Table of Contents

You’ve just got married, and you’re already thinking about your other halves’ potential death?

How very Henry the VIII of you.

How that’s for a niche historical/Life Insurance joke?

In all seriousness, getting married is a big deal.

Of course, it is – there’s nothing quite like standing up in front of your friends and families and pledging your love to someone forever.

Forever is a long time after all.

Probably why divorce rates are going up.

Joking!

While your head is still very much filled with squishy feelings of love for your other half and memories of your big day and your honeymoon, now is the perfect time to sit down and table “the talk” about Life Insurance.

A lot of it comes down to one thing: responsibility.

When you’re single, you don’t really have any responsibilities.

You can pack your bags and jet off without having to consult the other half, or having to consider how you’re gonna stop your kids from bating the snot out of each other for the length of the flight.

Kids, they’re a joy really.

Now you’re married, you’re very much a solid unit.

You’re likely aligned on finances, buying a house, or having kids.

Whether you’re planning on settling down and having a whole brood.

Or renting a van, getting a dog and driving around Europe, you’ll know what the shape of the next few years looks like.

If the plan involves high-tailing it around in the van, you can exit out of this article right now.

Enjoyyyyyyyyyyyyyy!

However, if your life looks like it’s going to involve a house and kids, it’s time to get serious about the big stuff.

If anything were to happen to you or your other half, you need to consider how your life would play out.

Could you afford the mortgage or raising the kids or even just continuing your life if the worst were to happen?

For one, landlords and bankers won’t care; they’ll still want your money for rent or the mortgage or the car – or even for paying off that swanky honeymoon you’ve just been on.

Any debts will still need to be paid.

Funerals are ludicrously expensive.

Hell, life is costly.

And I know it’s a bit harsh to break down the love of your life into a pool of cash, but when it comes to insurance, that’s the unfortunate truth.

It’s simple, if you have plans for the future with your spouse, you’ll want to consider Life Insurance.

Simply put, life insurance is a legal agreement between you and an insurance company that will provide financial protection for your partner in case you unexpectedly die from a surreptitious poisoning overnight

In other words, when you croak, they’ll get a big wedge of cash money so when your time does come, they’ll be able to either

a) splash the cash on the trip of a lifetime in Las Vegas

b) pay off the funeral expenses, mortgage, and provide for the kids

So did you marry an a) or a b)?

Agreeing to marry someone means there’s more than just yourself to worry about now.

Along with throwing out your old undies and remembering to put the toilet seat down, you are now also obliged to make sure your partner is protected if the worst were to happen.

Here are some benefits of life insurance for newly married couples in Ireland:

Life insurance coverage offers invaluable and affordable financial protection for your family.

If you and your partner rely on two incomes or are on the hook for joint debts, it’s a good idea for both of you to get a life insurance policy.

The lump-sum they receive from a life insurance pay-out could go a long way in covering costs for your mortgage, raising your children or keeping your business afloat.

Let’s face the facts; even if you and your spouse are young, happy and healthy now, the years are sure to fly by!

As they say, life is unpredictable so the sooner you get life insurance, the better.

The thing about life insurance is that with each passing birthday, it’s not just the hangovers that seem more severe.

Every year you put it off, the quotes you receive for your life insurance policy will continue to get higher so the sooner you take the plunge and buy a policy, the better rate you will lock-in.

On top of that, you never know when you might develop an illness that could skyrocket the price of an insurance policy.

You can customise your life insurance policy to fit the needs of your family.

Most Irish insurance companies offer a range of options depending on the type of coverage you need, the number of years you want your insurance to last and the type of policy you choose.

If you die while your life insurance policy is active, your spouse can simply submit a claim and a life insurance lump sum will be paid out.

Everybody needs a different coverage from their insurance based on individual circumstances.

The policy you choose comes down to what coverage your loved ones would need to remain in a stable financial situation if you were no longer in the picture.

While it may seem convenient, you can’t sign up for a life insurance policy on behalf of your partner, the insurance companies seem to think it’s a bit suspicious, so if you want your spouse to consider getting covered you’ll need to do some research together to find out which policy is best for both of you.

Generally, Life Insurance is the big one: it’s the one that gives your other half a tax-free lump sum if you die.

There are others, too:

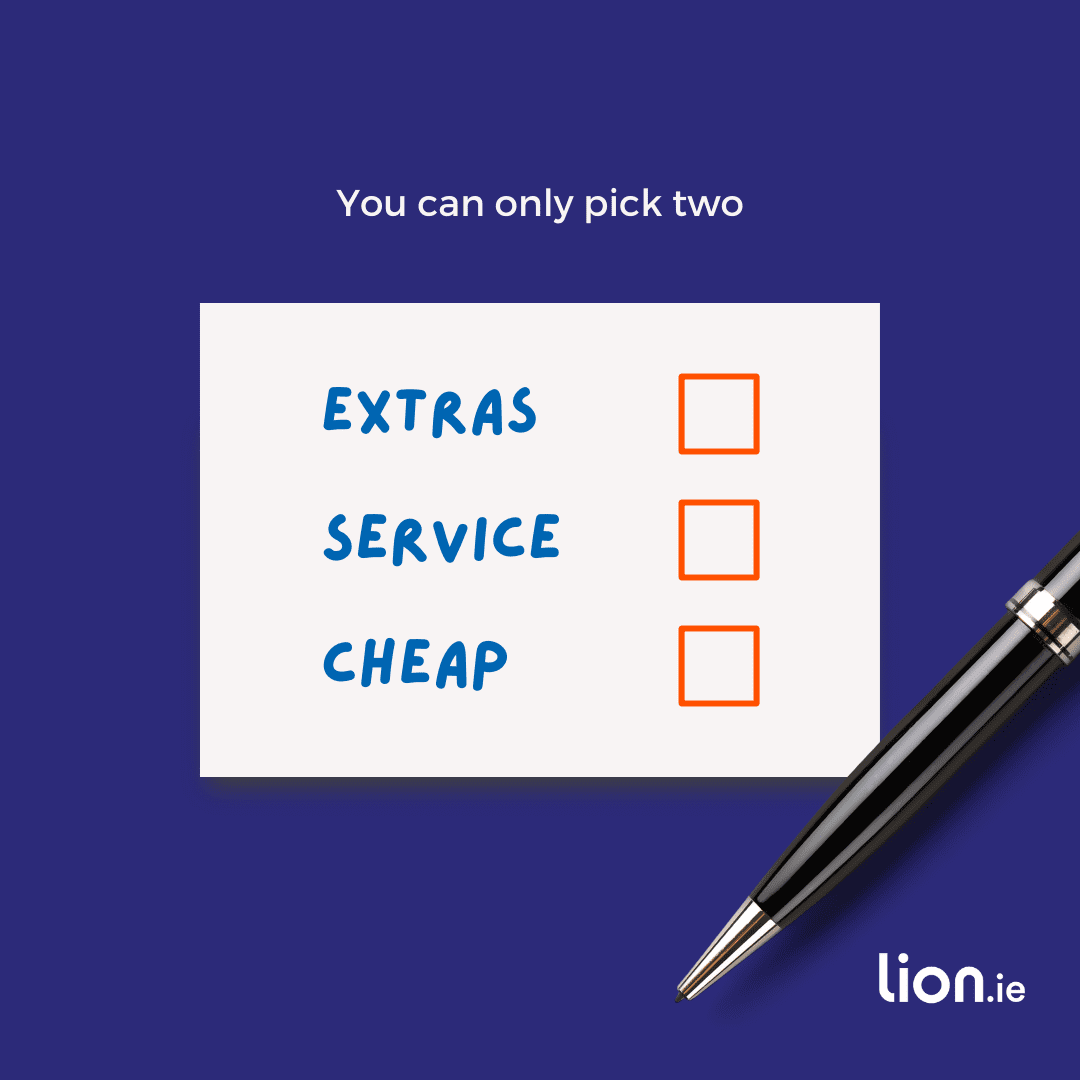

As a broker who makes his money peddling insurance, I’d like to say all of them.

But that would be unnecessary.

You don’t need ALL of the insurances. Life is pricey enough without paying for a whole load of cover.

Instead, what I will say is that it’s situation dependent.

If you’re buying a house, you have to buy Mortgage Protection. There’s no getting around that one.

If you’re planning on having kids, you should consider Life Insurance.

If you were to die while they were young, your family would be in awful trouble.

If kids aren’t on the cards and you’re not about to get a mortgage, your number one priority should be Income Protection.

Income Protection is sometimes overlooked because of the mistaken belief that everyone has sick pay, but lordy that is so untrue. Did you know your employer has no legal obligation to offer you any sick pay?

Imagine you had a money machine at home coughing out €1000 per week.

Would you insure it? Darn tootin you would.

You are the money machine, income protection is the insurance you need.

Consider the extras too.

Did you know there were extras? There are. You can read more about that over here.

And yes I know reading policy documents from all the insurers is super-boring but that’s why you can get someone to do it for you!

Most people will know about Single or Joint cover.

Indeed, most people will go for Joint protection as that covers both them and their other half.

But Dual cover is the insurance type you need to choose.

Why?

Well, because you get two pay-outs.

Count ’em.

Two.

A solid shout if kids are in the plan.

Also, a solid plan if you’re buying Mortgage Protection.

That way, with Dual, you’d get one pay-out which would go to the bank and a second pay-out on the death of the survivor.

This could act as an additional Life Cover = money for kids left behind.

I know I just orphaned your kids in this hypothetical but trust me: go for dual, it’s the same price as joint but you get double the cover.

By the way, avoid the bank like the plague for anything except the actual mortgage.

You have two broad choices when buying Life Insurance:

Term Cover and Whole of Life.

Term is cheaper and covers a specific period/term – for example, 30 years.

Whole of Life, as the name suggests, covers your whole life.

It’s more expensive.

With Term Life Insurance, you’ll pay a premium every month. If you die, the insurer pays out. If you outlive your policy, you don’t get any money, and technically you don’t get anything in return.

Not great.

Instead, opt-in to a conversion option.

That way, if you outlive your term, you can extend your cover without having to do a medical, potentially saving you loads of money in the long run.

Think of it like this: you’re probably as healthy as you’ll ever be right now.

In 30 years, you’ll be 30 years older – which will perhaps bring health issues.

When insurers see health issues, their greedy little faces light up with glee about all the extra money they can charge you for cover.

Feckers.

Remember: it’s all a game of chance that the insurer wants to win. They want you to outlive your policy so that they can keep your premiums without having to make a pay-out.

Another pro-tip: if you’re dealing with Whole of Life, make sure it’s Guaranteed and not Reviewable. Reviewable means they can review your terms and charge you more. See this Indo article.

Well yes.

Top of the list is how much cover you need.

You might be tempted to rub your chin and declare 100 million dollars, but in truth, the amount of cover you need will depend on your income.

Remember, the insurance money is replacing your financial worth.

So: what will your family need to pay for?

If you have Mortgage Protection, your house will be paid for, so that’s one less commitment.

But then there’s all the other stuff as your newlywed nest-building habits evolve: loans, debts, the car, general sustenance and the art of living.

A quick way to work it out revolves around your kids.

So: youngest in this example is 3.

Your outgoing spending on the essentials is €2,000 per month.

You’ll need 22 years of cover till baby kiddo is 25, and theoretically independent.

That’s €528,000 cover.

And a rough example, but you catch the general drift.

How much would that cost?

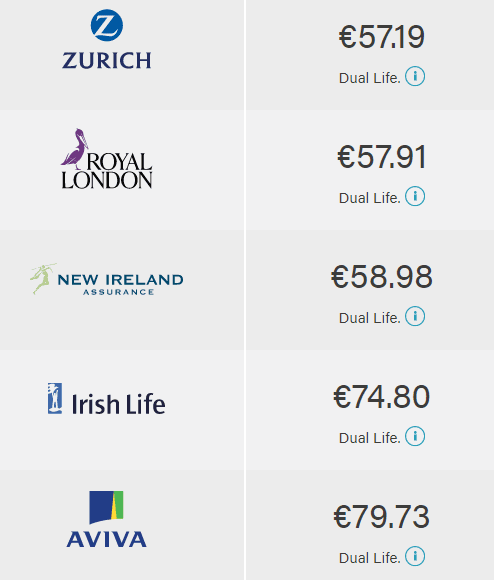

I’m glad you asked, assuming you’re both 35, non-smokers, in decent health:

Quote Type: Life Insurance

First Person: Non-Smoker, born on 23/10/1984

Second Person: Non-Smoker, born on 23/10/1984

Cover Amount for First Person: €528,000

Cover Amount for Second Person: €528,000

Paying monthly, over 22 years.

Continue Cover: Yes

That €57.19 covers both of you so it’s less that €1 per day each. Yep, I know, much less than you expected. That’s what everyone says.

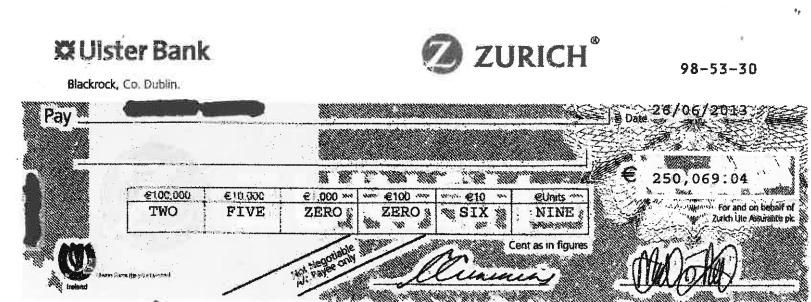

I’ve kept a copy of that cheque as a reminder of the importance of life insurance.

My newlywed clients took out a policy in November 2012 paying €38.50 per month, they had two children. He died in a car accident three months later so they only paid premiums of just over €100. Zurich Life wrote a cheque for €250,000.

No matter how much I may slag off the insurers, it’s a fact that they pay claims.

That cheque bought a site and built a house, without it she told me she could have ended up homeless.

We understand that death is a topic you’d rather avoid. But the fact of the matter is that we’re all going to the grave one day. When you’re gone, it’s unavoidable that you’ll leave behind grieving loved ones but with a life insurance plan, you can guarantee that you won’t be leaving them to struggle financially.

When you’re trying to figure out how much life insurance you need, think about it properly – and don’t just get the same amount of coverage as your best friend or your neighbour or some auld lad taxi driver who seemed very sure about it.

If you’re not sure about which type of insurance is best for you or how much coverage you need, give me a call on 057 93 20836 or fill in our questionnaire and I’ll get back to you in a jiffy.

Prefer a quick chat first – you can schedule a time that suits here.

Chat soon.

Nick

Editor’s note | We published this blog in 202 and have updated it regularly since

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video