Life insurance in Ireland is confusing — term, mortgage, serious illness… what’s the difference?

And do you even need it?

Don’t worry, we’ll explain it all without the usual insurance waffle.

📱 Swipe left/right to view full table on mobile

| Type of Cover | Best For | Typical Cost | What It Covers | Payout | Extra Notes |

|---|---|---|---|---|---|

| Term Life Insurance | Families who want a safety net | 💶 Low | Death during a fixed term (e.g. 20 years) | Lump sum to family if you die | Flexible amount and term |

| Mortgage Protection | People with a mortgage | 💶 Very Low | Clears mortgage if you die | Lump sum to lender | Usually required by banks |

| Whole of Life | Leaving a guaranteed inheritance | 💶💶💶 High | Guaranteed payout when you die | Lump sum to your family | Premiums never stop |

| Serious Illness Cover | Cover if you get seriously ill | 💶💶 Medium | Specific critical illnesses | Lump sum after diagnosis | Only covers listed illnesses |

| Income Protection | Replacing your salary | 💶💶 Medium | Loss of income from illness or injury | Monthly payments until recovery | Tax-deductible premiums |

We’ll help you figure it out — fast. Just answer a few quick questions, and we’ll recommend the right life insurance policy for your situation (no spam, no salesy nonsense).

When you see a list of Life Insurance quotes, you might think that you’re comparing like with like – but you’re not.

They won’t always cover the same things or have the same benefits. The product type may even be a bit different.

Life Insurance falls roughly into two categories: Term Life Cover and Whole Life Cover.

Term pays out if you die within a certain time period (the term of your policy), whereas Whole Life covers your entire life – presuming, of course, that you continue to pay your premiums.

Don’t pay the premium – no Bueno.

Term is less expensive as there’s a chance you might actually outlive your policy so the risk to the insurer is less compared with Whole of Life.

Think of it like this: with Whole Life you’re covered for your literal whole life.

The chances of you dying during the event of your whole life is 100 percent.

You can’t outrun this one.

But with Term life cover, let’s say you’re 35 and you get 35 years’ Term cover.

You could outlive your policy by a decade or so, with ease.

Whole Life is best but the premiums are higher because the insurer is on the hook for a guaranteed payout.

So which type is right for you?

Well it depends.

And to complicate things even further, there are actually two types of Whole Life Insurance.

I know.

It’s almost as if someone somewhere made Life Insurance so complicated that it seems inaccessible to average folk.

Almost. As. If…

Term Life Insurance is fairly straightforward.

Term Life Insurance Cover also does what it says on the tin: it covers you for a certain term e.g. 35 years. Once the term is over, you’re no longer covered.

However, most insurers offer a conversion option, which you should add to your policy.

It means you can extend your policy in the future without having to provide additional medical information – think of it as guaranteeing you cover even if you suffer a health scare in the future.

Click here if you’d like to compare quotes from 5 insurers.

Whole Life tends to be a bit more complicated. We looked at the basics in the last section (it’s an assurance policy that you can’t outlive, presuming you don’t cancel it).

But there are different types of Whole of Life Insurance:

Exhibit a. Reviewable Whole Of Life Insurance

In short: you don’t want this.

Exhibit b. Guaranteed Whole Of Life Insurance

In short:

Guaranteed Whole of Life = good.

Reviewable Whole of Life = bad.

Question: What does Whole of Life Assurance cover do?

Answer: It leaves a lump sum whenever you die.

Whole of Life assurance will pay a cash lump sum whenever you die, as long as you continue to pay the premium.

You can’t outlive Whole of Life cover (because like it says on the tin, it covers you for your whole life!) which makes it ideal for funeral expenses or to leave as a gift.

Your cover begins as soon as the insurer issues your policy. There’s no waiting period, which is pretty nifty.

As above, there are two types of Whole of Life:

Guaranteed Whole of Life covers you for your whole life presuming you keep paying your premiums. It’s also fixed, so the price can’t change.

With Reviewable Whole of Life, the big difference is that it can be reviewed every 10 years up until you’re 60 – which leads to big price hikes. It’s a trap so AVOID IT at all costs.

Pro-tip: There is also a special type of cover called Section 72 Whole of Life assurance. Pay-outs are not subject to tax if used to pay inheritance tax. Did you know the most you can leave to your child tax-free is €335,000?

They will have to pay 33% inheritance tax on the balance unless you have a Section 72 Life Insurance policy in place.

As we can’t quote online for Whole of Life cover, please fill in the short form at the bottom of this page or call me on 05793 20836 for a quote.

More here: Should you Choose Term or Whole of Life Insurance?

Here’s everything you need to know about mortgage protection in Ireland

Question: What does Mortgage Protection do?

Answer: It clears your mortgage on death.

Mortgage Protection clears the remaining balance on your mortgage if you die. It’s the cheapest type of Life Insurance you can buy.

If you’re getting a mortgage on a residential home, you need Mortgage Protection. (Where ‘need’ means ‘legally have to get it’.)

But you don’t have to buy it from your bank.

Why not?

Imagine, in a few years’ time, you find a better mortgage deal at a different bank.

You decide to switch your mortgage to the new bank. What will happen to your current Mortgage Protection policy?

Your bank will cancel your policy as soon as you move to the new lender, forcing you to apply all over again for a new policy.

What if you can’t get a new policy in the future? You’ll be stuck paying your expensive mortgage.

But, if you had the good sense to buy from a broker, you can bring your policy with you.

Buy direct from a bank – it’s non-transferable i.e. your policy ends when you switch to a new bank.

Buy from a broker – the policy is yours and you can transfer it to the new mortgage.

Click here if you’d like to compare quotes from 5 different Irish insurers.

Question: What does Specified Illness Cover do?

Answer: It pays you a cash lump sum if you get one of the specified/serious/critical illnesses outlined in your policy.

This is also known as Serious Illness Cover or Critical Illness Cover.

Mortgage Protection and life cover pay-out when you’re gone. But with Specified Illness Cover, you’ll get to use the money while you’re still here.

You could use the pay-out to cover your day-to-day expenses and medical bills while you’re out of work. So you can focus on getting better without worrying about money.

Life Insurance takes care of your family; Serious Illness Cover takes care of you.

Be careful when buying Serious Illness Cover. The most important thing is not the number of illnesses covered by the insurer but how easy it is to make a claim. Make sure you understand why it’s easier to make a claim with one insurer over all the others.

You don’t need loads of Serious Illness Cover.

I think €30,000 is enough – here’s why.

Click here if you’d like to compare quotes from 5 insurers or go here for an answer to anything you may ever need to know about Specified Illness Cover.

Question: What does Income Protection do?

Answer: It pays you an income for as long as you’re unable to work.

Also known as Permanent Health Insurance, it pays you up to 75 per cent of your annual salary should you be unable to work due to ANY illness, injury or disability.

You need Income Protection if you’re the main breadwinner or self-employed.

In the nicest way possible, you’re a lunatic if you’re self-employed and don’t have Income Protection. Takings risks are part of being self-employed but not having Income Protection is daft. You’ll get nowt from the government if you’re out of work. Not a sausage.

How long could your family cope if your income stopped for an extended period of time?

Income Protection has a lot of booby traps. Don’t buy it before taking professional, independent advice from a broker who deals with all 5 providers. (Aviva, Zurich Life, Irish Life, New Ireland and Royal London).

The real importance of Income Protection lies in the rehabilitation and retraining benefits on offer at some of the insurers.

Sure, you may think it would be great to have a few months off and get paid but believe me, you’ll be itching to get back to some sort of work sooner than you think. Some insurers are better than others at getting you back on your feet, so that’s a major plus point in their favour.

Read more: What is Income Protection?

Click here if you’d like to compare quotes from all 5 insurers.

📱 Swipe left/right to view full table on mobile

| Feature | Term Life | Mortgage Protection | Whole of Life | Serious Illness | Income Protection |

|---|---|---|---|---|---|

| Covers Death | ✅ | ✅ | ✅ | ❌ | ❌ |

| Covers Illness | ❌ | ❌ | ❌ | ✅ | ✅ |

| Lump Sum Payout | ✅ | ✅ | ✅ | ✅ | ❌ |

| Monthly Income | ❌ | ❌ | ❌ | ❌ | ✅ |

| Covers past age 70 | ❌ | ❌ | ✅ | Sometimes | ✅ |

| Tax Relief Available | ❌ | ❌ | ❌ | ❌ | ✅ |

As you can see, there’s no one-size-fits-all approach when it comes to Life Insurance.

I’m married with three young kids, self-employed and have a Celtic Tiger mortgage so I’m insured up to my oxters with:

Your situation is different so you need alternative cover.

It’s hard to pick the perfect policy from all the different types of Life Insurance available – especially doing it on your own.

At Lion, we’re the Life Insurance experts. Our job is to help you just like we’ve helped many others.

We’ll get you the most suitable cover at the best price – saving you time, money and hassle. I’m an independent advisor which means I know the good and the bad about all the Life Insurance providers.

Unlike the banks or other insurers, I work with all five Irish insurance providers so can get you the best deal. The insurers are:

This is how we roll (also known as our Terms of Business) and here are some links you may be interested in:

Our commission structure:

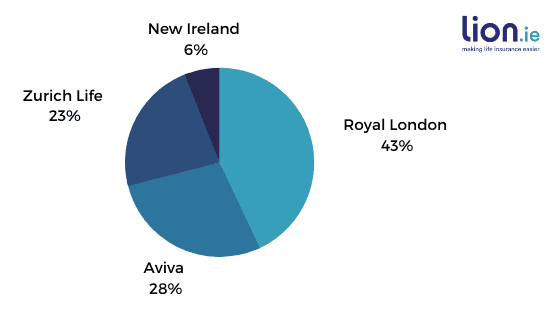

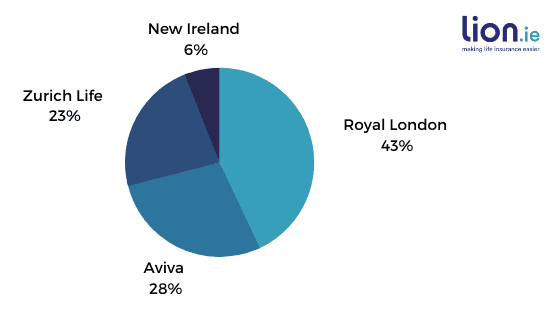

Where we placed our business last year:

We’re the only broker who shares this data because we’re trying to be as transparent as possible. Unfortunately, Life Insurance is associated with sleazy selling and sneaky shenanigans.

Our mission is to change that perception and to make Life Insurance accessible to everyone.

Let us figure it out for you. We’ll ask a few simple questions and give you a straight answer — no pressure, no waffle.

I’ll email you a no-obligation recommendation and we can have a call to discuss or chat over email – whichever suits you!

Talk soon.

Nick McGowan

lion.ie | making Life Insurance easier

057 93 20836

Ask a question

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video