Table of Contents

If you’re getting a mortgage, you need mortgage protection.

You’re going to be paying the premiums for 35 odd years so you might as well buy the best.

In this blog, we compare all the policies of offer so you can make an informed choice.

Let’s drive on.

Buying a house, as we all know, is a considerable pain in the hole as it involves any number of the following.

No wonder you might be tempted to say ‘feck it and go with your bank when they offer you a Mortgage Protection policy.

But this decision could cost you a lot of your hard-earned.

Banks are tied to one insurer, meaning they offer no choice, and their chosen insurer charges higher premiums.

You’re stuck with the policy they push.

You wouldn’t shop in a supermarket offering only one brand (Cadbury’s Mushroom Soup, anyone), so don’t do it for your mortgage protection.

Brokers (☺️) give you access to

So, to avoid a bad case of buyer’s remorse, today I will help you choose the best Mortgage Protection policy available in 2025.

Let’s look at the basics:

Whether arranged by a bank or a broker, every policy will clear your mortgage if you die.

And all the insurers have a similar batting average, paying around 99% of all death claims.

This means that with all of them, once you’re insured, your mortgage will be paid off if you die (presuming you haven’t done something stupid like telling a whopper on your application, that’ll get your claim refused)

I’m looking at you social smokers who say they don’t smoke.

Once you get past the raison d’etre (ooh la la) for Mortgage Protection, you’ll find loads of other bits created to discombobulate (world’s greatest word) you.

Many of them are a bit meh.

However, a few are worth looking at in more detail.

If you’re in perfect health, you can choose any insurer.

However, we rarely see an application with no health condition or family history of a health issue.

So, your goal is to find an insurer who will offer you coverage with the smallest loading

That’s where we come in.

We’re absolute legends if you have a pre-existing condition.

If you’re concerned about a health issue, complete this medical questionnaire so we can find you the most suitable insurer.

If you’re married and buying together, this is what you need.

Dual Mortgage Protection can pay out on both deaths – grim, I know, but you might as well get the best cover!

The bank would get the first payment to clear the mortgage; the second would go to your spouse.

If someone tries to peddle a joint policy – run, ar nós an gaoithe (like the wind, for my non-Irish speaking friends, which probably also includes most Irish people reading)

Most insurers offer dual mortgage protection.

By the way, if you’re not married, you’ll need two single life policies to reduce inheritance tax (you didn’t know this was a thing, did you?)

A conversion option is fantastic.

There, I said it.

It’s great because you can buy a new policy in the future without answering medical questions…which probably doesn’t make much sense on its own.

So: example.

Jim is 40 and has 20 years left on his mortgage.

Fifteen years later, he’s near the end of his term, and his mortgage is pretty much paid off.

However, he’s 55 now and has a dodgy ticker.

However, he has a conversion option, so now he can turn his MP policy into a Life Insurance policy without disclosing the dodgy ticker, which would otherwise cost him a price hike.

Sound.

This one is important, so keep an eye on it when deciding.

NB: You will pay a few euros more to add the conversion option (roughly 5% extra), but it’s well worth it.

Guaranteed insurability sounds fancy, but I’ll break it down for you.

It allows you to increase your coverage on special occasions without answering health questions.

The special occasions include:

Let’s say you’re 30 and fancy-free when you first get your Mortgage Protection.

Fast forward ten years, you’ve had a sprog and have decided to move to a house, a very big house in the country.

Of course, you’ll need a bigger mortgage to fund the purchase.

You’re now 40, have put on a few pounds, and your cholesterol is raised, as is your BP, but apart from that, you’re grand!

If you reapplied for cover, you would face a loading because of those new health issues.

However, with the GIO, you can increase your coverage by the lower of €100,000 or 50 per cent of your original coverage without answering health questions.

Which is pretty sweet, let’s be real.

Aviva is slightly different here because it lets you increase your cover by €40,000 only when getting a new mortgage. But they also allow you to extend the term to be the same as the new mortgage. SOUND!

This is also a biggie.

Zurich will pay your premiums if you’re injured or too ill to work for over 13 weeks.

This isn’t a huge help if you’re only paying a tenner a month, though it could be worth it if you have a hefty premium.

This benefit is exclusive to Zurich (i.e. the other insurers don’t offer it)

We recommend this to clients with a health issue, or even if their parents have health issues.

Essentially, it lets you double-check your diagnosis or the treatment you’re on.

An independent peer-reviewed medic from the World’s Top Hospitals will review your medical reports to make sure your diagnosis and treatment is correct.

You’d be surprised how many misdiagnoses there are.

It’s available to your children, parents, partners and their parents.

Aviva’s Best Doctor is top of the class here:

Aviva also offer access to AvivaCare,:

Digital GP (saving you €60 every time you use it, and giving immediate access to a GP)

Best Doctors Second Medical Opinion (as discussed)

Mental Health Support (saving you €600 for 5 consultations – open to you, your spouse/partner and your children to 18 or 24 in full-time education)

Bereavement Support

Royal London offers Helping Hand Benefit.

Irish Life has Medcare

New Ireland gives you access to Better Health (GP, Physio, Mental Health and Nutritionist)

Unfortunately, Zurich offer nada.

As a dad, I know this one is grim.

But it’s there as a consideration.

If one of your kids were to die (I know: it’s awful!), you get a lump sum from the insurer. Zurich Life has no children’s cover, while Irish Life has up to €7,000 cover.

Royal London will strictly not pay out on a death claim if a child is younger than three months when they pass, which I think is abhorrent.

Irish Life is the only insurer that will pay a death claim from birth.

This one is gas.

So let’s say you’re getting a mortgage with someone you’re unsure about.

Maybe it’s grand, but you don’t know if ‘grand’ is enough for you.

Separation Cover lets you cover your bases.

Basically, if needed, you can split your dual policy into two plans without having to answer any medical questions.

A consideration if you don’t think your relationship will outlast your mortgage.

That one is on you, buckaroo.

I talk to a lot of people about insurance.

It’s my job.

For many, it comes down to price—a simple comparison of €54.72 v €55.83

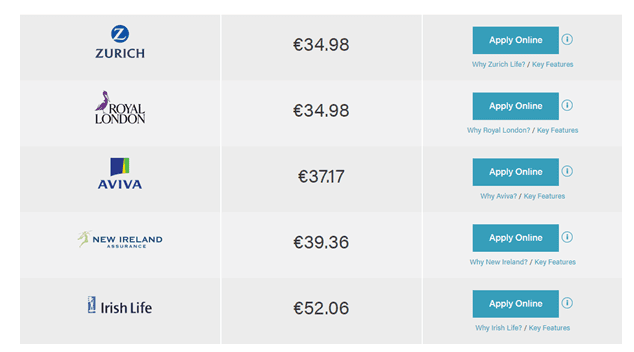

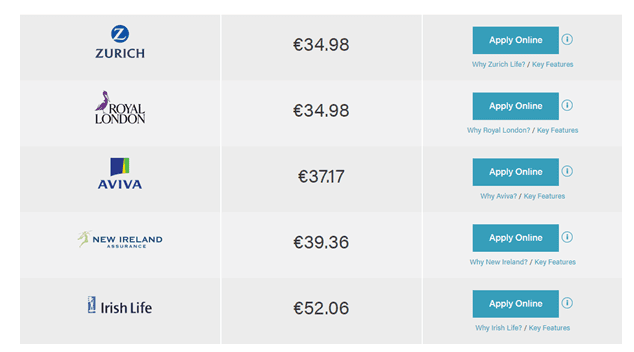

Let’s look at Jim again.

He’s 40 and in decent health and wants to get €300,000 cover for the 25-year term of his mortgage.

His options, from my magical quote machine, look like this (not including the conversion option)

Access to AvivaCare is well worth the extra €4 per month.

You’re quids in if you use the digital GP once every year.

When our three children were smallies, we were constantly in and out of the GP – it all adds up.

Jesse is 34 and buying a house with his partner.

Jesse is a Hyrox Hero; we know this because he constantly talks about it and posts about it.

He used to do CrossFit, but that’s so 2023.

His mortgage is €350,000, and he wants to pay monthly for the 30-year term of his mortgage.

Jesse doesn’t smoke (his body is a temple; he does Hyrox in case he hasn’t told you yet), and neither does his partner (she would love to, but because Jesse does Hyrox– there’d be murders over the smoking).

Anyway, Jesse stumbles upon lion.ie and gets himself the following banger of a quote.

Jesse’s first thought is probably that it’s between Zurich and Royal London and that Irish Life are robbing feckers, bleeding their customers dry of that extra €17 a month.

So, does Jesse take the path of least resistance and become a Zurich Lifer?

Should he?

The crucial thing to remember is that you’re not just paying for Mortgage Protection.

There’s also a bunch of other stuff included.

So let’s look at what the various insurers offer for your hard-earned.

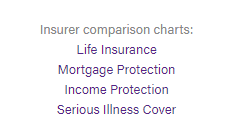

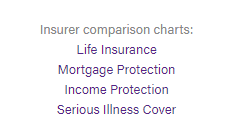

Pro-tip: you can see all this information yourself when you get a quote – simply scroll down to the comparison charts.

1. Aviva

Our top choice for mortgage protection is Aviva because of AvivaCare.

Let’s look at Best Doctor’s (exclusive to Aviva)

If you or a family member has a health condition, you can request Best Doctors to review your medical reports to ensure your diagnosis and treatment is correct.

If you’re diagnosed with an illness in the future, your first questions be:

With Best Doctors, you have an expert in your corner to answer these questions.

You also get

2. Zurich

If you solely want the cheapest option, Zurich is a good shout.

We can get you up to 6 weeks free – i.e. your policy will be in place for 6 weeks before you pay a premium.

Other insurers only offer 4 weeks free.

They also offer an exclusive waiver of premium. If you can’t work due to illness or accident for more than 13 weeks, Zurich will cover your payments. This is exclusive to Zurich Life.

3. Royal London

Along with Zurich, they offer the quickest turnaround and best service

Competitive premiums.

If you ever suffer a serious illness, injury or bereavement, Helping Hand benefit provides the additional support you might need beyond a financial payout.

Bereavement Counsellors

Speech and Language Therapists

Face-to-face second medical opinion

Complementary therapies

Physiotherapy for specific serious health conditions

Sometimes, they run discounted premium promotions, so keep an eye out.

Better Health offers nice benefits – GP, Physio, Nutritionist, Counselling.

Service can be slow so if you’re a rush – avoid!

5. Irish Life

It is best for children’s and maternity cover, so if you’re in the family way, look at Irish Life.

Generally is the most expensive insurer – they are the biggest insurer and are tied to most banks, so they don’t need to be competitively priced!

Adding serious illness cover to mortgage protection is a good shout because it will clear the mortgage if you get an illness listed on your policy (cancer, heart attack, stroke and 80 other illnesses).

BUT PLEASE NOTE

the proceeds of a serious illness claim will go to the bank, not to you

If you want the proceeds to be paid to you, you must take out serious illness cover on a separate policy.

Fair play for getting this far.

As you can see, it is a bit of a minefield, so if your brain has started to melt out of your ears, you can fill in this short form or give me a buzz at 057 93 20836, and I’ll get back to you with my thoughts!

Nick

PS: This blog took AGES as it’s pretty comprehensive, so please feel free to share it with your friends or on your socials. TYVM!

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video