You might say:

But what about smoking

I say:

Good point but you can always quit and make yourself a non smoker.

You can’t make yourself younger.

Or can you?

With every birthday, the price of your life insurance will increase. But you can avoid this by backdating your policy.

It’s a totally legit way of reducing the cost of your cover.

All other things being equal, older people are more likely to die than younger people.

Older people represent a bigger risk of a claim to the insurer.

The insurer charges older people a higher premium for life insurance than younger people.

Q.E.D

A 30-year-old pays more for her cover than a 29-year-old, a 44-year-old pays more than a 43-year-old and so on.

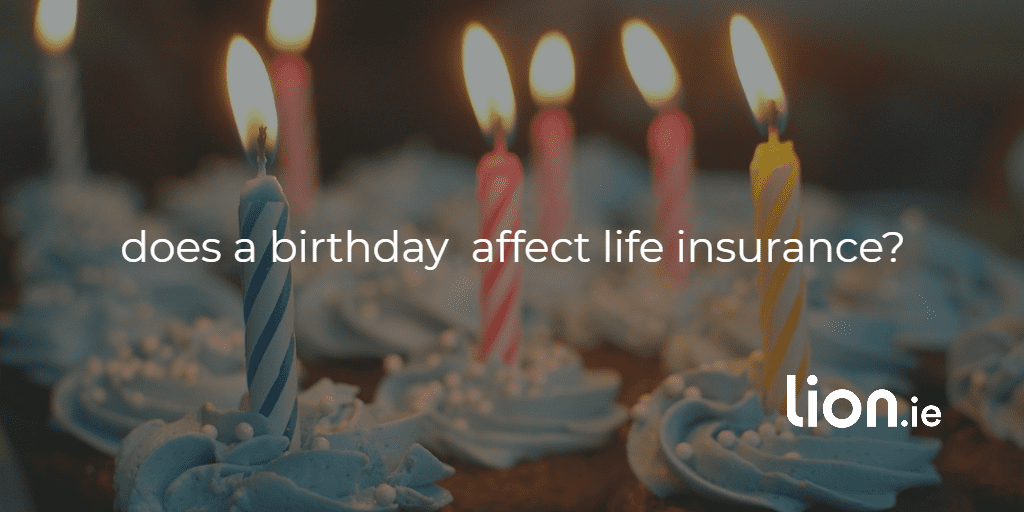

Some examples will clear it up. Let’s quote for €250,000 over 25 years.

Here’s where it gets interesting:

Brian, a 59-year-old, will pay €278.53, but as a 60-year-old, he’ll pay €353.70.

That’s a 27% increase.

Taking out the policy as a 60-year-old will cost Brian €22,500 more over the life of the policy compared to him taking it out as a 59-year-old.

Being one day older costs €22,500!

FML thinks Brian.

But we can save Brian all that moolah.

Imagine Brian turns 60 on the 15th of December.

Today is the 17th of December.

We can change the start date of his policy to the 1st of December, turn back time and make him 59.

Brian now pays €278.53 instead of €353.70 per month.

Brian must pay December’s premium, but long-term, it’s a small price to pay.

Three months is usually the longest the insurers will allow.

So if you have had a birthday in the last three months, you can get a lower price.

Some insurers will backdate to 6 months, but this is on a case by case basis. Let me know if you’d like me to look into it for you.

Backdating mortgage protection works in the same way. To calculate how much you’ll save:

Using the example above, here’s the maths.

You can save €2253 by backdating your policy.

Not too shabby.

The older you are, the stricter the life insurance underwriting is.

If you’re 49, you might get cover based on an application form alone.

However, the insurer may request a medical screening for a 50-year-old.

The medical could affect your premium if the blood test reveals a health condition you were unaware of

Unfortunately, you can’t backdate your age to avoid a medical. You can only plan by applying before you hit a milestone age.

Hi Nick, I’m looking for life insurance but I’m confused and don’t know whether to go for the whole of life cover or normal, is it term life cover?? What’s the maximum age for life insurance anyway? Cheers! Linda

I received this question a few months back, and it’s a question we get asked a lot, as life insurance costs vary with age.

At that time, Aviva was the only company that would cover you until age 90.

At the other five insurers, the maximum age for life insurance was 85.

Aviva was the only insurer going to age 90; they could pretty much charge what they liked.

There was no competition.

If you needed a life insurance policy past your 85th birthday, you were stuck with Aviva.

As well as the price, this sucked for another reason…

Aviva offered a minimum cover of €30,000 and wouldn’t quote for a lower amount.

A lot of our clients just wanted to covered funerals costs of say €15,000

It’s still 90.

So what’s changed?

There’s another insurer offering cover up to age 90!

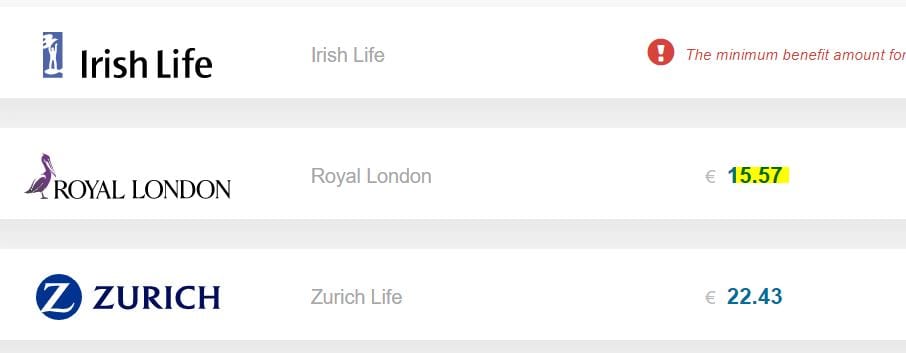

Royal London will offer mortgage protection and life insurance to age 90.

Royal London will quote for €10,000 worth of life insurance – ideal for funeral planning.

Congratulations, old-timer!

But you will have outlived your policy, and the insurer will pocket your premiums as payment for providing the promise to pay your claims had you passed.

Lovin the alliteration in that sentence.

You can guarantee your policy pays out eventually with whole of life assurance.

Usually yes…but it’s always worth checking.

Let’s take a 50-year-old man looking to put €10,000 life insurance in place to pay for his funeral.

With Royal London, €10,000 40 year life insurance costs €15 per month.

But €10,000 whole of life assurance also costs just 57c extra.

Always go for the whole of life assurance rather than the 40-year term life insurance if the difference in premiums is negligible.

Only a whole life policy will guarantee to pay out on your death, whenever that may occur.

To qualify for all of the insurers, you need to be 69 or less.

But most insurers will allow you to buy cover up to your 75th birthday.

With one of our insurers, you can buy term life insurance right up to your 83rd birthday!

You can buy whole of life assurance up until your 75th birthday.

The same rule applies to S72 inheritance tax life assurance.

Are you considering life insurance with a birthday fast approaching?

Have you just celebrated a birthday?

Let me show you how to backdate your policy – with my help; you too can be Dorian Gray!

Even if it’s not your birthday, but you’d like me to make a recommendation on the types of cover you need based on where you are in life; fill out this questionnaire, and I’ll be right back.

Or you can request a callback here.

Talk soon!

Nick

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video