Call us now on 05793 20836 if you need your cover in a hurry

Mortgage protection insurance is mandatory when getting a mortgage in Ireland.

Getting it sorted out in good time is critical.

But what happens when you’re about to close on your new house, and suddenly, there’s a hiccup because your mortgage protection isn’t in place.

That can stall your entire deal, turning what should be excitement into a nail-biting cliffhanger.

Once upon a time, you’d struggle to get your mortgage protection quickly.

It could have taken around five working days

I know, five days is hardly ages

But it is when you’re just about to close on a house purchase, and you’ve just been told you need this thing called mortgage protection.

Then every hour delay seems like FOREVER.

Life insurance providers have upped their game of quickly issuing mortgage protection.

Some insurers can issue your policy the same day they receive your completed application form (assuming you’re in good health and you don’t hit non-medical limits)

That’s good news if you need your mortgage protection quickly, urgently, ASAP!

Just remember to tell us up front that you need your policy immediately.

We’ll make sure you get it.

At best, less than 24 hours.

Here’s how.

If there are minor health issues, your application may have to be manually reviewed by an underwriter, which will slow down the process.

If there are more serious health issues and a doctor’s report is needed, you can add at least a week to the process- depending on the efficiency of your GP.

Some GPs are on the ball, but some, especially at busy surgeries, will take weeks/months to return the form.

By the way, if you’re not yet in the market for mortgage protection but soon will be, and you know you have a health issue requiring a medical report, you should get yourself mortgage protection ready to avoid a stressful closing.

Issues such as these will delay your life insurance:

Although you feel they are nothing to worry about, you must disclose them on your application form, and the insurer may request more information from your GP.

Read: 6 Ways to Avoid Delays with Mortgage Protection Insurance

This usually happens around seven days before you’re due to close on your mortgage.

Problem 1:

Your bank, which has said there will be no problem with your mortgage protection up to now, suddenly informs you that a medical report will be required.

Problem 2:

Your GP delays sending back the PMAR (medical report) as they require prepayment, or even worse, is on holiday for three weeks

Problem 3:

Your GP sends back your report, but it doesn’t contain the required information. Unfortunately, that information is with your consultant, who never shared it with your GP! The insurer requests that you get that information directly from your consultant.

This happens all the time.

You may roll your eyes and think I’m just exaggerating.

I’m not.

I have witnessed first-time buyers lose their dream home due to a delay in their mortgage protection—heartbreaking stuff.

When do you Start Your Mortgage Protection Policy?

We would much prefer it if we could arrange mortgage protection with plenty of time to spare (so if you’re in the market, start now!)

But you have no time to spare if you need mortgage protection quickly.

Stop reading and call us now on 05793 20836

Stop reading.

Call us.

Now.

Please.

Then breathe easy.

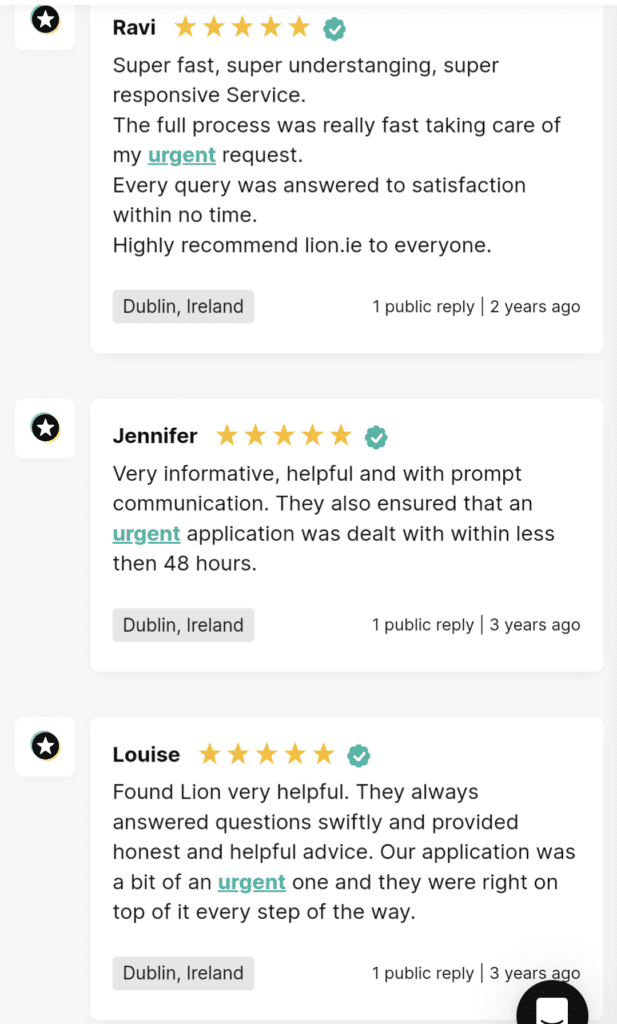

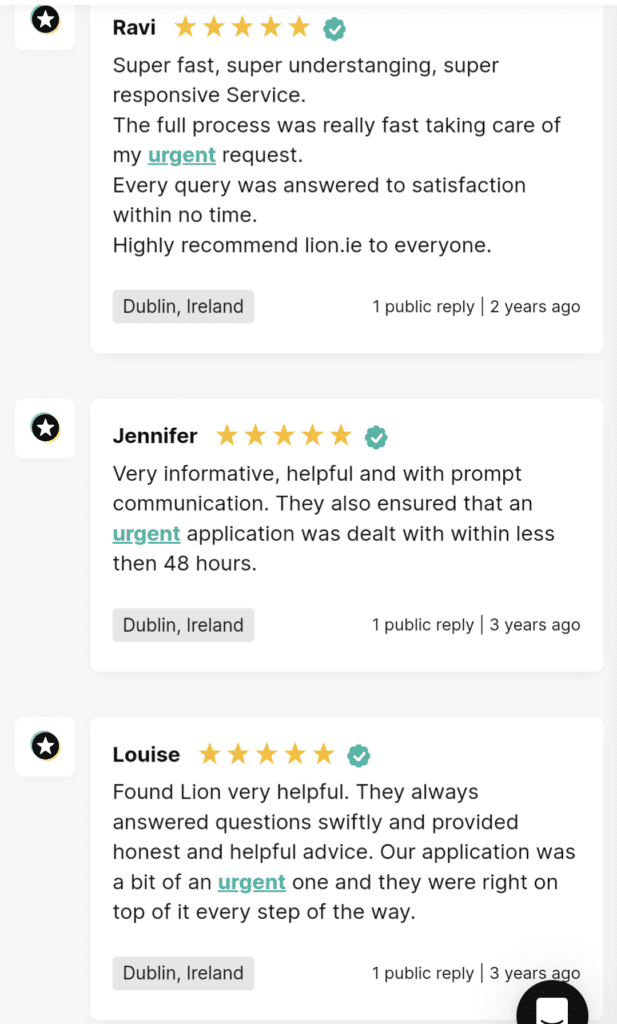

Just like these customers:

Thanks for reading.

Nick

Editor’s note: We first published this blog in 2020 and have regularly updated it since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video