Have you ever seen a TV show or movie where a desperate character takes a loan from a shady one?

But when they go to make a payment, the interest is so high that suddenly, there’s no hope of them ever paying it back.

Then it cuts to the next scene, and a large gangster dude is standing on their doorstep, threatening to break their legs.

Okay, so I may be exaggerating a bit here, but that’s kind of what Reviewable Income Protection is like.

The insurer is the heavy on the doorstep threatening you with immense financial pain.

You might think that’s a weird way for an actual insurance broker to start an article about insurance, but bear with me for a second.

Insurance is a complicated game between you and the insurer

The insurer hopes for the best because it can only “win” the game if you don’t die or get sick.

Perversely, you only beat the house if you die or get sick and make a claim.

At the end of the day, insurance lets you transfer the financial risk associated with death or illness to someone else in exchange for a monthly fee.

But don’t get me wrong, the insurers get paid very well to take on this risk.

Like, insurance is for the greater good, but a few quid can be made, too.

In America, the most shambolic place of all, the CEO of a well-known insurer (formerly of the Manchester United parish) was paid $75.3 million.

Which is madness.

And sure, the bigwigs in the glass buildings in Ireland aren’t raking in millions as take-home pay, but they’re definitely not shy of a few bob.

Putting private jets and enormous yachts aside, in the grand scheme, getting Income Protection is one of the most responsible and valuable things you can do.

Income Protection is insurance that pays you cash money income if you can’t work due to illness/injury. If you can’t work again, you can count on it until you retire.

Think of it as an investment into your future financial well-being because you can’t rely on the state to care for you.

Illness benefit is fairly fecking meagre: it caps out at €232 per week and is only guaranteed for 2 years

€232!

Try living on that with any quality of life for an extended period of time.

Grim

This brings us back to insurance and how, yes, sometimes it can seem like a bit of a rip-off (especially if you go into the process uninformed), but it can also be a magical cash machine that falls from the sky just when you need it most.

For example, Vince is 45 and in fairly good health.

He’s just had another kid, so he’s decided to tidy up his financials and get Income Protection.

Vince is hit by a car when crossing the road and suffers a bad break.

Complications mean he won’t be able to go back to work for a solid year.

Ouch.

Then he finds out that his company doesn’t have a sick pay policy, so he’s forced to live off state benefits.

Even bigger ouch.

If we left it like that, Vince’s family home would soon be repossessed.

Thankfully, his Income Protection kicks in to save the day.

Now, the part where it starts to get tricky is which type of Income Protection you should buy– this is where the question of, “do you trust Life Insurance companies?” really kicks in.

You probably said no.

Good.

Be cautious.

Know what you’re getting yourself in for.

If you think all insurers are liars and cheats, consider Fixed/Guaranteed Income Protection.

However, if you said ‘yes’ (my sweet, innocent summer child), then you’re going to serve yourself and your money on a platter to a nefarious insurer who will pitch you Reviewable Income Protection.

The big problem with Reviewable Income Protection is that the price you pay is reviewed every five years.

The insurer can increase, reduce (yeah, right), or keep the premium the same every five years.

With every five years that pass, the chances of getting sick increases.

The unfortunate side effect of being human is that we spend our whole lives slowly expiring.

Dark.

With Guaranteed Income Protection, your premium is fixed.

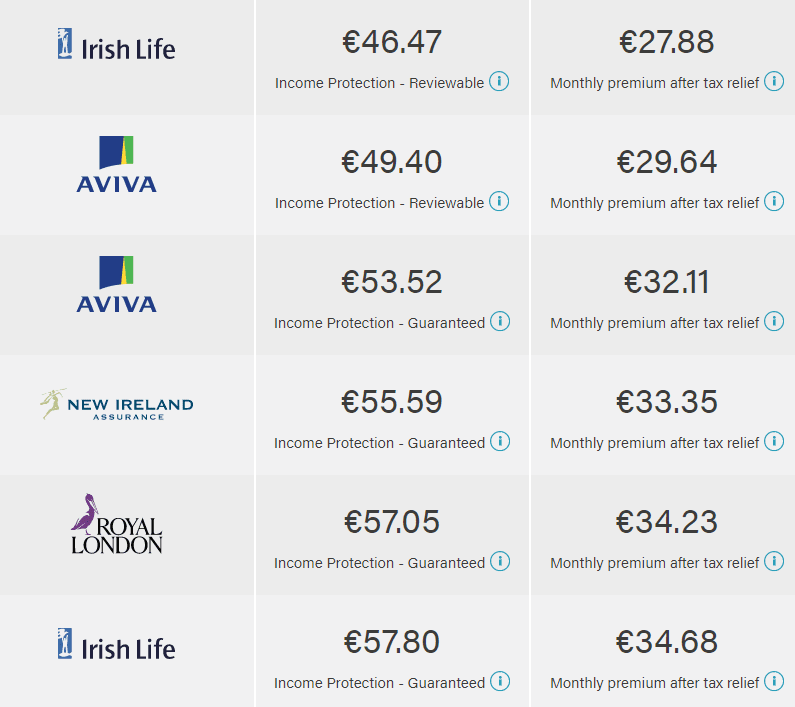

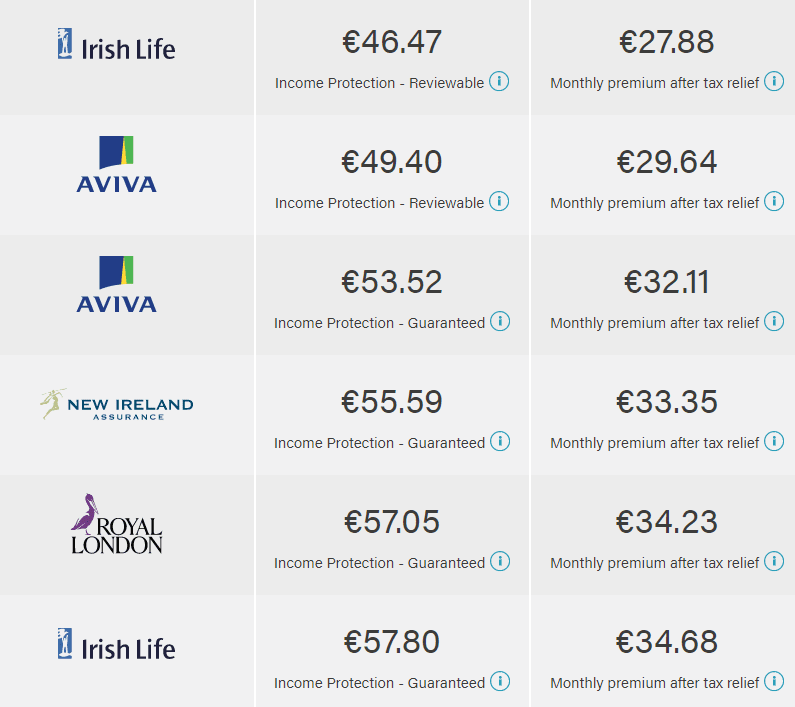

The main difference between Reviewable and Guaranteed Income Protection is the price.

Here’s a quote for a 35-year-old male insuring €50,000 income per year:

Reviewable Income Protection starts less expensive to lure you in, but over time, it can creep up and up with the hope that eventually, it’ll get too expensive and you’ll stop paying it.

The insurer wins when you cancel your policy, and they keep all the money you’ve spent over time.

When your policy is being reviewed, the insurer will look at:

So, if many of those people have made claims in the preceding 5 years, you can expect an increase.

Essentially, Reviewable policies are a safety net for the insurer.

Yep.

Now, here is an interesting statto.

Since Friends First (now Aviva) introduced their Reviewable policies, they have never increased their premium.

So you could get lucky.

You could end up paying less with all the same perks of Income Protection.

Or you could have an awful time of it.

It’s up to you, but we know what I’d do.

It could make a lot of sense for you, especially if you’re:

But remember, there is a chance your horse will fall at the first, like there is a chance Aviva may review your premium in five years.

And then again after that.

And maybe again after that.

So think about it.

Whatever you choose, ensure you know what you’re getting yourself in for.

Income Protection is important as it’s the only insurance that benefits you while you’re still alive and need it most.

I’ve bashed the insurers a bit in this article, but here’s a doozy for you: 97ish percent of all life insurance claims are paid every year.

So what I’m saying is they’re not all bad guys.

Look into your options.

Make the best decision for you.

Talk to an expert like me and get the peace of mind that Income Protection offers you and your family.

You can get me on the phone at 05793 20836 or schedule a call here

Alternatively, complete this short income protection questionnaire, and I will send some quotes.

Nick | Income Protection Specialist

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video