Table of Contents

Yes, it is possible to get life insurance after having a stent fitted, but there are a few factors at play:

Many insurance companies prefer to wait for a period (often six months to a year) after the procedure to give time for follow ups to see how well the patient is recovering and managing their heart health.

Insurers will review your overall medical history, including the reason for the stent placement, which vessel was stented, the overall condition of the heart and general health conditions.

Your current health, including follow-up medical reports, lifestyle changes, and how well you are managing risk factors (e.g., diet, exercise, smoking cessation), will be important.

The type of life insurance you are applying for can affect your chances.

Term life insurance and mortgage protection should be possible.

Income protection and serious illness cover will be trickier.

The cost of life insurance will be higher due to the increased risk associated with your heart condition.

How much higher depends on the risk category you fall into.

As a rough guide:

If you’re applying for life insurance

the insurers are likely to postpone offering cover.

If you’re over 40 and are applying for life insurance with a stent fitted more than 6 months ago, it’s possible to get cover once you meet two conditions:

The cost depends on the vessel stented, the number of stents fitted, the overall condition of the heart and whether there any other medical factors present, such as:

The starting price of your cover will be around twice the normal price.

That’s a loading of +100%.

We explain life insurance loadings in this article.

Stenting relieves symptoms, but it’s not a cure.

The insurer would prefer to see you address the causes of the narrowing arteries by changing your lifestyle.

To decide on whether to offer cover, the insurer will request a medical report from your GP.

You don’t need to arrange or pay for this; the insurance company will request the report and cover all the costs.

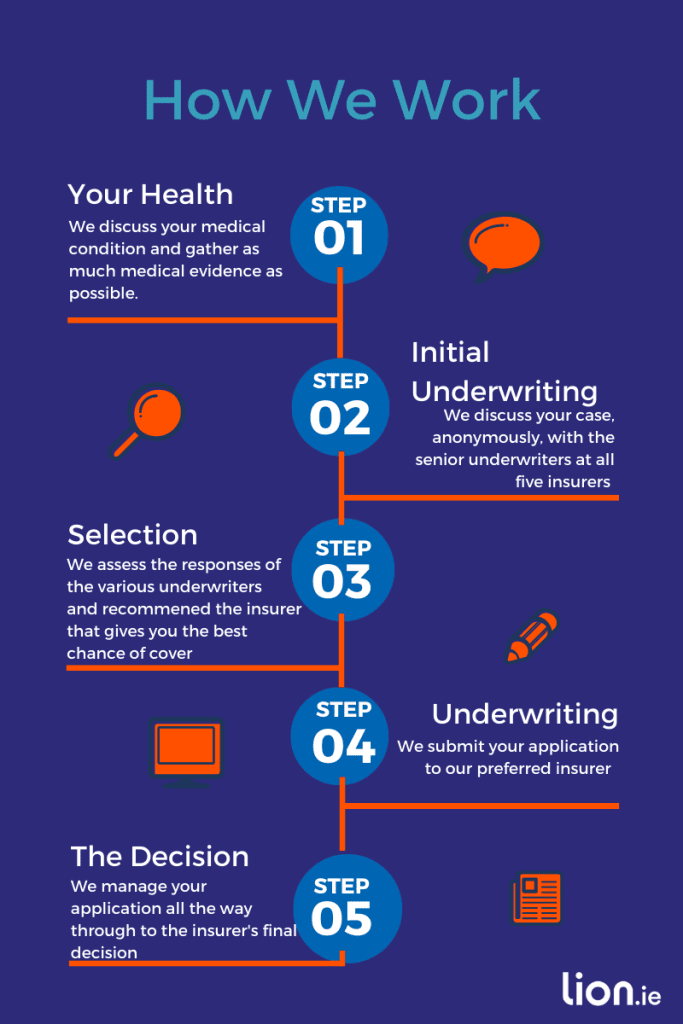

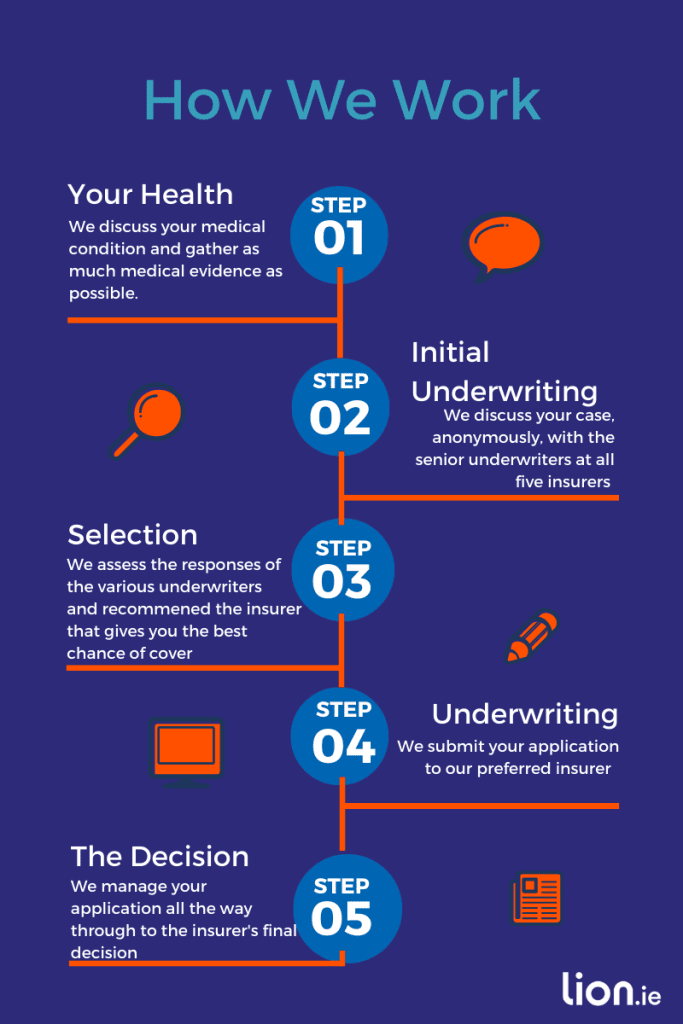

It is vitally important to apply to the most sympathetic insurer when it comes to heart conditions.

Some insurers are a lot stricter than others.

We know which insurer to apply to for the lowest price with the least amount of hassle.

Complete this short questionnaire, and I can discuss your case, in confidence, with my panel of underwriters before you apply.

The minimum information I will need to give you a steer is:

If you have any cardiac reports, please send them my way (nick@lion.ie)

Thanks for reading,

Nick

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video