Table of Contents

Okay, so you might think that Serious Illness Cover and Health Insurance are the same thing.

I mean, they’re pretty similar: insurance that covers you if you get sick – but that’s not entirely the case.

So Batman is a bad-ass, but even he goes into battle with his trusty gadgets: his Batsuit, his Batmobile, and his utility belt.

In this metaphor, his Batsuit is Life Insurance: it’s his most important defence.

His Batmobile is the extra protection in his daily life – or his Health Insurance.

His utility belt, then, is Serious Illness Cover. It’s gotten him out of a few sticky situations – but it’s not critically important.

Holy insurance, Batman!

Health Insurance is a comprehensive plan that may cover things like hospitalisation expenses, maternity benefits, surgery, or treatments. The extent of coverage generally relates to the cost of your plan: the more expensive your plan, the more that’s covered.

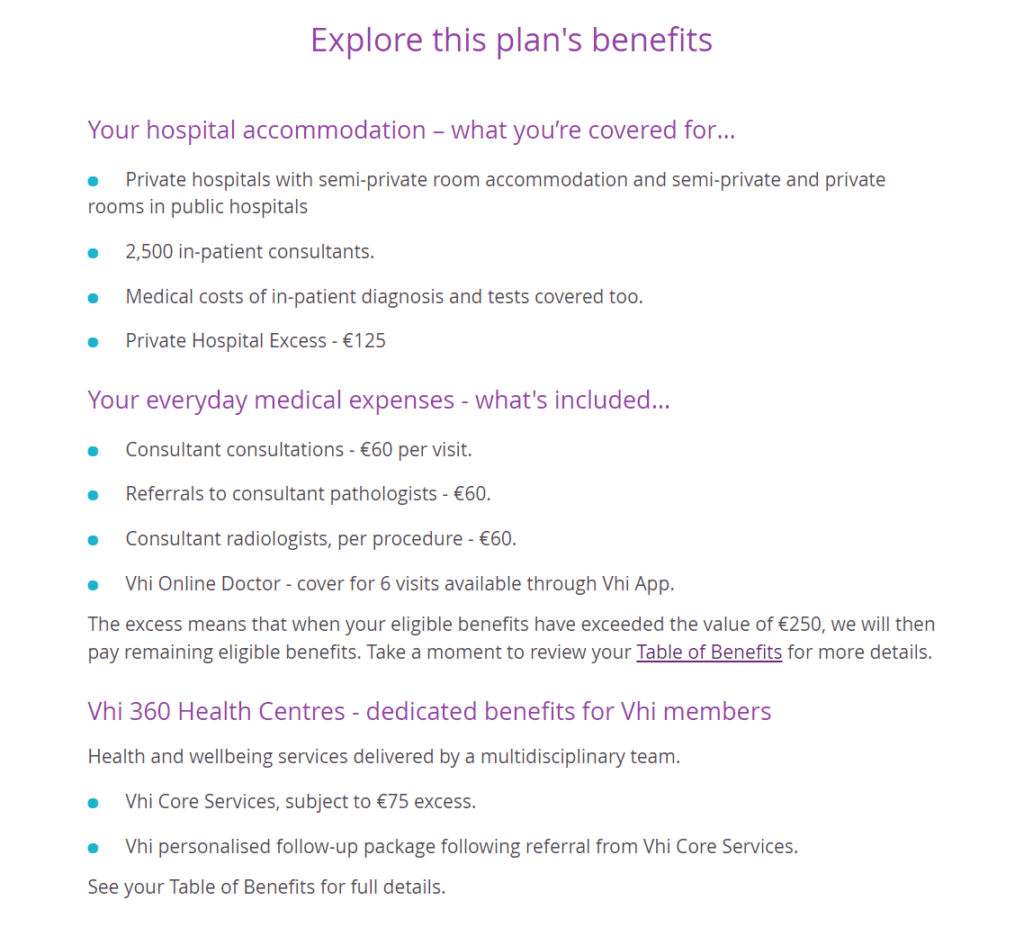

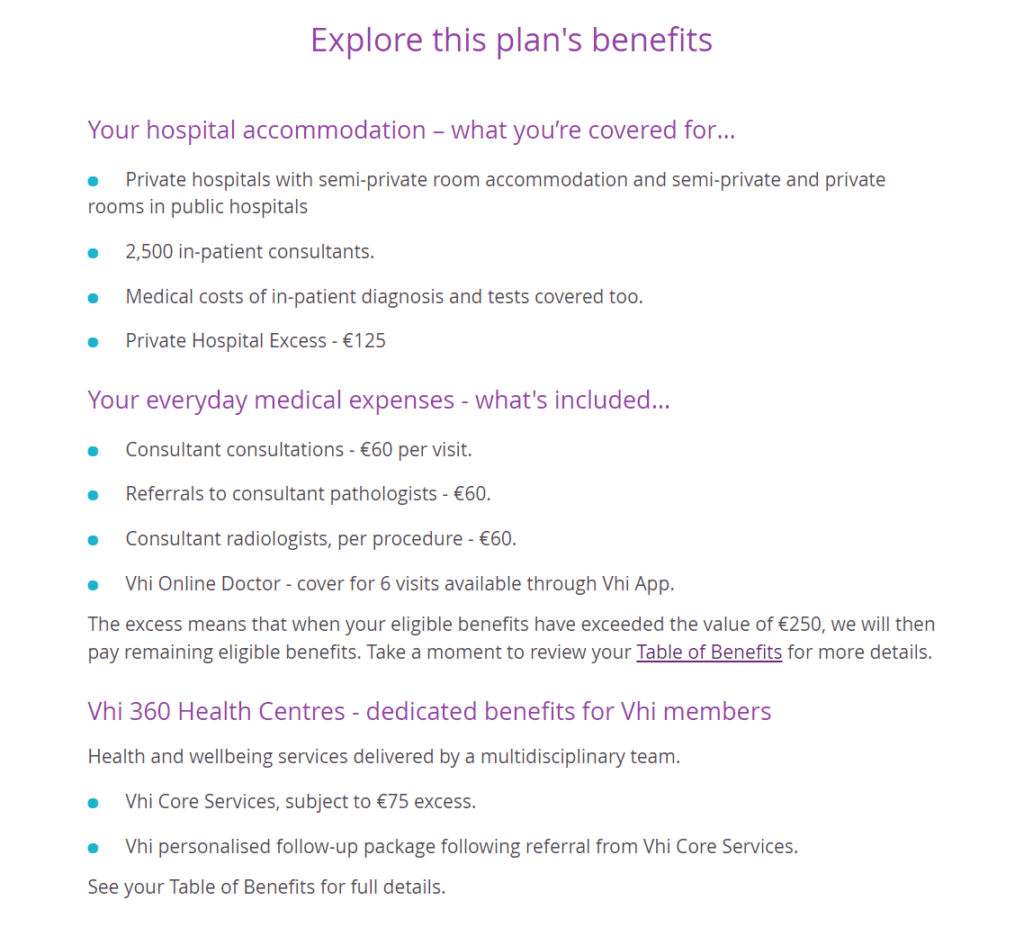

With VHI, for example, the basic One Plan for one adult between 26 and 34 costs €103 a month and covers the following:

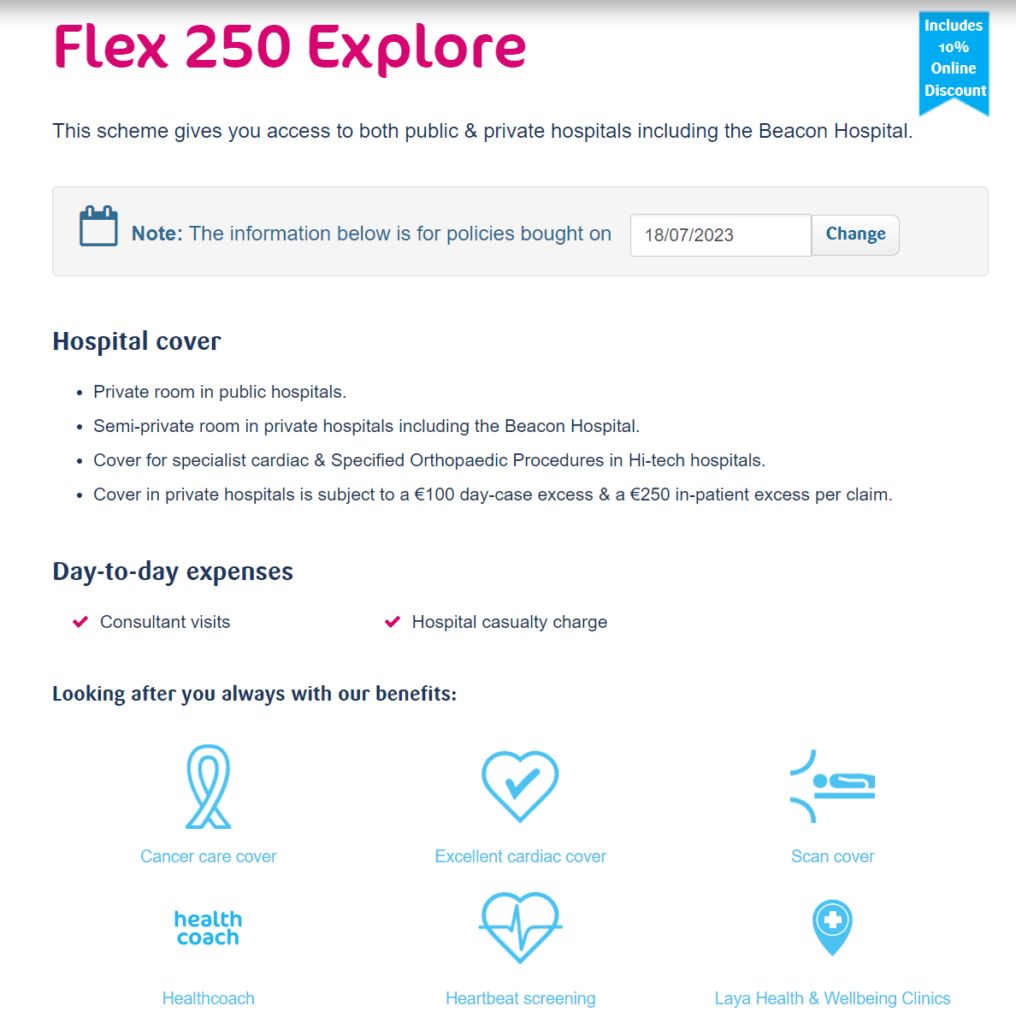

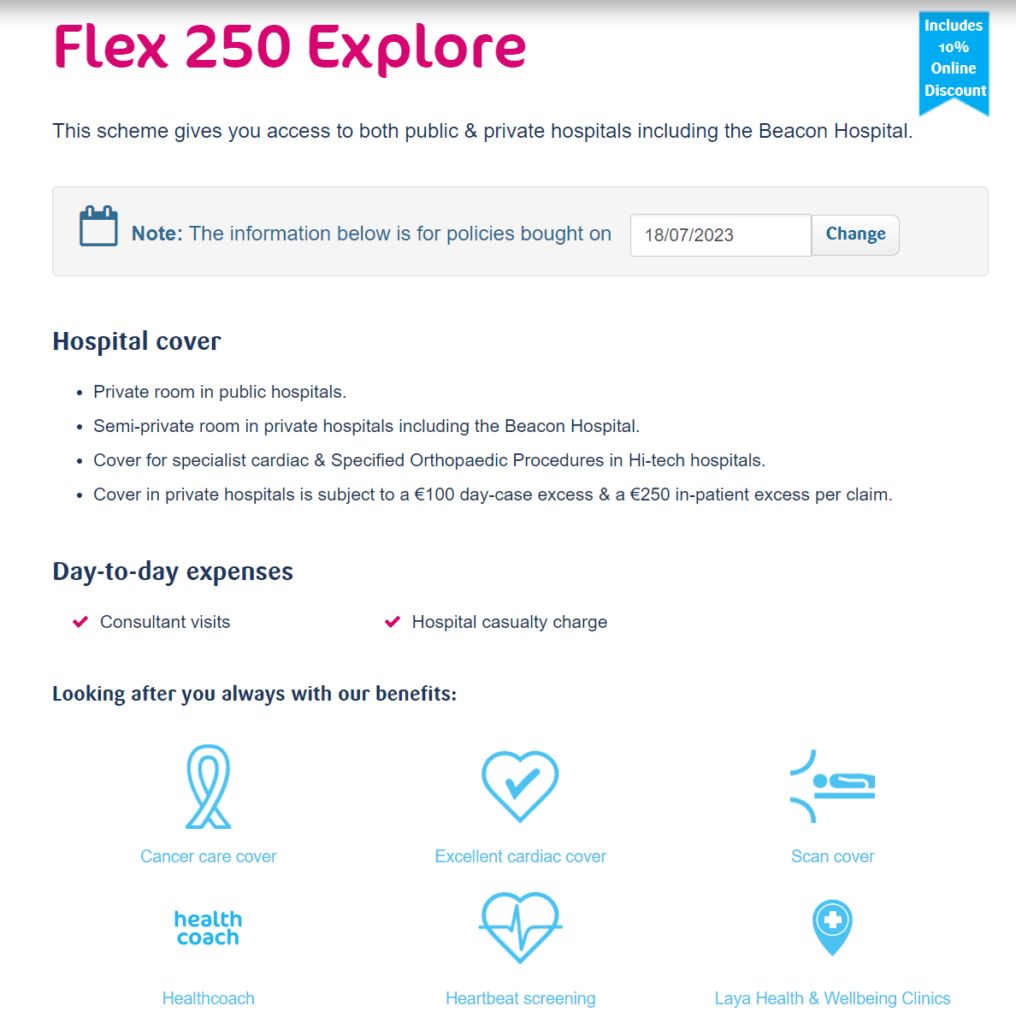

Laya Healthcare’s ‘Flex 250 Explore’ costs €108 a month and includes the following:

With Health Insurance, you could end up in hospital for any number of reasons – maybe you crash your Batmobile or you fall ill or your appendix starts acting up. Treatment ranges from minor day-to-day and outpatient stuff to a more serious hospital stay – again, the specifics will depend on your policy and whatever terms your insurer has in the small print.

Making a claim is usually pretty easy. For outpatient treatment, you’ll log into your insurer’s online portal and submit the receipts.

To quote modern philosopher, Kanye West: Keep the Receipt.

You’ll probably have to pay an excess and if the claim is approved, you’ll be credited the dollar bills.

Hospital stays are a bit more complicated. If you know you’re in for a hospital stay, you’ll need to let your insurer know. You’ll give them the hospital’s name, the consultant, and the procedure code (you can get this from your consultant’s secretary). You’ll fill out a claims form in the hospital and the insurer will pay the hospital directly.

Obviously, the system works a little differently if your hospital stay is unexpected – but it’s still fairly painless.

Say what you will about insurers being blaggards and schemers, but they do tend to make the claim process pretty handy – especially if they have an online portal.

Further reading: How getting older affects the cost of life and health insurance differently.

Serious Illness pays out a tax-free lump sum if you’re diagnosed with one of the specific illnesses or disabilities that your policy covers.

We’re talking about the bad stuff like cancer, heart attack, stroke (+ 50 other nasty illnesses).

You can claim on your policy if:

Your claim could potentially be rejected if the illness is self-inflicted or if you had it before you applied for insurance and tried to sneak it in, or if you move somewhere that’s not covered in your policy.

The list of illnesses covered varies a fair bit, but usually includes strokes, heart attacks, MS, kidney failure, and cancer.

Basically, any number of illnesses that you really don’t want to get.

Make sure you understand what’s covered before you start doling out your moolah.

Permanent Total Disablement is also sometimes included in Serious Illness Cover for extra premium but even just typing that gives me the heebie-jeebies.

Other ‘sometimes-included’ are children’s Serious Illness (see above about heebie-jeebies) that kicks in if one of your kids gets one of the covered illnesses, and overseas surgery benefits, which is pretty much what it sounds like.

Health Insurance is one of the most expensive types of insurance you can get – because claims are high. There’s a pretty high chance that you’ll get sick at some point during your cover. It is what it is.

With Irish Life, the cheapest basic cover starts at around €40 a month while the top Platinum plan will set you back over €700 per month. Wowsers!

The cost of Serious Illness Cover will depend on how much you want to pay out should you get sick, the age and health of the person applying, and the length/term/years of the policy.

With Zurich, €40,000 serious illness cover over 20 years will cost €10 a month, for a woman in her mid-twenties who doesn’t smoke.

As you can see, it’s a fair bit cheaper.

It depends.

You might never actually need Serious Illness Cover.

You could breeze through life with little more than the common cold.

But you could also fall ill with one of those horrific illnesses tomorrow.

Like all types of insurance, it can feel like you’re throwing away money until you need it – then it’s a godsend letting you shout from the rooftops how important it is and how screwed you would have been without it.

Look if you’re young, footloose and fancy-free, you’ll probably be grand without both.

But definitely consider Serious Illness Cover if you have no Health Insurance at all, or if you don’t have Income Protection (the Daddy of all the insurance, forget about everything else if you don’t have IP)

Illness cover is also worth thinking about if you have a mortgage, loans, or any debts. If you’re hit with one of the illnesses, your mortgage will be cleared giving you financial breathing space to take time off work to focus on getting better.

Imagine the relief that would bring.

Is it worth a few quid extra per month, money you will probably spend on pure shite!

Wondering if Serious Illness Cover is a good fit for you or is Income Protection is better?

Hint: Income Protection is MUCH Better.

Fill in this short form and I’ll review your current situation and come back with a personalised recommendation.

Further Reading: How a Serious Illness Can Drain Your Savings (even if you have health insurance)

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video