Table of Contents

Complete this questionnaire and I’ll send you a quote taking your BMI into account

—

30-second summary

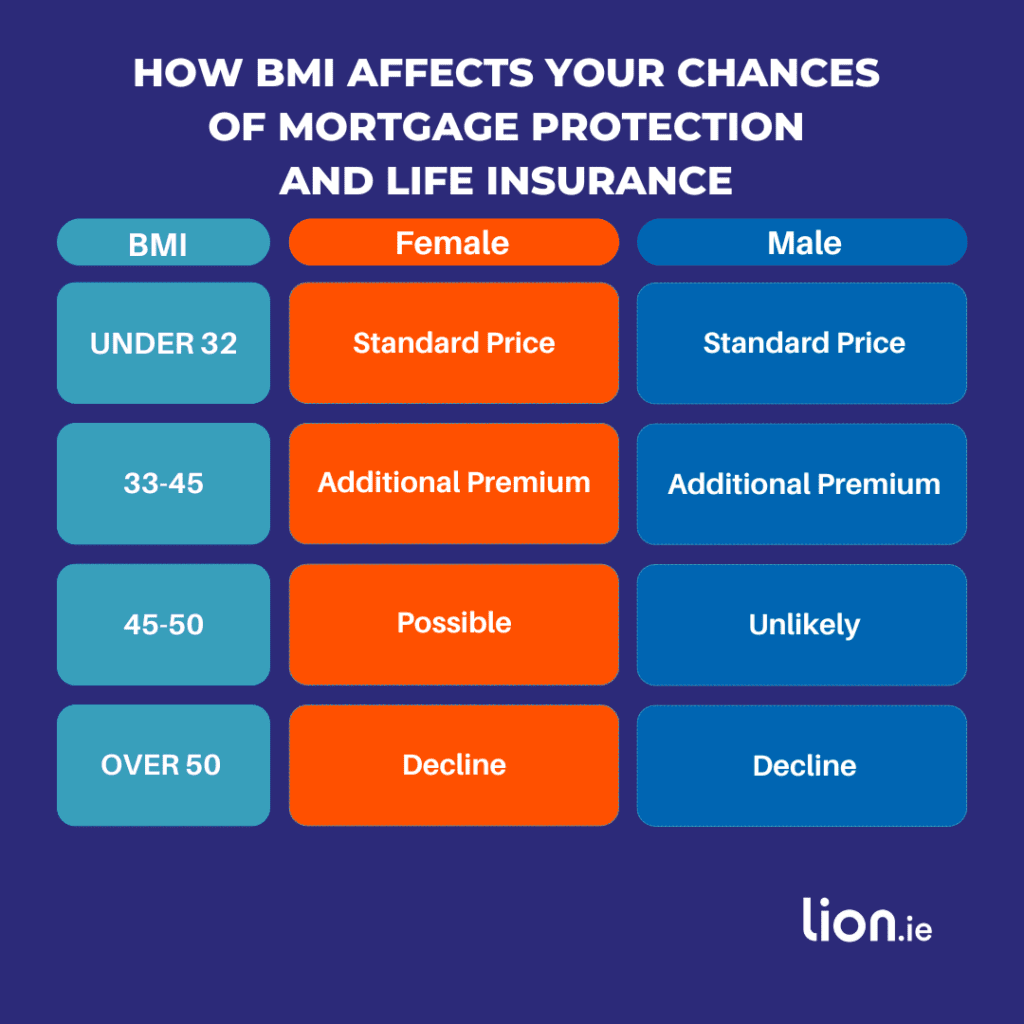

Assming non smoker, normal cholesterol, blood pressure and no other health issues.

The first step is to calculate your Body Mass Index (BMI).

BMI is a screening tool that uses height and weight to estimate body fat.

It’s not perfect, but it’s what the insurers use, so we’re stuck with it for now.

Click on the image below to quickly calculate your BMI.

An example should clear things up:

Michael is 40, 6’2 and 20 stone.

His mother would call him big-boned; however, the BMI calculator would put him in the obese category (BMI of 35.9).

You would expect Michael would have to pay more than someone in “better shape”.

But surprisingly, Michael would get the same price as someone with a “normal weight”.

However, if Michael were one year younger, with the same BMI, the life insurance company would increase his premium by 50%.

You see, overweight men under 40 are a bigger risk for the insurer.

Sorry for the reality check.

Apart from height, weight and age, the insurer will also look at some other factors when underwriting an application if you’re overweight.

There are many other factors the underwriters will consider when reviewing your application:

It’s safe to say that the more factors that are present, the higher the loading the insurer will add to your premium.

You may think because you’re overweight you cannot get life cover.

That’s not true.

You may have to pay a higher premium than someone of normal weight but you can get life insurance.

It all depends on which insurer you apply to.

We know exactly who to apply to, depending on your circumstances.

By the way, always give your accurate weight and height on your application form because the insurers are goiung to arrange a medical exam to your check your height and weight.

The same rules apply to mortgage protection insurance as for life insurance.

The insurers take a stricter approach if you have a high BMI and want to get critical illness cover.

If your BMI is over 40, you will struggle to get income protection or serious illness cover.

Michael, aged 40, in our example above, wouldn’t face an increase in premium for life cover only.

But if he were applying for serious illness cover too, the insurer would increase his premium by 50%.

The insurers underwrite income protection even more strictly, so; please get in touch before making an application.

If your BMI is >40, you won’t be able to get income protection.

Male 24/08/1983

Height 183cm

Weight is 145kg.

BMI 43.3

His bank and another broker had declined Kyle.

Honestly, I thought we would struggle to get him cover too due to his age, but fortunately, Kyle had a recent check-up with his doctor and was in perfect health apart from the weight:

I had a yearly check up back in June with my doctor and everything is in the normal range. They took bloods and checked my cholesterol, heart rate, HDL, LDL, Triglycerides, glucose, sodium, potassium, CO2, chloride, calcium, BUN, Creatine, Alk phos, ALT, AST, Albumin, and total protein. All were within normal levels except for HDL which was 0.1mmol/L under the recommended level of 1.4mmol/L, the doctor saw no reason for concern with this. I also had a Haematology FBC, Haematology BFF, and Thyroid function tests. All came back as normal. The doctor also took blood pressure and heart rate and both were ok.

We managed to get Kyle cover with a loading of +225%.

Further reading: Getting cover if you have a high BMI

Each insurer takes a different approach to underwriting applications from people with weight issues.

One insurer may increase your premium based on your age and BMI, but you could get the normal price by applying to a different insurer.

That’s where I come in; if you think you’re overweight for life insurance, let’s have a chat, and I’ll find you the best insurer based on your BMI.

Complete this short BMI questionnaire, and I’ll be right back.

Thanks for reading

Nick

Editor’s Note | We published this blog in 2016 and have updated it since

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video