Table of Contents

Each year, approximately 10,000 Irish people have a stroke.

Unfortunately, around 2000 die.

That’s more deaths than breast, bowel and prostate cancer.

So you can see why the underwriters at the life insurance providers are concerned if you have had a stroke in the past.

One in five people will have a stroke at some time in their life.

By the way, I’m not trying to scare you with all of these statistics, I’m just trying to reassure you that you’re not alone… and that you’ve come to the right place.

The good news is that more people are surviving a stroke than ever before.

However, two thirds of survivors leave hospital with a disability, with strokes causing a greater range of disabilities than any other condition.

If you have suffered a stroke or are looking into life insurance for somebody else, you’ll find this article on getting life insurance after a stroke useful.

I’m glad to say that most of our customers have successfully obtained life insurance or mortgage protection after a stroke.

A stroke is like a “heart attack for the brain”.

It occurs when the brain is starved of oxygen much like a heart attack strikes when the heart is deprived of oxygen.

This means getting life insurance has similarities to to getting life insurance after a heart attack.

A Transient Ischaemic Attack (TIA) occurs in the same way as a stroke but the blood flow is only temporarily interrupted.

It’s less serious than a full stroke and symptoms are short lived, lasting no more than 24 hours.

The most common factors the life insurance companies look when they decide if they can offer cover are:

1. Ischaemic Stroke:

Over 80% of strokes are caused by a blockage of an artery supplying blood to the brain.

This is known as an ischaemic stroke.

2. Hemorrhagic stroke:

Up to 20 per cent of strokes are caused by a bleed into the brain from a burst blood vessel.

This is called a cerebral haemorrhage and causes the more serious kind of stroke.

The younger you are when you have a stroke, the more difficult it will be to get life assurance.

If you’re under 40 and have suffered a stroke, cover is unlikely unless it was a TIA brought about by the birth control pill.

If you’ve had two or more strokes, a decline is likely.

Getting life insurance after a recent stroke is more difficult.

If you had a stroke or surgery for a stroke in the last 6 months, the insurer is likely to postpone offering cover for a period of time to see how things settle down.

How severe is the damage to the brain?

Is it temporary or permanent?

The milder and less permanent the damage, the better your chances of getting cover.

Are there any underlying conditions present like diabetes, high blood pressure, high cholesterol, smoking.

If you have a had a stroke and you continue heavy smoking and/or diabetes and/or heart disease will result in a decline.

It boils down to how many of the factors above are present.

Before making a decision, the insurer will request a detailed medical report from your GP.

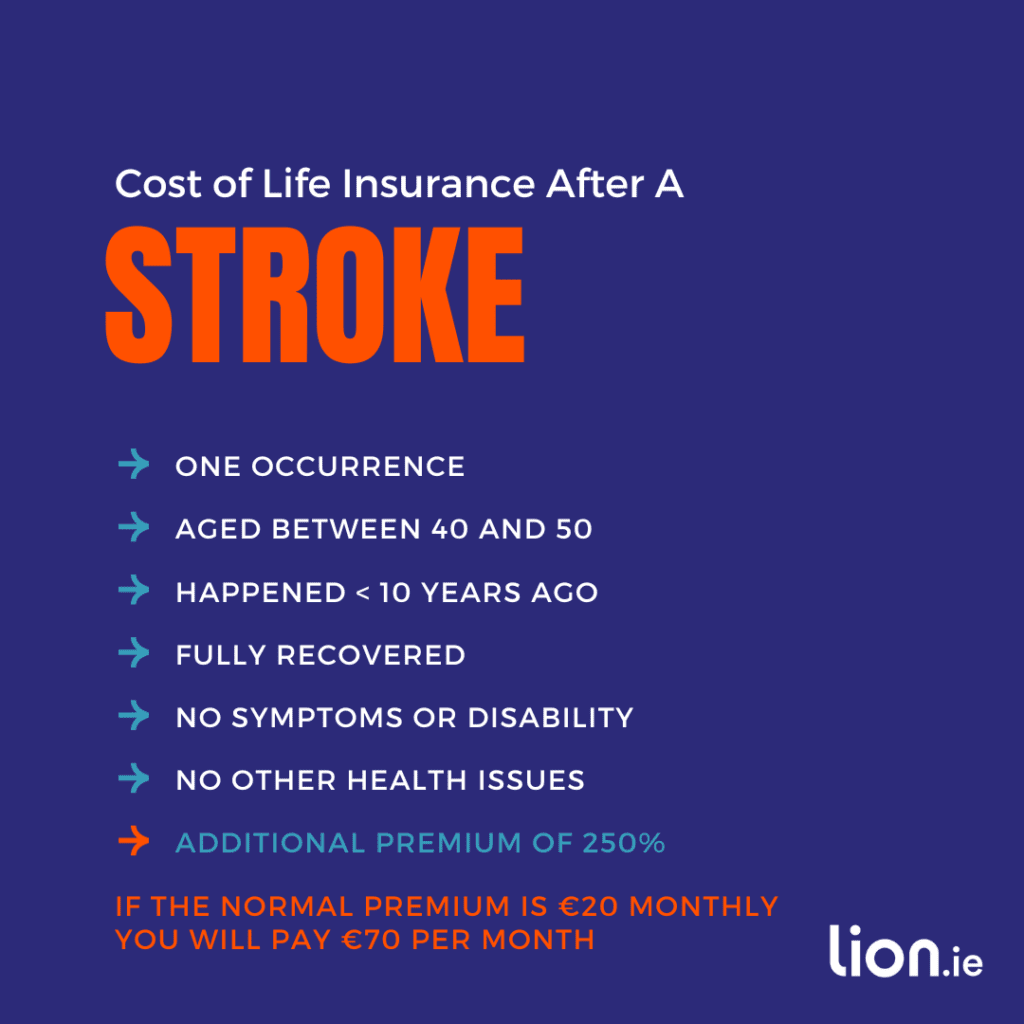

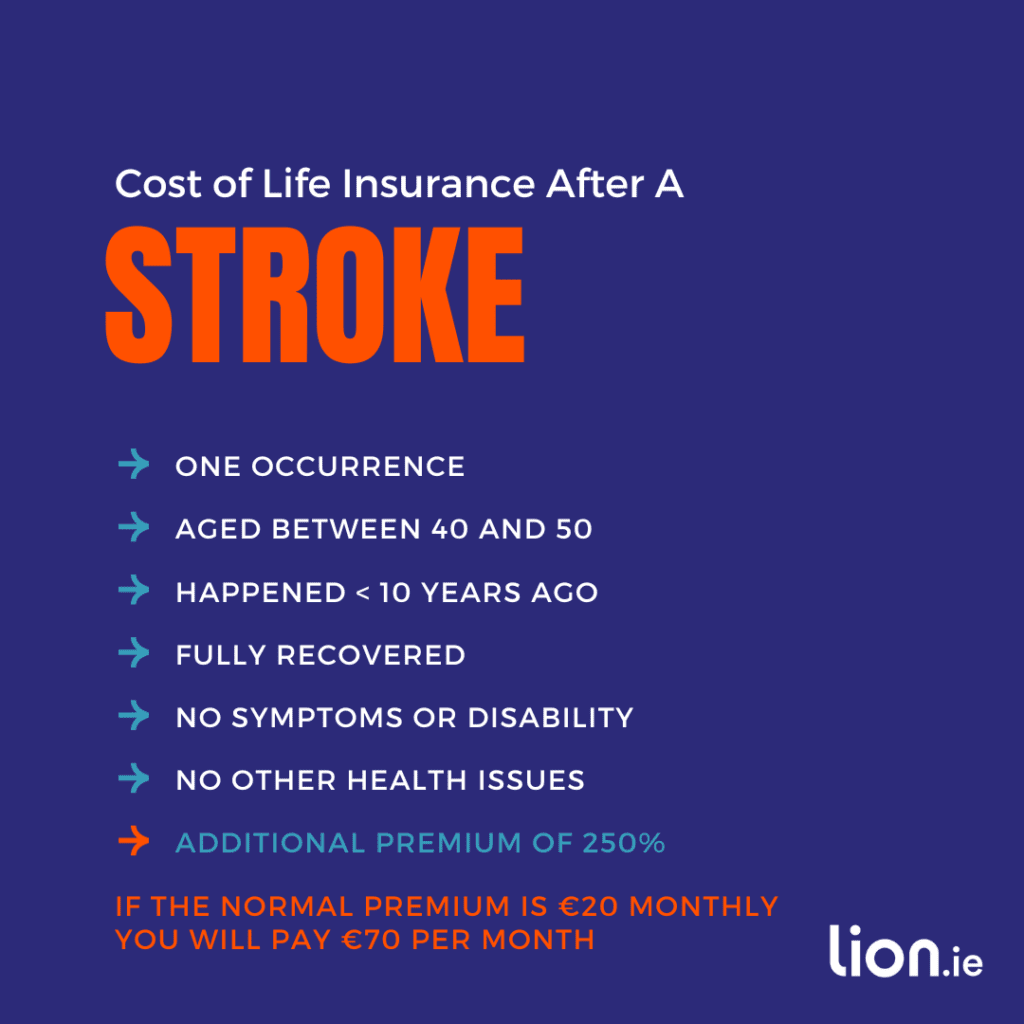

If cover is possible, you’ll pay upwards of double what somebody with no health issues would pay.

The insurers will automatically decline applications for Serious Illness Cover and Income Protection Cover but you may be able to get cancer only cover.

As sudden as the impact is on health, there’s also an immediate and perhaps unforeseen impact on your lifestyle.

In the UK, the Stroke Association reports that:

Often, the breadwinner loses their income and their families are faced with the unexpected costs of rehabilitation, recovery or life-long disability.

Appropriate financial protection is therefore something that everyone should consider to take away some of the hardship that a stroke could bring.

Some people think the State will look after them and it will to a basic degree but I would firmly advise you to make provision for yourself and your family in order to maintain your current lifestyle should the worst happen.

If someone you know has had a stroker and didn’t get their affairs in order, it would be foolish of you not to learn from their mistakes while you’re in good health.

Have you had a stroke or are you looking into getting life insurance for someone else?

If so, don’t be afraid to pick up the phone and give me a call on so we can discuss your own case in confidence, or if you’d prefer to work over email, please complete this questionnaire.

I will then speak with my underwriters, anonymously, to assess your chances of success and try to get you an indicative quote before you make a formal application.

If you have been heavily loaded on your current life insurance policy for a stroke you had many years ago, now might be a good time to reapply to get a better price.

Thanks for reading

Nick

lion.ie | Protection Broker of The Year 🏆

Editor’s Note | This blog first appeared in 2018 and has been regularly updated since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video