Table of Contents

10-second summary: You can still get life insurance or mortgage protection after cancer. The longer you’ve been clear, the better your chances — and many Irish insurers offer standard rates five to seven years after treatment ends.

Editor’s note: First published March 2017 | Refreshed November 2025 with updated Irish insurer guidelines, waiting times, and Code of Practice for Cancer Survivors.

Cancer is a bastard.

Everyone knows someone who’s had it — but everything changes when it’s you.

Treatment makes you sick, your life gets flipped upside down, and by the time you finally get the all-clear, you’ve spent years in survival mode.

So when you try to move on with your life — maybe buy a home — it’s natural to feel frustrated when your bank or insurer suddenly makes things awkward.

It can feel like punishment for something you’ve already fought hard to beat.

You’ve done the tough bit.

Getting insurance shouldn’t be another battle.

That’s where we come in.

We specialise in helping cancer survivors get life cover and mortgage protection — at the best possible price, with the least possible hassle.

Some insurers are understanding with a cancer history; others… not so much (and applying to the wrong one can make things worse).

We work with all five Irish insurers and know which reinsurers to approach for different cancer types. Here are the ones we see most often:

Yes — you can still get life insurance after a cancer diagnosis. The outcome depends on your diagnosis, treatment, and current health.

If you’ve been in complete remission or off active treatment for more than seven years, you now qualify for standard-price cover under the Mortgage Protection Code for Cancer Survivors.

That’s a major change for 2025 — and a relief for thousands of Irish families.

💬 Been through cancer and not sure if you can get cover?

Fill out our confidential Cancer Questionnaire — it only takes two minutes, and we’ll tell you if cover is possible.

They’ll look at:

Insurers will ask your GP for a Private Medical Report (PMAR), so make sure your doctor has your latest discharge or follow-up letters on file.

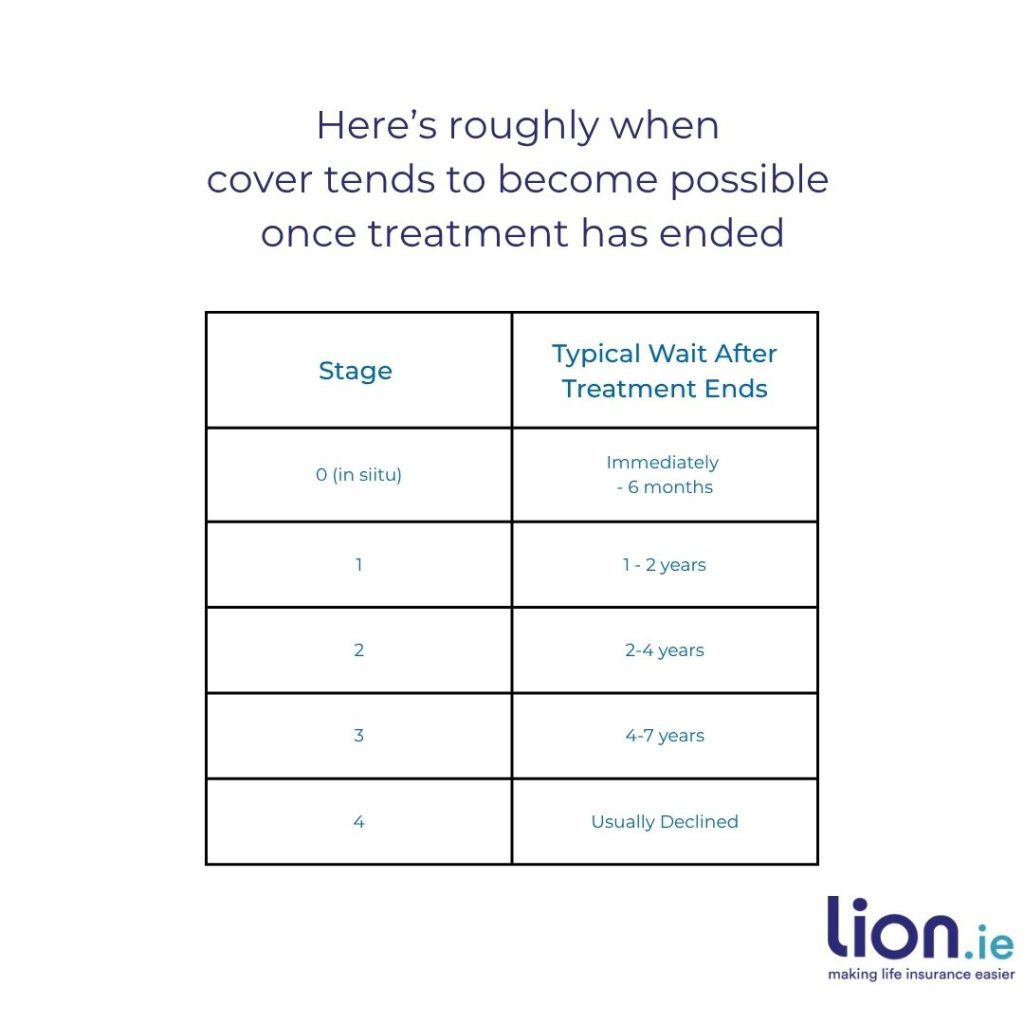

It depends on the stage.

For early cancers, cover can be possible within a year.

For advanced cases, insurers usually postpone applications for three to five years.

No insurer will offer cover while treatment is still ongoing or scheduled to begin — you’ll need to be clear and stable first.

For most cancers they use the TNM staging system:

If you can get me a copy of your Histology Report, that would be really useful , it helps me find the right insurer and avoid unnecessary delays.

For more on how underwriting works, see our underwriting process guide.

For more on cancer staging and follow-up care, see the Irish Cancer Society’s guide.

Each cancer has a different postponement period.

Here’s a general guide (subject to your consultant’s reports and current health):

If it hasn’t spread, cover can be available within three months of treatment. For deeper or spread cases, expect 6 months to 2 years.

The most common skin cancer in Ireland — slow-growing and 95% curable. Once removed, cover can be arranged quickly.

If there’s been no spread, cover may be possible 6–12 months after treatment. For others, the wait is usually 1–2 years.

Stages 1–2: postponement of 3–10 years depending on outcome.

Stages 3–4: usually declined until remission period is very long.

For childhood acute lymphoblastic leukaemia (ALL), adults often qualify since the postpone period has passed.

For chronic lymphocytic leukaemia (CLL), insurers look at your age and stage (Binet or Rai). Cover is sometimes possible after age 50 if stable.

This is where things change.

Life insurance and serious illness cover are assessed differently.

If you’ve previously had invasive cancer, you may still be able to get serious illness cover in Ireland but the insurer will almost always permanently exclude that specific cancer from the policy.

That means you could still be covered for other listed conditions such as heart attack, stroke, multiple sclerosis or major organ failure. But if the same cancer returns, there would be no payout.

In more advanced cases, or where treatment ended recently, insurers may postpone or decline altogether.

This is why sequencing matters. Applying to the wrong insurer first can result in an unnecessary decline on record, which can limit your future options.

If serious illness cover is important to you, tell us before applying anywhere else. We’ll check which insurer is most realistic for your situation and whether an exclusion is likely before a formal application is submitted.

There’s no sugar-coating it — premiums are higher.

But it’s often a temporary loading, lasting one to ten years, depending on your type of cancer and recovery history.

Once you hit key anniversaries, we can review and often reduce your rate.

If you’d like me to get an indicative quote, complete this questionnaire (I’ll need your TNM stage and treatment dates).

Here’s a real-world example from a recent client:

I want to inquire with you about life assurance. My fiancée and I have been approved for a mortgage with AIB. Irish Life said they’d postpone cover because I had Non-Hodgkin’s Lymphoma in 2019. I’ve been in remission since November 2019 — six years — but they still quoted a ten-year wait. I saw your site and reviews and figured you might know a better route.

We got them covered at normal rates — no loading, no postponement.

If you’ve been postponed or declined for life insurance after cancer, don’t take it personally — it’s about risk models, not people.

But that’s also why you need a broker who knows which insurer to try next.

I can usually tell within 24 hours whether it’s worth making a formal application.

💬 Been through cancer and not sure if you can get cover?

Fill out our confidential Cancer Questionnaire — it only takes two minutes, and we’ll tell you if cover is possible.

Thanks for reading

Nick

Written by Nick McGowan, QFA RPA APA

Nick is a qualified financial advisor and founder of Lion.ie, an independent Irish life insurance and income protection brokerage based in Tullamore.

He’s been helping people get fair, transparent cover for over 15 years — and was named Protection Broker of the Year 2022.

If you’d like straight answers (without the sales pitch), learn more about Nick here.

Further reading: Irish Independent article

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video