Table of Contents

SHORT ON TIME? Complete this form, and I’ll email you a range of Income Protection Quotes

Think about this for a second.

If you had a money making machine in your house, would you insure it?

Of course, you would.

You, dear reader, are a money-making machine.

You will generate hundreds of thousands, if not millions of euros in your working life.

And that’s why you need to safeguard that income.

If you break down and are out of work for a long period, the money-making machine will stop.

What would happen then?

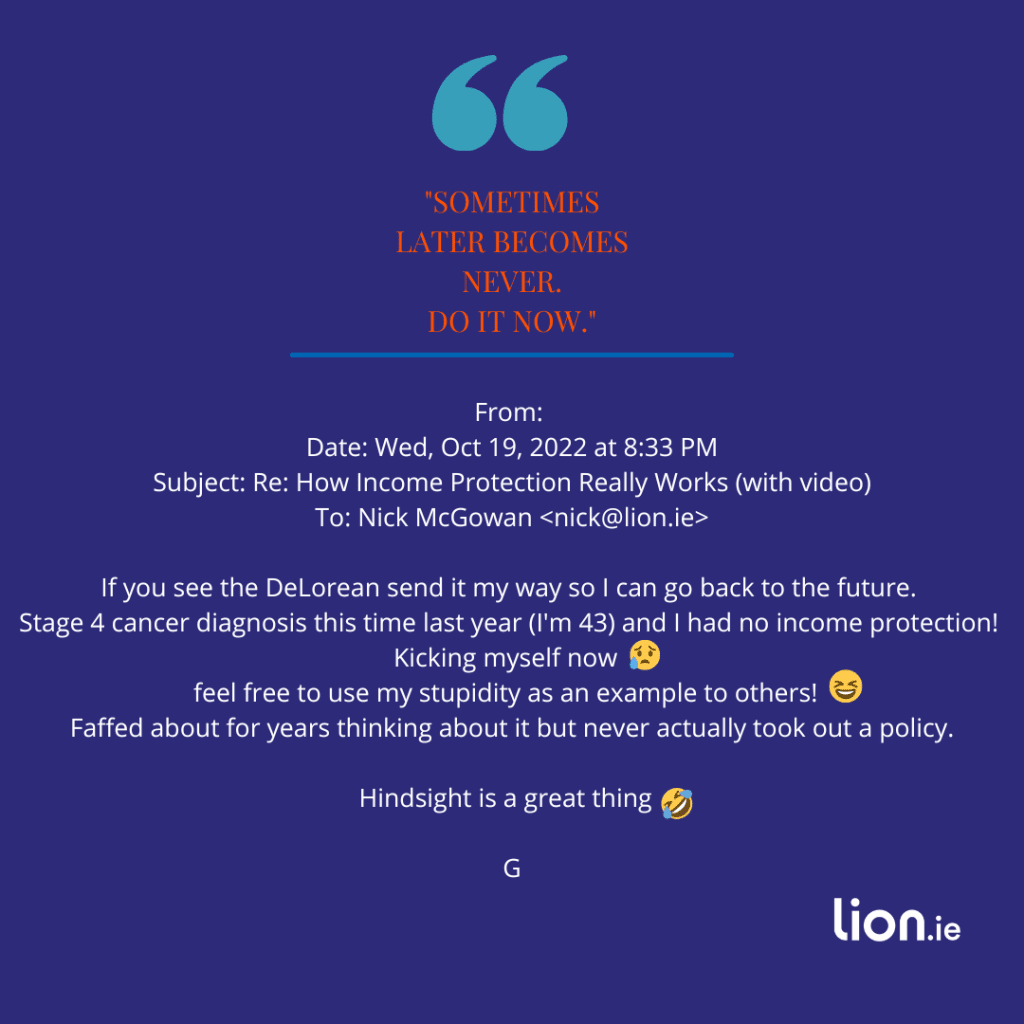

I received this email from a client in response so one of my newsletters. It was heartbreaking.

Some people like to read, some prefer videos.

You do you, Boo.

If you like videos – here’s our Income Protection Explainer Video.

If you like to read, let’s crack on!

Who doesn’t like a good duvet day?

It’s appealing: stay snuggled in bed, wrapped around your blankie – especially if you have young kids who think 5 am is a good time to stand on mam and dad’s bed to shout and roar. (Kids. Aren’t they great?)

Those fake sick days can add up – and that’s not to mention actual illnesses. There’s only so much flat 7up and hoping for the best will actually cure.

So what’s the story when you go far beyond man-flu, sickies, or a stomach bug brought into the house by your loveable but extremely sneezy kids?

What happens if you’re hit by a car or you get an illness that leaves you bed-bound for months?

Income Protection might seem pretty far down the list of required insurances, but if you’re out of work for more than a few weeks, you’ll be so very glad you have it.

So what do you need to know about Income Protection – and should you actually buy it?

If you can’t explain a concept to a five-year-old, the theory goes that you don’t fully understand it.

Now, I have no idea why a five-year-old would want to know about Income Protection, but to confirm the theory let’s break it down:

If you’re out of work for more than four weeks due to any illness, injury or disability, you’ll receive a payment of up to 75 per cent of your income until you can go back to work.

Will a five-year-old understand that?

Absolutely not.

Explaining it to a five-year-old might go as follows:

Mum is sick and can’t go to work, so the people in suits are going to give her money to buy toys and food.

Moral of the story: if your five-year-old is asking about Income Protection, give him a suitcase and a little hat and send him on his way, because he’s secretly 40 and there was a terrible mistake at the hospital.

Why?

I think I know…

Because you think it’s a scam and the insurers never pay?

Do you think you can’t afford it?

Or are you afraid you don’t qualify for some reason?

These are all valid points (I asked the same questions before I took out my policy)

So let’s go through them one by one.

Aviva, our preferred provider of income protection paid 90% of their claims last year.

The 10% they didn’t pay out was due to non-disclosure (lying on the application form) or the claimant getting back to work before the deferred period was over.

Could you survive financially on €12,032 per year?

If not, then you have to make some room in your budget for income protection.

Maybe you can’t afford to insure the full 75% of your income…. with a 4-week waiting period…. that pays out until you’re 70.

But if you tweak the numbers, you’ll find a level of salary protection cover that suits your budget.

Insuring 50% of your income with a 26-week waiting period until age 60 beats leaving yourself exposed by having no income protection at all.

Have a read of this article to find out ways to reduce your premiums to a more affordable level

More than likely yes.

The main reasons people don’t qualify are:

If you’re worried about a pre-existing condition, please complete this questionnaire and I’ll discuss it with my underwriters on a no-name basis.

All of them!

Unlike serious illness cover, income protection covers you for ANY illness, injury or disability that stops you from doing your job.

You’re covered for absence from work due to a serious illness like cancer.

But you’re also covered for a simple accident that keeps you out of work.

Let’s say you slip and hurt your back – you’re covered.

You’re covered if you’re out of work due to any illness, injury or disability.

In a previous article, I looked at the alternatives to income protection.

As you can tell, I don’t think any of the alternatives provide peace of mind should you be unable to work long-term.

And if you’re thinking of relying on sick pay from work, this blog on how much sick pay you are entitled to in Ireland will be an eye-opener.

A robust Income protection plan is the only way to properly safeguard your income.

By the way, in case you’re wondering: income protection = salary protection = income continuance insurance = disability insurance.

People often confuse serious illness cover and income protection.

Although they are two different products that serve different purposes, it looks like we, as an industry, have failed to clearly separate them.

Serious illness cover – pays out one tax-free lump sum if you get one of the specific illnesses as defined on your policy.

e.g. certain types of cancer, stroke, heart attack – so you must be seriously ill for a successful claim.

Income protection – pays you an ongoing income for as long as you cannot do your job due to ANY illness or injury

e.g. backache, stress – once the illness prevents you from doing your job, your policy pays out.

You can insure up to 75 per cent of your income.

This takes a little explaining so listen up down the back.

Let’s say you’re an employee earning €80,000 and you’re entitled to a state illness benefit of €232 per week (€12,064 per year).

The maximum you can receive in total from the state, your employer, and your insurance company is 75 per cent of your income.

That breaks down into €12,064 illness benefit from the state with a balance of €47,936 from your insurer.

€12,064+ €47,936 = €60000 (75% of €80,000).

Capiche?

Now, onto the tax implications.

Any pay-out is classed as income so you’re taxed at your marginal rate at the time of the claim (income tax, PRSI and USC are payable)

It could so happen that you get the higher rate of tax relief on the premium but you’ll only pay the lower tax rate on your claim.

And it’s still an awful lot more appealing than trying to survive on the weekly €232 the state pays.

No, income protection covers your inability to do your job due to illness, accident or disability.

It doesn’t protect you from getting on the boss’s nerves and getting yourself fired or made redundant.

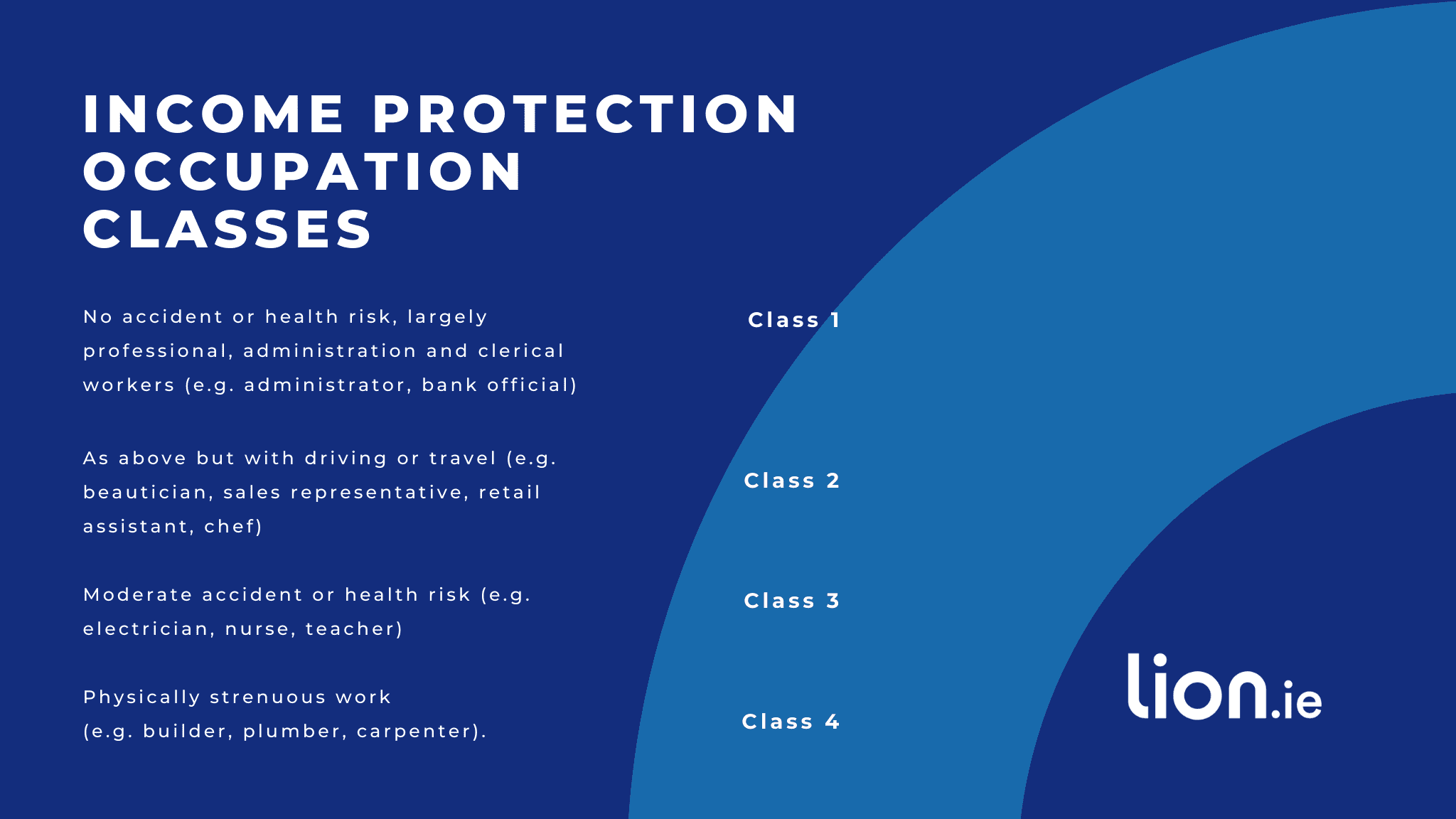

The insurers class what you do for work according to the likelihood of a claim for that occupation.

The higher the risk of a claim, the higher the occupation class you will fall into and the higher the premium you will pay.

There are four income protection classes.

Ils sont la!

(I’ve been burning it up on Duolingo since Jan 1)

If your occupation is Class 1 (e.g a pharmacist) you will pay less than someone who is a Class 2.

If your occupation is Class 3 or 4, you may want to look at Wage Protector which is a more affordable type of income protection.

People ask why can’t you insure 100% of your income.

Well, you must have some financial incentive to return to work.

If you’re earning the same (or more) out of work that you do at work, well, you might get comfortable being out of work.

As you can imagine, the insurer doesn’t want to pay your wages forever!

That’s why you are limited to insuring 75% of your income.

How would you pay your mortgage if you were unable to work long-term due to illness?

The bank would have some sympathy, but that wouldn’t stop them from trying to repossess your home and turf you out onto the street.

Imagine if you had a fairy godmother, who, with one wave of her magic wand could stop this from happening.

Your income protection policy is your fairy godmother.

It’s your guarantee to the bank that you’ll be able to pay your mortgage in a few months, once your income protection kicks in.

So the bank will call off the dogs giving you some breathing space to focus on getting better and getting back to work.

Yes.

It’s easier to claim because it covers ANY illness, injury or disability that prevents you from doing YOUR job.

To claim serious illness coverage, you have to contract one of the illnesses defined on your policy.

See more on income protection v serious illness cover

Once you’re out of work on an income protection claim, your policy will pay you until you get back to work or until you retire.

Serious illness cover pays out a one-time lump sum.

And remember you get tax relief on income protection putting 40% of the premiums back in your pocket.

You don’t get tax relief on serious illness cover.

Income protection doesn’t cover:

Exclusions vary between insurers so please be careful when it comes to choosing which provider you go with.

The cheapest isn’t always the best.

The following exclusions are common to all providers:

You can cover your income up to any age between 55 and 70.

So if you buy an income protection policy to age 65, your policy will pay you a replacement income until you hit 65 if you can’t do your job due to any illness.

If you insure yourself for €5000 per month, you’ll receive a taxable income of €5,000 per month until your policy ends.

However, you can add “claim escalation” to your policy – this means your payout will increase by 3% every year you are out on a claim.

Yes, if your employer is evil enough to fire you while you are out on an income protection claim, at least your insurer has your back:

What happens to income protection if you’re dismissed?

Surprisingly less than you think.

The insurer calculates your premium based on your

Read this piece on the factors that influence the cost of income protection.

Or you can buy income protection that suits your budget.

How?

Like this:

Hi Nick, I want to spend €100 per month on income protection.

OK, here are three options, a, b and c.

Great, option A looks good, what now?

Let me arrange the paperwork and we’ll get you covered.

Brilliant, that was so easy, thanks.

Seriously, it’s that simple.

If that appeals, what are you waiting for, complete this questionnaire and I’ll be back with an a, b and c option.

Let’s Gooooooooooooo!

If you choose a policy with a fixed premium, your premium will not change as you age.

This guarantees your premium will be sustainable for your whole life because the premium you pay at age 35, you will pay at age 55.

Inflation will make your premiums look positively cheap as you get older!

However, if you choose a reviewable premium policy, your premium could increase every five years.

Here I compare reviewable and guaranteed premium income protection.

You can have as many income protection policies as you like, but you must stay within the 75% of income rule.

So let’s say you earn €100,000, and you have a policy for €50,000 (50% of your income) through your employer.

You can take out an additional policy for the remaining €12,964 of your income ( €25,000 – state illness benefit)

If you claim on your policy, the liability will be split 50:50 between your work and personal policy.

Yes, if you are entitled to a social welfare payment, you will receive it in addition to your income protection payment.

If I were to become ill with, say, stomach cancer. I recovered and returned to work after two years. Then sometime later, I got prostate cancer, or I had a bad car accident and was badly broken up (or some other thing). Does the policy payout again for another “thing” happening to me?

Yes, income protection can be paid multiple times.

If you return to work and relapse with the same illness within 6 months, you don’t have to serve the waiting/deferred period again.

But you must serve the deferred/waiting period again if it’s a new condition that prevents you from doing your job or if you relapse after 6 months of returning to work.

Yes, let’s break things down:

Income protection is a living benefit (pays out while you are still alive).

It provides a replacement income should you be unable to do your job due to illness or injury.

From a selfish point of view, income protection is the only one you will benefit from!

Life insurance and mortgage protection are for the ones you leave behind.

It works fantastically!

Your company can pay the premiums.

There is no BIK for the company director.

The company can claim Corporation Tax relief on the premiums!

It’s a tax-efficient way to use cash in the company.

Income Protection for Directors

By the way, you don’t have to be a director, a company can take out executive income protection on behalf of any staff member.

If you’re lucky enough to be a company director, you can take out an additional 33% to cover your pension contributions.

Let’s say your taxable income is €100,000.

You can insure up to 75% of this as income replacement = €75,000 and also 33% to cover your pension contributions = €33,000.

Depending on the insurer, it will pay €108,000 gross to your company if you make a claim.

Of course, you have to prove you are paying that €33,000 into a pension.

Absolutely!

Income protection is essential if you’re self-employed because you don’t qualify for any state benefit.

But didn’t the government change all this a few years back?

I’m afraid not, the only thing that changed was access to the Invalidity Pension.

To qualify, you have to be permanently incapable of work!

It was a sop to the self-employed, but if you dig deep, it’s pretty worthless.

Here’s how difficult it is to qualify:

If you’re self-employed and you don’t have income protection, you’re a lunatic.

I’m sorry but you are, I know we self-employed people have to take risks but you have to mitigate those risks where possible.

Read more here about income protection for the self-employed

You can claim, but the insurer will reduce your payment by any income you continue to receive from your employer, be it in the form of income or shared profits.

Before you take out income protection, make sure you will have an income shortfall to protect if you can’t work.

Remember, you cannot be better off out of work claiming income protection than you would have been if you were still at work.

Self-employed, sole traders or anyone who is self-employed and hasn’t formed a limited company can insure up to 75% of their profits (not their drawings).

We deep dive into this important distinction in this blog.

This depends on the insurer.

Some will accept a percentage of overtime/commission/bonus as part of the income you wish to insure.

Even better, if it’s a guaranteed bonus or your Statement of Earnings can show it has been consistent over several years, some insurers will accept the full amount of part of your basic income.

Ask yourself:

what if my partner couldn’t work long-term, would we be in trouble financially?

If the answer is yes, then you both need income protection.

But if the answer is no and affordability is an issue, then insure the higher earner only.

Sadly I have seen cases where the higher earner had to give up work to care for the lower earner, so it was a double whammy; both were hit with a reduced income.

In such a case, the lower earner’s income protection policy can make all the difference.

I know this is an extreme example, but it happens more than you think.

With income protection, as with all insurance, you prepare for the worst but hope for the best.#

Which Insurer is the Best for Income Protection

I was always wondering what insurance company should I have my policy with or maybe it does not matter because all insurance companies work the same way. If they are all different how would I know what company to take policy from?

Great question – that’s where we come in.

We’re income protection specialists so we know the ins and outs of all five income protection providers in Ireland so we can recommend the one that suits you best.

Each insurer has its little quirks like these:

Unfortunately not, but once you’re back at work full time, you can apply.

If you already have income protection and are going on maternity leave, it doesn’t pay out for maternity as pregnancy isn’t a “health issue”.

However, should an event during pregnancy stop you from returning to work (e.g. a childbirth complication or Post-Natal Depression), you can make a claim.

Your income protection policy will roll over each year at the same price even if you suffer a health issue.

If you’re a 40% taxpayer, you can claim 40% tax relief.

It’s a simple process to claim tax relief on Revenue’s MyAccount.

In effect, if your quote for income protection is €100 per month, it will only cost you €60. To help make this crystal clear we show both quotes on our website.

We go through the nuts and bolts of claiming tax relief in this blog: Tax Relief on Income Protection

It depends on how much coverage you are applying for.

If you’re under 35 you can apply for up to €1000 cover per week without having to do a nurse medical.

If you’re between 35 and 40, you can apply for up to €900 per week without having to attend a nurse medical exam.

aged 40-45: up to €800 per week without a medical

aged 45-50: up to €700 weekly – no medical

50-55, up to €500 weekly – no medical

And if you’re aged between 55 and 60, you can apply for up to €400 income protection per week without having to do a nurse medical.

If you have no health issues and don’t trigger a nurse medical due to a combination of the cover you need and your age, we can have your policy within 24 hours!

Yes, but if you claim while working abroad, the insurer will limit the number of payments and will require you to return home now and again for medical tests.

If it’s a personally held policy, you can take it to your new employer.

This is true even if you move from a low-risk occupation to a high-risk one (from an accountant to an acrobat).

However, if you’re part of a group income protection scheme, your policy will end when you leave your job.

Can I Get Income Protection Before Starting a New Job?

Most insurers will refuse your claim because they require you to be in full-time employment for a valid claim to arise.

However, some insurers will offer you Essential Activities Benefit.

In other words, if you are seriously incapacitated, they will pay out €15,000 per year until you get back to work.

If your employment status changes, contact your broker or insurer immediately!

If it’s earned income that continues while you are out on a claim, then the insurer may reduce your payout by that continuing income.

e.g. someone who works in an office but also has farming income that continues while they are claiming income protection.

If you have two sources of income, you must disclose this to the insurer when applying.

Some insurers won’t offer cover if you have two jobs.

You can increase your income protection in three ways:

Make sure your income will be strong enough to support a future claim.

An example will clear things up:

Let’s say you earn €60,000 and you’re a PAYE employee who is eligible for an illness benefit of €12,036 per year.

You insure the maximum amount possible:

(€60,000 x 75% – €12,064 = €32,936

You add indexation, which will increase your coverage by 3% each year.

In 5 years, your insured amount of cover has risen to €40,000.

You fall ill and make a claim.

When you make a claim, the insurer will request proof of your income over the preceding 12 months.

If your income has remained at €60,000 then the maximum the insurer will payout is €32,936 (€60,000 x 75% – €12,064)

Your income would have had to rise to €69,381 to get the full €40,000. (€69,381 x 75% – €12,064) = €40,000

In other words, if you are adding inflation protection, you must be confident that your income will increase in the future.

Otherwise, you are in danger of over-insuring yourself.

Adding inflation protection will not increase your initial premium. Instead, it will increase on each anniversary.

The rate of inflation isn’t identical at all of the providers:

New Ireland is best for inflation protection because they increase your cover and premium by 3%.

You don’t have to answer health questions.

Your initial premium will not change.

You will pay extra for the additional cover.

You can do this up to 5 times over the life of your policy, thus doubling your original cover.

Zurich has a different (less attractive) way of doing this.

You must answer health questions for the additional amount if you use this option.

Adding Claim Escalation to your income protection will increase your payout by 3% every year you are out on a claim.

You have to pay an additional premium from the start of your policy if you add this benefit.

The end date of your policy should match the ceasing age on your contract of employment.

If this isn’t on your contract, most people choose 68 as that’s when you’ll be eligible for the state pension under current rules.

But the way things are going, soon you’ll have to wait until 70 to get the pension!

Here are a couple of testimonials from clients of Aviva:

Yes, we did it!

As you can see there is an awful lot to income protection so Please, Please, PLEASE take advice before you sign up.

How to choose an income protection broker.

If you don’t have an advisor, we’d love to help you.

Complete our short income protection questionnaire below, and I’ll be right back with a no-obligation recommendation and some quotes.

Or if you’d like a quick chinwag first, please schedule a call here.

Thanks for reading

Nick

Editor’s Note : We first published this blog in 2018 and have updated it regularly since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video