Table of Contents

Complete this questionnaire, and I’ll discuss your case anonymously with my panel of insurers and send you the best quote possible.

Hello Nick,

I currently have a mortgage application going through. It won’t be a problem to be approved for this amount as I have a permanent job and am applying for less than originally approved for. However although I’m only 27 years of age I was diagnosed with Multiple Sclerosis in September – so far it’s only optic neuritis I suffered. Will I get mortgage protection cover? I didn’t even think it would be a problem until I googled it? Now I’m extremely concerned and worried. I would be very grateful for your help.

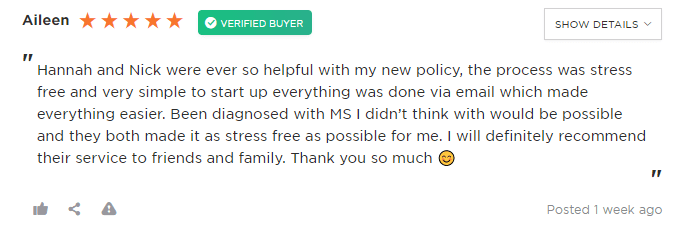

Aileen

Aileen had herself worried to bits, but we managed to arrange her mortgage protection without any hassle.

The insurer requested a medical report from her GP, and once they received it, they accepted her for mortgage protection immediately, albeit with a premium loading.

MS is a chronic condition affecting the protective layer surrounding nerve cells.

MS does not significantly reduce life expectancy, and this is why it’s fairly straightforward to get life insurance if you are living with multiple sclerosis.

Before offering cover, the insurer will request a medical report from your GP.

The insurer will increase your premium based on the severity of your condition:

So let’s say the standard price for someone with no health issues was €50 per month.

For the same cover, someone with mild MS will pay €75/€100 per month, with moderate MS €100/125 per month, with severe €125+ per month.

Unfortunately, if you have been diagnosed with MS, you cannot get serious illness cover or income protection insurance.

Multi Claim Mortgage Protection, though your policy will have an MS exclusion bundle.

And you can get Cancer Only cover at the standard price.

If you need mortgage protection or life insurance and don’t know where to turn, I’d love to help.

Please complete this questionnaire, and I’ll be back over email.

Alternatively, you can schedule a call back here.

Thanks for reading

Nick

Editor’s note | We published this blog in 2018 and have updated it since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video