Table of Contents

We know getting life insurance after a heart attack can be really stressful.

It’s a tough time, and dealing with insurance on top of that can feel overwhelming.

Just know, you’re not alone.

Lots of people go through this and have the same worries.

We’re here to help you through it and find an insurer who understands your situation.

Like most health issues, the answer is “Yes, it’s possible, but it depends on a number of factors.”

I’ll run through the most important ones.

Different insurance companies have varying guidelines and risk assessments.

Some may have stricter criteria and longer waiting periods, while others might offer more lenient terms.

Our job is to find the most suitable insurer for your situation.

If you’ve had a heart attack in the last three months, insurers will wait until this period has passed.

They also need you to complete any follow-up tests before offering coverage.

Younger people will find it more difficult to get life insurance after a heart attack.

If you’re under 40 and have suffered a heart attack, I’m afraid it’s going to be almost impossible to get cover.

Two or more heart attacks will usually result in a decline.

If you have other health conditions such as diabetes, stroke, circulatory problems or other heart problems such as valvular heart disease or cardiomyopathy, the insurer will refuse cover.

Mild heart attacks may result in shorter waiting periods, while severe ones often lead to longer waiting periods.

A well-documented, smooth recovery with no ongoing complications can shorten the waiting period.

Ongoing health issues or complications can extend it.

Regularly following up with your cardiologist and sticking to prescribed treatments and lifestyle changes can shorten the waiting period.

Positive results from recent medical tests, such as EKGs, stress tests, and other cardiac evaluations, can shorten the waiting period.

You’re looking at a loading of between 100% and 300%.

If someone in perfect health pays €50 per month for their cover, you’ll pay between €100 and €200 per month for the same cover.

Unfortunately not, but Multi Claim Protection Cover and Cancer Only Cover are possible.

Are you worried you or a loved one won’t get covered because of a heart attack?

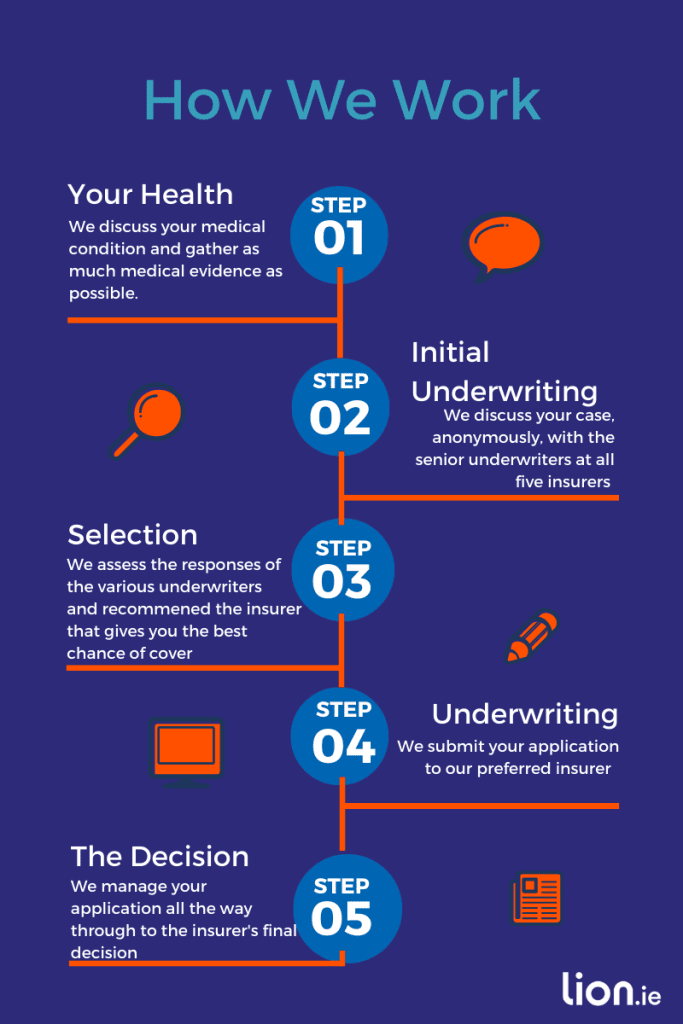

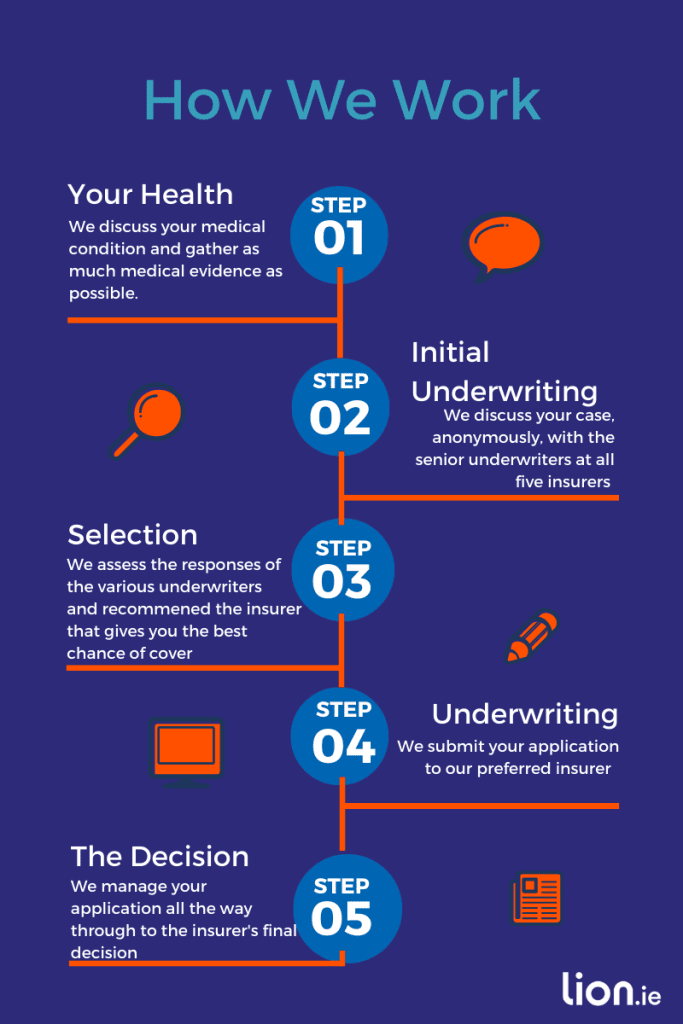

The most difficult part of getting coverage is trying to find the most understanding insurer.

That’s where we come in:

If you’d like me to check with my insurers, please complete this questionnaire.

Or, if you’d prefer a call first, please book a time that suits you here

Thanks for reading

Nick

Editor’s Note: We published this blog in 2017 and have regularly updated it

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video