Table of Contents

✅ How Smoking Affects Life Insurance in Ireland in 2025

The packaging on the auld smokes has been changed for years now, and if anything, all it’s done is train smokers to steadfastly ignore the big rotten tumour on it.

The massive jump in the price of cigarettes over the last few years has probably done more to dissuade you from smoking.

It’s why that one mate is always so popular when he comes back from Spain with a suitcase loaded with packets of 200 cigs for cheap.

I’m not going to tell you not to smoke.

I’m not your ma.

I’m also not going to tell you about the health risks, because we all already know. After all, we’ve seen the big rotten tumour on the fag packets.

I am going to tell you that smoking and/or vaping makes your Life Insurance premiums more expensive.

And don’t think you’re not included in this one too, holier-than-thou-vape-smokers. While your vape may smell like cotton candy or whatever notion-y flavour you’ve gone for, the insurers will charge you more for mortgage protection too.

I can’t give you an exact quote as I don’t know your personal situation, Mr/Ms Blog Reader, but I can give you an example.

Cheech and Chong are 30-somethings who are looking for €300,000 cover for the next 30 years.

For argument’s sake, everything about them is the exact same except that one smokes, and the other doesn’t.

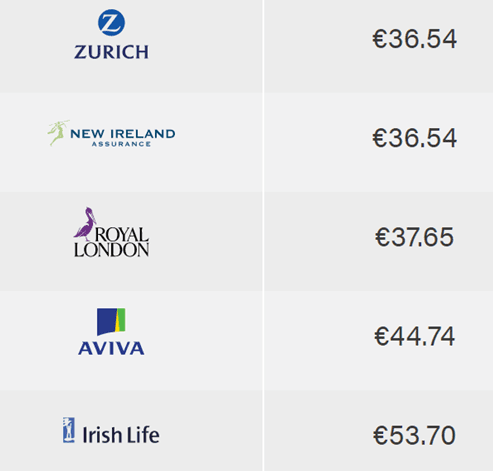

This is the non-smoker’s quote:

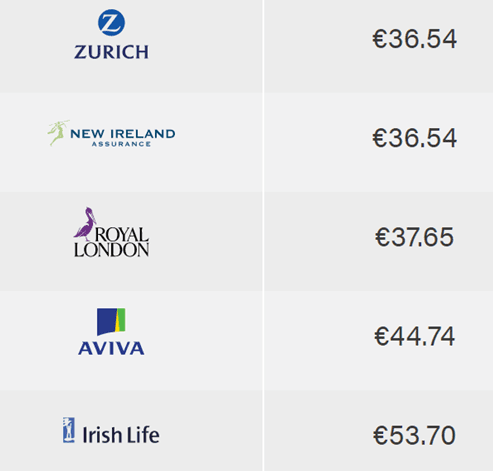

This is the smoker:

It’s almost twice as expensive.

Let’s say that Cheech, the non-smoker, and Chong, the smoker, both go with Royal London.

Across the lifetime of their policy, the difference really adds up.

Chong will pay more than €6,000 for THE EXACT SAME THING.

And let’s not even go near how much he might be spending a month on the smokes.

It adds up to thousands over those 30 years.

And remember e-cigarette vapers: it’s the same for you.

The only way to get cheaper Life Insurance as a smoker is to quit smoking.

In case you’re skimming: you have to be off the cigs to get cheaper mortgage protection

In fact, you have to be off all tobacco products for 12 months before the insurers will consider you to be a non-smoker.

That includes your rocket-powered vape, patches, chewing gum, the whole shebang.

You may just have to give Keith Barry a buzz and ask him to hypnotise you.

Now, you mayyyyy be thinking that you’re just going to lie.

And lookit, you wouldn’t be the first person in the world to have this thought – or even to follow through.

According to a study by the AA, almost two in five smokers are lying on their Lie Insurance forms.

But if you die and your insurer can prove you used nicotine in the 12 months before taking out life insurance, they will refuse to payout.

Your policy will be void, at best you’ll get back your life insurance premiums but that couple of thousand euro won’t be worth much to those you leave behind.

Well done for giving up cigarettes, from one ex-smoker to another.

Here, I made you a badge of honour.

Wear it with pride ?

Yes, you can get non-smoker rates as soon as you are 12 months off all smoking paraphernalia:

If you’re considering quitting and are taking out life insurance or mortgage protection, please get in touch.

One of our insurers will automatically reduce your premium as a non-smoker.

However, with the other insurers, you will have to reapply and answer health questions.

Let’s rattle through some quick info for the skimmers.

You might, but if you don’t get away with it, your family won’t get any pay-out, and they’ll be destined for a lifetime of poverty because you lied.

You won’t have to live with the consequences, but they will.

Don’t do it.

If you’re a social smoker, disclose you smoke but then quit and get a non-smoker policy in 12 months.

You’ve been meaning to stop the social smoking nonsense for ages now anyway.

DO IT

Not usually but you might be randomly picked and asked to go for a cotinine test with your GP.

This is where your GP gets a sample of blood, urine, saliva, or even hair and tests it to see if there is any cotinine or nicotine in your system.

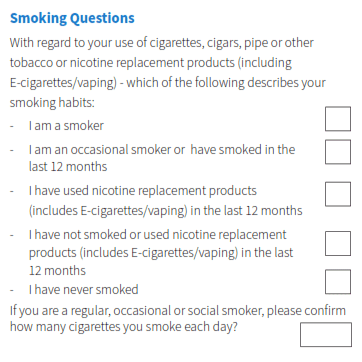

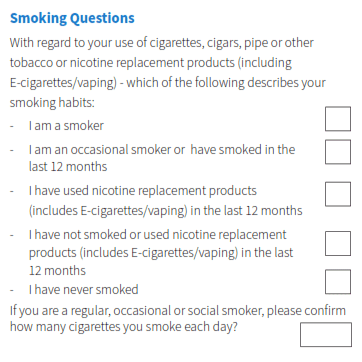

Which box would you tick?

If it’s not the “I have never smoked” then you’re a smoker.

The insurers used to ask “are you a smoker y/n”.

Since they changed how they ask the question, a lot more smokers are fessing up.

Sneaaaaaky (just like those sneaky smokers you have when you’re OUT-out)

Vapers are classed as a smoker, just the same as your baccy-based pals.

This was formally rolled out by all the insurers in August 2019.

Time.

Flies.

Fair play to you pal, but any patches or nicotine products need to be out of your system for 12 months.

So in short: you need to be off the fags or vape, and any nicotine replacement products for an entire year.

When it comes to life insurance for vaping the information isn’t wildly different as the insurers now class them as being the same.

For balance, you can also watch a video of sick vaping tricks here.

It’s a thing and appears to be a bunch of young lads in hoodies blowing smoke out their noses.

A bit like ole Gandalf.

The insurers will assess you separately.

You’ll get non smoker rates, the insurer will charge your partner smoker rates which will increase the overall cost of your policy.

If you are getting a policy and you know the smoker is going to quit or at least is very strongly thinking about it, find the insurer who is most sympathetic to this situation.

Some insurers will offer non-smoker rates automatically once you haven’t used nicotine in 12 months.

Others will make you reapply all over again.

Little carcinogenic sticks are always, always, always a blight to the cost of insurance and the only way to get a lower premium is to quit.

Have you or your partner quit smoking for over 12 months?

If so, you could save over 50 per cent by applying for non-smoker’s Life Insurance.

If you’ve reached the end of this article and you’re resolute in continuing to smoke, fair play, something’s gonna kill you in the end, it might as well be something you enjoy.

The discounts we offer take the edge of the extra you will pay as a smoker.

If you’d like some help getting the most suitable cover, complete this questionnaire and I’ll be right back.

Thanks for reading

Nick (ex-smoker, yep, the worst kind of smoker!)

Editor’s Note | We published this blog in 2018 and have updated it since

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video