Table of Contents

Picture this:

You’re at a party, mingling with colleagues, when the topic of adulting comes up.

While they chat casually about mortgages and pension planning (and you think, kill me now), someone drops the ultimate conversation bomb: insurance.

You quickly realise this is the worst party you’ve ever been to.

But before you can make a quick exit, someone looks you dead in the eye and asks—

what’s better, income protection or serious illness coverage?

As luck would have it, you had bought your mortgage protection from lion.ie and your advisor, Nick, never stopped banging on about the importance of income protection.

So, you confidently answer:

It’s Income Protection for me ALL DAY LONG!

Income protection provides regular payments to replace lost income if you cannot work due to illness or injury, while serious illness cover pays a lump sum upon diagnosis of a specified critical illness.

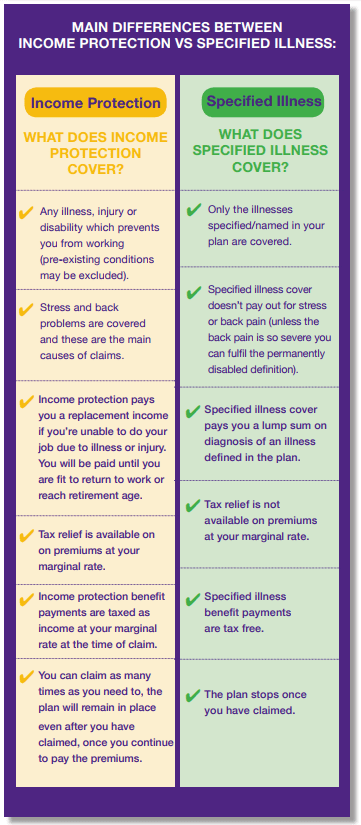

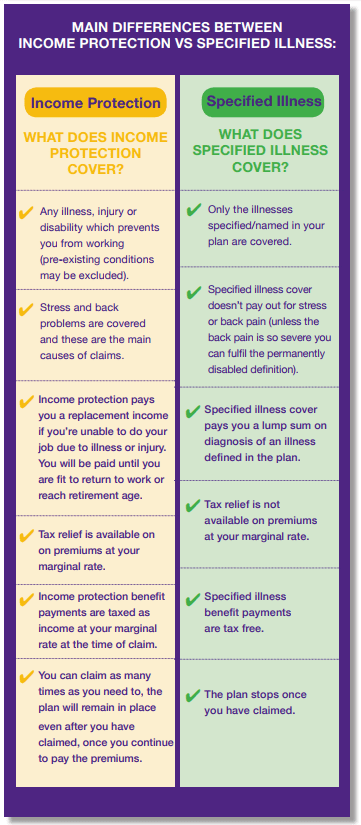

Here are the main differences between income protection and serious illness cover in handy chart form!

Let’s look at those differences in more detail.

Salary protection will pay for ANY illness, injury or disability that stops you from doing YOUR job (pre-existing conditions may be excluded)

However, serious illness coverage will only pay out if you get one of the illnesses listed on your policy.

Income protection will pay out if you can’t do your job for longer than the deferred period due to a mental health issue or if you can’t do your job because you hurt your back/pulled a hammy/cricked your neck/stubbed your toe (badly).

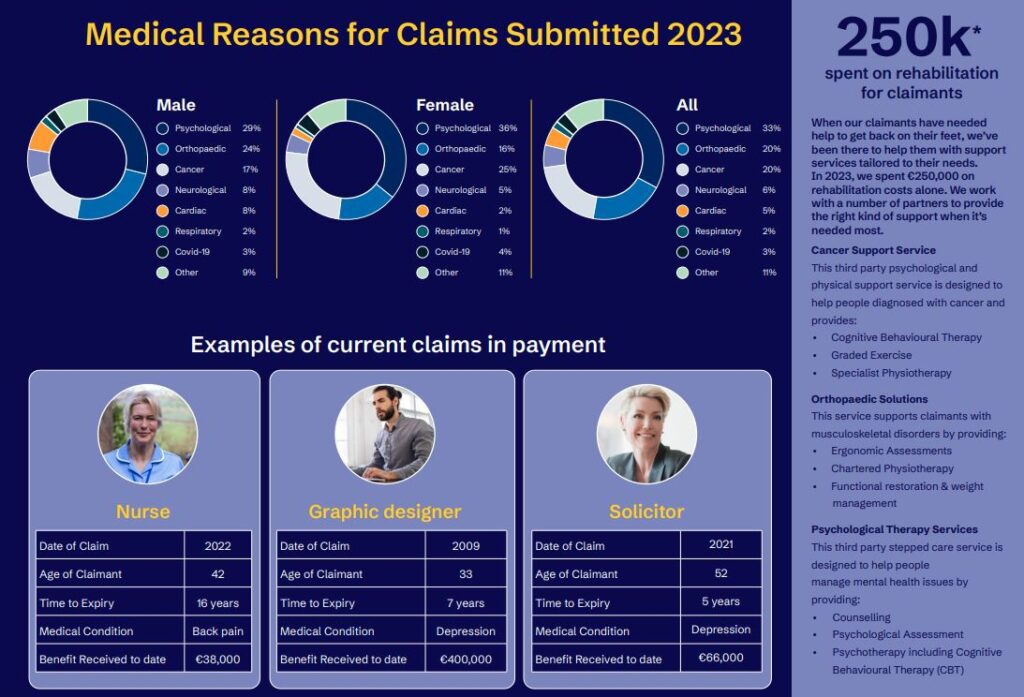

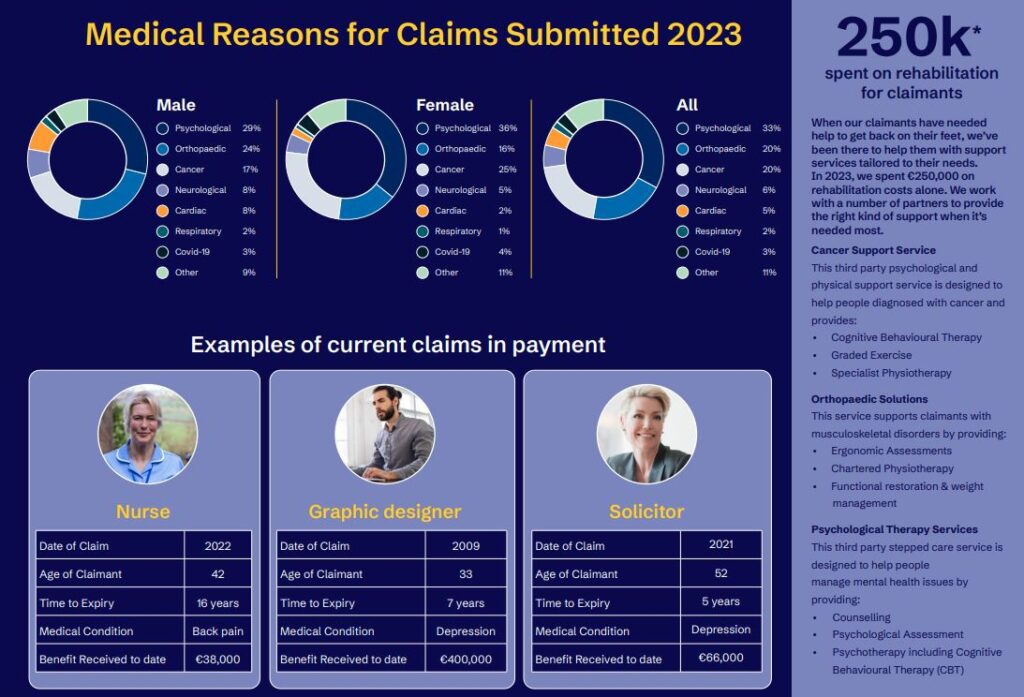

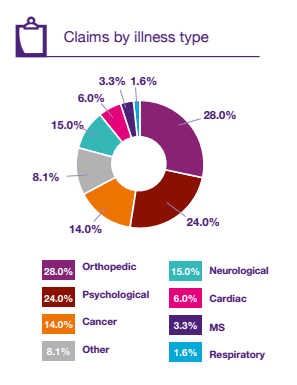

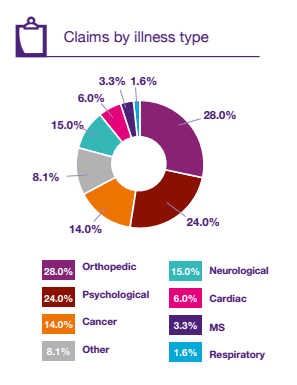

In fact, these issues make up a huge percentage of income protection claims.

However, a serious illness policy won’t pay for mental health or musculoskeletal issues.

Serious illness cover pays you a one-time, tax-free lump sum upon diagnosis of an illness defined in your policy.

Income insurance pays you a regular, recurring, taxable income if you’re unable to do your job due to any illness.

You can claim tax relief on income protection at your marginal rate. This means you can get up to 40% back on your premiums.

There’s no tax relief on serious illness cover.

But you’re taxed on income protection payouts?

What the taxman giveth with one hand, he taketh away with the other!

Although you get tax relief on your premiums, you pay income tax, PRSI, USC on the payout.

Serious illness payouts are tax-free.

You can claim as many times as needed on your income protection.

Your serious illness policy will end once you have made a full claim.

Any illness, injury or disability severe enough to prevent you from doing your job (pre-existing conditions are excluded) for longer than the deferred period.

As I mentioned, but it’s worth reiterating – stress and back problems are covered and these are major causes of claims.

You can read more about what income protection covers here.

4,8,13,26 or 52 weeks – depending on your chosen deferred/waiting period.

You’ll receive a single tax-free lump sum.

One word of warning, if you have serious illness cover on a policy that’s assigned to the bank for a mortgage, the bank will receive any payout!

Whaaaaaaaat?

Read more here – Don’t add serious illness cover to your mortgage cover.

Do you choose Third Party, Fire & Theft or Fully Comprehensive when buying car insurance?

Critical Illness is like Third Party, Fire & Theft.

It pays out for pre-defined, specific events only, like types of cancer, heart attack and stroke.

Income Protection is Fully Comprehensive

Income Protection covers any illness that stops you from working.

Most of us prefer the security that fully comprehensive car insurance offers.

We recommend income protection over serious illness cover for the same reason.

PAYE Worker earning €100,0000

You can insure up to 75% of your income, less state illness benefit of €12,064

Let’s say you earn €100,000

If you’re an employee, you can cover a maximum income of €62,936 per year (75% x €100,000 – €12,064).

If you make a claim, the insurer will pay €62,936, and you can claim €12,064 from the state = € 75,000.

You can’t insure more than 75% of your income because there must be a financial incentive to return to work.

Self Employed earning €100,000 (company director’s income or sole trader’s profits)

If you’re a sole trader or a company director, you can insure the full €75,000 because you don’t get illness benefits from the state.

You get nothing if you can’t work.

Your income drops to a big, fat ZERO.

If you’re self-employed, income protection is essential.

You choose the amount of insurance you need

For example, if you buy €75,000 serious illness cover, you’ll receive a tax-free lump sum of €75,000 should you contract a specified illness listed on your policy.

I’ve considered income protection but feel that any absences of more than a couple of months are likely to be due to a serious illness, at which point serious illness cover would kick in?

I see where you’re coming from but I’m afraid serious illness cover isn’t that comprehensive.

As you can see from the charts above, many people claim income protection due to mental health and musculoskeletal disorders (limbs, back and neck pain).

Remember, serious illness cover won’t pay out if you’re out of work due to depression, anxiety or joint issues.

With serious illness cover, there’s a danger that the illness that prevents you from working either

For example, you’d assume if you got cancer, your serious illness coverage would pay out immediately.

Afraid not, the cancer has to be of a specified severity to get a full payout.

What you don’t want is to be out of work and hoping your illness gets so bad that you get a payout on your illness cover.

That’s an awful situation to contemplate.

Income protection, on the other hand, pays out if you cannot do your job due to ANY illness, injury or disability.

If your budget allows, by all means, put some serious illness cover in place, too—maybe one year’s after-tax income.

But to safeguard your income in the long term, you can’t beat income protection (what are the alternatives?)

By the way, did you know the average duration of an income protection claim is five years?

You’d need to buy a geansai-load of serious illness cover to cover five years of income.

Mental maths: multiply your income x 5, it’s a big number isn’t it?

You don’t have to choose between income protection or serious illness coverage.

It might be a case where buying a little of both is the best way to protect yourself.

Serious illness coverage covers immediate, short-term expenses.

Income protection replaces your income long-term and allows you to get on with your life. That’s why it’s called Long-Term Disability Cover in other countries.

Income protection and serious illness cover are tricky products. Please take advice from a professional (or me, if they’re all busy)

If you want to learn more about income protection, have a nose through our free guides.

Or read this whopper:

Finally, here’s a good run-through of income protection and serious illness cover from The Sunday Times that we helped with 💅

If you’re weighing up income protection and serious illness coverage but are a bit stuck, let me help…that’s what I’m here for.

Complete this questionnaire, and I’ll look at your situation and make a recommendation for you.

Or if you prefer to have a quick chat first, that would be excellent.

I’m all ears.

Thanks for reading

Nick

Editor’s Note | We first published this blog in 2020 and have regularly updated it.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video