Table of Contents

It depends on the relationship between the dead person and the person getting the moolah.

If you’re married, there is no tax liability.

Let’s look at the case of JR and Sue-Ellen.

Sue Ellen had a life insurance policy in her name for a cool €10 million.

If JR was lucky enough to marry Sue-Ellen before she popped her clogs, he wouldn’t pay any tax on the money he received.

However, if there were no wedding bells, then in the eyes of Revenue, they are strangers, and he will be hit with a whopping tax bill on the life policy.

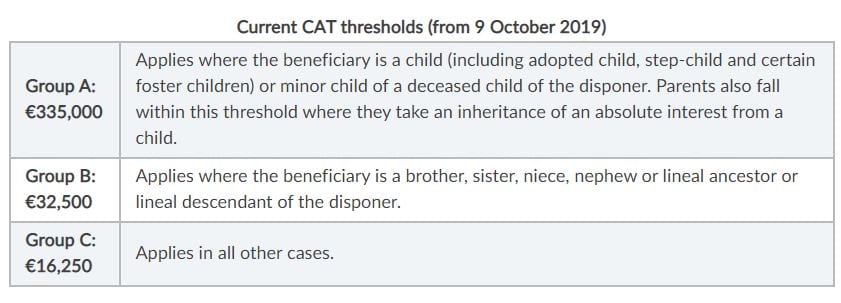

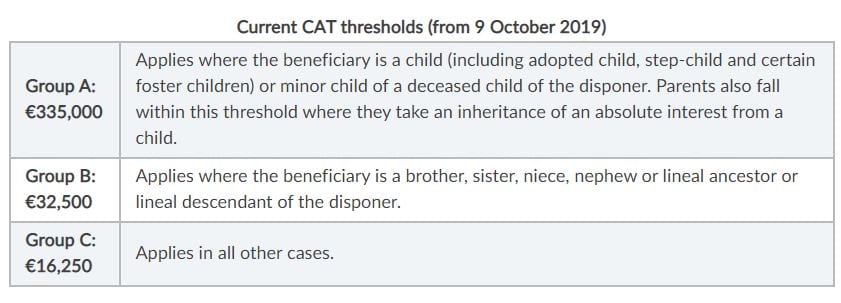

The proceeds of a life insurance policy are taxed at 33% less the current CAT threshold you can see below (still current in 2024)

The above in plain English:

So if JR didn’t marry, he would have to South-fork out 33% tax on the value of the life insurance policy minus €16,250.

That’s a tax bill of 33% of (€10,000,000 – €16,750) = €329,447.25!

So, the takeaway is that you should get married for one sole reason: to avoid paying taxes on your spouse’s life insurance.

Why else would you get married??

I wrote a previous article that would be of interest if you’re not married and are considering life insurance.

Premiums on standard-term life insurance policies are not tax-deductible.

But you can get tax relief on a special type of life insurance called Pension Term Assurance.

Also, if you’re lucky enough to be a company director and your company pays your life insurance premiums, the premiums may be a tax-deductible expense for the company.

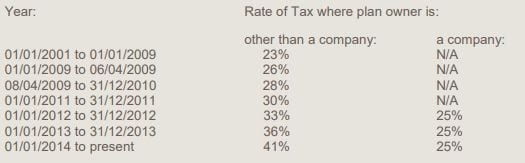

Yes, any gains on the investment of the proceeds of a life insurance policy are taxable at 41%.

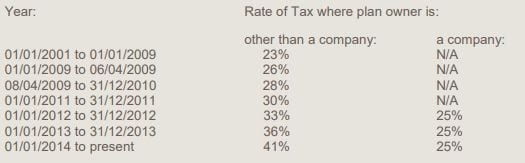

This exit tax here in Ireland has risen steadily since 2001:

And you thought having to pay 33% tax was harsh.

Similar to a lump sum payment from a life policy, the insurer will pay out proceeds on a monthly income life insurance policy tax-free.

However, if these monthly amounts were invested by the beneficiary, any growth would be taxed at a rate of 41%

Again, it comes down to your marital status.

Remember, there is no tax liability between married couples or civil partners, so there are no tax implications for mortgage protection policies.

However, if you are buying as a cohabiting couple, there are some pitfalls to avoid.

Here’s a previous article on mortgage protection for cohabiting couples.

Please take this as a general guide to Ireland’s basic tax rules around life insurance.

So, if you have a specific query, I suggest you take legal and professional advice before doing anything stupid!

Thanks for reading

Nick

Editor’s Note: We first published this blog in 2020 and have updated it since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video