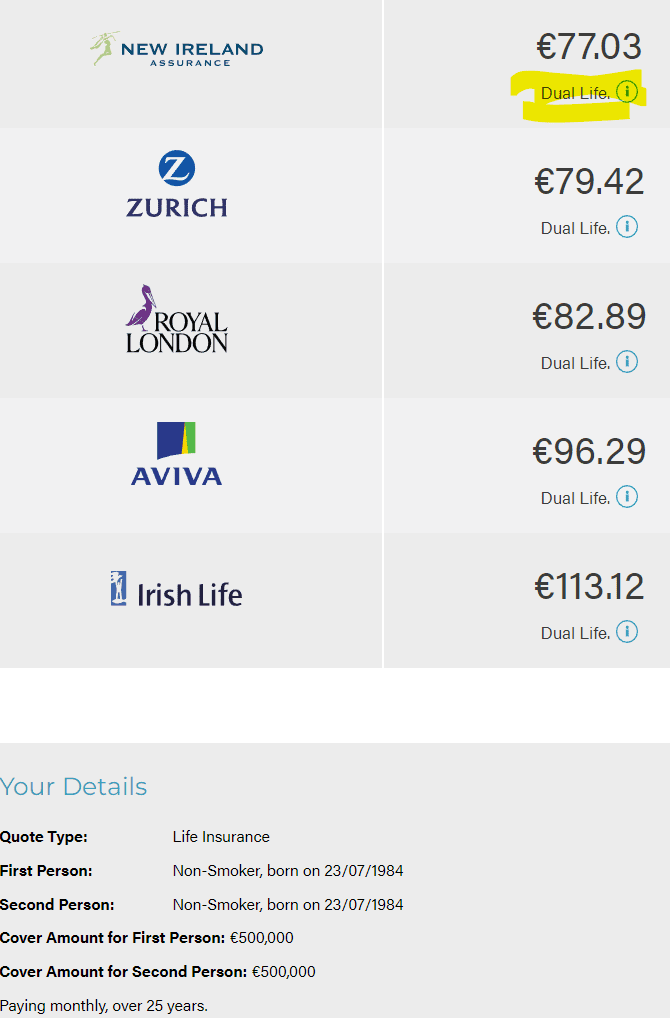

Let’s look at €500k life insurance over 35 years for a 43-year-old and a 45-year-old, non-smokers, no health issues.

Quote Type: Life Insurance

First Person: Non-Smoker, born on 17/12/1977

Second Person: Non-Smoker, born on 07/05/1975

Cover Amount for First Person: €500,000

Cover Amount for Second Person: €500,000

Paying monthly, over 35 years.

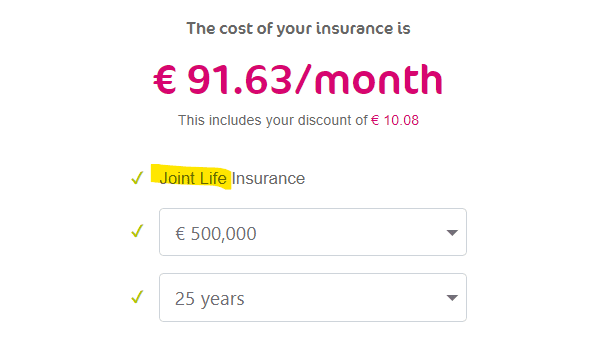

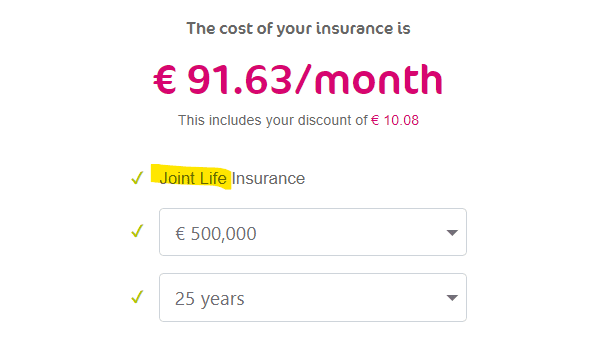

Laya:

Broker:

Over a 35-year term, the Laya policy will cost €4,380 more than the New Ireland Ireland policy.

You could buy some decent private health insurance with those savings

Apart from the savings, the eagle eyed among you may have noticed that Laya offer joint life cover compared to the dual life cover on offer through brokers.

On a dual policy, there can be a payout on each person (for a total of €1m).

A joint life policy pays out on the first death only.

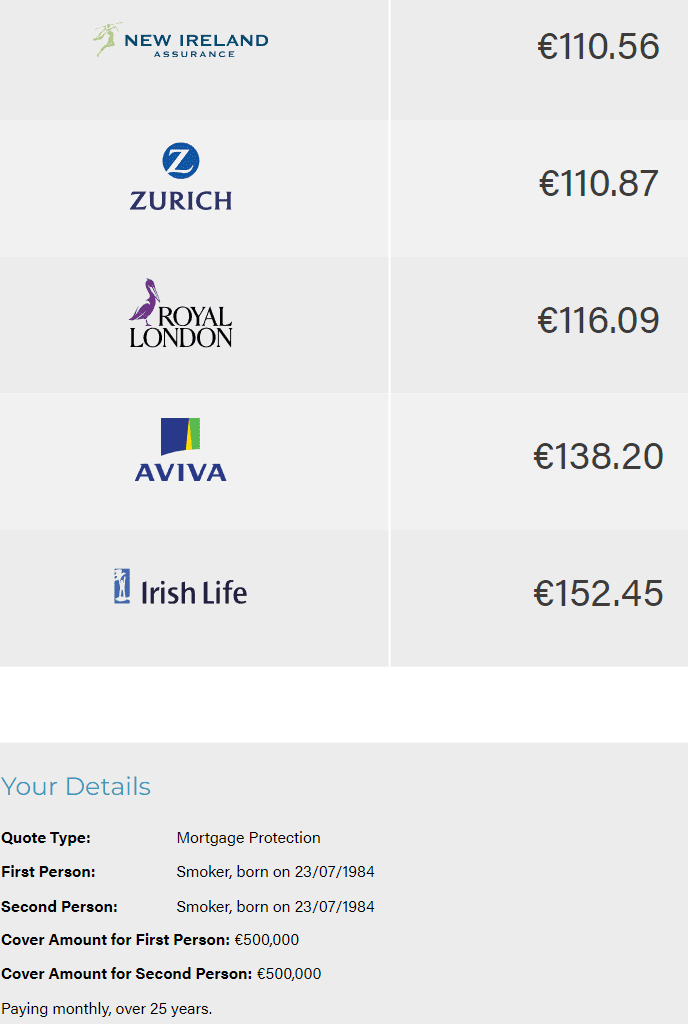

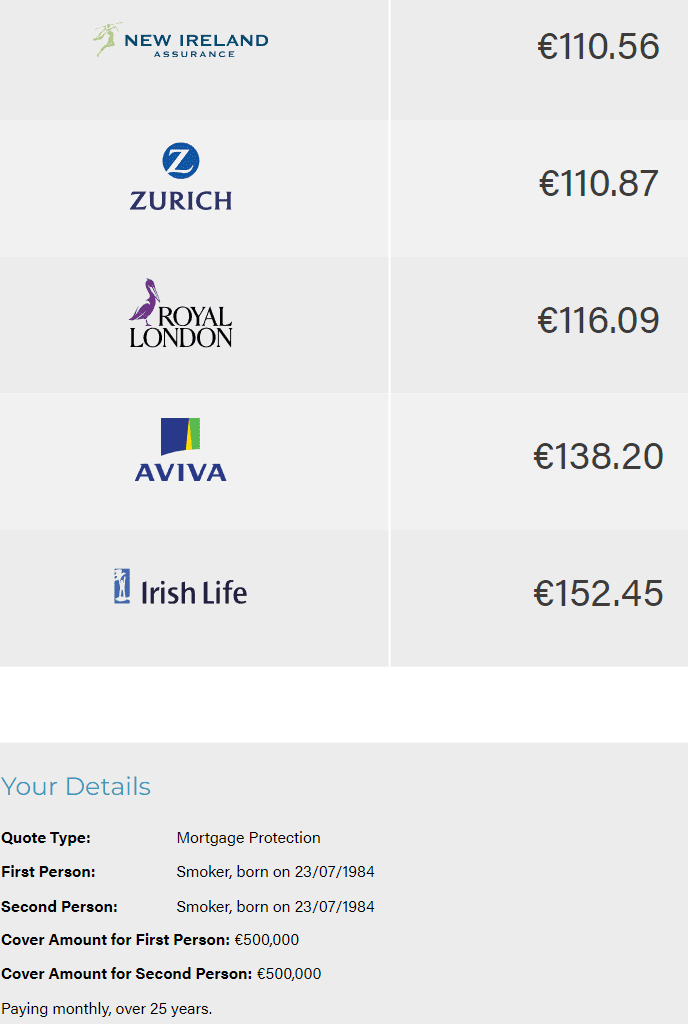

Using the same details but let’s make them smokers:

Laya

Broker

Again, we can do better and our cover is dual life so you’re insured for €1m not €500k.

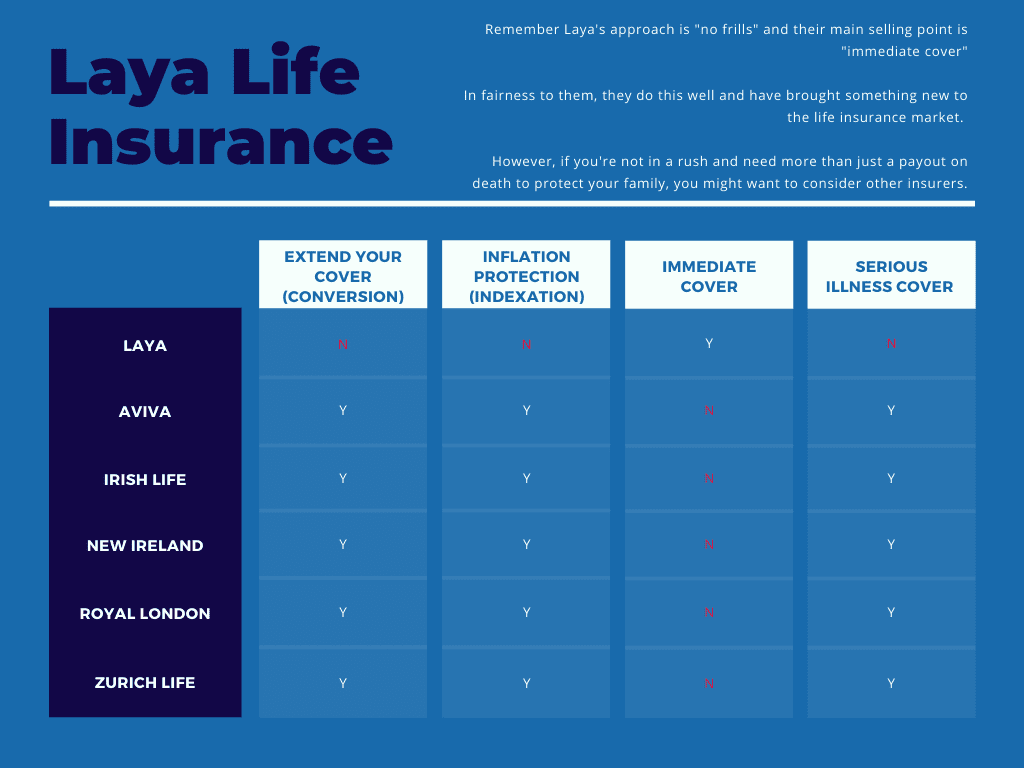

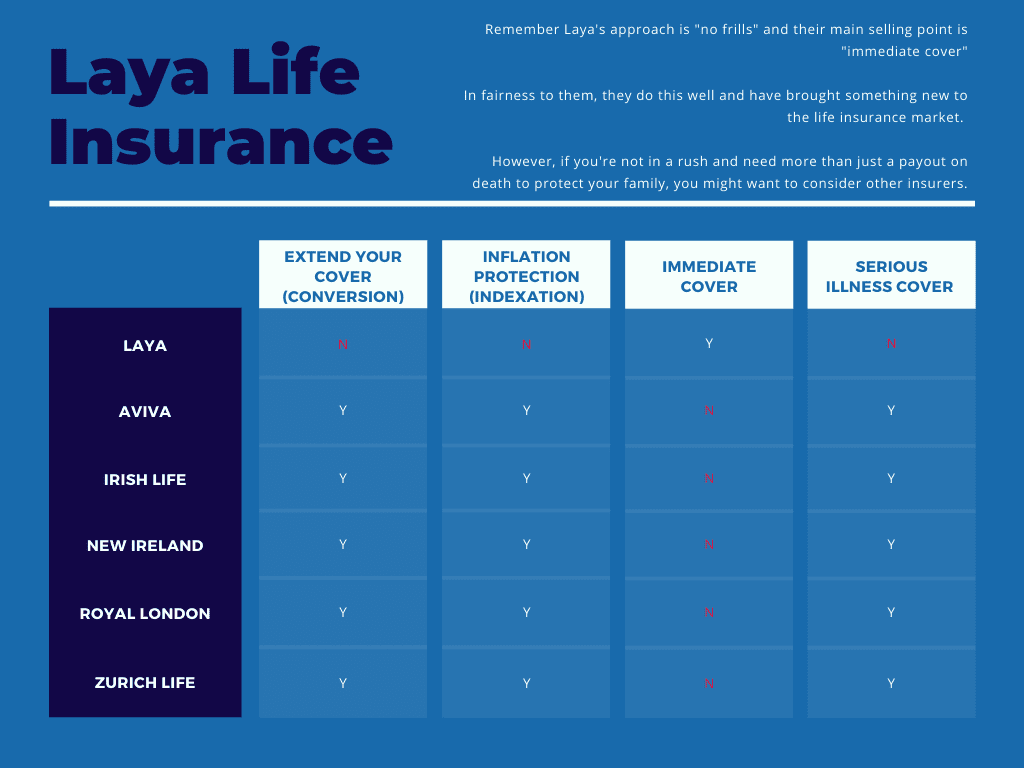

Laya doesn’t offer a conversion option, so your cover will expire at the end of the term.

With all of our insurers, you can extend your policy without having to answer health questions.

One of our insurers offers a whole of life benefit that guarantees your policy will pay out eventually. You can structure this policy so that it will pay out more than you pay in.

Another insurer we deal with offers the option to cash in your policy after 15 years and receive 70% of your premiums back in cash.

Once the policy has been set up you cannot change your cover

Other insurance policies give a degree of flexibility with free benefits, such as a Guaranteed Insurability Option (GIO).

This gives you the option to increase your cover in the future without answering any medical questions.

The market average across the main life insurance providers (Aviva, Irish Life, New Ireland, Royal London and Zurich Life) is around 98%.

Basically, once you don’t lie on your application form, your policy is guaranteed to pay out.

Our insurers publish their claims statistics every year like this:

Competition is good for everyone.

Hopefully, Laya will continue to ruffle a few feathers and bring about some positive change.

Good luck to them.

If you’re considering life insurance and need some guidance on the policies available at the other insurers, namely Aviva, Irish Life, Royal London, New Ireland and Zurich Life, we’re here to help.

Please complete this questionnaire, and I’ll be right back over email.

Thanks for reading

Nick

Editor’s Note: We published this blog in 2018 and have regularly updated it.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video