Table of Contents

10-second summary: Yes — you can get life insurance in Ireland with a pre-existing condition. The key is choosing the insurer most understanding of your condition and applying in the right order to avoid unnecessary loadings, postponements, or declines.

Editor’s note: First published in 2018 | Refreshed in 2025 with updated underwriting criteria, GP-report timelines, and insurer attitudes toward common medical conditions.

In the interest of your already frazzled nerves:

yes, it is possible to get Life Insurance with a pre-existing health condition here in Ireland.

The fact you’ve typed a question that led you to this blog means you’re interested in getting Life Insurance with whatever pre-existing condition you have.

I won’t soften the blow here: it’s harder than getting Life Insurance if you were in perfect health.

If you think about it, it makes sense.

One of the questions I get around these here parts is, “how does Life Insurance work?”

It’s a fair question.

If you’re parting with your cash, you want to know what you’re getting.

Despite how the insurers dress it up, Life Insurance isn’t complicated.

You buy a policy that covers you for a certain amount of time.

If you pass away in that period without breaking the conditions of your policy (like lying on your application), your family will receive an agreed monthly payment or a lump sum.

Tell the truth, pay your premiums, and the policy will pay out.

Enter: The Underwriter (who may or may not sound like a bad-boy WWE wrestler from the ’90s).

Underwriters do the sums on every application.

They consider your health, family history, age, and occupation before accepting, postponing or declining your application.

If they offer cover, they may add a loading if you have a health issue.

If you have a dangerous hobby or job, your premium may be higher again.

In short, the higher the risk, the more expensive the cover.

But here’s the kicker: some insurers will charge more than others.

Scoundrels. Blaggards. Thieves.

Call them what you will — but if you have a family (especially young kids), Life Insurance is a necessity.

It’s up there with Wi-Fi and food.

The most common pre-existing conditions our clients need advice on include:

Cancer

Diabetes

Inflammatory Bowel Diseases (Crohn’s & Ulcerative Colitis)

Heart Attack

Kidney Disease

Mental Health

Multiple Sclerosis

High BMI / Weight Issues

If you have a pre-existing condition, underwriters will need more information to decide whether to offer cover.

In general, they need to know:

If you’d like me to check your chances of getting cover, please complete this short questionnaire.

If you’re looking for mortgage protection information instead:

I’m not going to guarantee you’ll qualify — sometimes the risk is too high.

It depends on the type of Life Insurance you need, the illness, and how severe the symptoms are.

Date of diagnosis matters.

If it’s recent, the insurer may postpone the application.

Underwriters love stability. They don’t like seeing results bouncing around outside the normal range.

They may need a PMAR from your GP.

You may need a nurse medical screening (common for high BMI).

The screening isn’t scary — measurements, bloods, maybe a urine test if you’re unlucky!

Negative Ghostrider.

The type of cover matters.

If you have MS or Type 1 Diabetes, you won’t get Serious Illness Cover or Income Protection — but Life Insurance should be fine.

Not fair, I know — but them’s the rules.

A loading is an increase in your premium.

If the loading exceeds certain limits, an insurer may refuse cover or remove conversion.

Conversion lets you get another policy without medical evidence.

Some insurers remove it if they add any loading.

Zurich is more generous — they’ll allow conversion if the loading is under 75%.

If you can’t get conversion, pick the longest term.

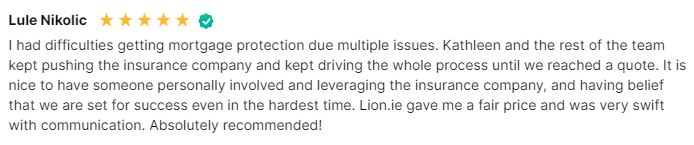

A specialist broker knows which insurer is most sympathetic to your condition giving you the best chance of avoiding a dreaded decline.

A previous decline means you must tick “yes” to:

Have you ever been declined, postponed or accepted on special terms for life, serious illness or income protection?

A “yes” raises a red flag making it harder to get cover from the next insurer.

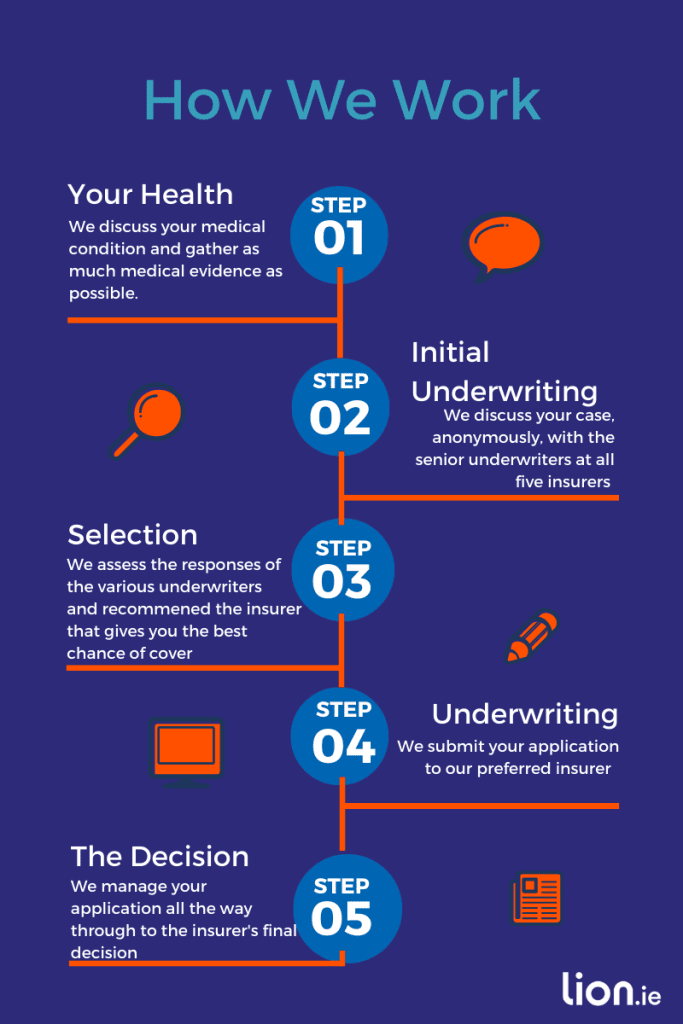

If you’d like me to check your chances of getting cover, complete this quick health questionnaire and I’ll anonymously run your case past all 5 insurers or schedule a callback here

Our initial discussions with underwriters will be on a no-name basis.

Thanks for reading

Nick

Written by Nick McGowan, QFA RPA APA

Nick is a qualified financial advisor and founder of Lion.ie, an independent Irish life insurance and income protection brokerage based in Tullamore. He’s been helping people get fair, transparent cover for over 15 years — and was named Protection Broker of the Year 2022.

If you’d like straight answers (without the sales pitch), learn more about Nick here.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video