Table of Contents

Get my 60-second summary into your earholes!

Cast your mind back to History class in school and the epic battles of our time.

The Battle of Hastings.

The Siege of Stalingrad.

The Invasion of Normandy.

Millions fought in bloody, awful wars.

And now we have the Battle of the Brokers, where a man on the internet will compare Life Insurance brokers so you can choose which one is right for you.

It’s scintillating stuff, folks.

I know what you’re thinking.

But, Nick, you own lion.ie.

Of course, they’ll win

Well spotted, eagle-eyed readers.

Both of these things are true.

BUT NOT because I’m unfair or biased towards myself.

Here, our policy is no bullshit – and we bring that into everything we do.

We’re straight-talking, and we’ll give you the truth.

Even if you don’t choose us, this article is still a good launching point for your research.

Getting the best deal on Life Insurance or Mortgage Protection Insurance matters – and knowledge is the key.

The more you know, the better equipped you’ll be to protect your family’s future.

That said, let’s dig in.

So how should you compare Life Insurance brokers?

Regardless of where you buy your insurance, one thing remains the same: Policies are identical no matter which broker you use.

So if a broker offers:

Rest assured. All brokers can do the same; it’s just that some aren’t as good at shouting from the rooftops as others.

Let’s say you’re interested in a policy from Royal London.

If you use a local or online broker, the policies are the same, although the price may differ because online brokers usually offer bigger discounts.

However, your bank can only sell you a policy from its preferred insurer (usually Irish Life)

However, the price and the choice of insurers will differ from broker to broker. This leads on to:

Brokers pay their bills by earning a commission on the policies they sell.

It’s how I earn a crust and pay our staff.

I’ve written about it before, in the interest of transparency.

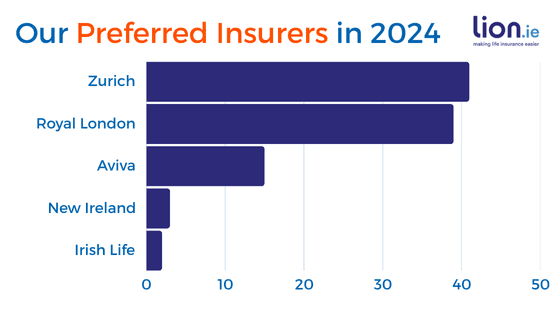

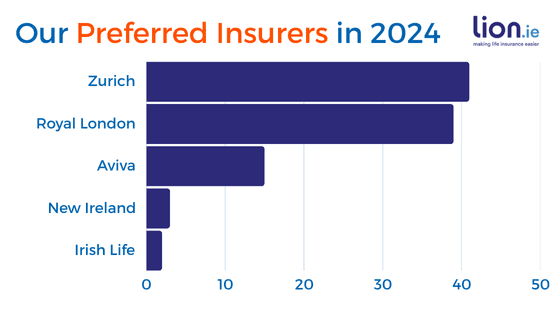

While we’re talking transparency, here are our preferred insurance providers in 2024

We’re the only broker that publishes these figures every year.

If the broker doesn’t deal with all the insurers, move on.

‘All the insurers’ here means Aviva, Irish Life, New Ireland, Royal London, and Zurich Life.

We deal with all five.

The easiest way to find who the broker deals with, if they’re an online broker, is to run a quote and see who comes up.

Count ’em. You want to see quotes from all five insurers or get outta dodge.

You don’t want to see a quote from one particular insurer because this might mean the broker can only sell policies from that insurer.

Tread carefully.

Insurance is CONFUSING.

I’ve been in this game for a long time, and sometimes it still trips me up.

Especially if someone has a complicated medical history or a job, that means they’re a high risk to insurers.

In your quest to take out a policy, you’ll come across loads of jargon and terms that seem interchangeable. So make sure your broker is on hand to explain.

Online brokers are handy if you’re in perfect health. However, if your situation is complex, it’s helpful to have someone in your corner going to bat for you.

In our case, we can make a personalised recommendation for you based on your health and situation.

Plus, we go one step further than all the other brokers in Ireland: we’ve written loads of articles to give you all the info you need to DIY.

And we pride ourselves on being easily understood.

But bear in mind your best bet is your local high street broker if you need a face to face consultation.

We’re an online broker, so we’re happy to work over email and the phone, but it’d be a bit weird if you wandered into our offices for a chat.

We’d make you tea, don’t get us wrong, but we prefer to do things the modern way.

As I mentioned, if you’re in perfect health with a clean medical history, you’ll breeze right through getting Life Insurance. If you have a dangerous job or medical complications, you could flag it as high-risk to the insurers.

And insurers don’t like risk – which means a loading charge and more expensive premiums. In some cases, it may mean no cover or a postpone.

If you’re in this boat, inexperienced advice, even if meant well, can ruin things for you.

Instead, you’ll want a broker who knows his onions and has advised all kinds of people in all sorts of situations. With Life Insurance, the magic is knowing which insurer to choose for each medical issue or profession. It’s not just about getting cover; it’s about getting cover at an affordable price with the least amount of hassle.

For example, one insurer might be more sympathetic to someone with heart disease. At the same time, another might charge you a boatload of extra money. In this case, they both offer cover, but you’ll pay thousands more over the term of your policy if you choose the wrong one.

It’s not enough to trust a broker who says they’ve helped people with tricky cases. Instead, look for proof – such as testimonials or real-life customer stories.

You’ll find our testimonials right here. We have hundreds of them and a 4.98/5 average because we go the extra mile to help our clients out.

To save you a click, take a peek at a sprinkling of our reviews:

It’s simple: you’re going to pay a chunk of money every month to protect your family. Please don’t skimp on it by going with whoever because life insurance seems like a lot of hassle or because you think it’s not very clear.

A good broker will clear it all up for you, and they’ll do most of the work as well.

If an online broker forces you to give a phone number before they quote – think twice, or get ready for some cold calling sales guy hounding you night and day.

You should be able to get your quote without signing up for anything.

Likewise, you should be able to complete your application form online. Who has time to find an envelope, buy a stamp and post a letter these days?

Don’t get me wrong, you don’t want to pay over the odds for this stuff, but if you have a health issue, you’re never going to get that cheap quote you see online. You’ll complete the application form in the expectation of that quote. The insurer will properly underwrite you and then offer you a revised quote that’s three times higher.

Your head will explode in rage.

To avoid this nightmare, make sure you get a “real quote” based on your health BEFORE you apply. That’s the service we offer. All you need to do is complete this questionnaire.

Buying insurance is a lot like any purchase. If you feel like you’re being strong-armed into a quote or insurer, it’s because you are.

Remember, the more you know, the better equipped you’ll be to get a good deal for yourself.

All else being equal, pull the trigger on the broker who offers the best price and the best advice.

That’s it.

It’s that simple.

Price + advice = ❤️️

Here’s the thing: you can take the cheapest policy you see – but make sure you know what you’re getting.

Is it convertible?

Does it come with indexation?

Is it reviewable or guaranteed?

Is it dual or joint?

Who will get the payout?

If you can’t answer those questions, don’t leap – because each one equates to euros spent down the line.

With Life Insurance, you’re buying peace of mind and security for your family. Make sure you choose a broker you can trust with your family’s future, who explains everything, and who makes it effortless.

Remember, that broker is the guy or gal your family will be dealing with if there is ever a claim.

Hell, if that’s someone other than me, go for it (if they’re that good, tell them there’s a job waiting for them here. Seriously, we’re hiring!)

However, if you like what we do here, give me a call or fill in this financial questionnaire, and I’ll get back to you with my recommendation.

Alternatively, you can schedule a call back at a time that suits you.

I look forward to it!

Nick

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video