Table of Contents

Yes– you should be able to get a life insurance policy if you have an autoimmune disorder.

Autoimmune Diseases affect many parts of the body and can begin with similar signs and symptoms like:

This is due to the body’s immune system mistakenly attacking healthy tissue.

Symptoms range from mild rashes to life-threatening conditions that attack major organ systems and this is the reason the life insurance underwriters take these conditions seriously when they are assessing a life insurance application.

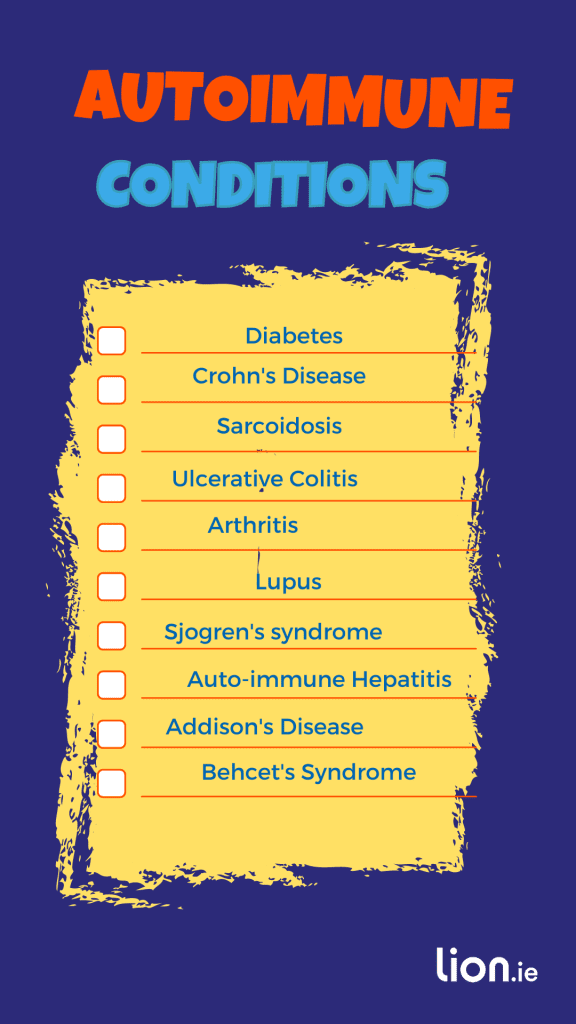

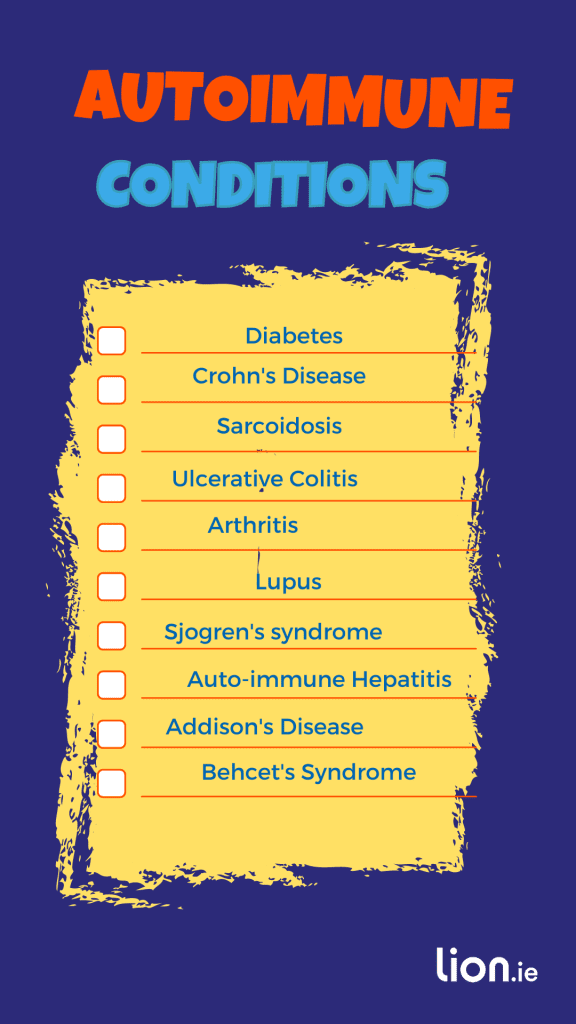

For this article, I will concentrate on the ten most common autoimmune disorders we come across here at lion.ie.

Getting life insurance or mortgage protection if you have diabetes can be tricky, but it should be straightforward assuming your control is good.

Compared to someone in perfect health, you’re looking at an additional premium of around 150%.

So if their premium is €10 per month, yours will be around €25 per month.

Unfortunately, you won’t qualify for income protection or serious illness cover but cancer insurance is an option.

Here’s our in-depth guide: Applying for Cover if you Have Diabetes

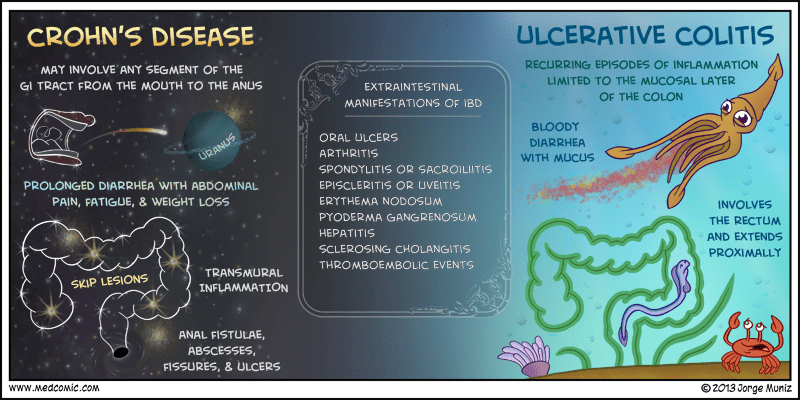

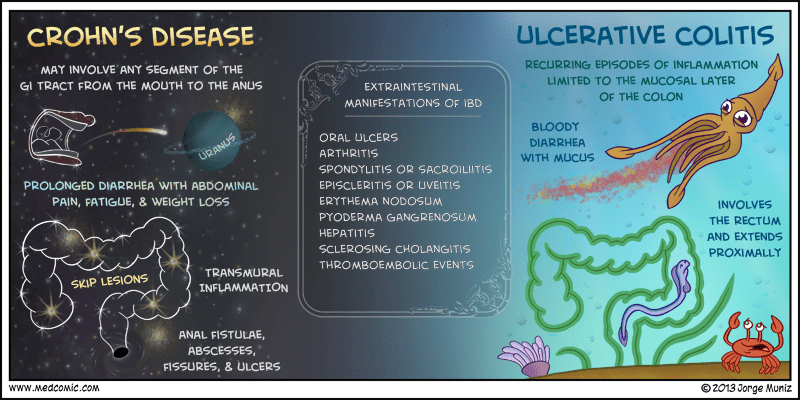

Crohn’s can be mild, moderate or severe.

If you have been symptom-free for over four years, have not used oral steroids, and have had no complications, we may be able to get you the normal price!

Otherwise, your final premium will depend on the severity of the condition and the date of your last major flare-up

Generally, the insurer will increase the cost of your cover by 75% to 150% e.g if the normal price is €10 per month, you will pay between €17.50 and €25 per month.

Here’s all you need to know: How Crohn’s affects life insurance

Sarcoidosis is a condition where tiny nodules (lumps), known as granuloma, develop at various sites within the body due to inflammation.

It most commonly affects the skin and the lungs but may also affect other organs including the liver, central nervous system, heart, kidneys and spleen.

If your condition is fully resolved and you’re off all treatment, we should be able to get you cover without a loading.

In ongoing mild and stable cases, the insurer will increase your premium.

For moderate cases, you’re looking at a loading of 100% to 150% (i.e. 2 to 2.5 times the standard premium you may see online.

If your sarcoidosis is severe or getting worse, it won’t be easy to get you covered.

Real Life Example

Hi,

I have only recently been diagnosed with sarcoidosis. Despite the fact that it is stage 1 which requires no medical intervention or treatment I cannot find a provider for mortgage protection insurance due to the date of the diagnosis being only last week. Can you advise if you would be able to provide any assistance?

This was a recent query; unfortunately, we couldn’t help in this case.

With a recent diagnosis of any condition, including autoimmune disorders, the insurers will have to wait for a period (usually 3 to 6 months) before they can insure you.

Why?

They need to see how your condition develops and reacts to the prescribed treatment.

I can get a steer for you from my panel of underwriters if you complete this questionnaire.

Ulcerative colitis is a long-term condition affecting the colon. Symptoms of ulcerative colitis include:

Like Crohn’s Disease, your final premium will depend on the severity of the condition and the date of the last major flare-up.

Usually, the insurers apply a loading of +50% to +150%.

The standard price is possible with one of my insurers, provided you have been symptom-free for a long time, and

Check this article out if you’d like to know how rheumatoid arthritis affects life insurance.

Psoriatic arthritis is also an auto-immune disease.

On the surface, rheumatoid arthritis and psoriatic arthritis can look very similar.

A rheumatoid factor (RF) blood test can diagnose Rheumatoid Arthritis. People with rheumatoid arthritis carry the protein RF in their blood.

RF is uncommon in people with Psoriatic Arthritis.

Psoriatic arthritis involves both the skin and the joints and that is why it often times is referred to as having a ‘Double Whammy’. So, now when I’m trying to explain it I just say, “It’s a lot like rheumatoid arthritis but with a nasty skin rash.

Lupus is a long-term autoimmune disease.

As we said in the intro, an autoimmune disease causes the body’s immune system to mistakenly attack healthy tissue.

This leads to long-term (chronic) inflammation.

The most common forms of Lupus are

Before an insurer can decide whether they can offer cover or not, they typically need the following information:

If you have lupus, your final premium will be 2 to 3 times the normal price.

Getting mortgage protection or life insurance if you have Lupus is not straightforward. The insurers will need to see your medical reports. If you would like me to check out the possibility of cover, please complete this questionnaire.

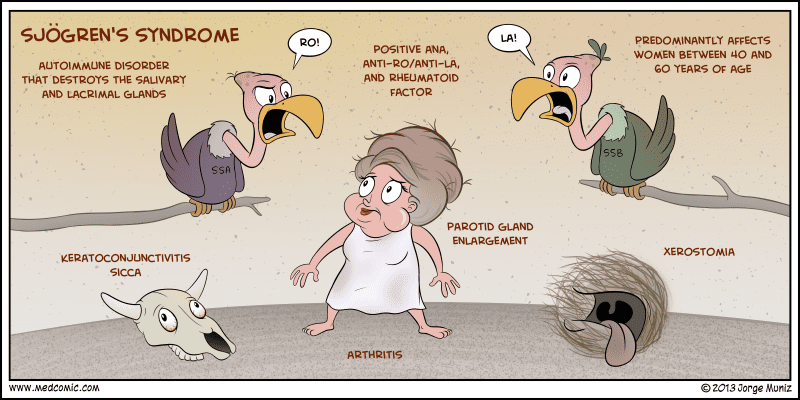

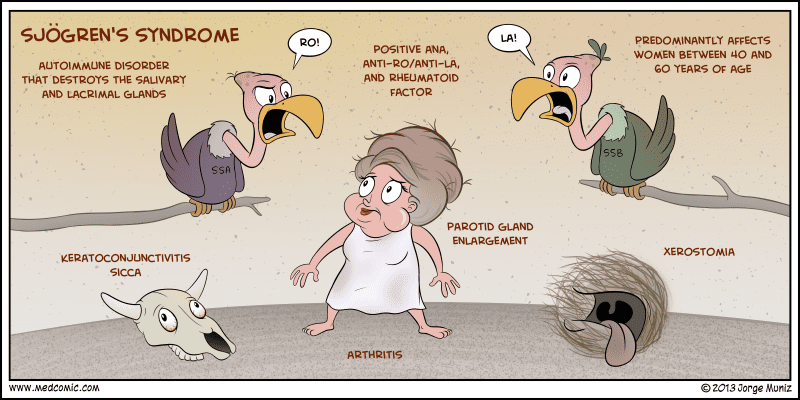

This chronic disorder affects the immune system and is characterised by two common symptoms:

The condition can occur by itself or often with other autoimmune diseases such as lupus, rheumatoid arthritis, and other rheumatic conditions.

Sjogren’s syndrome can be difficult to diagnose as symptoms can vary from one person to another and also can be similar to those caused by other conditions.

Symptoms generally appear between the ages of 45 and 55.

It affects 10 times as many women as men.

Approximately 50% of those affected with Sjogren’s also have rheumatoid arthritis or other connective tissue diseases such as lupus.

The condition can affect other body parts, including the lungs, brain, nerves, joints, kidneys, thyroid and liver.

The condition can be classified as follows:

Life insurance is possible with primary Sjogren’s, but it’s more difficult to find an insurer willing to cover someone with secondary Sjogren’s.

Complete this questionnaire if you would like me to run your case past my insurers anonymously.

Cover is possible but at a slightly higher premium than viral hepatitis.

The most important factors are current liver function and how the condition is being treated.

Being autoimmune, the treatment is an immunosuppressant with its own risk.

To get the lowest premium, you’ll need to be

For a more severe form, cover may not be possible.

Addison’s disease is a rare disorder of the adrenal glands reducing their ability to produce hormones.

It results in general debility, tiredness and weight loss.

Assuming treatment started over six months ago and there are no complications, we will be able to get you covered

More here: Getting Life Insurance if you have Addison’s Disease

Some of our insurers will generally offer cover with an increased premium. You may struggle to get cover if there are issues with blood arteries e.g. blood vessel inflammation.

After trawling through that post, you may feel a little

Well, I’m here for you.

I’ll be your one point of contact and will deal with all five insurers (Aviva, Irish Life, New Ireland, Royal London and Zurich) to ensure you get the most suitable cover at the best price with the least amount of hassle.

If you have an autoimmune disorder and would like my help, simply give me a quick outline using this form or call me for a confidential chat at (01) 693 3382

Thanks for reading.

Nick

lion.ie | Protection Broker of The Year ?

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video