If you’re reading about Mortgage Protection, you’re either really bored, are one of those people who just likes to know *things*, or you’re on the cusp of buying a house.

If it’s the former, I suggest a hobby.

If you’re the latter, congratulations!

Buying a house is one of the most exciting things you can do; there’s no feeling quite like officially being handed the keys to your gaff and taking that first step over the threshold.

If you’re well on your way to owning your own house, you’ll know that you have to get mortgage protection insurance, which pays off your mortgage if you die.

What you might not know is that you don’t actually have to buy a mortgage protection plan from your bank. In fact, you shouldn’t.

Your mortgage lender might be tempted to throw their weight around (it wouldn’t be the first time a bank has given bad advice, now would it?) or you might be considering it because it’s handy, but here’s the thing: the banks are tied to one insurer so your chances of getting the best deal aren’t great.

I guarantee you I can get you a better deal online today than your bank can quote you.

Congrats again

And I mean that very sincerely. Saving for a deposit is a unique sort of hell that generally requires having to move home with your parents or future in-laws, or giving up everything you love.

Past-times? Remember those?

Takeaway? In the bin.

Online shopping for something notion-y? A luxury of the past.

A holiday? You might be able to stretch to a caravan at the side of the road in Waterford.

You’re going to have to sit at home for a bit and watch those euros climb. Only to give them all to a bank in exchange for a massive stonkin’ loan you’ll spend the next 30 years paying off.

Life, it’s a funny old thing.

It’ll all be worth it though when you can actually fill your home with the furniture you like, and you can get a pet without having to worry about your landlord throwing you out. Really, the hardship of saving for a deposit is the trade-off for never having to deal with landlords ever again.

You’re that bit closer to having a home of your own – but it also means you’re going to need to get Mortgage Protection.

Presumably, that’s why you’re here, reading this article about Mortgage Protection. We’re a specialist insurance broker, and we’re here to walk you through the ins and outs of mortgage protection insurance so that you can get the right deal for you. Your mortgage is going to last thirty or so years; your mortgage protection policy will be with you for that time too.

You’re gonna want to make it count! Or at the very least, you’re going to want to make sure you’re not being overcharged for the next thirty-odd years. That’s a lot of years.

In the grand scheme of insurance, mortgage protection insurance is pretty straightforward.

Essentially, mortgage life insurance clears the balance on your mortgage if you die before paying it off. Because nothing is more frightening than the idea of the bank not getting the money you owe them!

RIGHT?

Well, not so right.

By the way, banks have umpteen different names for mortgage protection just so they can really confuse you. There’s mortgage protection, decreasing term insurance, reducing life cover, life home cover and finally mortgage life insurance. They are all the same thing. Just make sure the bank doesn’t try to sell you life insurance. It’s more expensive, and you don’t need it.

After you get Mortgage Approval in Principle, which is a bit like a pre-agreement from the lender, you’ll then go on the house hunt, proper until you find the house you love. You’ll then camp outside it for three weeks to make sure you get a viewing and have the opportunity to charm the pants off the owner/agent.

After that, you’ll bid for your dream home, and all the paperwork will come into play – including signing on the dotted line of Mortgage Protection.

At this point, your bank will try to sell you a mortgage protection policy to go with your mortgage, and you’ll tell them no because you’re not a stupid head. The banks will have one insurer on their card instead of giving you the option to get quotes from all the insurers.

You’ll get your mortgage protection, pay your deposit, finish off the last of the paperwork-y bits (Stamp Duty, survey, deeds transfer, that sort of thing). And afterwards, you’ll be given the keys to your casa.

And then begins paying back the mortgage and also paying your monthly Mortgage Protection Insurance policy.

Simples!

When Should You Apply for and Start Your Mortgage Protection Policy?

This is where it gets a little confusing. Mortgage Protection is a type of Life policy, but it isn’t Life Insurance.

Life Insurance pays out a tax-free lump sum if you die during the length of your cover. Whoever you leave the money to can use it for anything they want. Most people use it sensibly, but if they’re going to buy a yacht and sail the world, who are we to begrudge them?

To reiterate: Mortgage Protection clears your mortgage debt to the bank. You’re also obligated to have Mortgage Protection if you’re buying a house in Ireland, whereas Life Insurance is optional.

Clear as mud?

OK, to make it simple:

You need mortgage protection if you’re getting a mortgage.

You need life insurance if you have children or a partner who depends on your income.

Yes! As above. Life Insurance is optional. Mortgage Protection is mandatory. No Mortgage Protection = no mortgage. No Life Insurance = that’s your decision.

Are you planning on/actively getting a mortgage to buy a house? If yes: yes, you do. If no, what are you doing here? There are far more entertaining ways to spend your time than reading this article.

I suggest finally learning some dances on TikTok and embarrassing your whole family or finding out who your celebrity twin is.

Before getting into the best Mortgage Protection, let’s loop back to the comment I made a little earlier in this article about not getting a policy from your bank.

Your lender will mention it very casually: you’re getting a mortgage, and you need this insurance so why not get a quote for it while you’re on the phone/in the office/sharing a cuppa in the bank?

No matter how charming and lovely your banker is (and yes, they are just people, so they do have positives despite the ‘banker’ of it all), you’re going to say no. It’ll be a polite, but firm no.

I touched on this briefly, but five main insurance companies offer mortgage protection in Ireland: Royal London, Zurich, Aviva, New Ireland, and Irish Life. We compare each in detail in our mortgage insurer comparison guide.

Your bank will be dealing with only one of these insurers. This isn’t necessarily a super bad, evil thing – it’s just that it limits your choices and the potential policy you can get.

It’d be a bit like a single person going on Tinder, matching with one person, and deciding they’re going to marry this person – and all before considering what other options are out there. And maybe this is a match fated from the gods, and they’re destined to be very happy together.

Or maybe the Tinder person clips their toenails at the kitchen table or likes to kick puppies.

You’re taking a risk is what I’m saying. You’re going to have your mortgage protection for the length of your mortgage. Tis a long time, so you really want to give yourself the best chance of getting the right policy from the start, armed with the right information to make a fully-informed financial decision.

And remember, down the line, you might want to re-mortgage or change providers to get a lower interest rate. If you have your own independent policy, you can take it with you and give it to your new lender. If you buy a block policy from your lender, they will cancel that policy leaving you up Schitt’s Creek without a mortgage protection paddle.

In short: your best bet is to apply to all of the insurers yourself or to get a (decent, reputable) broker to do it for you. It’s an extra step that will be worth it in the long run in a monetary sense. (You know we’re very serious when we refer to saving money as ‘in a monetary sense’. Fancy. ?)

You might think that getting mortgage protection just comes down to the prices offered by the insurers. Sure, what else would you need to think about?

Well, there are actually a bunch of other useful benefits that you can get included, depending on your level of cover. Did your bank tell you about that, as a valued customer? I’d just about keel over if they did, to be honest.

The benefits/bits to consider are:

If you’ve never heard of any of those, don’t worry. It just means you’re not an insurance broker or someone who listens to podcasts about insurance or that one uncle you have who is a conduit for Eddie Hobbs. Remember Eddie Hobbs? He was some dose.

Price is self-explanatory – the financial cost of mortgage protection.

The others, not so much.

Jim is 40 and in decent health and wants to get cover for the €300,000 he is borrowing over the 25-year term of his mortgage.

Sound, thanks for volunteering there, Jim.

By the way, Jim only needs to cover the initial amount he is borrowing, he doesn’t need to worry about the total interest the bank will charge on the mortgage. If Jim saw how much this mortgage was going to cost him over 25 years, he’d choose to live in a tent instead.

Anyway. 40. Good health. €300,000 cover for 25 years.

His quote:

Sure it’s a pain in the hoop to have to give that money to an insurer to ultimately PROTECT THE BANKS, but at least it’s not gonna cost Jim too much each month.

It does get a little trickier if you have a health condition. If you do, the secret is to go with a broker who has oodles of experience dealing with ALL the insurers. This broker can go to the insurer who is most sympathetic to your health condition and help you get cover with the least amount of hassle.

You can read more about that in the article, mortgage protection cover if you have a health issue.

You pay extra for this type of insurance. It lets you add more years to your cover without having to answer medical questions.

On its own, you’re probably wondering WHY you’d ever want to buy more cover, especially if you’ve paid off your mortgage.

So what this essentially lets you do is to turn your Mortgage Protection policy into Life Insurance once you’ve paid off your mortgage, without answering any medical questions.

For example, our pal Jim is 30 when he gets a 25-year mortgage & Mortgage Protection.

Jim does well and clears the mortgage in 10 years, but unfortunately, he has developed Type 2 Diabetes. He uses his conversion option to buy 30 more years of Life Insurance cover based on his perfect health at age 30. If he didn’t have the conversion option, Jim would have had to disclose diabetes and would have been screwed for higher premiums.

With this, you can sneak in under the door to get coverage regardless of your health.

You pay around 5% extra for this option, but for me, it’s well worth it.

What’s a Convertible Mortgage Protection Policy?

Most people end up with either single or joint cover. Single works if you’re buying on your own. A joint or dual policy is for you and your partner. With a joint policy, there’s a pay-out TO THE BANK on the first death only.

Dual can pay-out twice if both of you die during the term of your policy. Once to the bank and the second time to your partner’s estate. And OK, in this scenario, I’ve just killed off you and your beloved. Sorry about that.

We’ll use Jim and his partner instead, so you don’t need to imagine your death.

Jim dies first, and the policy clears the mortgage. He and his partner have Dual Cover and two kids. When said Partner dies 10 years later, there’s a second pay-out to the kids.

This is another way to sneak in under the door of milking the insurers for more money.

The great thing about dual life mortgage protection is that it’s the same price as joint life mortgage protection, yet you get twice as much cover.

Dual life mortgage protection is NOT AVAILABLE from your bank.

Yikes.

The Definitive Guide to Dual Mortgage Protection

This allows you to increase your cover without answering medical questions. More cover if you get married or have a kid or want to get a new mortgage. That sort of thing. Again the ‘without answering medical questions’ is the useful bit here.

A sound little extra if anyone in your family has a health issue. This lad is included for free with Aviva’s Best Doctors, and it lets you double-check your diagnosis or any treatment you’re having. It also applies to your kids, parents, or partner and their parents.

So it’s not a massive big thing. Still, it definitely could be useful primarily as any of those people mentioned above can use it from the first day of your policy. So you can use it if you’re worried about the treatment one of your parents has been prescribed.

I’ve used it myself for my mother before she had eye surgery so can 100% recommend it.

Best Doctor’s is not available from your bank.

The world’s leading medical specialists are waiting to help you

If you die between submitting all your paperwork and actually being approved for insurance, this lad will offer up to €150,000 to cover life insurance limbo. Technically, it’s insuring you while you’re not quite insured.

Doesn’t really come into play too often though you never know. Life is strange.

Like my local butcher always says whenever I can’t decide how much to buy, “better to be lookin’ at it that lookin’ for it”.

Zurich (and only Zurich) will pay your mortgage protection premiums for you if you’re unable to work for more than 13 weeks.

Waiver of premium isn’t available from your bank.

Life Protection Policies for your kids. It’s icky, though it is included at different amounts in various policies so have a look into it if you can stomach the thought.

Here is what each insurer offers, as you can see Zurich doesn’t offer Children’s Cover on mortgage protection.

Consider what’s important to you for the extra peace of mind and weigh it against the extra cost, and that should bring you one step closer to finding out which is the best form of Life cover for you and your family.

This is relative of course to how much money you have and how much cover you need. The bigger your mortgage, the more your premium will cost.

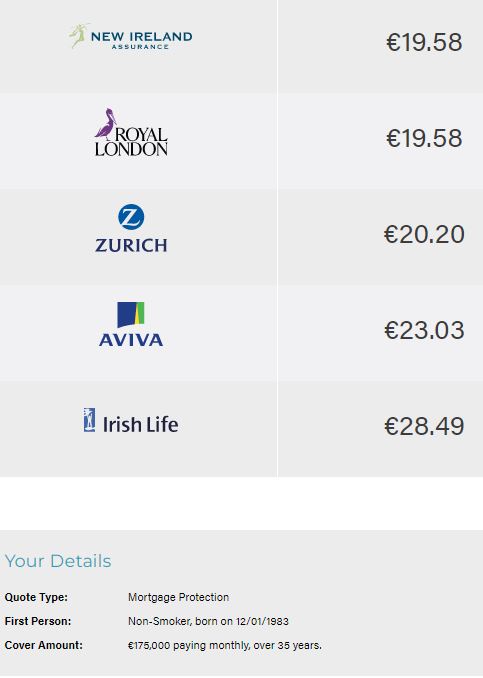

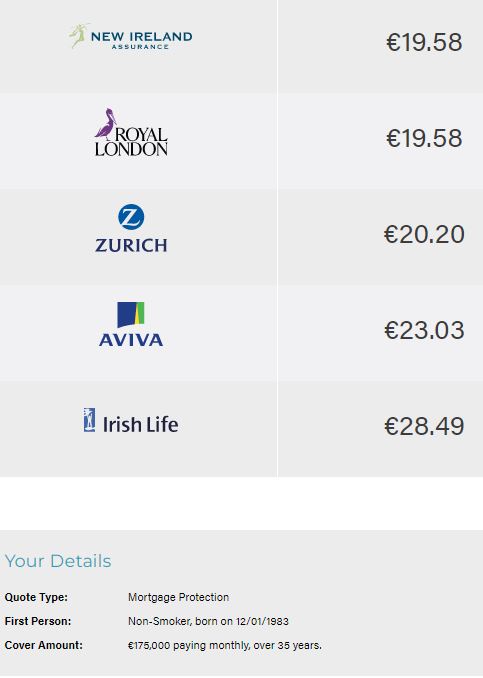

Inversely, if you have a smaller mortgage, your cover will cost less. We’ll look at two quick examples. Agnieszka is 40 and needs a mortgage of €175,000 to buy in Sligo. Her mortgage is 35 years.

Ruben is in the same boat except he lives in Dublin and is buying a three-bed redbrick in Stoneybatter for €600,000 with a 540k mortgage. It’s also across 35 years.

We can make the argument here that it’s actually quite affordable in both instances.

For fun, let’s say you’re on Daft and you see a country house in Cork that has 16 bedrooms and costs two million quid, and you’re curious about Mortgage Protection.

Because, why not?

We all like to dream.

The cover here will max out at €271. But in this scenario, you’re a millionaire, so you can well afford it.

Once more for those in the back: DON’T GET MORTGAGE PROTECTION FROM YOUR BANK.

I touched on this earlier as well, but I’d be remiss not to bring it up. When you’re getting a quote or speaking to a broker or bank, you’ll be asked if you’d like to get Serious Illness Cover as well.

Serious Illness Cover is a tax-free once-off lump sum payment if you get sick with any of the illnesses covered by your policy. Usually, this payment goes to you, and you can use it to pay for medical expenses or your rent or even to buy that aforementioned yacht if things aren’t looking so great.

However, if you get Mortgage Protection + Salary Protection and you fall ill, the pay-out GOES TO THE BANK to clear off a chunk of your mortgage. Which isn’t exactly helpful while you’re facing the here and now of being out sick with a dried-up income.

Nope.

Mortgage protection clears your mortgage on death.

Payment protection insurance (PPI) will cover your mortgage repayments for twelve months if you can’t work due to illness, accident or unemployment.

We don’t arrange PPI, never have done, never trusted it to be honest.

You can read more about PPI on the Competition and Consumer Protection Commission website.

PPI has a poor reputation because it was mis-sold in the past as a profit-making product for banks and brokers. If you bought PPI in the past, you might be able to claim a refund. Again, this isn’t something we do at lion.ie, though head over to Money Guide Ireland as a starting point for more info.

Fear not, brave mortgage-taker, we are nearing the end of this article. By now, you should be well equipped to go toe-to-toe with the insurers to get a great deal on your Mortgage Protection.

The last step in all of this is to get a Mortgage Protection quote for you. While our pal Jim was a useful example, he isn’t you.

If you’re in good health, getting a quote for Mortgage Protection is pretty straightforward. Just fill in your details in my magic quote machine, and it’ll return a quote for you and all the brokers. Once you have that price, take a look at this table and weigh up the pros and cons of the benefits.

On your online quote, you’ll be able to submit an application form, and I can take it from there.

If you’re someone with a chronic illness or a health condition, it’ll be a little more complicated though I can help you too. I’ve helped many people with a “difficult” health history get Mortgage Protection. The key really is in knowing which insurer is best for each medical condition, whether it’s a mental health issue, BMI, diabetes etc.

Just fill in this short questionnaire, and we can take it from there! I’m also available over the phone if you’d rather not use this new-fangled internet-machine to sort out your insurance. Just drop me a line on 057 9320836. That’s an Offaly number – far enough away in case you’d prefer to keep your health history between you and a fella you’ll NEVER meet ?. Sure you wouldn’t know who would know you in the bank!

It depends on the insurer, some are 30 days, some are 90 but the following will affect your quote regardless of the validity period:

The only way to lock in a price is to issue your policy.

If you are considering activating your mortgage protection policy early, make sure you add to the term and the amount. If you don’t, your policy might be short by the time you come to closing.

Remember, the term and the cover decreases as soon as your mortgage protection policy is live.

At lion.ie, we’re a specialist Life Insurance broker, and our mission is to help you get the cover you need at a price you can afford.

We’re a small team of four based out of our offices in Offaly, and we’re big advocates for making Life Policies accessible.

Life Insurance doesn’t need to be confusing and full of mumbo-jumbo and bullshit. All the woo-woo is there to make it seem harder than it is.

We’ll always explain everything to you in simple English so that you actually know what you’re buying. We also have a long history of helping “quirky” cases but don’t just take my word for it. Instead, pop over here to read any of our 1000 customer testimonials.

And only about five of them have been written by our parents.

If you like the sound of that and you think I can help, either give me a call on 057 9320836 or fill in this short questionnaire to get started!

We’ll take it from there. Saving for a mortgage may be painful, but getting cover doesn’t have to be!

Have a cookie for getting this far. Well done you.

Thanks for reading

Nick

lion.ie Protection Broker of the Year ?

This blog was first published in 2018 and has been regularly updated since.

Further Reading: First Time Buyer Guide to Mortgage Protection Insurance in Ireland

I know what you’re thinking: why trust this guy? He’s just another broker out to make a quick buck on other people’s misfortune.

Harsh!

Scroll down to read some of my testimonials from my lovely clients. You won’t find a single bad one – and there’s a reason for that – bribery I mean, GREAT CUSTOMER SERVICE

I believe in plain English and in avoiding the makey-uppy terms insurers and banks use to bamboozle you. After all: if you can’t understand what they’re saying, how are you meant to get the best deal?

You can go ahead and get Mortgage Protection with your bank – but do you really want to be stuck with a policy that they can cancel if you ever want to move your mortgage in the future? Getting your quote takes 30 seconds and we can do the rest over email, so it’s a really easy process.

What else?

I believe in plain English and in avoiding the makey-uppy terms insurers and banks use to bamboozle you. After all: if you can’t understand what they’re saying, how are you meant to get the best deal? I’ll give you independent, unbiased advice so you can get the right deal for you.

I can’t wait to speak with you and to make life insurance a little less drab and a little more fun.

Nick McGowan

lion.ie | making life insurance easier