Table of Contents

Were you nervous?

I was terrified.

And lost.

Maybe I was terrified because I was lost.

And I couldn’t figure out how to use the headlights.

So I was terrified, lost, and couldn’t use the headlights.

It’s not the best combination for driving in the dark for the first time.

Yeah, good story Nick, but what’s this got to do with life insurance for new parents?

Well, you see, my firstborn, Chloe, was due to arrive imminently.

And the way things were going, I wasn’t going to make it to the birth.

17th September 2010 (time flies)

Hannah (Mrs Lion) was still in labour; she had been induced three times, but there was no sign of the baby.

“Nothing stirring”, the nurses said, so the hospital advised me to head home.

My home was in Tullamore, and the hospital was in Mullingar, so I booked into a hotel that was apparently a few minutes’ drive from the hospital.

Off I went on the supposed 2-minute drive to the hotel.

A route I thought I knew quite well.

But things look very different in the dark, especially roundabouts.

Pretty soon, I was lost, heading out of town and down a DARK backroad.

In fact, it was the darkest road I had ever seen.

Like pitch black dark.

Why is the road so dark?

Beeeeeeeeeeeeeeeeep, HONNNNNNNNNNK.

Oh, hi there, friendly folk beeping and gesticulating at me?

Hang on a minute; this is rural Ireland; there’s no road friendliness here, only rage!

Oh sweet Jesus, I’ve been driving for without any headlights on.

OK, LIGHTS ON, PHEW.

More flashing and beeping.

More rage.

Oh shite, I have full beams on, how do I turn them off?

I pulled into an old, disused petrol station and tried to calm down.

I was freaked due to nerves, strong hospital coffee and a lack of sleep.

Eventually, I made it back to the hotel unscathed and was there when little Chloe was born the next morning.

Holding her for the first time made me think about how her life would have panned out if I hadn’t made it to the hospital.

You see, I didn’t have any life cover.

I was young, had no kids, and both Hannah and I were working, so I had no need for life insurance.

Maybe you’re in the same boat?

If you are, you’ve come to the right place.

Here’s what you need to know about life insurance as a new parent.

In plain English, it replaces your future income if you die by leaving a lump sum of cash behind, thus preventing your family from becoming a one- (or no-) income household.

When you die, your income stops, but your family will still depend on that income.

Life insurance will leave a tax-free lump sum your family can dip into to replace your income.

You may have death in service through work, but you may still want to consider some personal cover for the following reasons.

Here’s a ready reckoner:

Life insurance replaces your income, so the more you earn, the more you need.

Let’s say you earn €60,000 and have 25 years to retire.

In those 25 years, you are on track to bring €1.5m home in pay.

If you die unexpectedly, that €1.5m future income stream disappears.

Life insurance will pay out to replace that income and keep your family financially secure when you’re no longer here.

How much life insurance is enough life insurance?

A stay-at-home-parent should be paid €54,590 per year for all the work they do:

and a million other things.

What would happen if they were no longer here to do the above?

Would the “working” partner have to reduce their hours and stay at home to mind the kids?

Could they afford to keep working and pay for a childminder?

That is why SAHPs need life insurance.

God forbid the worst happens; the policy will leave a lump sum to reduce financial stress during great emotional distress.

This blog post examines issues from the perspective of a single mother, and this one is for Dads!

The cost of life insurance depends on several factors:

Life insurance leaves money to take care of your family. It protects your family.

Mortgage protection leaves money to clear your debt to the bank. It protects the bank.

If you have a mortgage and a family, you need both.

Don’t try to combine mortgage and family protection on one policy.

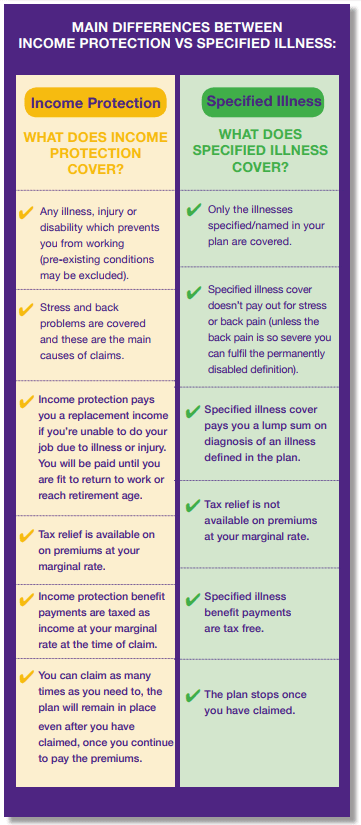

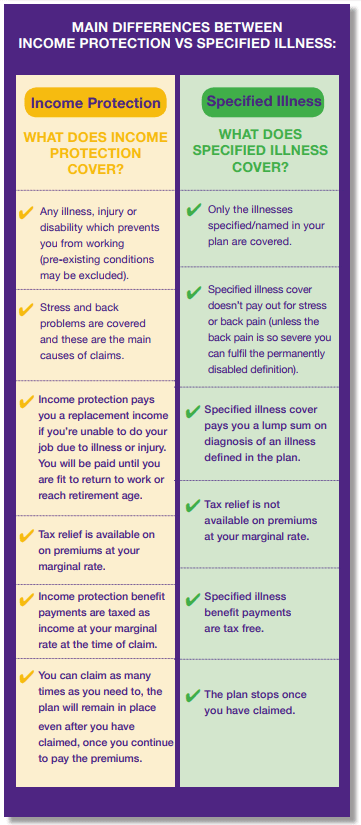

Income protection ALL DAY LONG!

Your income is your biggest asset; it should be the first thing you insure – even before your car, house, etc – because your income pays for everything.

Imagine if it stopped suddenly because you fell ill.

How would you pay the mortgage, food bills, clothing, etc?

State illness benefits wouldn’t go far.

Specified serious illness cover, as its name suggests, only covers specific illnesses.

But what if you’re out of work long-term due to an illness not covered by your policy?

Here’s a link to an article on this very subject.

Basically:

Not really, but it all depends on how much of each you are considering.

Your occupation has the biggest influence on your income protection premium.

The higher the risk of a claim, the higher your premiums will be.

For example, income protection for accountants will cost less than income protection for builders.

I recommend buying a policy until your youngest is 25.

At 25, they should have finished full-time education, so, hopefully, they won’t have to leech off you for much longer.

By the way, always add a conversion option to your policy.

This will allow you to buy a new policy without the need to answer medical questions.

Life insurance companies only get the heebie-jeebies about insuring you when you have a health condition that may shorten your life expectancy.

A normal pregnancy doesn’t carry the same risk.

You might have to neck an iron tablet now and again, or your cholesterol might be a bit higher than usual, but this won’t affect your application.

Should you suffer from any other health issues, though, these will be considered when you apply.

Gestational diabetes is the most common one we see, and this will attract a loading on your policy until your blood sugar has normalised.

You might want to read our Having a Baby Checklist or if you are pregnant, read this one on how pregnancy will affect your application.

No, unless the answers on your application form highlight serious medical issues and/or you need A LOT of cover.

If you’re in good health, you’ll be accepted immediately.

If you have minor health issues, the insurer may request a report from your GP, but a medical exam is rare.

Yes, of course, it’s the perfect time!

Soon, you’ll be a mother and too busy to even have a cup of tea—sorry, but it’s true.

You will find cold cups of unfinished brews all around the house!

Sort it out now while you have a bit of free time.

If you’re already pregnant, you won’t be able to add some benefits to your mortgage life assurance policy, e.g. hospital cash cover.

That’s why I always advise you to put mortgage life assurance in place as soon as you decide to try for a baby.

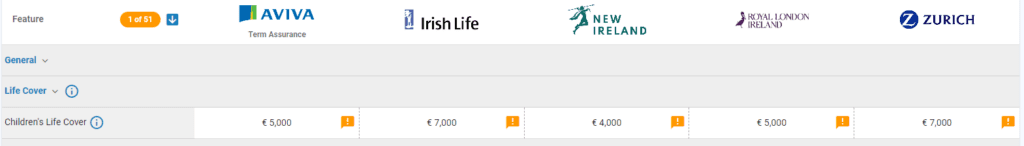

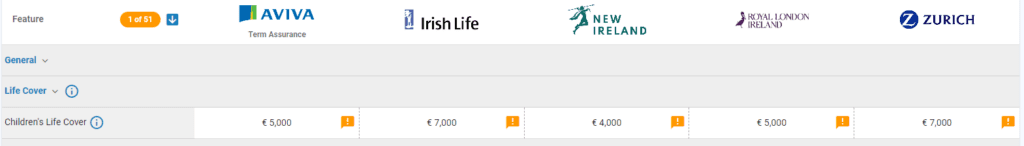

The insurers include Children’s life insurance in most policies.

During the term of your plan, children between the ages of 3 months to 18 are automatically covered for up to €7000 in the event of their death or up to the age of 25 if in full-time education.

All you need to know about getting life insurance if you’re pregnant

There are also additional benefits, such as a medical second opinion, included in some policies.

So that’s the basics of life insurance for new parents.

Actually, they’re the basics for all parents who don’t yet have life insurance.

For some strange reason, I find that people don’t buy life insurance until child number two is born.

Maybe you’re here because you’ve just had your second or third child.

There’s quite a bit there, so I expect you’ll have questions.

I’m here to answer them no matter how small, silly or insignificant you think they are; I’m all ears.

Please complete this questionnaire if you’d like me to make a recommendation based on your current situation.

Thanks for reading

Nick

Editor’s note: We first published this blog in 2019 and have regularly updated it since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video