Table of Contents

Complete this questionnaire and I’ll check if cover is possible and send you an indicative quote.

Louise (not her real name) rang me in an awful state.

She was due to close on her mortgage but had just found out from her bank that they wouldn’t offer her mortgage protection insurance as she was on a waiting list for bariatric surgery.

She was frantic and terrified she was going to lose her dream home.

Could we help?

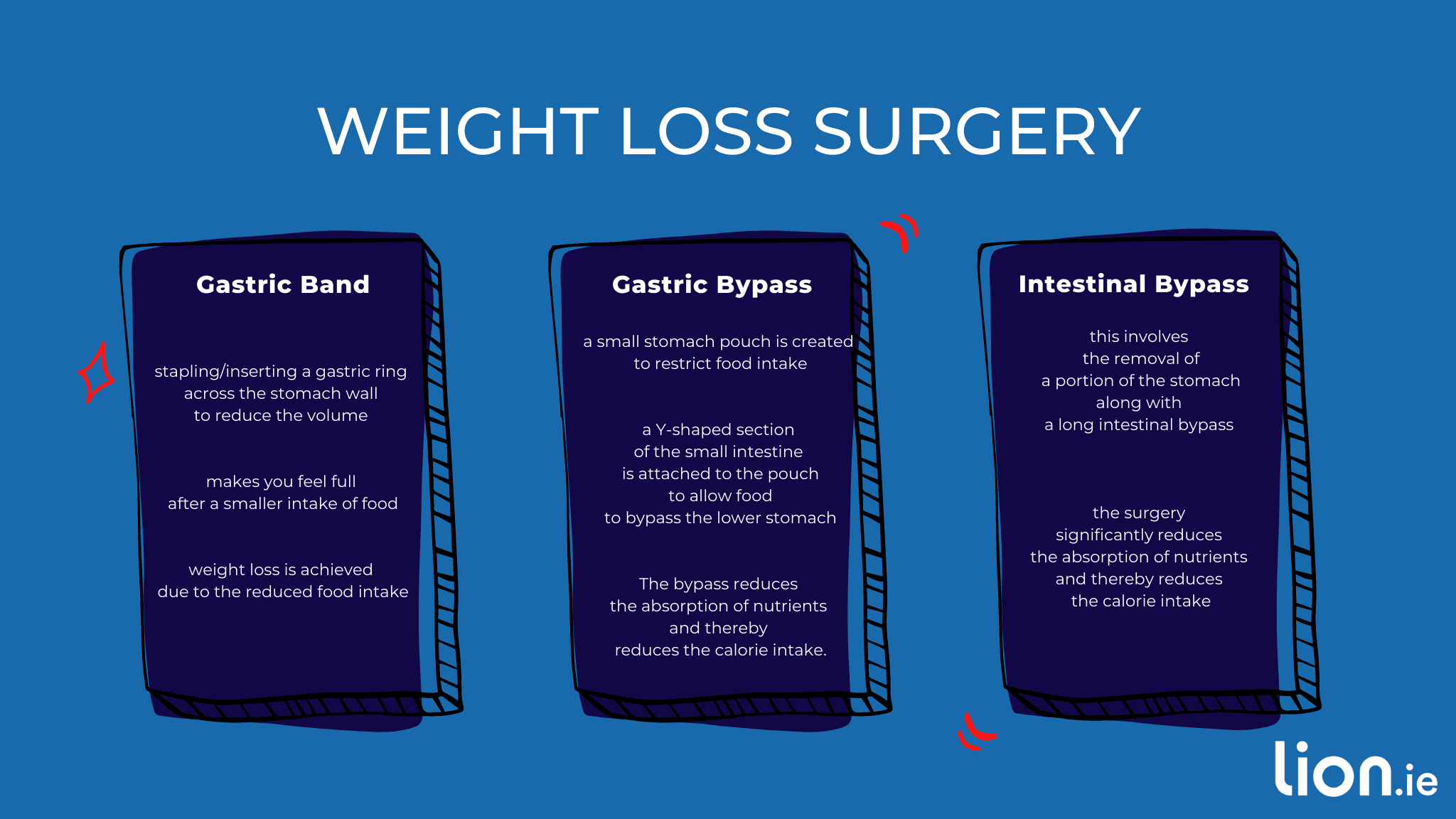

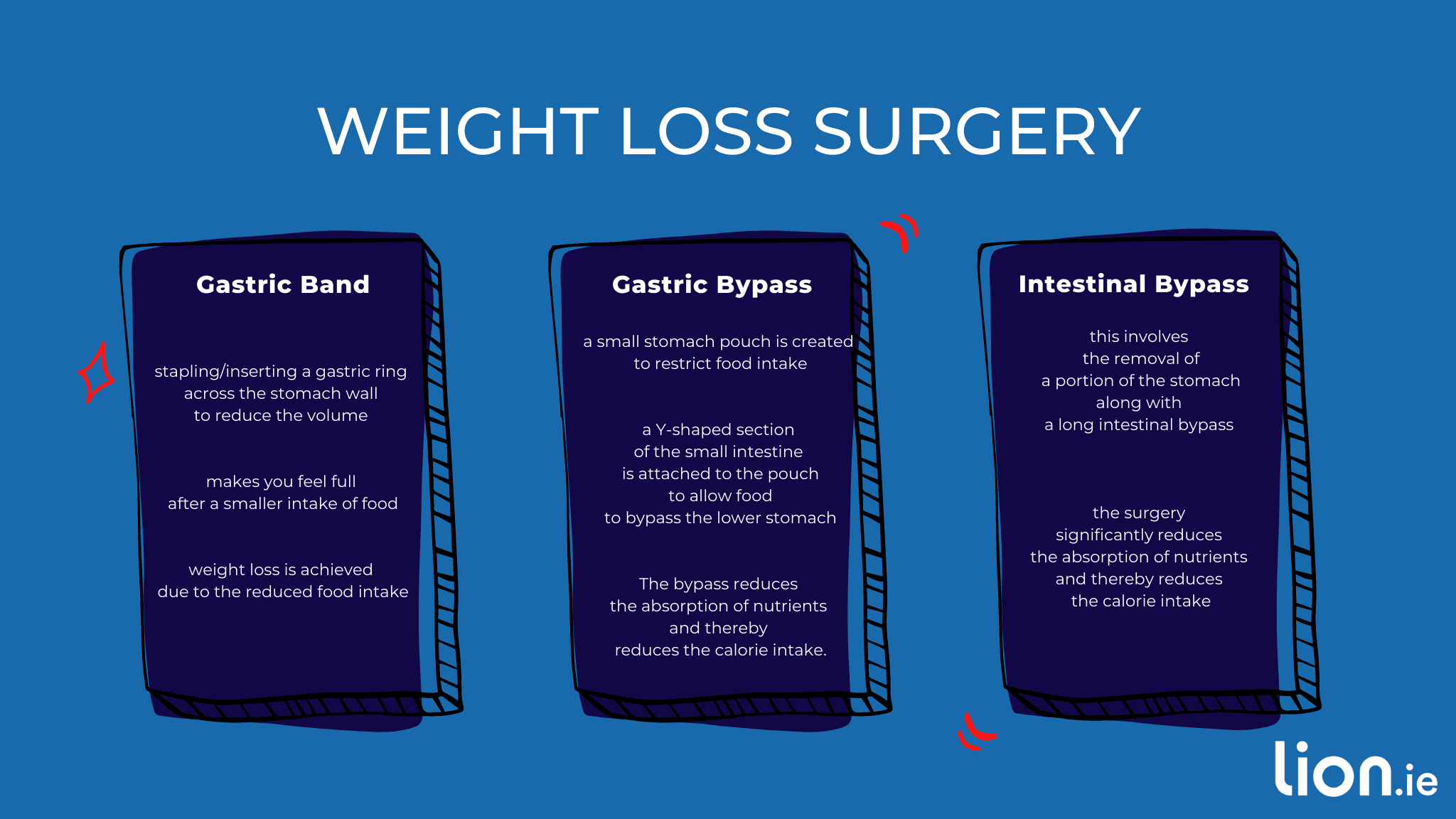

Bariatric surgery includes a variety of procedures for people who are unable to achieve satisfactory weight loss through diet and exercise alone.

The surgery reduces the stomach size making you feel fuller after smaller amounts of food.

In most cases, yes, you can get life insurance once at least three (for gastric banding) to six months (for gastric bypass) have passed since the surgery.

The insurers will charge an additional premium depending on the type of surgery and the time since the surgery.

They will also take your current weight into account and any other health issues.

However, Louise had been on a public waiting list for bariatric surgery for the previous ten months!

She didn’t know if she would ever even have the surgery!!

I could understand her frustration, so I spoke with our underwriters, but I didn’t hold out much hope.

You see, their underwriting guidelines advise a postponement if there are investigations planned or test results outstanding.

Some insurers are better than others when it comes to life insurance with weight issues.

The first four underwriters I spoke with couldn’t help.

They would postpone until the weight loss surgery took place; they had no wriggle room on this.

So I wasn’t very confident before speaking to the fifth insurer.

But lo and behold, they were willing to consider cover 🙌

Louise would have to pay an extra premium initially, but my underwriter would review and reduce Louise’s premium once the surgery had taken place.

The extra premium was significant (it went from €39 to €110 per month), but Louise was over the moon:

Oh my God Nick, thanks so much. When I read your email I actually nearly cried. This has been so stressful, not wishing to sound like a moan, and I am so happy now. I am out of the office today (on top of everything else am in final month of a part-time masters so am studying from home), so will sign first thing tomorrow. Thanks very much again, once dust settles, I will be very happy to add review to your website if that’s of any help?

In Louise’s case, they requested a nurse medical.

She did this on Friday; the results were back with the insurance company on Monday.

The nurse medical confirmed the details Louise had disclosed on her application form

Louise’s policy was issued on Tuesday.

It’s not always that quick, but the insurer helped me out…plus I pestered them quite a bit 😉

Yes, but if it has been less than two years since your surgery, you will pay a loading to cover any potential complications that may arise.

We’re the experts when it comes to more complex life insurance applications and would be delighted to help you with the strictest confidence.

If you’re concerned about how weight loss surgery will affect your application, please complete this questionnaire and I’ll be right back over email.

Alternatively, you can schedule a callback here and we can go through your options.

Thanks for reading

Nick

Editor’s note | We published this blog in 2016 and have regularly updated it

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video