Table of Contents

You know how when you were a kid

You’d huddle around in a circle with your knobbly-kneed friends to play, and someone (usually Timmy) would insist you’d test the bonds of your brotherhood.

And you’d all agree because you didn’t want to be the loser who said ‘no’?

Your good pal Timmy would tell you that he’d catch you if you fell backwards.

You’d agree because he was sound.

And then you’d fall like a bag of rocks and smack your head while Timmy laughed at what a trusting eejit you were.

Well, it seems we have a trust hangover from our youth because

a lot of people don’t trust insurers to payout.

And I get it: insurers can be tricky fellas, with watertight terms and conditions, complicated underwriting and confusing jargon.

We all know someone who made a house insurance claim that fell through or whose car insurance is sky-high.

But the thing is:

Life Insurance is a different beast.

“What percentage of claims do insurers pay?”

You might think it’s 80 or even 90%

But do you know what the truth is?

98 per cent of all death claims are paid every year.

Those are damn good odds.

And the insurers have to keep paying out because if Life Insurers never actually paid out, why would people bother getting a policy?

Life Insurers actually need your money so that they can make money.

They invest the money they receive from you so that they can make money on your money.

If they never paid out, no one would ever pay in, so they’d have no money to invest, pay claims or buy yachts for the bigwigs.

The other way that Life Insurers make money is if you outlive your policy, so they get to keep your premium without having to pay a death claim.

However!

You can play them at their own game by getting a Whole of Life policy.

Once you pay your premiums, the insurer is on the hook for a pay-out no matter when you shuffle off this mortal coil.

Take that, bigwigs.

Life Insurance is a business like any other, and it’s changed over the years.

More insurers (Ireland now has five companies providing Life Insurance) and the internet means that customers are better informed.

Life Insurance policies used to have exclusions, wherein they might not pay out if you had a dangerous hobby, a high-risk job, or because of acts of war (a bit of a random one, that).

Now, companies have to be more straightforward or risk losing customers.

It’s very easy for a customer to spread the word about poor customer service or a bad experience.

Something goes wrong, and you can complain all over social media.

25 years ago, you could… write a strongly worded letter?

More knowledge, independent brokers, and the competitive nature of the industry means that insurers have to play nice, or they’ll lose their customers.

This is why the insurers only refuse around 2 per cent of claims.

Why Are Life Insurance Claims Not Paid in Ireland?

Now don’t read that paragraph and come away thinking, “okay, so if I die of a heart attack, I have a 98% chance of getting away with telling porkies about my smoking habit.”

That’s not how it works either, as the cause of your hypothetical death doesn’t have to have anything to do with the thing you haven’t disclosed.

You might not see the link between lying about smoking and being hit by a bus, but the insurer might.

Smoking (or a high BMI or a dangerous job or whatever) will make your policy more expensive.

Smoking will actually make it a lot more expensive, so if ever there was a good reason to quit, that’s it – carcinogenic, be damned.

If the insurer finds out that you’ve been economical with the truth (and they probably will), they’ll refuse to pay out because your premium should have been higher from the outset of your policy.

Therefore you have underpaid, so they have grounds to cancel your policy ab initio (from the beginning)

There’s a very simple solution to this problem: don’t lie

If you have a chronic illness or an issue that you think might cause problems or lead to an insurer declining you outright, don’t worry: we work with all five insurers, so we can likely get you cover.

Again, the secret is knowing how to play the game: and we’re the World Cup winners of the life insurance game.

We’ll match you up with the insurer who is most sympathetic to your health issues/the most likely to give you a good deal.

Ultimately, insurance is a business, but the more you know, the more likely you are to get the best deal.

Another question we’re sometimes asked is whether a life insurance provider can go bust and what happens if they do?

Yes.

Is it likely?

No.

Let’s look at how life insurers work.

When you pay a premium to your life insurer, you are now owed something in return by the life insurance company, i.e. if you make a claim, they promise to pay.

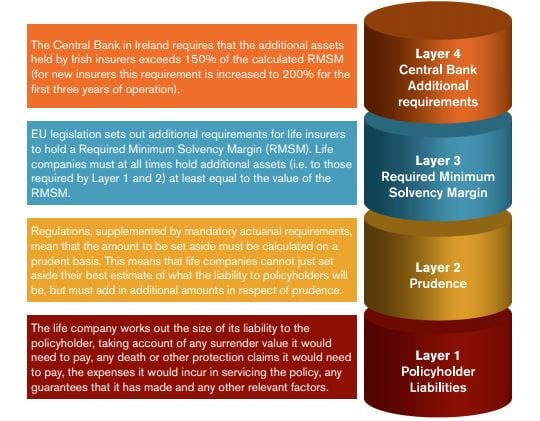

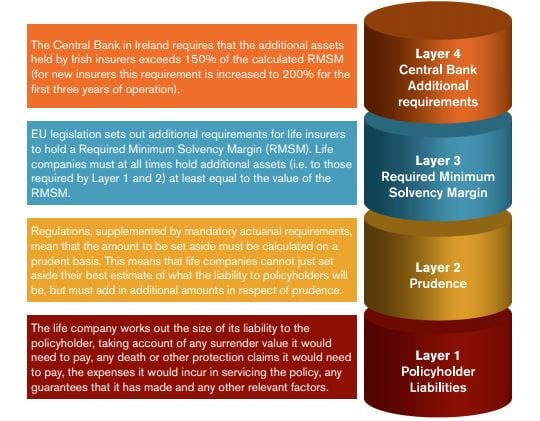

Life companies regulated by the Central Bank must hold four different layers of reserves to meet their liabilities to policyholders.

It would not be unusual for life companies in Ireland to seek to maintain surplus assets over liabilities of around 200%.

e.g., if they owe €100m, they would have reserves of €200m

The life company must hold the assets and cannot rely on having resources available through a parent company.

The solvency of each life company is determined on a stand-alone basis and must be met at all times without recourse to external resources.

Life companies established in the State must submit reports setting out details of their solvency position to the Central Bank quarterly, with very detailed returns annually.

Life companies operate very differently from banks.

As we have seen, each time a life company receives a premium, it receives an asset (the premium) but then has a policyholder liability in respect of that premium.

Typically banks will lend more than they have on deposit, so they will seek external funding to do this, and they will need to pay interest on that external funding.

The idea of a “run on the banks” whereby depositors fear that banks will not have enough assets to cover the deposits, so they all try to withdraw their cash will not arise in the case of a life insurance provider.

Every life company liability must have specific and suitable assets set aside to meet their liabilities.

Each time a life company experiences a ‘withdrawal’, i.e. policy encashment or claim payment, its policyholder liabilities reduces accordingly.

Not in the modern era.

Some small insolvent life companies merged in the 1930s to become what is now today Irish Life.

Legislation governing the winding-up of life companies in Ireland means that the insurer cannot use assets that have been set aside to meet liabilities to policyholders to pay the company’s creditors.

In simple terms, the insurance company has to pay the policyholders first.

Hopefully, that puts your mind at ease.

Click to read the full article on policyholder protection.

Now you know your premiums are safe – check if you’re paying too much by getting a life insurance quote.

Getting Life Insurance is one of the best things you can do for your family.

If you’ve got kids, it’s your responsibility to take care of them when you’re here…and if you’re not.

Want some guidance on putting the correct cover in place?

Complete this questionnaire, and we’ll be right back to you.

Or, if you prefer to have a quick chat first, please schedule a call here.

Talk soon!

Nick

Further reading: How to make a claim.

Editor’s Note | We published this blog in 2021 and have updated it since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video