Table of Contents

Quick Summary

Navigating the maze of mortgage protection can feel like trying to find a needle in a haystack.

But fear not, dear reader!

With the right information and a sprinkle of guidance, you’ll be well-equipped to make an informed decision that suits your unique circumstances.

Let’s gooooooooooooo.

The average cost of mortgage protection in Ireland is €33

And that concludes this blog post.

Have a nice life.

—–

If you’re wondering, €33 is the cost of a dual life mortgage protection plan for

But, of course, you’re probably not a healthy, non-smoking 35 year old getting a mortgage protection policy of €250k over 23 years with another non-smoking 38-year-old.

If you are, I’m sorry to say, you are Mr or Miss Average, and we can’t help.

We only deal with exceptional, groundbreaking and remarkable people here at lion.ie.

Yes, like you there, you 42-year-old legend who has come through the life of hard knocks with a few scars and underlying conditions and is getting a mortgage of €512,781 over 31 years.

Welcome, we’ve been expecting you.

So, yeah, I can make an educated guess at the average cost of mortgage protection in Ireland, but €33 is about as useful as a Kardashian.

Your mortgage protection is not going to cost €33 for several reasons.

There’s not much you can do about your age unless your local GP goes by the name of Doc Brown.

If you smoke or vape, you can quit and get non-smoker rates in twelve months (automatically with some insurers – so make sure you apply to the correct one!)

Instead, focus on any underlying conditions to get the best price.

You can’t change your health, but you can apply to the insurer that is most understanding of your condition.

Let’s look at something most of us suffer with – our BMI.

If your BMI is over 30, the insurers can increase your premium, and it’s usually by 50%, so let’s say the standard price for your cover is €50 per month, you will pay €75.

However, some insurers are much stricter on BMI than others, so may increase your premium by 75%, now you pay €87.50 per month.

Over a 25 year policy, you will pay €3750 extra!

So, if someone offers your mortgage protection with a loading, make sure to shop around, especially if you’re told:

All the insurers are the same. You won’t do better

That’s a lie.

All the insurers are not the same.

And remember, if you’re buying mortgage protection from a bank, they can only deal with one insurer, so you might get royally screwed.

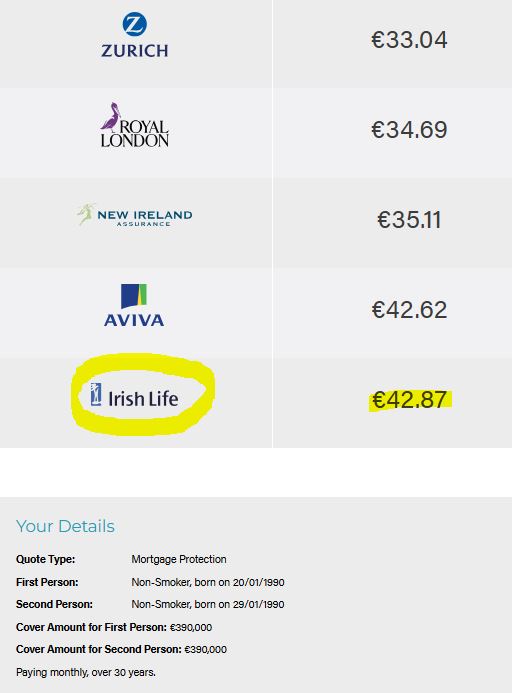

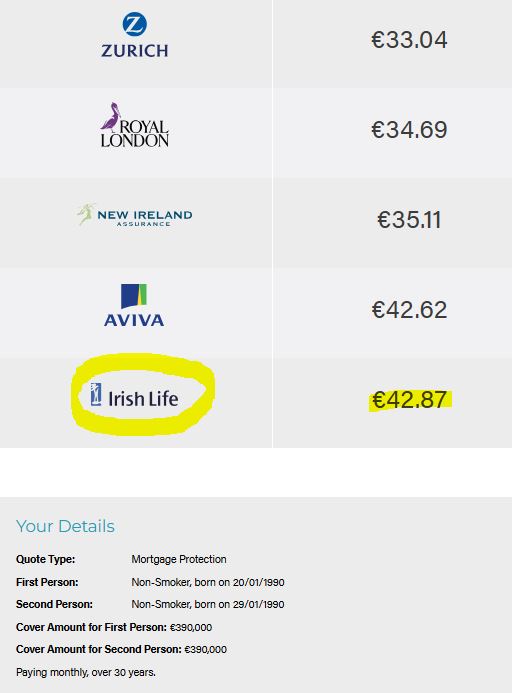

The average cost of €33 I mentioned is our discounted rate.

The majority of Irish banks are tied to Irish Life:

Add ons.

If you add any benefits (bells and whistles) to your cover, you will pay more.

So, convertible mortgage protection costs more than standard mortgage protection (although we highly recommend the conversion option to give you the flexibility to amend your cover in the future regardless of your health).

And if you add serious illness cover (be careful – see number 11 above), you will pay more for your cover because there is a bigger risk of you getting sick than dying.

Nah, not really; basic mortgage protection is straightforward.

Follow these Golden Rules, and you won’t get ripped off.

I hope this helped.

The average cost of mortgage protection is useful if you’re starting to budget for the total costs of buying your first home.

But if you’re close to applying for cover, you should get an indicative quote before you apply.

If you’d like my help, complete this short questionnaire, and we can get you sorted.

Thanks for reading.

Nick

Editor’s Note | We published this blog in 2o21 and have regularly updated it

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video