Table of Contents

Complete this questionnaire and I’ll send you an indicative mortgage protection quote taking your diabetes into account.

As someone on the exciting journey of buying a new home, the prospect of mortgage protection is likely high on your mind.

You’ve probably searched the forums and found nothing, but bad news and scare stories.

Don’t worry, you never find a good news story in those forums so here’s one we made earlier!

However, if you have diabetes, you might be feeling concerned about how this condition could impact your ability to get mortgage insurance.

Rest assured, you’re not alone in these worries.

We have helped literally hundreds of people with Type 1 and 2 Diabetes get Mortgage Protection and buy their forever home!

In this blog, we’ll explore the ins and outs of getting mortgage protection in Ireland while managing Diabetes.

Before diving into the specifics, let’s call a spade a spade – there’s no getting around the fact that diabetes adds a layer of complexity to the process of securing mortgage protection.

It’s a condition that requires careful management, and insurance providers take this into account.

However, having diabetes should not crush your dreams of buying your own gaff.

There are primarily three main types of diabetes: Type 1, Type 2, and gestational diabetes that we see on a daily basis.

Here’s a brief summary of each:

It’s important to note that there are other, less common forms of diabetes, such as monogenic diabetes and secondary diabetes, which have distinct causes and characteristics.

Additionally, prediabetes is a condition where blood sugar levels are higher than normal but not yet in the diabetic range, serving as a warning sign for potential Type 2 diabetes.

Managing diabetes involves careful monitoring of blood sugar levels, lifestyle modifications, and, in some cases, medication or insulin therapy to maintain stable glucose levels and reduce the risk of complications.

Here’s a closer look at the factors that might affect your ability to obtain mortgage protection:

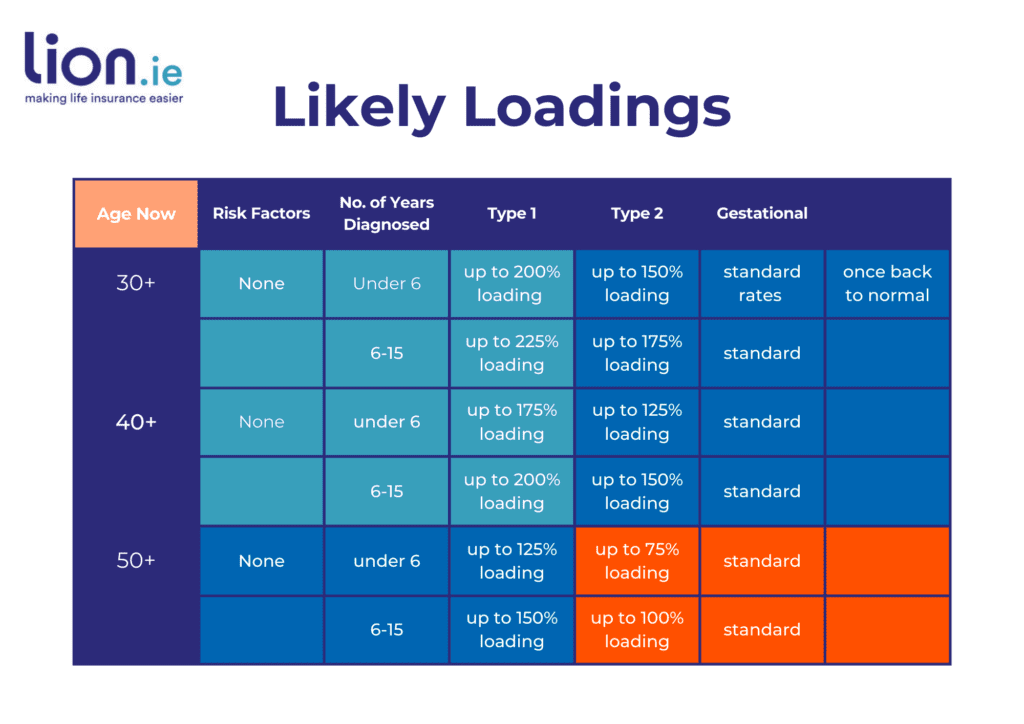

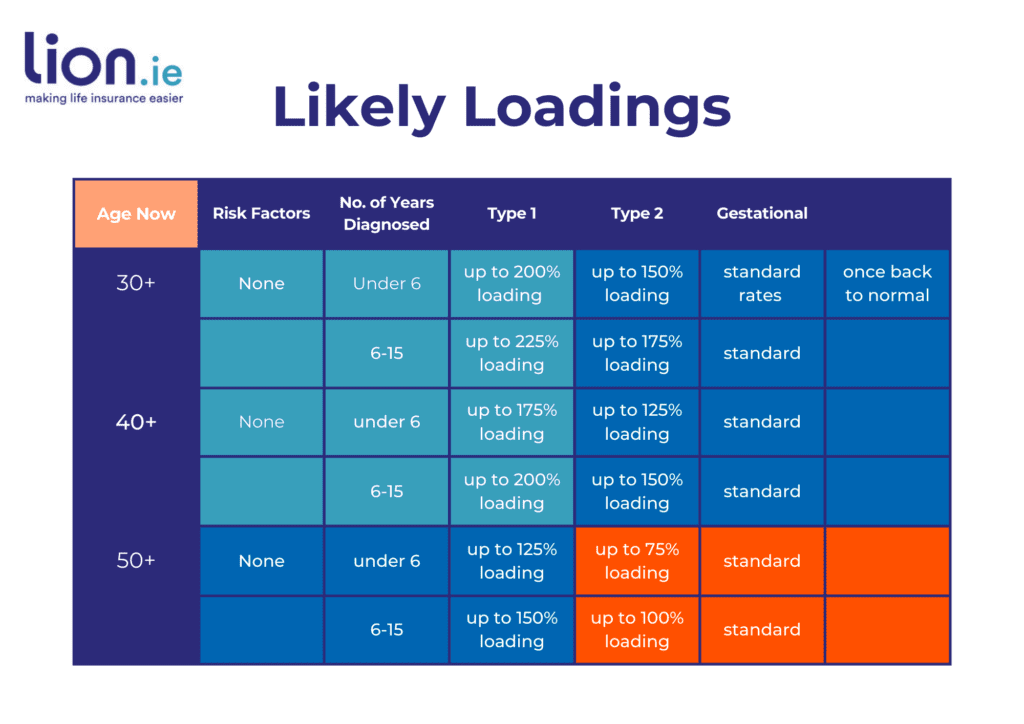

All else being equal, someone who was diagnosed at an earlier age will pay more than someone who was diagnosed later in life.

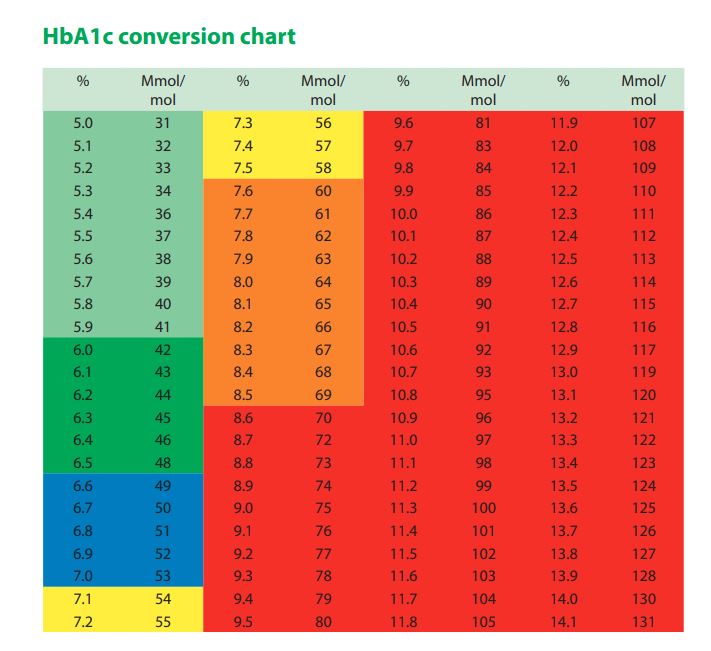

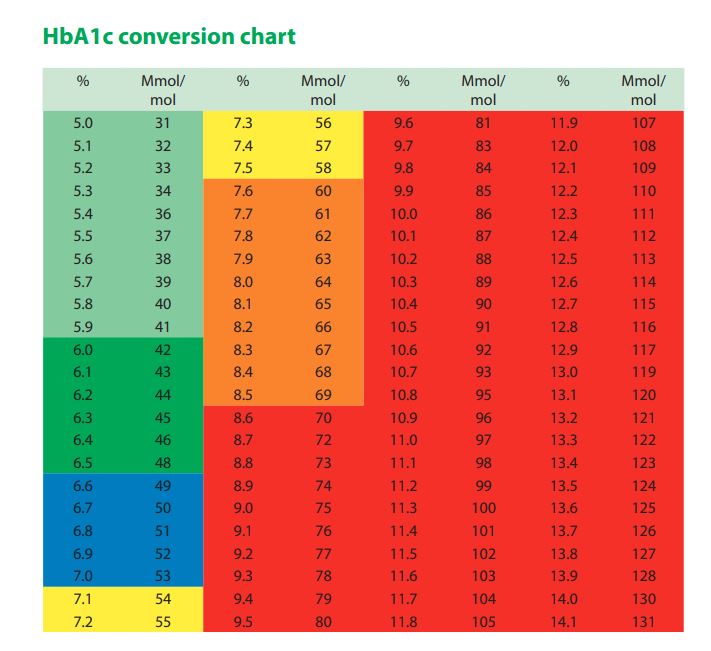

If your latest HbA1c level is above a certain threshold (usually 9.5%/80mmol), it’s likely the insurer will postpone offering mortgage protection until you have achived better control.

Complications and Other Health Factors:

Any complications resulting from diabetes or additional health risk factors like smoking, cholesterol levels, blood pressure, and BMI can impact your eligibility and the cost of your mortgage protection.

With the seemingly unending costs attached to buying a home in Ireland, one of your most pressing concerns is how having diabetes will affect the cost of your mortgage protection.

Insurance providers will increase/load your premium if you have diabetes (sometimes if you have T2D and excellent control, you can get the normal price).

It’s important to be aware that these increases can be substantial.

For instance, if a non-diabetic can secure coverage for €20, you might end up paying €70 per month for the same coverage.

Unfortunately there’s no guarantee.

Sometimes the insurers will refuse offering cover.

Typically the insurer will postpone or refuse your application for mortgage protection if your

If you are refused by more than two insurers, you can request a mortgage protection waiver from your lender.

Mortgage protection and life insurance should be possible.

Unfortunately, if you have Type 1 Diabetes, you won’t be able to get Income Protection or Specified Illness Cover although you can get Cancer Only Cover.

If you have T2D and your control is examplary, you may be able to get Income Protection with a certain insurer.

If you’re determined to secure Mortgage Protection with Diabetes, here are some steps to consider:

Talk to Your Specialist:

Contact your diabetes specialist and your healthcare team for up to date medical reports and advice on improving your control (if you need it). Alternatively, make sure your GP has copies of the most up to date reports. If you haven’t had bloods done recently, the insurer may be able to arrange them as part of the underwriting process.

Get Advice:

Discuss your application with a specialist Mortgage Protection advisor who has experience in this area.

Complete this Diabetes Questionnaire (if you’d like our help)

Be thorough when filling out the diabetes questionnaire, providing detailed information about your condition and management.

The general consensus (peddled by the banks) is that all the insurer are the same.

They’re not.

Each insurer will add a different loading/increase to their premium.

Let’s say the normal price for someone without diabetes is €20 per month for 35 years.

Irish Life adds a 200% loading so your final premium will be €60

Zurich adds a 100% loading so your premium premium will be €40.

In this exampled, over 35 years, by going with Zurich, you would save €8,400.

Always shop around!

Buying a home is a significant milestone, and diabetes should not be a barrier to achieving that dream.

While there may be challenges along the way, with the right approach and support, you can secure mortgage protection that provides peace of mind for you and your loved ones.

Remember we have helped many others successfully navigate this path, and we’d love to help you.

Thanks for reading.

Nick

P.S Please share this blog with someone who may find it useful.

lion.ie | Protection Broker of the Year 🏆

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video