You can still get life insurance or mortgage protection with high cholesterol — usually at normal prices if your readings are stable and there are no major cardiovascular risk factors. Delays tend to come from GP reports rather than cholesterol itself.

Editor’s note: First published in 2017 | Refreshed in 2025 with updated cholesterol ranges, TC/HDL guidance, insurer underwriting criteria and GP report timelines.

Table of Contents

If you’ve high cholesterol, the first thing you probably thought was:

“Ah for feck’s sake… is this going to cause hassle?”

Cholesterol on its own is rarely a major issue for life insurance or mortgage protection.

The delays usually come from insurers asking your GP for a medical report.

That’s the part that slows things down, not the cholesterol itself.

A total cholesterol level of around 6.0 mmol/L or below is generally seen as normal.

If your numbers fall in this range and you don’t have other cardiovascular risk factors (high BMI, high blood pressure, diabetes or a strong family history), there’s usually nothing to worry about.

The key is choosing the right insurer from the start. They don’t all treat cholesterol the same — some are more flexible than others.

If you want me to check how your case will be viewed, complete the short high cholesterol questionnaire and I’ll match it to the best insurer before anything goes near a GP.

Cholesterol is a fatty substance in your blood. Everyone has it, but some people naturally produce more than others.

Lifestyle can push levels up (diet, alcohol, lack of exercise). Certain health conditions can do the same, including:

For some people the cause is genetic.

Familial Hypercholesterolaemia is the best known example of this.

Most people with raised cholesterol get through underwriting without too much drama. Maybe a GP report, maybe a small price increase, but usually nothing major.

Familial Hypercholesterolaemia is different. Because it’s genetic, insurers treat it as a higher long term cardiac risk than ordinary high cholesterol.

Insurers pay closer attention to your recent readings, how well your numbers respond to treatment, and whether there’s any family history of early heart disease.

FH almost always triggers a GP report. Sometimes the insurer also wants a cardiology report or recent blood tests. This is standard procedure for inherited lipid conditions and doesn’t mean anything is wrong.

Standard prices are still possible if your readings are well controlled, but it’s more common to see a loading on life insurance or mortgage protection with FH.

Serious illness cover and income protection can be more difficult. Depending on your history, they may come with exclusions or a higher premium, and some FH cases are declined.

FH doesn’t mean you can’t get cover. It just means the insurer will dig deeper than they would for someone with normal high cholesterol, and the process can take a little longer.

If you have FH, choosing the right insurer first makes a huge difference. You can complete the short cholesterol questionnaire and I’ll speak to underwriters who tend to be more understanding with FH cases.

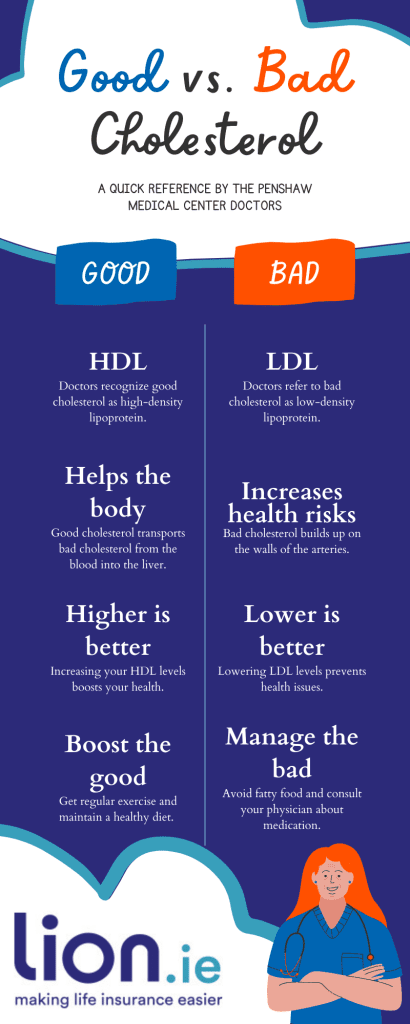

Think of LDL and HDL as two very different siblings.

LDL is the messy one. He shows up empty handed, eats everything in sight, drinks too much and leaves your house destroyed.

HDL is the sound one. He arrives to collect his brother, clears up the mess and gets everyone home safely.

LDL carries cholesterol into your arteries. HDL carries it away so your body can get rid of it.

The more HDL you have, the better job it can do keeping LDL under control. This is why insurers look at your balance of LDL to HDL, not just your total cholesterol.

Insurers look at a few different numbers when assessing cardiac risk. These are the ranges generally viewed as desirable:

Total cholesterol (TC): 5.0 mmol/L or less

LDL cholesterol: 3.0 mmol/L or less

HDL cholesterol: 1.2 mmol/L or more

The TC/HDL ratio is the figure insurers like most. Anything around 4.5 or below is usually a good sign.

More of the sound twin, less of the messy one.

Underwriters don’t just look at a single cholesterol number. They want a quick picture of your overall heart health.

The main things they check are:

If everything else is in good shape, most people get cover at the normal price without delays. If there are a few extra risk factors, the insurer may want a GP report. That’s usually the only thing that slows the process.

This is why the questionnaire helps. It lets me check your case anonymously with underwriters so we start with the insurer most likely to say yes.

A cholesterol test isn’t routine for life insurance or mortgage protection.

The only time it appears is when the insurer asks you to attend a nurse medical screening. This is a short appointment where they take basic measurements and sometimes do bloods. Cholesterol is often included.

Most people never need this step. If your readings are recent and everything looks stable, the insurer usually makes a decision without any tests.

If two or more insurers can’t offer you cover, your lender can allow you to draw down your mortgage without insurance by granting what’s called a mortgage protection waiver.

It’s not common, but it does happen. The bank looks at whether you’ve genuinely tried multiple insurers and whether the refusals are outside your control.

Most people with high cholesterol never get this far. The key is applying to the right insurer first so you don’t collect unnecessary declines.

If your cholesterol is stable and well controlled with medication, many insurers still offer the normal price. Cholesterol alone rarely causes a loading.

Loadings tend to come from the things that travel with it — high BMI, high blood pressure, diabetes or a strong family history.

When a loading applies, it can range from a small increase to a few hundred percent if there are multiple cardiac risk factors. But most people don’t see anything dramatic once you use the insurer most flexible for cholesterol.

If you’re unsure where you stand, the questionnaire is the best first step. I can check your case with underwriters before you apply.

If you’re worried about how high cholesterol might affect your life insurance or mortgage protection, you’re not alone. Most people assume it’s a much bigger issue than it actually is.

If you want me to check how your cholesterol will be viewed by each insurer, you can complete the short questionnaire below. I’ll review your details myself and speak to the most suitable underwriters before you apply.

You’re under no pressure to proceed afterwards.

It just means we start with the insurer most likely to say yes and avoid delays or unnecessary GP reports.

Thanks for reading,

Nick

Written by Nick McGowan, QFA RPA APA

Nick is a qualified financial advisor and founder of Lion.ie, an independent life insurance and income protection brokerage in Ireland. He has been helping people get transparent, fair cover for over 15 years and was named Protection Broker of the Year.

If you’d like straight answers, you can learn more about Nick here.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video