Table of Contents

Skip to my other article if you’re getting a mortgage together and you’re not married : Inheritance Tax on Mortgage Protection for Unmarried Couples

—

Picture it: a moonlit night, two lovebirds staring deeply into each other’s eyes, whispering sweet nothings, and then suddenly, one of them asks,

“Honey, do we have to pay taxes on our life insurance policy if one of us snuffs it?”

Nothing like tax to ruin the moment, eh?

Well, it depends on whether these love birds are married/civil partners or are an unmarried couple

Let’s look at an example of each:

Ann and Barry are working, married parents.

They have two children.

They have a joint life insurance policy of €400,000.

Ann pays the life insurance premiums.

Ann passes on.

Their insurer pays out €400,000

Barry, as the spouse, receives the €400,000 payout tax-free.

This lump sum replaces Ann’s income so Barry and the kids are not financially affected by her death.

But what if Ann and Barry were single.

Let’s meet Bill and Ben.

Like our other couple, Bill and Ben also have a life insurance policy of €400,000.

They both work, are not married and have two children.

Bill pays the premiums.

Bill dies.

Ben does not receive €400,000 tax-free.

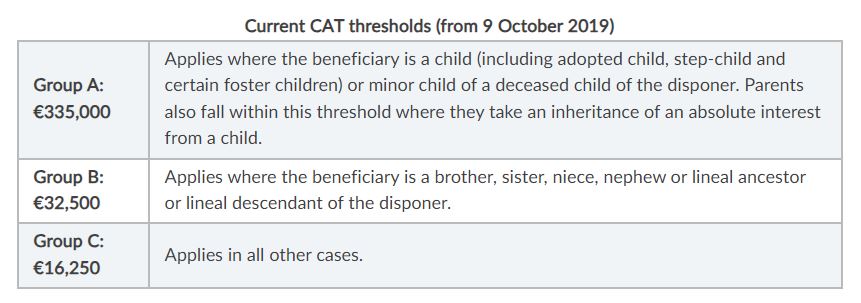

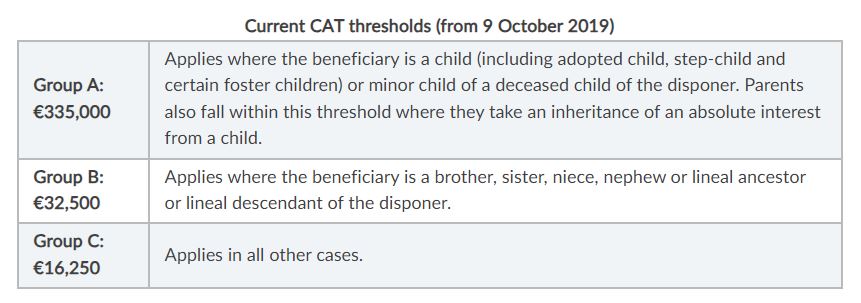

You see, in the eyes of Revenue,Bill and Ben are “strangers” so Ben receives just €16,250 tax free because he is in Group C below.

Revenue will charge 33% inheritance tax on the balance of the life insurance policy.

So Ben will lose €126,638 from their life insurance pot.

(how much is a wedding again?)

Instead of €400,000, Ben and the kids receive €273,362, still a nice sum of money but a lot less than he had expected when he and Bill took out the policy.

If you’re neither married nor in a civil partnership, you can still avoid paying inheritance tax on your partner’s life insurance.

How?

Pay each others premiums.

This can be done quite simply by taking out two “life of another” policies.

If they do so, the surviving partner will receive any pay out tax free because they are the beneficial owner of the policy.

Here’s come the legalese…

Seek professional legal and tax advice as the information given is a guideline only and does not take into account your personal circumstances

Yes, you’ll pay a little more for two single life policies but you’ll avoid a 33% Capital Acquisitions Tax so it’s well worth it.

Here’s an example:

Quote Type: Dual Life Insurance

Bill: Non-Smoker, born on 17/12/1977

Ben: Non-Smoker, born on 07/05/1975

Cover Amount for Bill: €400,000

Cover Amount for Ben: €400,000

Over 20 years.

Total Premium : €73 per month

Splitting this into two life of another policies:

Quote Type: Bill’s Single Life Insurance

First Person: Non-Smoker, born on 17/12/1977

Cover Amount: €400,000 paying monthly, over 20 years.

Premium : €36 (paid from Ben’s account)

Quote Type: Ben’s Life Insurance

First Person: Non-Smoker, born on 07/05/1975

Cover Amount: €400,000 paying monthly, over 20 years.

Premium : €42 (paid from Bill’s account)

Total : €78

Bill and Ben would pay €4 per month exra but could save €126,638 in tax – probably worth it amirite?

Goin’ to the chapel and we’re gonna get married

Goin’ to the chapel and we’re gonna get married

Gee, I really love you

And we’re gonna get married

Goin’ to the chapel of love

If you get married in a chapel, a registry office, underwater or or on top of the world, you can keep the two single life policies or switch to a dual/joint life policy if it’s better value.

Usually, it makes more sense to keep the two single life policies as by the time you get married (especially if you’re waiting for your other half to pop the question), you might be very, very old.

But if you do:

Are you and your partner considering life insurance?

Or did you take out a joint policy when you hadn’t the foggiest about these tax implications?

If you’d like me to make a recommendation on the types of cover you should consider based on where you are in life, please complete this questionnaire and I’ll be right back.

Thanks for reading

Nick

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video