10-second summary: Group Life Cover (death-in-service) is a great work perk, but it can’t be used for a mortgage, it ends when you leave your job, and it’s rarely enough to protect a family long-term. Treat it as a bonus — not your main life insurance.

If you’ve landed here, you’re lucky enough to work for an employer that gives you life insurance through your job; they might call it Group Life Cover.

So…

You might be wondering if you can use this cover for a mortgage because you’re struggling to get mortgage protection due to a health issue.

Or…

Somebody may have recommended you take out life insurance because you have children, and you’re wondering if your death in service will do instead.

We answer these questions below.

BUT MAYBE…

You’re just really bored, and you’ve somehow fallen down a life insurance rabbit hole.

WAKETHEHELLUP — you have better things to do!

Table of Contents

It’s a form of life insurance that employers offer their staff, usually after a certain time working with the company – say 6 months or after you have finished your probation period. The company will pay out a tax-free lump sum of money if you die while you are an employee.

Don’t worry; you don’t have to drop dead on the job; although the hours some of us have to work, I’m surprised more of us don’t croak it at our desks.

Your policy will pay out if you’re on the books when you pass away.

This depends on the T&Cs of your employment contract, but in Ireland, the average is 3-4 times your annual income, but it can be less.

Check the fine print for the sch-nakey stuff.

Yes indeedy:

There are no medical questions, so even if you have a serious health issue that would preclude you from getting personal life insurance, you will be able to get death-in-service cover.

Work schemes are heavily subsidised, even sometimes free (in lieu of salary), so you’ll pay less than for personal life cover.

You may or may not, it depends on your situation, but if you answer these questions, you may tease out the answer yourself.

Group/employer death-in-service benefits are set at up to 4 times income.

While this sounds like a fair whack of money, it’s only enough to replace 4 years of your income. Unfortunately, you’re going to be dead for a little while longer.

Let’s look at a practical example.

You’re 40 and the main breadwinner earning, say, €80,000 a year. You’re on target to earn €2,240,000 in your working life.

You have death in service of €240,000 (3 times your income).

That’s a gap of €2,000,000 if you get Tyson’ed.

How does your family bridge that €2m gap?

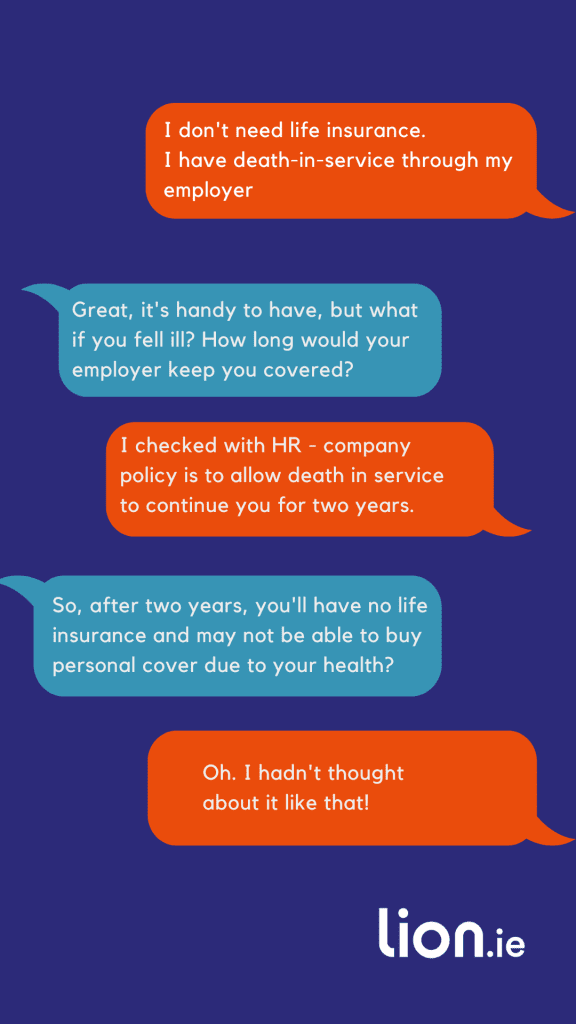

Can you honestly say you’ll be in your current job for the rest of your life?

Should you be made redundant, move from a full-time to a part-time role or leave your job, your cover will lapse.

You’ll have to apply for personal cover.

You’ll be older.

You may have had a health issue.

Your premiums may be outrageous, or even worse; you won’t be able to get cover due to ill health.

Sadly I see this a lot with older clients who become expendable to their employers later in life.

Usually, death-in-service schemes payout into a trust. This is normal — it’s a Revenue thing — but it means the trustees will get to decide where your money goes. It might not necessarily get paid to the person you’d like to receive it, especially if you’re not married.

With a personally held policy, you can extend your cover past your retirement age when you are most at risk.

With death in service, your policy will end at retirement.

You’ll have to apply for personal cover.

You’ll be older.

You may have had a health issue.

Your premiums may be outrageous.

Non-monsieur/madame.

Your employer can tear up your death-in-service contract without your consent (since the contract is between your employer and the insurer).

You’ll have to apply for personal cover.

You’ll be older.

You may have had a health issue…

Your premiums may be outrageous.

You can’t assign your death-in-service benefit to cover your mortgage, but if you’re looking for a waiver, it can strengthen your hand. The bank will take comfort that you have some life insurance.

You can tailor it to your individual needs.

You can add critical illness cover.

You can extend it at any time without answering medical questions.

You can get cashback.

You can buy life insurance that lasts for the whole of your life.

You can use it as security for a mortgage (though I don’t recommend you do).

For these reasons you should consider a personal life insurance policy in addition to any group life insurance you have.

Yep, you can.

We look at that very topic here:

Can I get Income Protection Before Starting a New Job?

Treat employer cover as windfall insurance.

Death in service is nice to have, but you can’t rely on it because there’s no guarantee it will be there when your family need it most.

When I make a recommendation, I consider your death in service by reducing the amount of personal life insurance you need.

If you’d like a free, no-obligation recommendation, simply complete this questionnaire, and I’ll be back over email.

Thanks for reading 🙂

Nick

Editor’s note: First published in 2017 | Micro-refreshed in 2025 with updated links, examples, and minor clarifications.

Written by Nick McGowan, QFA RPA APA

Nick is a qualified financial advisor and founder of Lion.ie, an independent Irish life insurance and income protection brokerage based in Tullamore.

He’s been helping people get fair, transparent cover for over 15 years — and was named Protection Broker of the Year 2022.

If you’d like straight answers (without the sales pitch), learn more about Nick here.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video