Table of Contents

Buying mortgage protection insurance in Ireland should be quite straightforward.

But after hearing different stories from the bank, your friends, your family, your colleagues and some random you met down the vegetable aisle, your head is melted.

Don’t worry, I’m here to set you straight.

Here’s what you need to know before you sign on the dotted line:

Before we start, let’s clear up what is meant by mortgage protection insurance or life home cover as the bank likes to call it (just to confuse you even more)

Mortgage protection is a basic type of life insurance policy that you need when getting a mortgage.

If you die the insurance company will pay a big wedge of cask to the bank to pay off your mortgage.

All clear?

Right, let’s fire ahead…

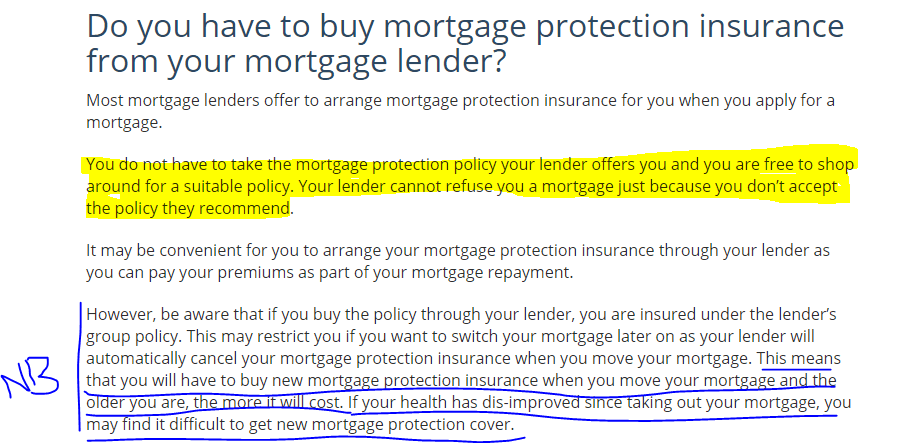

No, no, one million times no.

This is from the Competition and Consumer Protection Commission:

an independent statutory body with a dual mandate to enforce competition and consumer protection law in Ireland

Forgive my rudimentary scribbling btw

YOU DON’T HAVE TO BUY IT FROM YOUR BANK

But beware, the bank will do everything it can to make you sign up for one of their overpriced policies.

They may even resort to telling you downright lies to scare you into taking their cover

Be strong, politely decline then head, ar nós na gaoithe, out the gap.

If your mortgage loan offer states €500,000 over 25 years, you need a policy for €500,000 over 25 years.

Don’t worry about covering the interest payable (in fact, don’t even look at the interest payable to avoid a heart attack)

Yes, if there are two of you on the mortgage, you both need cover for the full amount of the mortgage.

BTW, if you’re not married and you’re buying together, you should take out two single policies, you pay your partner’s premiums and vice versa. (because of inheritance tax)

This confuses everyone so let me clear it up for you.

With life insurance, the amount that will payout remains the same throughout the whole policy.

Let’s say you buy a €500,000 life insurance policy to cover you for 25 years.

If there is less than €500,000 outstanding on your mortgage, the balance will go to your family or form part of your estate.

Compare this to mortgage protection (also known as decreasing or reducing term life insurance – again just to confuse you)

Let’s say you buy €500,000 mortgage protection over 25 years.

The bank will accept either life insurance or mortgage protection.

We recommend mortgage protection

You don’t need life insurance (unless you have kids or someone depends on you financially)

You can, but I don’t recommend doing so.

What if you took out the €500,000 life insurance, assuming you would live a long and healthy life, but then you die just after taking out the mortgage?

The bank will get the €500,000 and will clear the mortgage, which still has €500,000 left on it.

So your family will get a mortgage-free home, but no lump sum of money to replace your income.

So they’ll have to survive on one income…otherwise little Timmy is off down the mines again.

Seriously, if you have kids, always buy two policies

Serious illness cover is optional but you can add it to your mortgage protection policy if you wish.

The bank loves to try and sell you serious illness cover so be ready for the pitch!

Because:

If you add serious illness cover to your mortgage protection policy and make a claim, the bank will get the proceeds to pay down your mortgage.

Even if you need the money for life-saving surgery.

Finally, the amount of serious illness cover on a mortgage protection policy reduces over time.

You’re more likely to get a serious illness when you’re older so your payout will be much less than you you anticipated.

You’re much better off buying serious illness cover on a separate life insurance policy to ensure

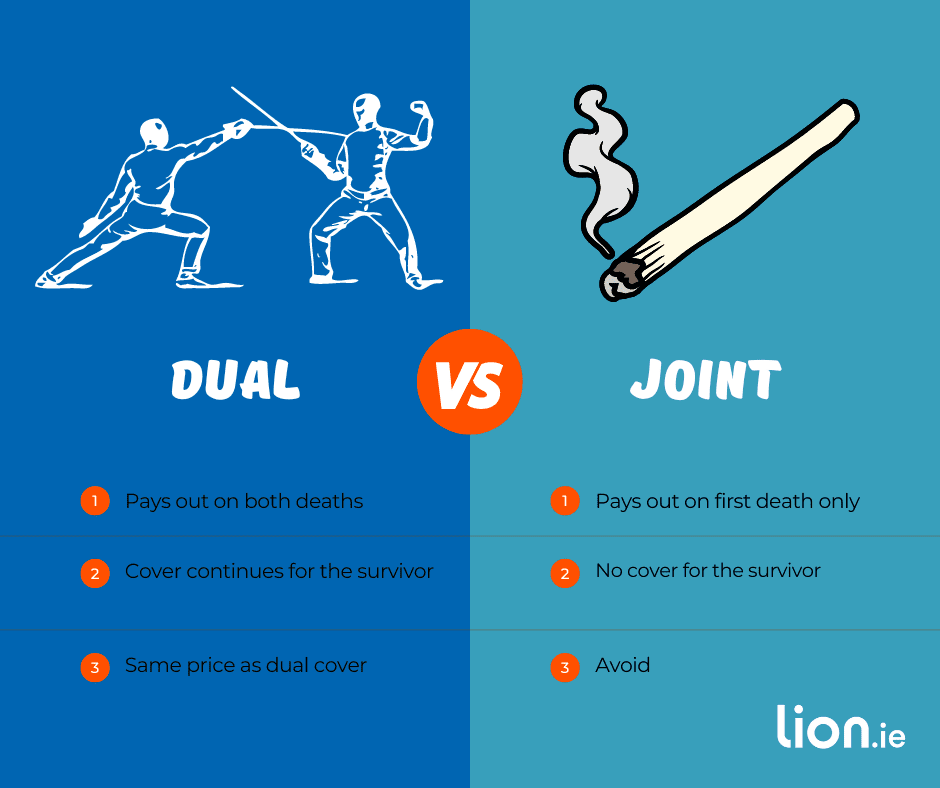

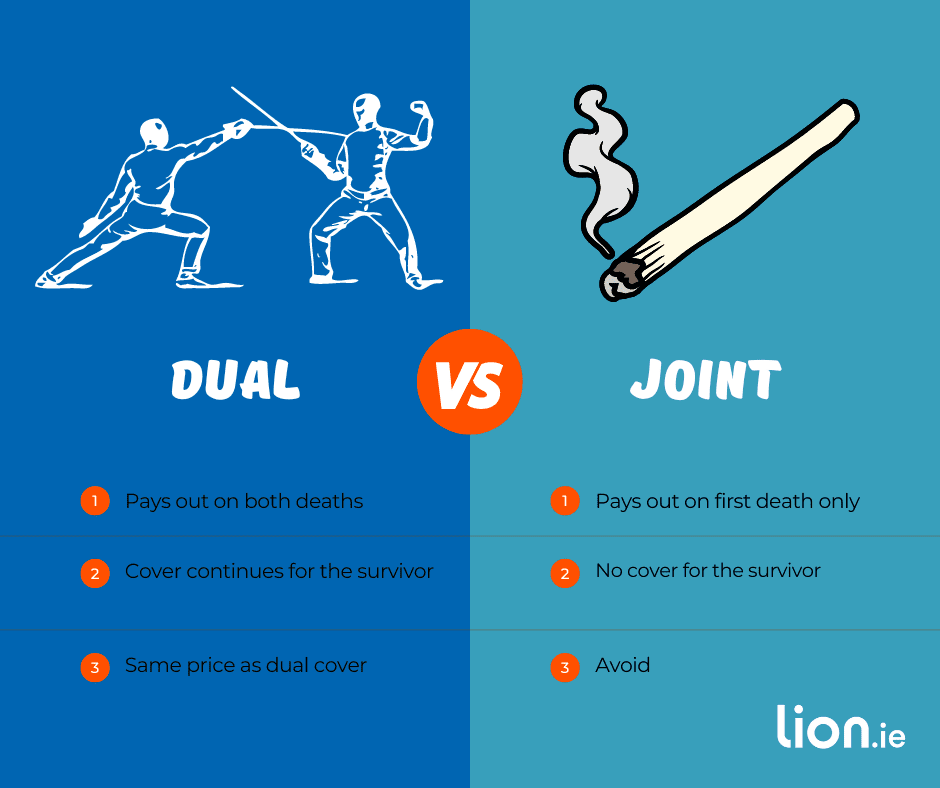

On a joint life policy, only the first death is insured.

If the first person dies, the insurer pays out and the policy ends.

On a dual-life policy, the insurer will pay out on the first death and cover will continue for the survivor. If you both die, there will be a double payout.

You’d expect dual life cover to be more expensive than joint but one of our insurers offers dual life cover for the same price as joint life, the crazy fools.

Ok, let me try!

Remember, life insurance (where the amount of cover is fixed) and mortgage protection (where your cover reduces over time)?

Adding the conversion option to a mortgage protection policy allows you to magically turn the reducing mortgage protection policy into a fixed life insurance policy at any time in the future.

You can also extend the term which is handy if you intend on remortgaging in the future to release equity.

There is an extra 5% premium for this option but we recommend it because of the flexibility it gives you/

Here’s an article I wrote about it in more detail

Assigning a policy makes the bank the owner of your policy so they get the proceeds of a claim.

Yep, you pay the premiums, and they get the moolah.

You transfer ownership of your policy by signing a Deed of Assignment (this will be in your legal pack) and by completing a Notice of Assignment (also in your legal pack that you’ll get with your mortgage loan offer).

The bank sends the completed Notice of Assignment to your mortgage protection provider.

Your provider then writes back to your bank (like an old-school pen pal) confirming that the bank now owns your policy.

It’s very straightforward despite what your bank might say – again here’s a more in-depth article.

The assignment must take place before the bank will issue your mortgage cheque.

Some lenders are happy for us to arrange the assignment for you.

You can apply for cover at any time, you don’t even have to wait for mortgage approval.

Once the insurer accepts you for cover, your policy will hang around kicking its heels until you tell us to go, go, gooooooooo.

Let’s look at a practical example.

You apply well in advance and have been accepted for cover.

On Feb 16th, the bank gives you a mortgage start date of March 1.

We’ll instruct the insurer to issue your policy immediately with a start date of March 1.

Why?

Even better, some of our insurers will give you up to 6 weeks of free cover so you might not pay a premium until April 15th!

Top Tip: You won’t get free cover if you buy from your bank.

Read: When Should You Start Your Mortgage Protection Policy?

Are you negotiating with your lender to pay interest only on your mortgage?

If so, you need to make sure your mortgage protection policy will clear the total outstanding balance on your mortgage should you die unexpectedly.

Let’s say you take out a mortgage for €500,000 paying capital and interest over 40 years.

In 20 years you should have paid €150,000 off the mortgage.

If you die, your mortgage protection policy would clear the outstanding €350,000.

However, if you paid only the interest on your mortgage, on death the full €500,000 would still remain outstanding.

Your mortgage life insurance policy would have been reduced to €350,000, leaving a shortfall of €150,000.

Before the bank releases the deeds to your home, someone needs to give them a cool 150k!

Until then the lender holds onto the title deeds of the property.

That’s a total nightmare for the loved ones you leave behind.

How to avoid this happening – buy a level-term life insurance policy if you’re going interest-only on your mortgage.

The cover on this policy doesn’t reduce in value so will clear the full balance.

Your family will avoid the nightmare scenario.

Life assurance policies are more expensive than mortgage life insurance policies.

But it’s a small price to pay for the peace of mind that you have left your loved ones a mortgage-free home.

Moratorium – A moratorium gives you a break from paying your mortgage for six months or reduces your repayments for up to six months.

In this case, you can take out a mortgage protection policy usually to the value of 102% of the mortgage.

Most banks will accept 102% cover but confirm this with your bank.

If you are getting a €300,000 mortgage with a six-month moratorium, you’ll need a mortgage protection policy of €306,000 (102% of €300,000).

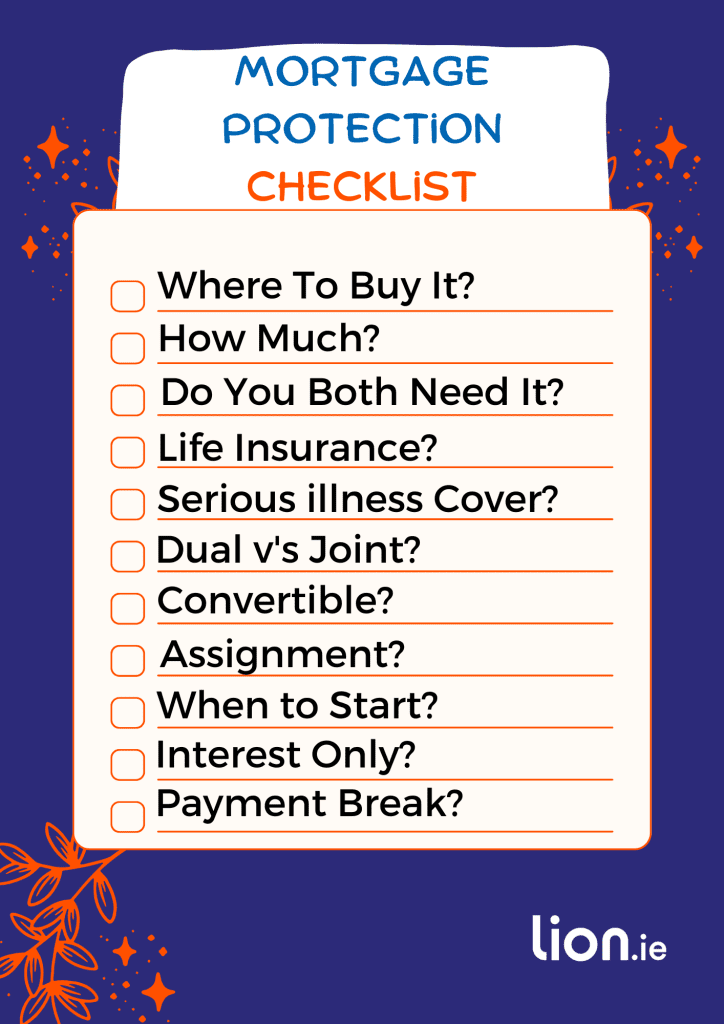

I hope you find our mortgage protection insurance checklist handy. They’re the 12 most frequently asked questions by our clients (the best clients in the world) but you may have questions of your own.

Best of luck with the whole house-buying process, it can be pretty stressful so make sure you have good advisors who can make it as hassle free as possible.

If you’d like me to take a look at your personal situation and make a recommendation on the types of cover you should consider, complete this questionnaire and I’ll be right back.

Thanks for reading

Nick

This blog was first published in 2019 and has been regularly updated since then.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video