You’re simply the best.

Better than alllll the rest.

Better than anyone… I have everrrrr met.

No doubt, Tina Turner didn’t sing those words with the intention of a life insurance broker from Offaly using them in an article about Serious Illness Cover.

Yet here we all are. #PleaseDon’tSueMe

When it comes to comparing life insurance insurance policies, it’s usually a reasonably open playing field between the providers.

For Serious Illness Cover, we’re going to pooh-pooh all of them except for Zurich and New Ireland – these are the Tina Turner’s of the SIC world. For reasons we’ll soon get into.

But first, let’s take a breather and look at what Serious Illness Cover is.

Serious Illness Cover is a type of insurance that pays out a wedge of cheese if you get sick with an illness as defined on your policy.

WAIT, THIS IS UBER IMPORTANTE.

The insurers define each illness explicitly in the policy conditions. This means your policy won’t pay-out on every disease that you would class as serious.

Also, it means that you could get an illness named on the policy, but if you don’t have a severe enough case of it, you might not get a pay-out.

Which sounds a bit hairy.

It’s also why I prefer Income Protection. However, Income Protection can be tricky for some occupations and medical histories. So,i f you can’t get it then you can’t go wrong with a chunk of Serious Illness Cover.

If you were to look at brochures for Serious Illness Cover, you might be tempted to go with whichever insurer covers the longest list of illnesses. I get it; it seems like a logical decision. More is usually better, right?

But some of those illnesses are ridiculous. You’re more likely to be knocked over by a unicycling bear on a sunny day in Ireland than to contract some of the illnesses covered by the insurers.

So then smartypants McGowan how should I compare Serious Illness Cover?

Here goes:

As I mentioned above, a provider offering cover for a raaake of illnesses is only useful if the disease is both

a) something you might actually have a chance of contracting and

b) easy to claim for.

See, the insurers keep adding new conditions and illnesses all the time to buff out their list. And lots of them are illnesses you’ll never actually get. It’s window dressing; otherwise shouldn’t the price go up every time they add a new illness as they are most at risk of paying a claim?

More illnesses yet no increase in premium? What sorcery is this?

Well, it’s a load of smoke and mirrors wherein the insurers are sure that adding all these new-fangled illnesses won’t result in additional claims. One such new-fangled illness is necrotising fasciitis – or flesh-eating disease. How many people do you know who have had a touch of necrotising fasciitis?

Exactly.

In short: don’t fall into the trap of going with the longest list of illnesses, esp. if you haven’t even heard of most of them.

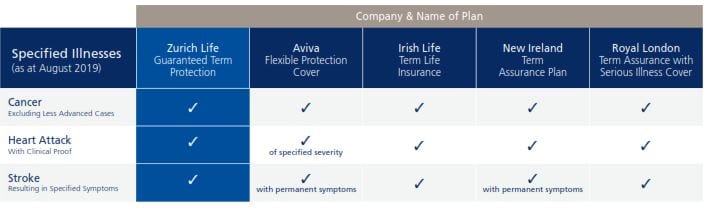

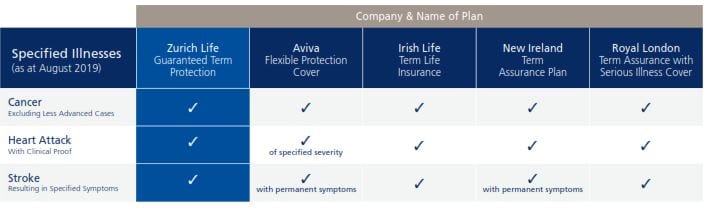

For example, 11 illnesses make up 96 per cent of all claims, while three of those illnesses make up a whopper 86 per cent of claims.

Those three illnesses are cancer, heart attack, and stroke.

As you can see in the above graphic from Zurich Life, the insurers all cover the big three, but there’s an additional layer here, where science kicks in.

So each illness is defined by the insurer. These definitions can make it easier or harder to claim for an illness—for example, a heart attack.

A heart attack, also known as a myocardial infarction (M.I.), happens when part of the heart muscle dies because it has been starved of oxygen. This causes severe pain and an increase in cardiac enzymes and troponins, which are released into the bloodstream from the damaged heart muscle.

The increase in troponins is essential here. In the past, troponins had to reach a certain level for a claim to be successful. Nowadays, any increase in the level of troponins is enough for Zurich Life, Royal London, New Ireland and Irish Life to pay-out. Aviva still requires troponins to reach a level which indicates a severe heart attack.

Just call me Dr Nick. (Hiiiii everybody.)

It’s similar for cancer, in that it’s a little different for each of the insurers, though Zurich is leading the way here. In effect, they will pay out €15,000 for any type of cancer if the tumour is treated by surgery.

Before this, your cancer had to be of a certain severity before the insurer would pay-out. With Zurich’s new definition, it’s easier to claim – and that’s what it’s all about.

For life cover having had a stroke:

Previously, to claim for a stroke, the medical evidence had to show permanent damage. Now symptoms just need to last 24 hours…with all insurers but Aviva. This is a much lower bar to overcome to get a pay-out.

Similarly, with Multiple Sclerosis, you had to have lasting symptoms for a certain amount of time. In contrast, now with Zurich Life and New Ireland, you can claim based on a definite diagnosis of M.S.

From Zurich’s Definition:

The definition requires that there have been symptoms that include the deterioration of the senses (sight, hearing, touch, taste or smell) and/or the ability to control movement. The diagnosis must be confirmed by a Consultant Neurologist.

Here, Zurich and New Ireland are best.

If you look at the next most ‘popular’ diseases, you’ll see a similar pattern emerge:

To gauge which policy seems best for you, you’ll want to look through the list of illnesses from each insurer and the corresponding definition to see which is fairest and most straightforward to claim on.

The short answer is that Zurich and New Ireland win out here.

To choose between Zurich and New Ireland, you can look through the extended list of illnesses too and see which listing is more comprehensive, like so:

Looking at that table, you’ll be thinking that it’s a home run for New Ireland.

However, Zurich has two little bonus benefits up its sleeve:

1. New Booster Serious Illness Benefit: An additional payment of up to 200 per cent if:

Essentially, it’s a booster payment for a radical change to your life.

e.g if you have €50,000 serious illness cover and you’re in a car accident which results in traumatic head injury, Zurich Life will pay out €100,000

2. New Child Specific Serious Illnesses which is a payment for parents if their children are diagnosed with types of cystic fibrosis, cerebral palsy, or spina bifida. The thoughts of ever having to claim on this is heart breaking but it will give the parents sufficient financial breathing space to take time off work to care for their little one.

While payment isn’t going to solve the health issues, at least knowing you’re covered financially is peace of mind in its own way.

AKA Price!

it’s all well and good wanting cover from Zurich or New Ireland but not if their prices are off the wall. Fortunately, both of these chaps are currently offering 10% off their serious illness premiums so there’s never been a better time to buy. Trust me…or if you don’t trust me, here’s the paragon of virtue, DT:

You can get an instant serious illness cover quote here

While I wouldn’t usually sway you so heavily towards a given insurer, you’ll see by the list of illnesses and how easy it is to claim for them that you should go for Zurich or New Ireland.

Which one you choose will depend on whether you want comprehensive cover for more illnesses (New Ireland) or Zurich’s additional pay-out as outlined above.

I’ll leave that one up to you.

Once you’re ready to take the leap, you can give me a call on , or you can fill in this form, and I’ll take it from there!

Chat ya soon

Nick

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video