Table of Contents

Editor’s note: First published 2016 | Refreshed November 2025 with new payout examples, insurer data and Irish Life claim stories.

10-second summary: Irish life insurers pay around 98 % of claims every year. When they don’t, it’s nearly always because of non-disclosure, missed payments, or fraud — not insurers being stingy. Here’s what really happens.

You’ve probably heard horror stories about claims being refused or payouts taking months. And because insurers aren’t famous for plain English, it’s easy to think “they’ll wriggle out of it.”

But when it comes to life insurance, the reality is far better than people expect.

Every major insurer in Ireland — Aviva, Zurich, Irish Life, Royal London and New Ireland — pays out on the overwhelming majority of claims.

They have to.

If they didn’t, nobody would buy their products, and the whole system would collapse faster than a tent in a storm.

Learn more in our full guide to life insurance in Ireland

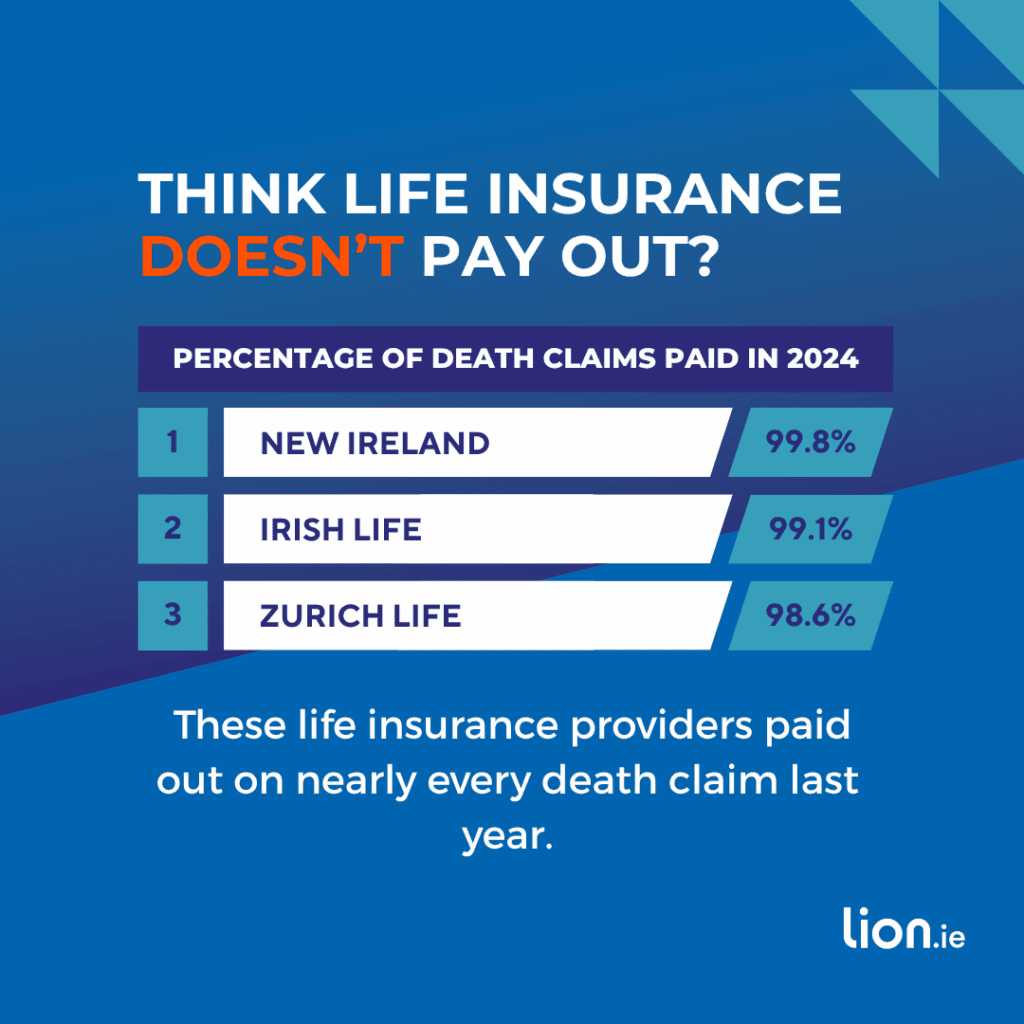

Each insurer publishes its annual claim statistics, and they’re all in the same ballpark — roughly 98–99 % of death claims are paid.

When you see that figure repeated year after year across five different companies, it stops being marketing fluff and becomes evidence.

And I see it every week in my own work.

Families receive lump sums that clear mortgages, pay off debts, and give them breathing space when life falls apart. It’s the one piece of good news after awful news — the system is doing exactly what it’s meant to do.

Learn more about how life insurance actually works

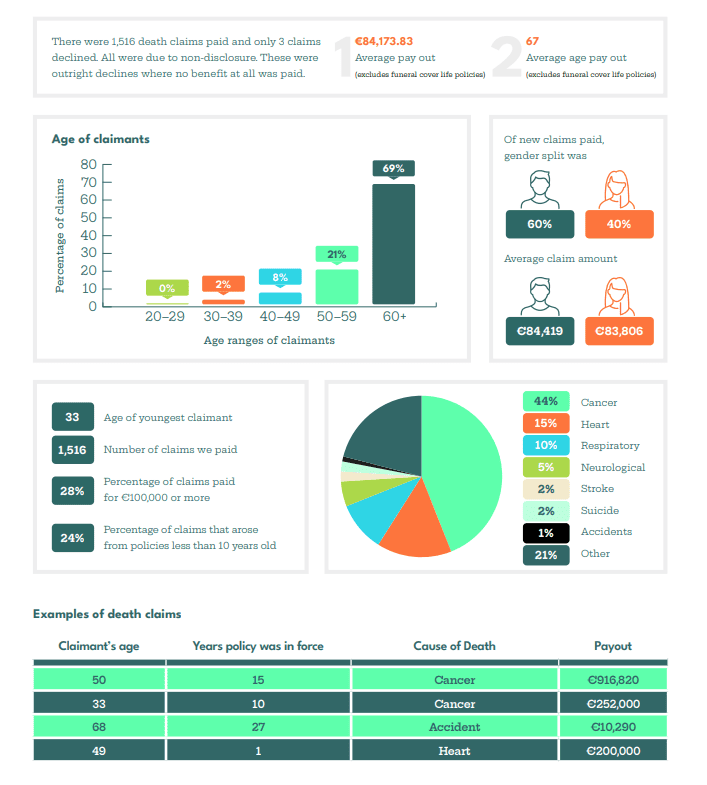

Irish Life’s 2024 data shows just how often these policies quietly do their job. They paid over €1 million every working day to families across Ireland — €178 million in death claims and €64 million in serious-illness payouts.

Irish Life’s payout rate stayed at 99 % for death claims and 92 % for serious-illness claims in 2024.

The other major insurers — Zurich, Aviva, Royal London and New Ireland — all report similar numbers.

New Ireland Life paid 1,516 death claims in 2024 with only 3 declined for non-disclosure.

Refusals are rare, but when they happen, the same three culprits keep showing up:

Maybe you “forgot” about a bit of high blood pressure, the odd cigarette or that hospital visit years ago.

Insurers call these material facts — anything that would’ve changed your price or cover. e.g. a lady ticked “non-smoker.” Her GP notes said otherwise. Claim refused. Simple as that.

Top tip: When completing a life insurance application form, answer the questions as you see them; you don’t have to volunteer information that is not requested.

What happens if you lie on your life insurance?

This one breaks my heart because it’s so avoidable. You miss a payment, plan to fix it next week but forget. Your policy lapses and you’re uncovered. If you die after that, there’s no payout. It’s like cancelling Netflix and then wondering why Drive to Survive won’t load.

If it’s a banking mix-up or life just getting in the way, talk to us before the policy cancels completely — we can usually rescue it.

Thankfully rare, but it happens. Fake death certs, forged medical reports, multiple applications for millions in cover without telling anyone — and yes, someone really tried that. Spoiler: didn’t end well.

Sometimes yes, sometimes no.

If you lied about smoking but were killed in a car crash, some insurers may pay anyway as a goodwill gesture; others won’t. If they’d have charged more had they known the truth, they can legally void the policy. Don’t give them a reason — just be honest from day one.

If you’ve had even one cigarette in the past 12 months, tick “smoker.” Pay the extra for now — after a year smoke-free you can re-apply as a non-smoker.

One of our clients died by suicide 💔.

His GP notes showed a history of mild depression he hadn’t disclosed. Technically, the insurer could have refused the claim — but they didn’t. They reviewed the records, saw it wouldn’t have changed the premium, and paid in full. That family’s mortgage was cleared within weeks.

I still get emails from the widow thanking us for pushing the paperwork through quickly. That’s why we ask awkward questions when you apply — so when the worst happens, your claim sails through instead of getting stuck on something silly.

One dad in his forties died suddenly from a stroke. His wife rang me in bits. We handled the claim for her, collected the forms, and the insurer paid out €310,000 within four weeks. She told me she had no idea it would be that simple. That’s the side of insurance you never see in the ads — it quietly works.

That’s it.

For most cases, the whole thing takes two to six weeks.

No courtroom dramas, no mystery boardrooms full of cigar-smoking executives deciding your fate.

For the step-by-step guide, see what happens when you make a life insurance claim.

Sometimes a claim gets paused because something doesn’t add up — a GP note, a missed premium, a typo on a form. That’s where we step in. We know the claims teams personally and can explain the context so you’re not just a reference number in a queue.

If an insurer ever does refuse a claim, you can appeal through the Financial Services and Pensions Ombudsman. They exist to make sure insurers play fair. You won’t need them often — but it’s nice to know they’re there.

Very unlikely. These companies are monitored within an inch of their lives by the Central Bank. Even if one ever did get into trouble (none have in modern times), customer funds are ring-fenced and must go to policyholders first.

Life insurance is one of the few products where you don’t get to see the benefit yourself. You have to trust that it works when it matters. And it does. Every week in Ireland, millions are paid out to families who never thought they’d need it. That’s why we bang on about getting your forms right — because those few extra minutes now mean everything later.

✅ 98 % of Irish life-insurance claims are paid.

❌ The tiny minority that aren’t usually involve non-disclosure, missed payments or fraud.

🦁 Be honest, stay covered and we’ll help you keep your policy bulletproof.

If you’re not sure what needs to be disclosed or want a second pair of eyes before you apply, fill out this short questionnaire or drop me a message. We’ll help you keep your cover clean and your claim future-proofed.

Wondering about critical illness claims payout – read our guide.

Thanks for reading

Nick — Making life insurance less crap since 2011 🦁

Written by Nick McGowan, QFA RPA APA

Nick is a qualified financial advisor and founder of Lion.ie, an independent Irish broker specialising in life insurance and income protection. He’s been helping people get fair, transparent cover for over 20 years and was named Protection Broker of the Year 2022.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video