Table of Contents

6 reasons why we recommend Aviva as the best income protection provider in Ireland

—-

Before we compare income protection, let’s go back in time to when you were a kid and things were simpler.

It’s highly likely that when you were a smallie, your Ma or your Da told you

to be successful in life, you need to do well in school, get a good job, and work hard.

It’s not bad life advice, though it’s probably a little different now given that every eight-year-old wants to be a YouTuber rather than a Doctor.

Instead of working hard, all you gotta do is make videos of yourself playing video games while screaming at your computer.

Keep it up, son, and someday you might have 111m subscribers like PewDiePie.

What your parents probably didn’t tell you is that

sometimes shit happens.

You can work hard and do everything right and then you can get sick or be in an accident, and it can knock you right on your ass.

The wheels come clean off, and you’ll be stuck struggling to make ends meet on the government’s paltry State Benefits (it’s currently €220 a week) and/or blowing a hole in your savings.

Unless you have the absolute belter that is Income Protection.

Presumably, you’re considering it, and that’s what’s brought you here to my corner of the internet.

Welcome! 🖐

A quick recap if you’ve stumbled here by mistake or you’ve never attempted to compare income protection before now:

Income Protection is a type of insurance that pays you a replacement salary if you can’t do your job because of any injury or illness.

Income Protection cover doesn’t kick in immediately; instead, you choose a waiting period (called a deferral period) of either 4, 8, 13, 26, or 52 weeks.

Once you’ve been out of work for that period of time, the insurer will start paying you a replacement income.

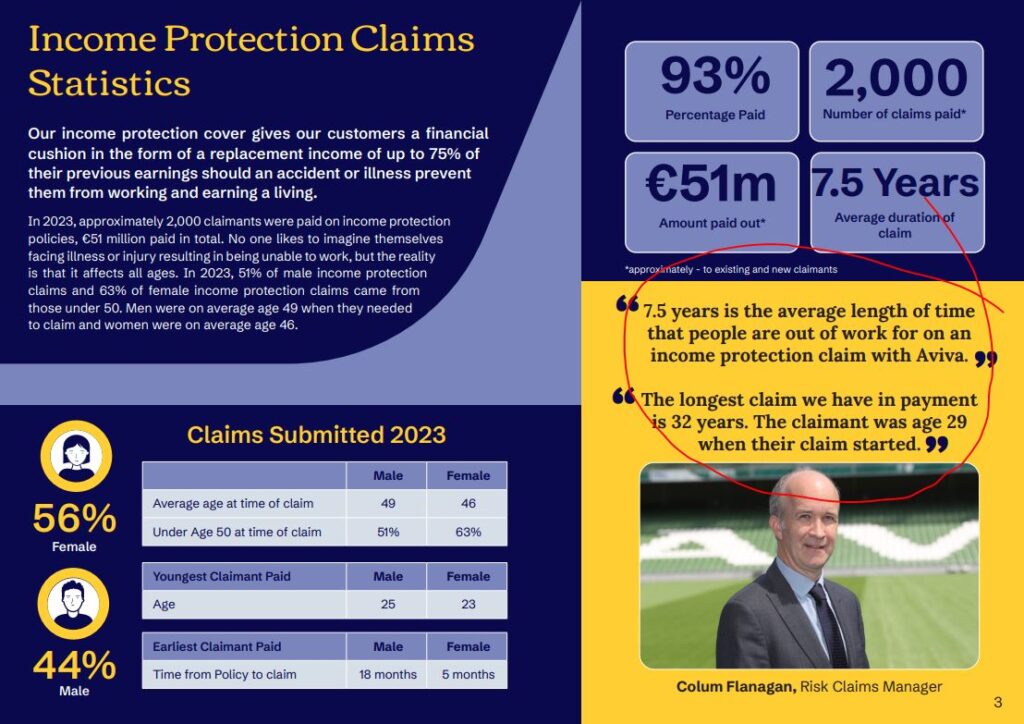

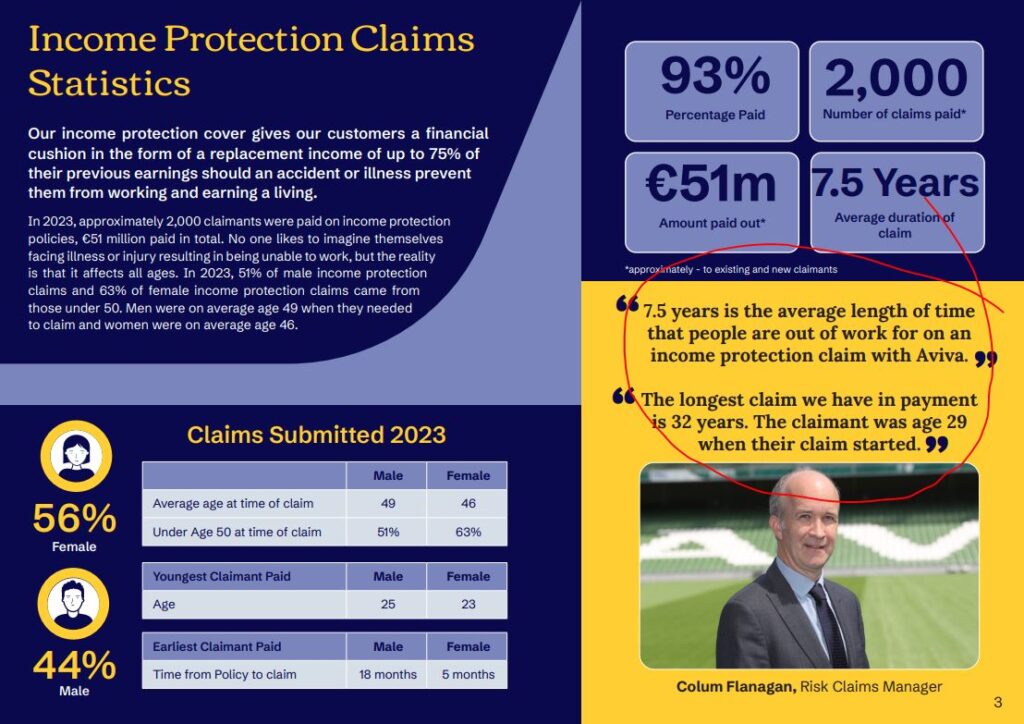

The average Income Protection claim, for context, last about seven years.

Aviva are paying one for the last 31 years.

Looking at those numbers, everyone should have Income Protection – are there any useful alternatives?

You don’t actually have to die to reap the benefits, which is a novelty for life insurance.

And it covers you for everything from long-term back pain to chronic depression.

Now we’ve covered the basics, let’s look at how you should compare Income Protection policies.

At lion.ie, we’re an online Life Insurance broker, and we deal with all the major insurers.

We’re not tied to any one insurer for income protection.

So if you choose us to arrange your cover, you get access to

For the TL; DRs among you, I recommend Aviva’s Income Protection.

For those who like to draw their own conclusions, let’s keep her lit.

Meet Sally.

Sally is a 40-year-old accountant.

For the sake of argument, she earns €45,611.

Yes, a precise number and as it’s from the CSO so we can assume it’s legit the average income in Ireland.

Sally wants Income Protection with a 13-week deferral period (remember this means it will pay out if Sally can’t work for more than 13 weeks due to illness/accident)

If Sally were to use my magic quote machine, her quote would look like this:

On the left, you’ll see a list of the insurers.

The middle column is the price before tax relief.

And the right column shows the real cost after tax relief.

The amount of tax relief you can claim depends on how much income tax you pay.

If you pay 20% income tax, you get 20% tax relief.

If you’re a higher earner and pay 40% income tax, well then you can get 40% tax relief which is WHOPPER!

And tax relief one of the main reasons that I recommend income protection over serious illness cover

If you’re wondering why you’re seeing double, it’s because some insurers offer two types of Income Protection: Reviewable and Guaranteed.

Reviewable means the price won’t necessarily stay the same over time, i.e. the insurer can review your policy/situation and change the price every 5 years.

Guaranteed means the price is fixed for the term of the policy so what Sally pays now as a 40-year-old, she will continue to pay even when is 60.

For what it’s worth, I recommend Guaranteed.

It may cost a few quid more at face value, but at least you know it’ll stay at that price.

P.S. if you want more info on how your premium/price you pay is calculated, hop over here to my article on Income Protection calculators for some more soothing bedtime reading.

You might be tempted to go for the cheapest quote.

You wouldn’t be the first person to take the easy option; you won’t be the last.

However, it’s also worth looking at the benefits each insurer offers.

So, because Income Protection is similar for each insurer, they also throw in handy little extras to sway you to them.

You could call it marketing.

Or bribery

Value Added Benefits

Their Best Doctors service is the most comprehensive Medical Second Opinion out there (for those of you who don’t trust your medics)

Once you engage Aviva, they’ll collect your health information directly from your GP/consultants and send it over to the “Best Doctor.”

I’ve used it before and was impressed by the service.

You can also use it for a second opinion on any minor ailment (except pregnancy-related or mental health issues), even if you haven’t been diagnosed yet.

Their Family Care Service offers therapy sessions with registered psychologists (not just counsellors).

And the cherry on the top of this delicious Income Protection cake is theirDigital GP Service giving you access to an online GP.

Key Features

Aviva’s executive/company paid policy has a great feature – the continuation option.

If you leave your job or your company goes under, you can transfer your policy into your own name.

Other insurers will cancel your policy in this situation, but with Aviva, you’re covered and won’t be left in a financial bind.

Another cool thing about Aviva is that they let you choose indexation and escalation separately on your policy.

This is handy if you ever feel like your policy is getting too expensive or you’re over-insured, and you want to cancel indexation.

With Aviva, you can do this without losing the escalation option on your policy.

(And just to clarify, escalation means your payout increases each year you’re out on a claim.)

Yeah, I know that’s pretty hard to get your head around, just trust me “it’s a good thing”.

Finally, you can increase your cover by up to 20% every three years without answering medical questions.

Claims

Aviva is known for having the best claims philosophy in the income protection market.

In other words, they pay claims quickly and fairly – I can attest to this having had a few claims paid for customers.

Their claims are handled in Dublin.

And when it comes to rehabilitation services, Aviva is top-notch.

Quick story – I had a physio who was interested in income protection and he insisted on going with Aviva. Why? Because in his job he helped people out on claim with Aviva and was so impressed with the service.

And get this: in 2023 they paid out over €51 million to more than 2000 claimants.

That’s a lot of people who were able to get the support they needed.

What else?

Here’s another little know benefit: if your company goes out of business while you’re on a claim, Aviva will pay the premium directly to you. That way, you’re not left high and dry without coverage.

And finally!

If you work in a Class 3 or 4 occupation, Aviva has a Wage Protector option that might be just what you need. It’s a lower-premium alternative to full income protection that could save you some serious cash.

So it’s a resounding thumbs up from us for Aviva Income Protection.

Watch Carole’s story.

Royal London’s Income Protection policy comes with some useful bits too.

If you’re diagnosed with a terminal illness, you can start receiving your Income Protection payment right away. That’s some relief in a horrendously difficult situation.

The deferred periods start at just 4 weeks, which means you won’t have to wait too long before your benefits kick in.

Royal London can cover you until you’re 70 years old.

But wait, there’s more!

Free steak knives?

Not quite!

With Royal London, you can split your deferred benefit into two separate periods so you can have some income paid out after 13 week with the balance after 26 weeks.

This is really handy if you’re a public servant with three months @ full sick pay, followed by three months @ half sick pay.

Plus, they’ve got a back-to-work benefit that provides you with financial support for the first three months after you’re back on the job to ease you back in gently.

As with Aviva, you can increase your cover by up to 20% every 3 years.

And last but not least, Royal London’s “Helping Hand” program gives you access to free counsellors and medical therapies to help you through your illness or treatment. It’s like having a little extra support when you need it most.

Oh yeah, they’l also throw in a free month’s cover – handy if your premiums are on the high side.

Zurich’s Income Protection is more than just a monthly income – they’ve got your back (excuse the pun) when it comes to rehab too.

They’ve got a team of rehab nurses who can come to your home and help you come up with a plan to get you back to work.

And get this, they’ll even pay for treatments with a local physio or counsellor if you need it.

They can sort out an appointment with your GP or even get you to see a specialist if you’re stuck on a long waiting list.

If you’re back to work but on reduced earnings, you could still get a partial benefit payment.

With Zurich you can increase your cover on certain life events (getting married, getting a salary increase of a certain percentage).

Personally I prefer Aviva and Royal London’s approach to increasing cover (i.e extra 20% every thee years regardless of “life events”)

UNIQUE BENEFIT

New Ireland exclusively offer a Confirmed Income Option.

This is handy for those with a fluctuating income because you can give evidence of your income at the time you apply. It puts a floor under your income so you can be sure of how much you will receive regardless of your income at the time you make a claim.

New Ireland also offers the best value indexation rates in the market, ensuring that your policy keeps up with inflation and maintains its value over time. This is important for those who know their incomes will increase significantly year on year. My medical consultants clients love indexation with New Ireland.

New Ireland also offer benefits available at the other insurers like the back-to-work benefit, providing you with financial support for the first three months after you return to work.

With Irish Life’s Income Protection, you can also protect your pension payments through their Pension Payment Protection benefit.

Additionally, Irish Life offers LifeCare which provides policyholders with access to a medical second opinion service, medical helplines, and a claims helpline at no extra cost.

So what you should be looking at when you compare income protection?

☑️ What does it cost? Remember to look at the column that shows tax relief.

☑️ Is it Reviewable or Guaranteed? Generally, go with Guaranteed.

☑️ Are the benefits the best you can get for your situation?

☑️ Risky occupation? If you’re a Class 3 (jobs like care assistant, nurse, electrician) or 4 worker (carpenter, plumber, etc.) and you want the lowest premium, look at the Wage Protector option, which is the only insurance of its type explicitly catered to help Class 3 and 4 workers to get a better deal. It’s not as comprehensive as full income protection, but it costs less..

I can see you’re far too clever, you know they can only sell their own policy (usually from Irish Life)

Yeah right, again, you know they can only sell their own policy.

Ah, now we’re getting somewhere. A choice of 5 insurers.

But which broker?

Let me outline the case for lion.ie

Yes, I know that seems like I’m setting the bar very low.

But there are some who just sell sell SELL.

That’s not our style – but don’t take my word for it.

So what do we do instead?

We offer advice on policies from

We answer your questions.

We outline which company will suit you best.

Then we get out of your way and give you some time to breathe and take it in.

Buying income protection is an important decision and one that’s not to be taken lightly.

If you decide you want to go ahead with us as your income protection broker, happy days!

If not, hopefully, you’ll be impressed enough with our service to tell your friends.

We know our onions when it comes to income protection.

You see, we’re a specialist protection broker (mortgage protection, life insurance, serious illness cover and income protection).

We don’t claim to be protection experts while also trying to flog you a pension, gadget insurance and something to cover Rover and Fluffy.

This gives us the time to focus 100% on knowing income protection inside and out.

We know income protection is a bit of a minefield and we’ll guide you through it without getting you blown up.

Insurers classify your occupation according to the risk of having to pay a claim.

So people who work in higher-risk jobs pay a higher premium

e.g an electrician will pay more than an accountant for the same amount of cover because on average, their risk of injury is higher.

That seems fair enough, yes?

Risk 1 = lowest risk, Risk 4 = highest risk

But did you know some insurers give a different risk rating to the same occupation!

Recently I arranged cover for a retail manager (he was a manager in Aldi).

Avvia, New Ireland, Royal London and Irish Life classed him as a Risk 2 (remember, the higher the risk class, the higher the premium).

But Aviva classed him as a Risk 1 saving him a small fortune over the life of his policy.

I’m not saying Aviva are always the most lenient when it comes to occupations though…

During the summer, I arranged cover for a marine engineer:

Royal London classed her as a risk 2, Irish Life and New Ireland classed her as a risk 3 while Aviva classed her as a risk 4.

Last week, I got a plumber covered, one insurer classed him a risk 3, the other classed him as a risk 4.

As you can see, you need to be very careful here, don’t accept a higher risk rating from one insurer without checking out the others.

Work with an income protection broker who knows their way around.

Income protection pays out if you are unable to do your job due to any illness, injury or disability…excluding pre-existing conditions.

Pre-existing conditions include any previous health issue

e.g

You see income protection in underwritten much more strictly than life insurance or critical illness cover.

A sprained wrist isn’t going to result in a death or serious illness claim but for someone who works on a keyboard, it could lead to an income protection claim.

But some insurers are more “trigger happy” than others and will add exclusions like a chef adds salt.

Other insures are fairer.

Again, don’t accept an exclusion, question it and check with the other insurers to see if the can offer cover without that exclusion.

Choose an income protection broker who knows which insurer is best for your particular health issue.

If we haven’t come across your condition before, we’ll speak to all 5 insurers to get you the best deal out there.

All income protection policies are not the same as we discussed above.

So if an income protection broker tells you all the policies are the same, “just pick the cheapest”, you know what to do.

Leg it!

If you like the sound of what we do, great we’d love to help.

Please complete this questionnaire and I’ll be right back with a no-obligation recommendation and an indication of cost.

Thanks for reading

Nick

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video