Table of Contents

You’re almost there.

The bank has eventually given you mortgage approval.

You’ve found your dream home.

The vendor has accepted your offer.

Now, all you need to do is meet with your bank and buy mortgage protection, right?

There are five reasons you should avoid the bank for mortgage protection.

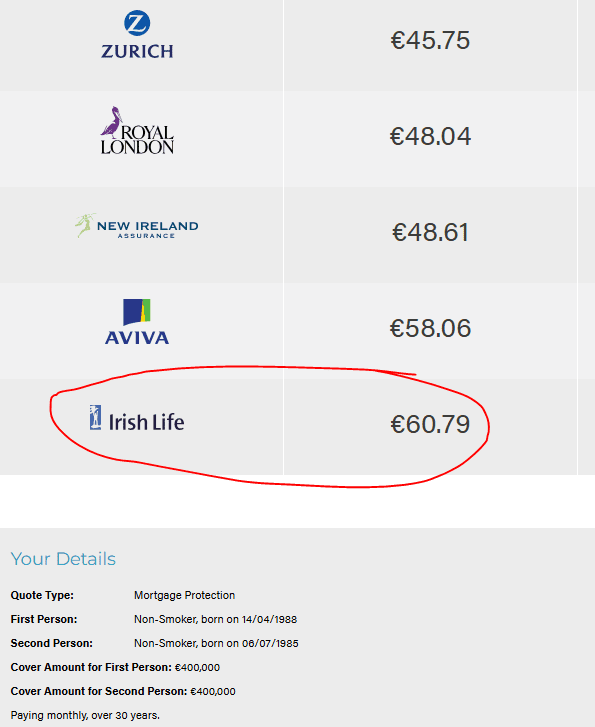

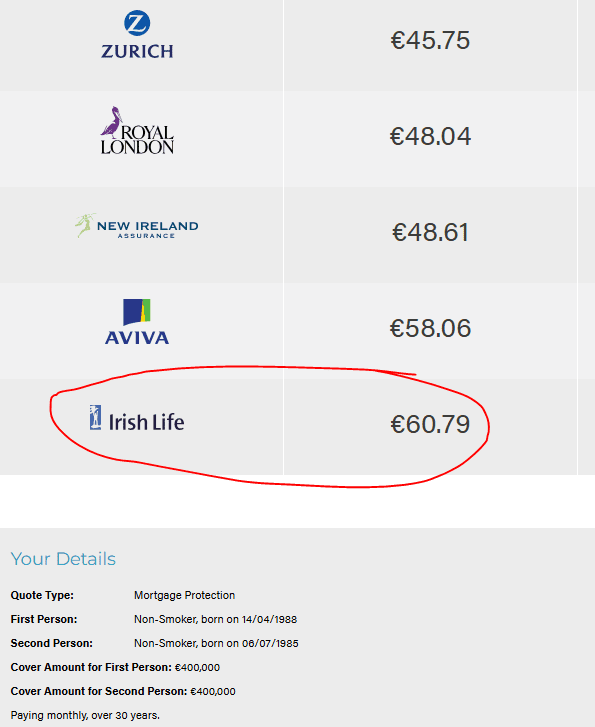

The majority of banks are tied to Irish Life for mortgage protection.

This couple would pay €5,414 extra over the term of their mortgage.

If you purchase mortgage protection from a bank group scheme, known as a block policy, the bank will cancel your policy if you ever move your mortgage.

Let’s fast-forward five years, and there’s a new mortgage provider in Ireland offering tracker rates for the first time in forever.

You want one; but to get one, you have to switch your mortgage.

You mention this to your banker, who explains that since you took out a block mortgage protection policy, they will have to cancel it should you switch to a new lender.

You will therefore need to reapply for mortgage protection all over again.

You’ll be older, which means you’ll pay more.

You may have suffered health issues, so you’ll pay even more.

If those health issues are severe, it may be impossible to get mortgage insurance.

What happens then?

You’re stuck with your current bank, and their rip-off mortgage costs you €000s extra per year.

As you can see, buying mortgage protection from your bank could have unforeseen repercussions.

If you buy from a broker, you will keep the policy even if you switch lenders in the future.

Permanent TSB, AIB, and EBS are all tied agents of Irish Life.

Those banks can only sell life insurance from Irish Life. They cannot advise on policies from

Bank of Ireland can only sell policies from New Ireland (Bank of Ireland Life)

This means you won’t have access to the value-added benefits available at other insurers.

If you’re unmarried, did you know you should take out two single-life policies to minimise inheritance tax?

Or, if you add serious illness cover to your policy, the bank will receive the proceeds of your claim.

If you are discussing cover with your bank, check if they mention either of these or if they are just too busy selling you a policy even to care.

You’re in trouble if the bank’s insurers refuse to offer cover.

The bank can’t help you because they don’t have another insurer to apply to, so they will recommend applying through a broker

However, since the bank has declined your application, you must declare this on your new application.

This will raise a red flag at the other insurers, potentially affecting your chances of securing the best price.

The same applies if your bank applies a loading to your premium.

So, what should you do if you’re worried about a health condition affecting your cover?

Use a broker specialising in getting cover for clients with quirky health issues.

👋

We’ll get you covered by the most sympathetic lender at the best price with the least hassle.

I’m here to guide you through the mortgage protection minefield.

Please complete this questionnaire if you would like me to review your financial situation and recommend the best ways to protect yourself when obtaining a mortgage.

Thanks for reading

Nick

Editor’s Note: We first published this blog in 2018 and have regularly updated it.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video