Table of Contents

Complete this questionnaire, and I’ll send you a quote taking your asthma into account

Hi, I’m 35 and have recently started having quite severe asthma attacks. My GP says I’m fine but I’m worried because I’m trying to buy a house and need to put mortgage protection in place. Can I get covered? Looking forward to your response, Dean

Breathing.

Most people take it for granted.

But for some, like our friend Dean, every breath in and out can be a struggle.

Fortunately, we got cover for Dean but we had to tread carefully because some insurers wanted to go to town on his premium.

Asthma is a common medical condition affecting the airways, causing narrowing and inflammation.

It currently troubles over 380,000 (or 1 in 13) Irish people.

It can lead to a build-up of mucus, making it difficult to breathe.

Symptoms can include coughing, wheezing and shortness of breath.

It depends on the insurer you choose.

Some are more understanding of this condition than others.

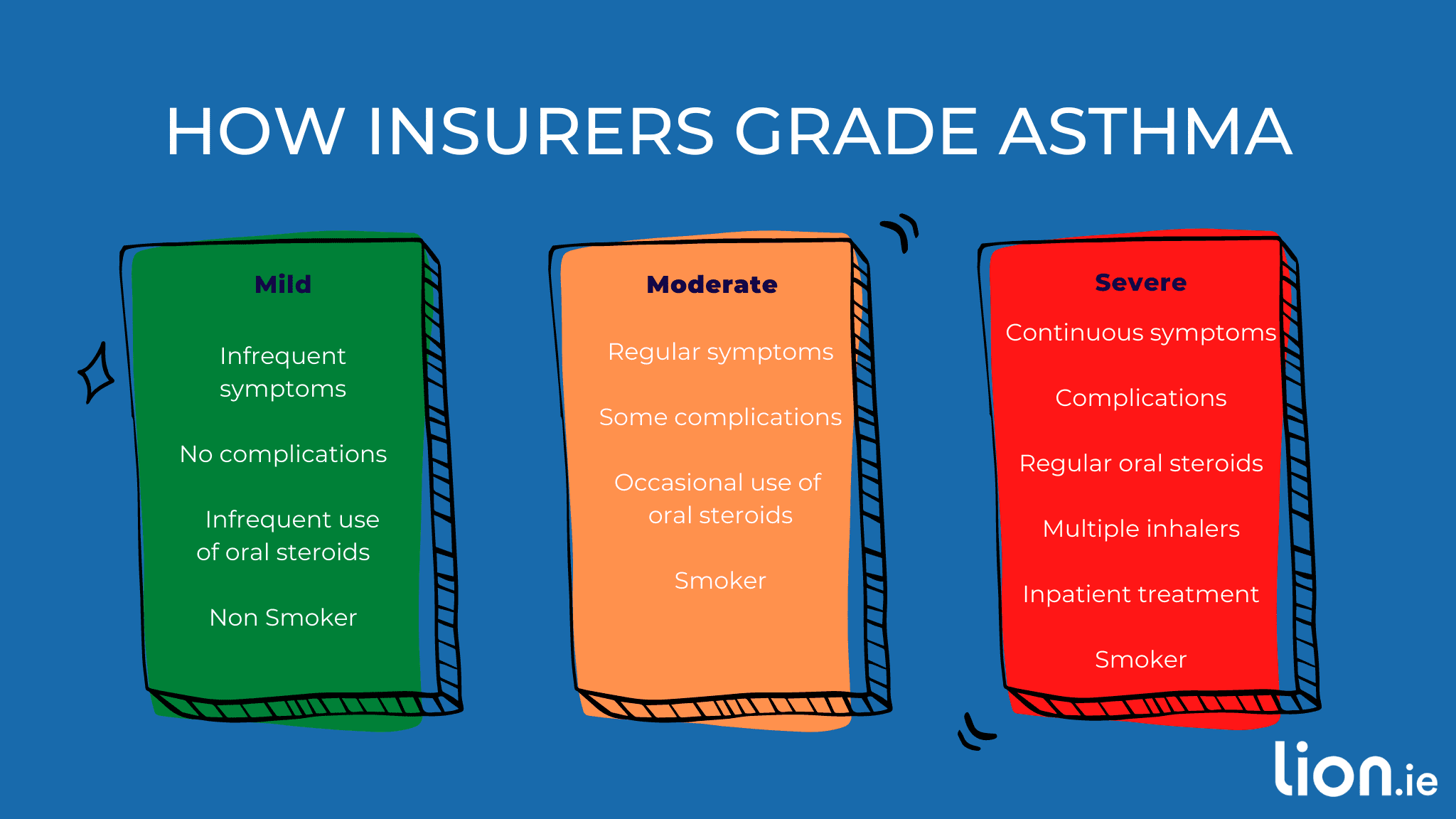

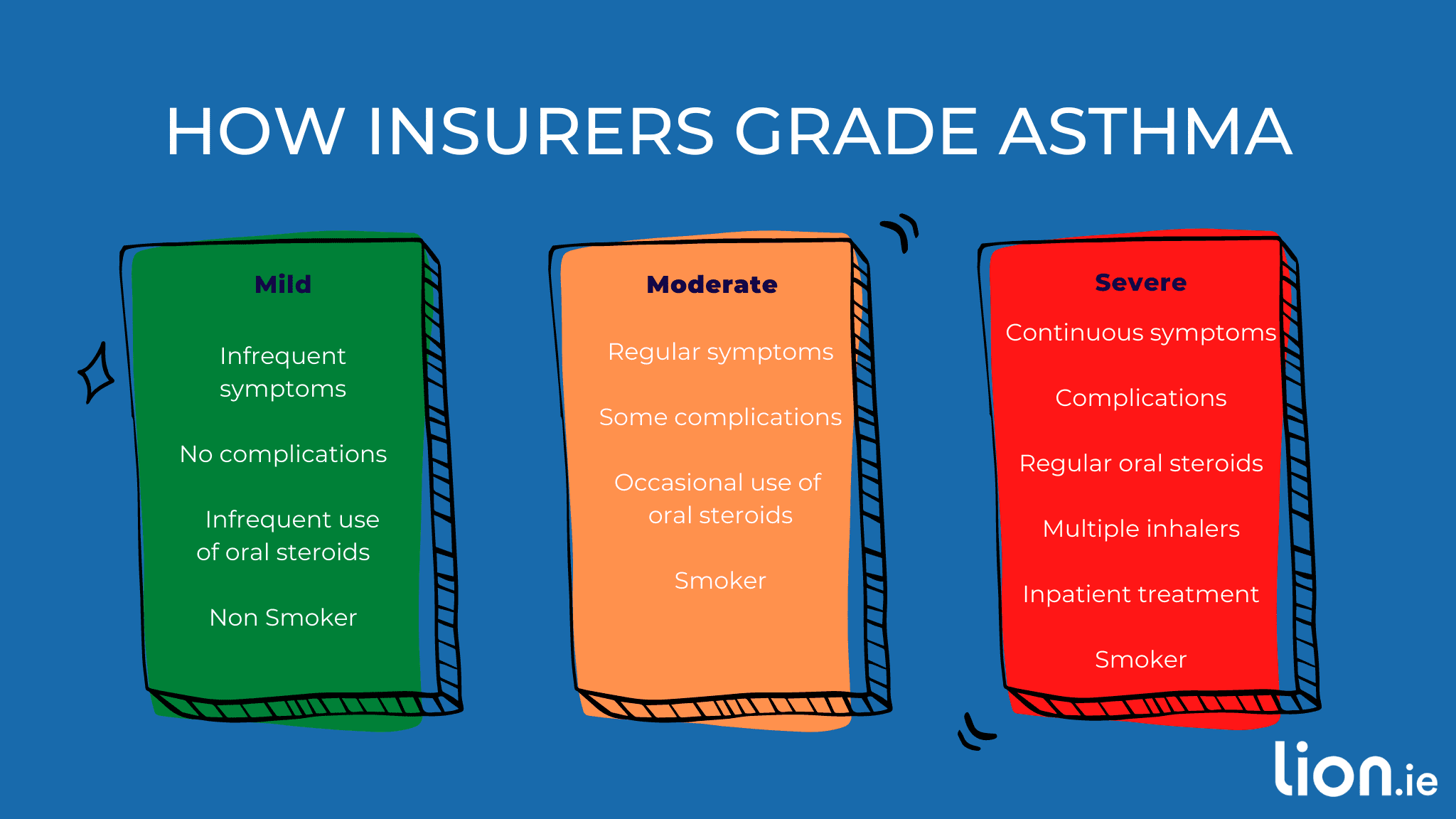

In most cases of mild asthma, you’ll pay the same price as everybody else.

For moderate asthma, you may pay a little bit more (again, choose your insurer wisely)

If you have severe asthma, you will pay more than normal.

Some insurers will increase the price you pay by 50%.

Others will increase it by 150%!

Yes, because smoking aggravates asthma, this can cause an increase in your premium, even for people living with mild asthma.

Life insurance provides rarely request a medical report because they can usually decide based on your application form and an asthma questionnaire.

However, if you have been hospitalised within the previous five years or have had more than two episodes of oral steroids, the insurer will write to your GP for a report.

Somebody with mild asthma will be able to get both SIC and IP without any issues.

For moderate asthma, you’ll get coverage but will pay more.

If you have severe asthma, the insurers are likely to refuse income protection and serious illness coverage, unfortunately.

Please feel free to contact us if you have asthma and want the best price on life insurance or mortgage protection.

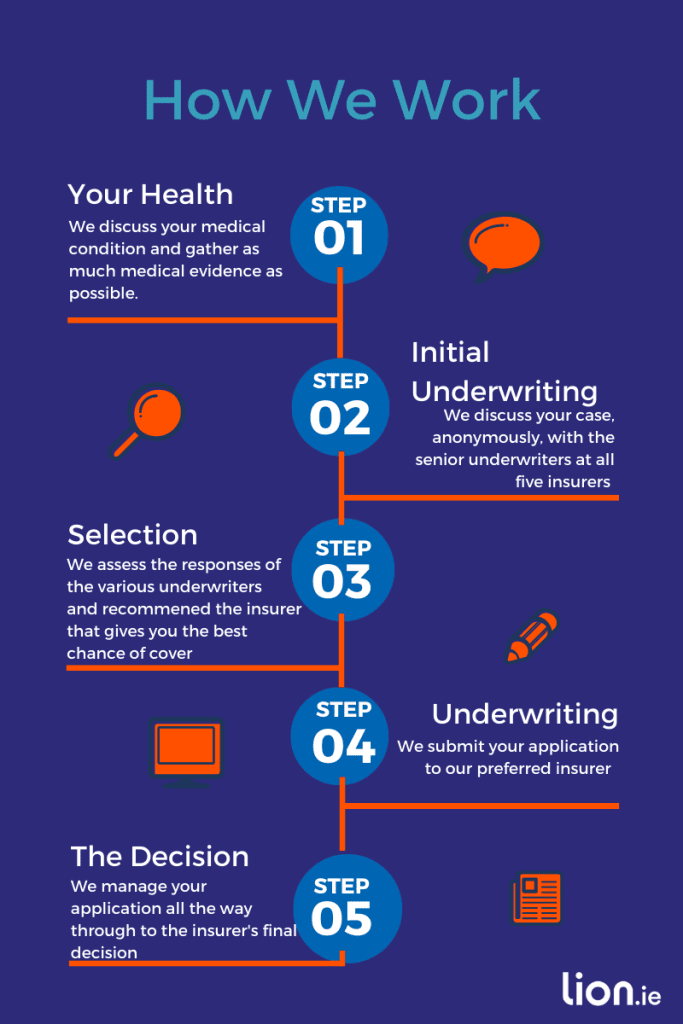

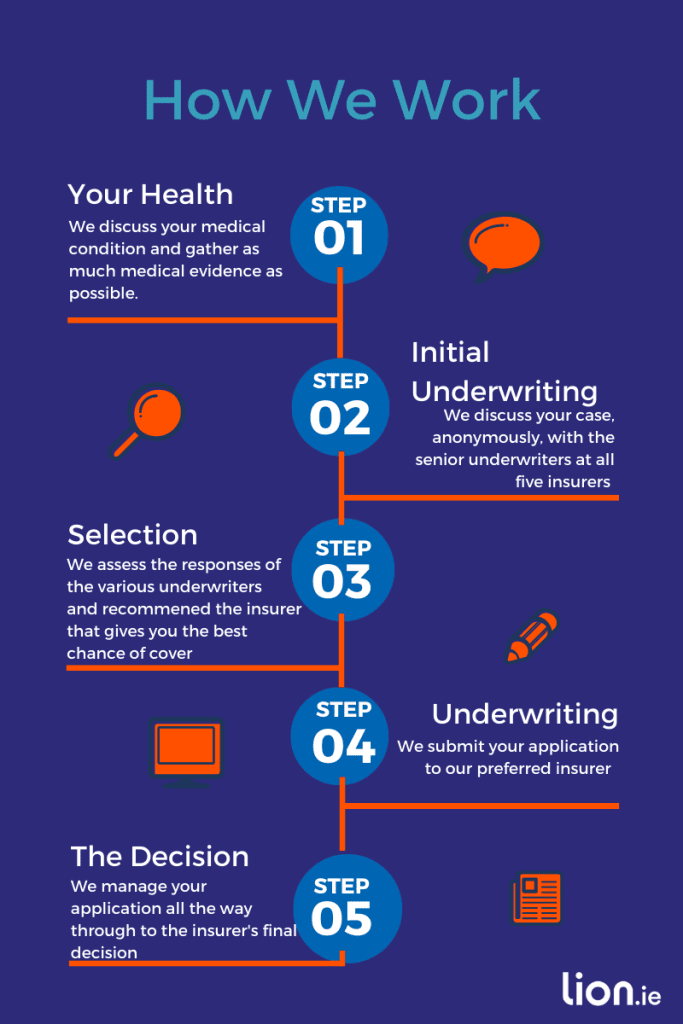

I’ll walk you through the application process, find the most understanding insurer, and ensure you get the best coverage with the least hassle.

If you don’t know your life insurance from your mortgage protection and would like me to make a recommendation, please complete this questionnaire, and I’ll be right back.

Alternatively, schedule a callback here and I can answer any questions you have.

Talk soon!

Nick

Editor’s Note | We published this article in 2018 and have updated it since

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video