Table of Contents

In my previous like, before life insurance, I didn’t know what sleep apnea was.

I figured it was just a case of severe snoring.

How wrong I was.

Sleep apnea is a serious medical condition.

There are three types of sleep apnoea:

This is the most severe type.

During sleep, the soft tissue in the throat’s rear collapses, closing and preventing normal breathing.

Less severe.

Here, the part of the brain that controls breathing fails to function routinely.

This is the least common form and is a combination of obstructive and central sleep apnoea.

Obstructive sleep apnoea (OSA) is a sleep disorder.

The sufferer frequently stops breathing (apnea) or experiences shallow or infrequent breathing during sleep (hypopnea).

Breathing can repeatedly stop for ten seconds and longer in extreme cases.

People with OSA experience repeated episodes of apnoea and hypopnea during the night.

The lack of oxygen causes the person to come out of deep sleep and into a lighter sleep or wakefulness period to restore breathing.

In one single night, sufferers may experience up to 350 apnoeic events.

Repeated interruptions can leave a person feeling very tired during the day.

OSA is classified as minor or major depending on the symptoms, response to treatment, impact on personal, work or social life and number of episodes of apnoea per hour

The most common sleep disorders I see in clients applying for life insurance are:

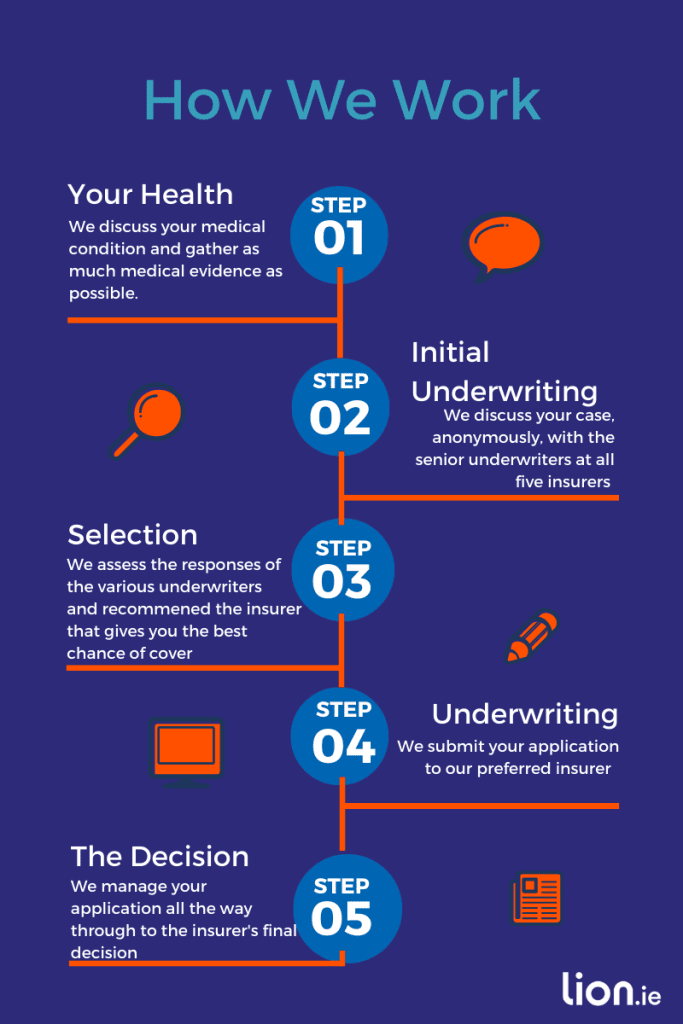

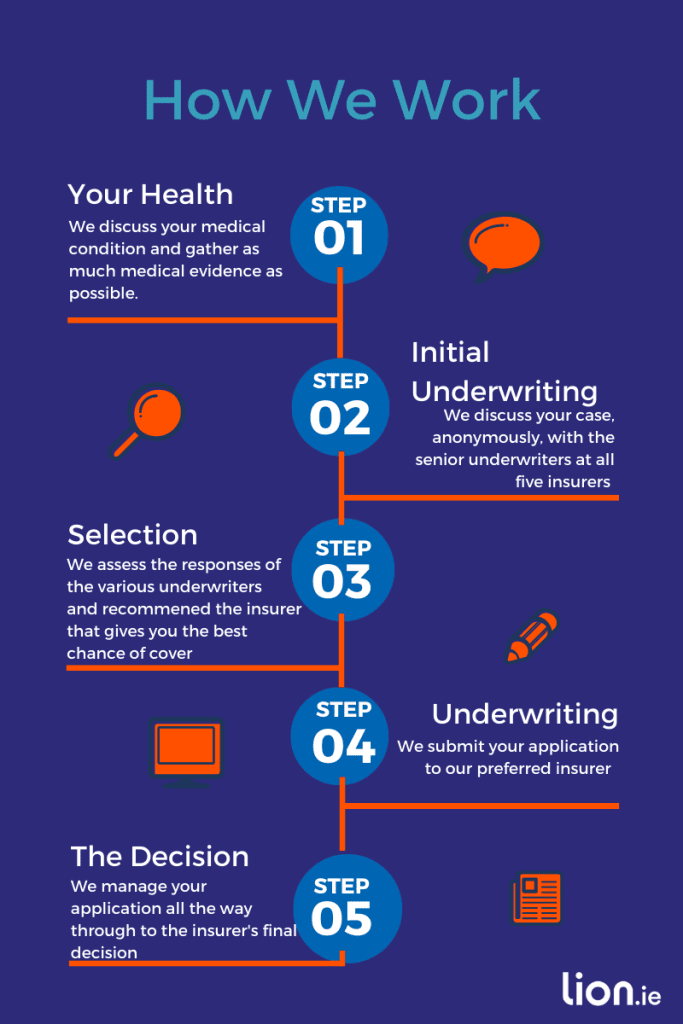

If you have a pre-existing health condition, the first thing we do is speak to our panel of underwriters anonymously.

Discussing your medical history helps us to identify the most suitable insurer for your medical condition.

By doing so, you avoid applying to companies that will end up being too expensive or, worse, refuse your application.

By conducting thorough research, we can save time and obtain the best possible terms for you with the least hassle.

The most important factors the underwriters need at this preliminary stage are:

If an insurer believes cover is possible, it will write to your GP for a medical report that should include your latest sleep test (polysomnography).

Your GP will also comment on whether you have followed their recommended treatment.

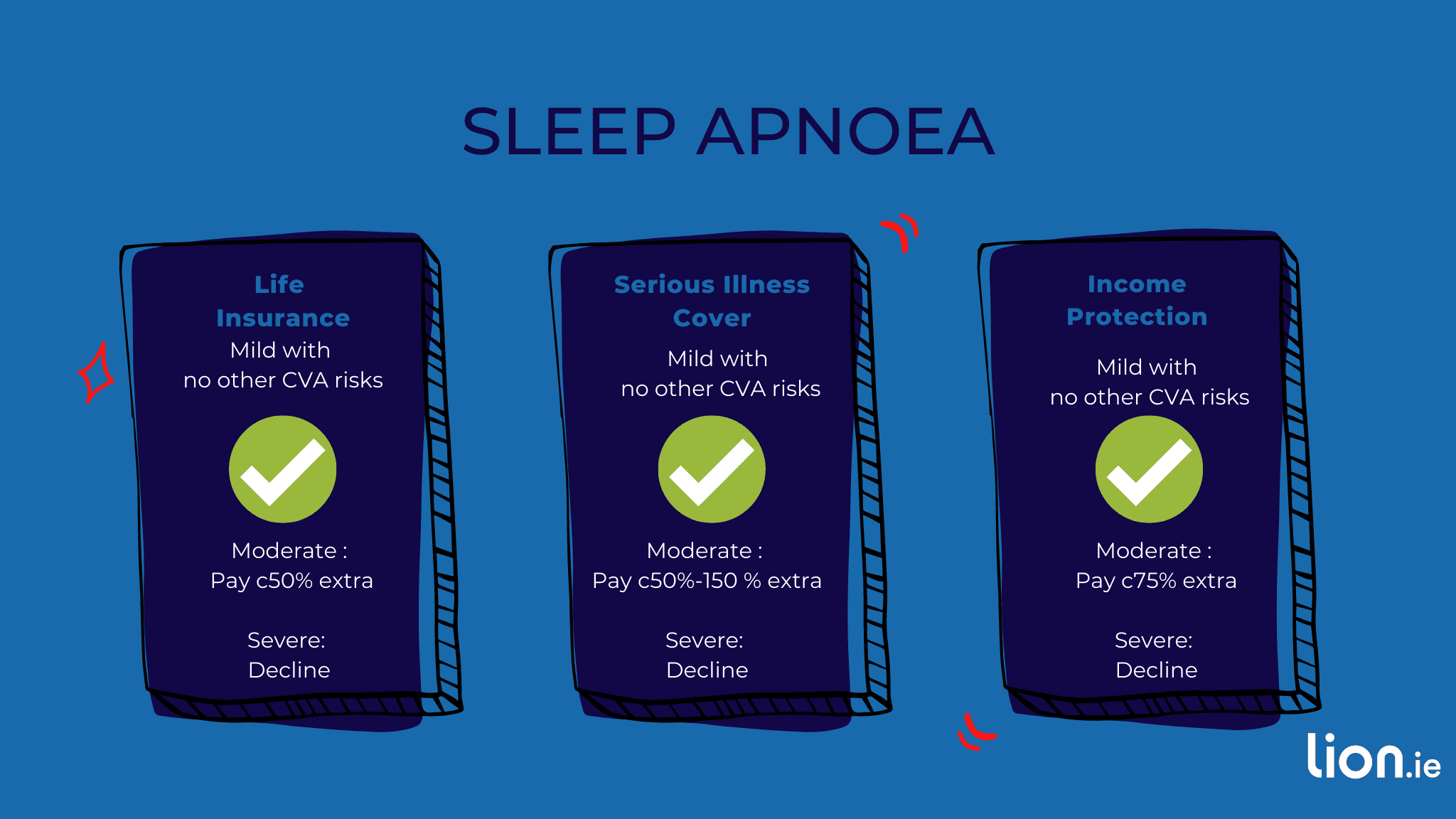

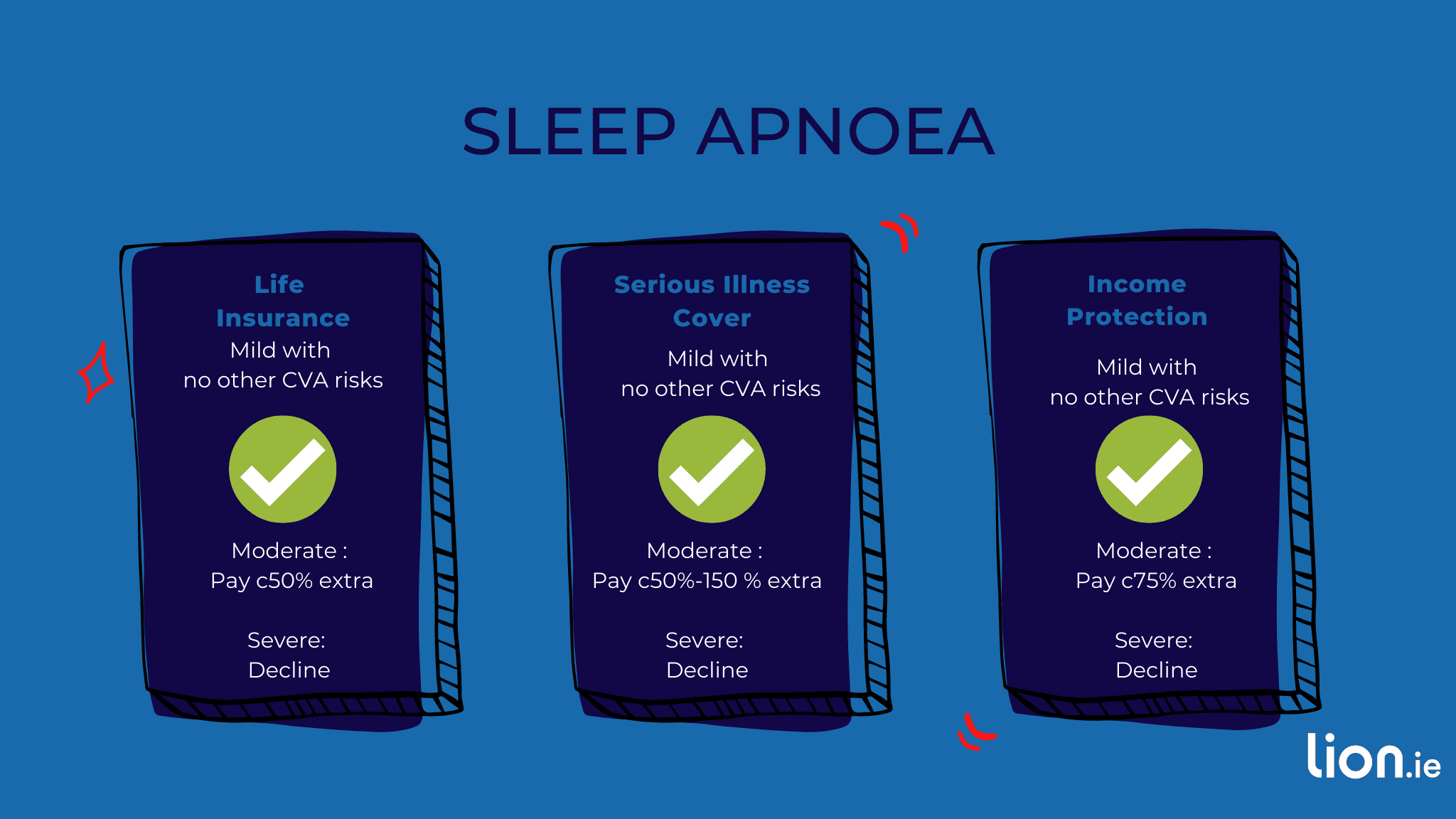

It depends on whether your condition is mild, moderate or severe (use of a Constant Positive Air Pressure (CPAP) machine) and whether you have any associated conditions (obesity, high blood pressure, heart issues, etc.).

For mild sleep apnoea, you can expect to pay the standard price.

If it is moderate, you will pay more.

If it’s severe, the insurer may refuse or postpone offering cover.

Insomnia is a prolonged inability to sleep properly.

It’s usually associated with an underlying condition such as stress or anxiety.

The insurer will be most interested in the underlying condition causing the sleeplessness.

Insomnia shouldn’t be a problem for life insurance as long as you have addressed the underlying issues causing the symptoms.

Narcolepsy will not usually affect your ability to get life coverage.

However, the insurers must rule out organic brain disease and confirm no history of injuries or accidents.

Unfortunately, they won’t be able to get cover until they have had their sleep study.

If they are diagnosed with sleep apnea and their AHI score is outside the normal range, they may have to wait until it is back to normal.

You don’t need to worry about insomnia and narcolepsy as long as there is no underlying medical condition.

However, sleep apnea is a serious condition that insurers underwrite strictly.

As a result, if you have sleep apnea and need life insurance, you should work closely with an experience, specialist insurance advisor who know which companies are most understanding of sleep apnea.

If you have sleep apnea and attempt to get life insurance independently, you may waste a lot of time and end up with nothing but decline letters.

Previous declines will put the next insurer on alert.

Even if the new insurer wants to offer you coverage, they’ll doubt themselves due to the previous decline.

This will make it more difficult for you to get cover.

The trick is to avoid a decline by first applying to the most likely company to approve your policy.

If you’d like me to help you find the best insurer, please complete this questionnaire giving full details on the sleep disorder.

Thanks for reading

Nick

Editor’s Note | We published this blog in 2017 and have regularly updated it.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video