Table of Contents

Here’s the number one thing you need to know about Life Insurance: it isn’t actually for you; you’ll be dead (sorry).

However, if you want to protect yourself while you’re alive and kicking, then Serious Illness Cover is an option (but it isn’t as good as income protection)

Also known as Specified Illness Cover and Critical Illness Cover, Serious Illness Cover pays you cash money if you get a serious illness.

But more about that in a second.

Serious illness cover is a type of insurance that pays you a tax-free lump sum if you get sick with one of the illnesses listed on your policy.

It’s mostly the big scary ones: cancer, heart attacks and strokes – the kind of illnesses that usually mean having to give up work for several months, so your wallet gets pretty sick too.

It varies depending on the provider.

Zurich Life, for example, will pay out for 81 illnesses.

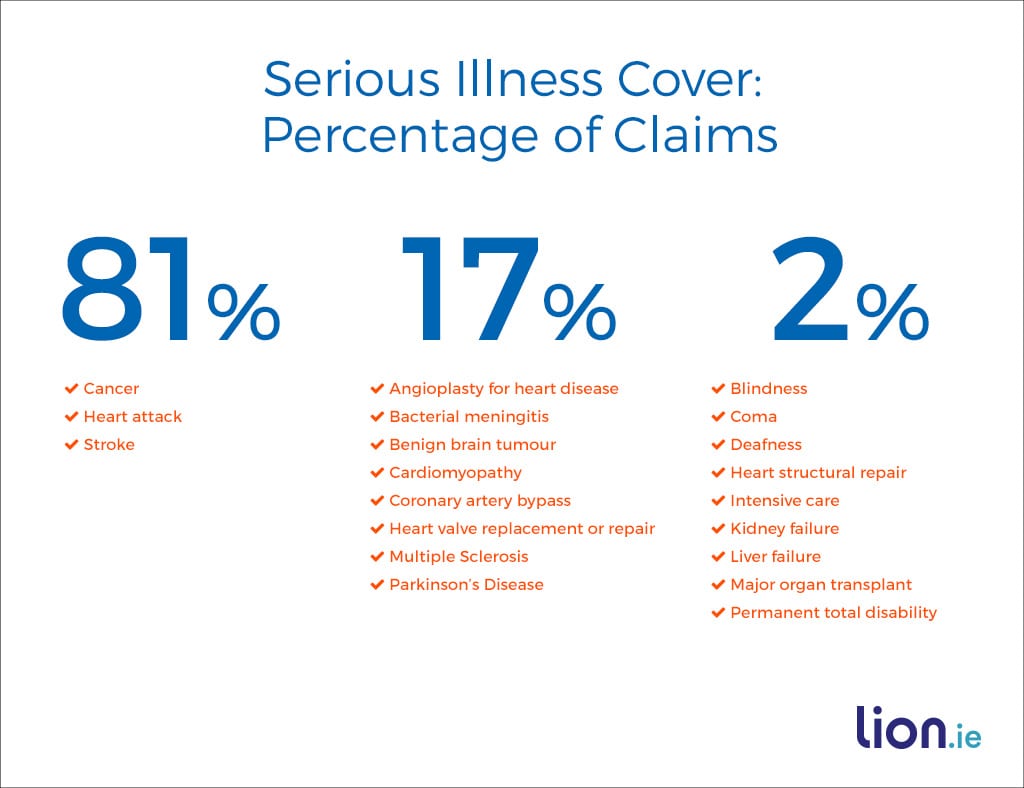

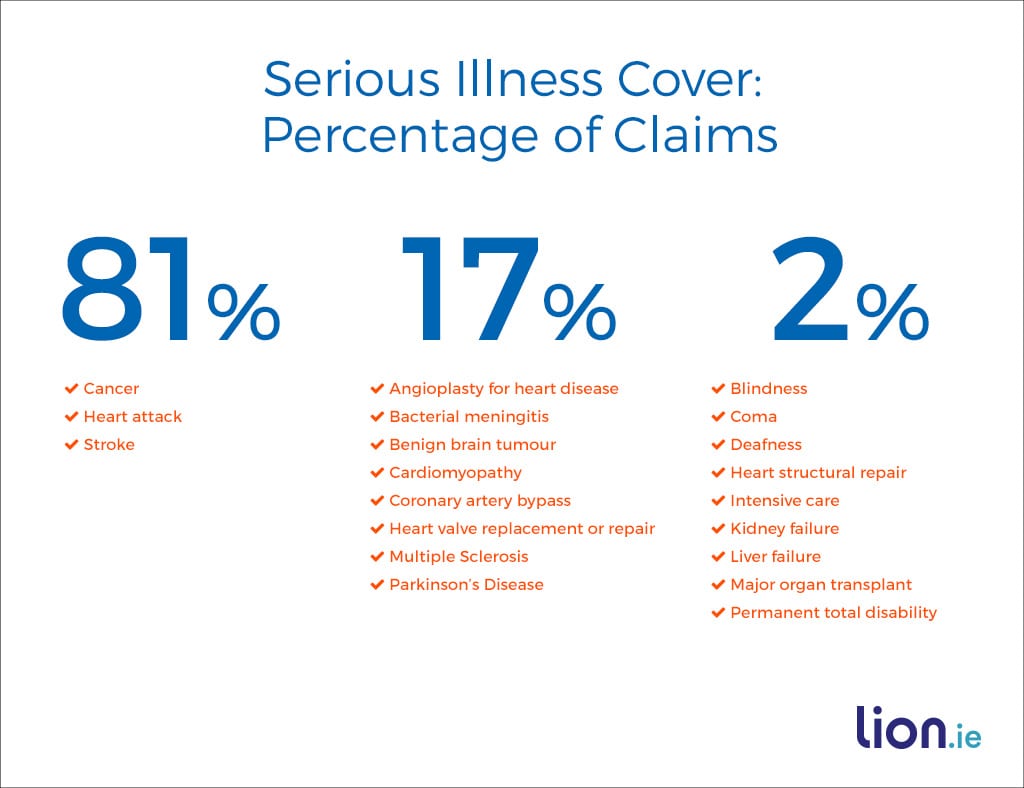

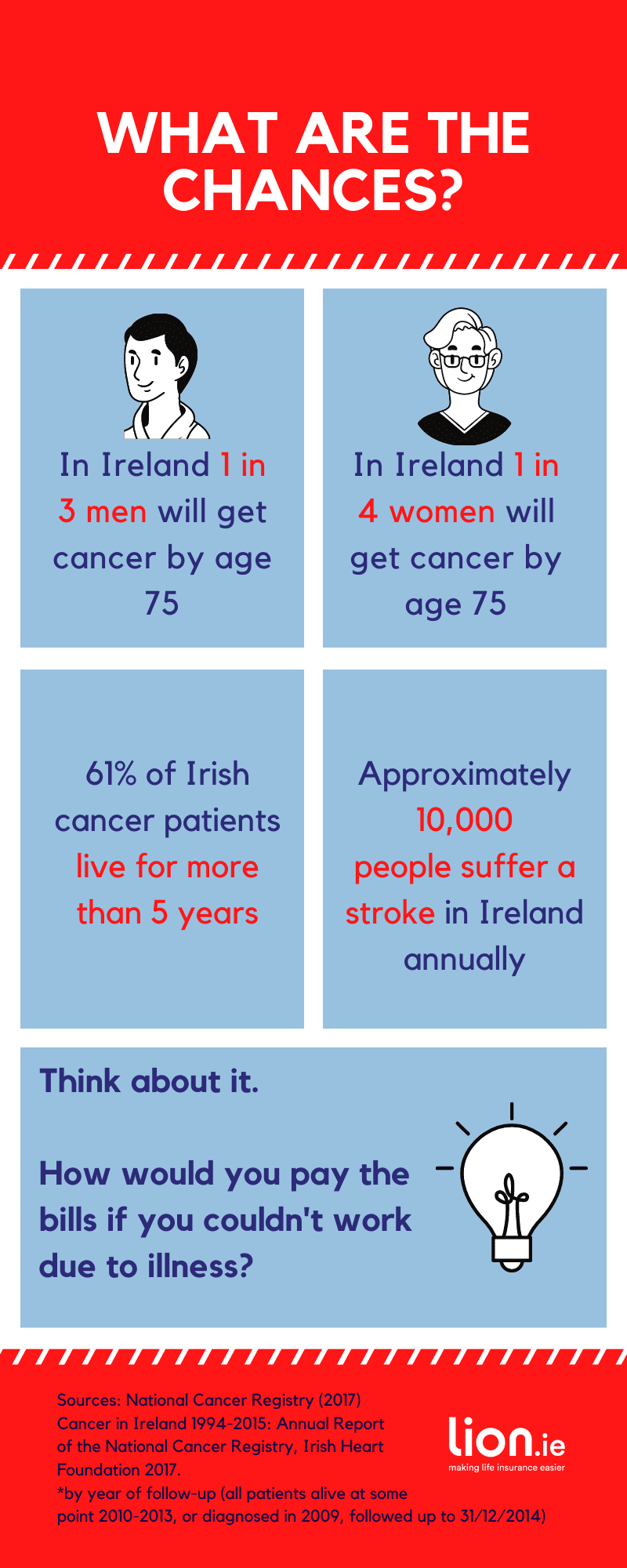

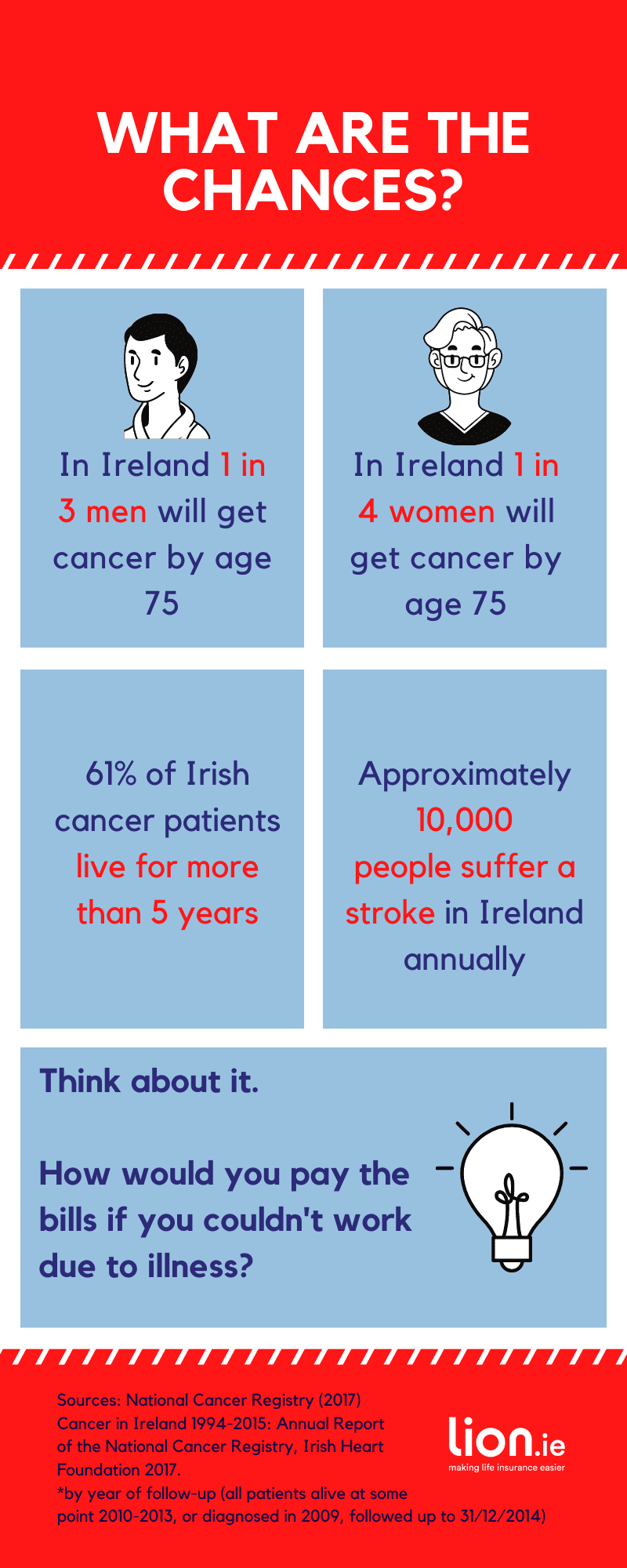

Three big illnesses account for approximately 81 per cent of all claims:

The next 8 serious illnesses together account for around 17 per cent of claims:

The remaining serious illnesses account for approximately 2 per cent of claims paid, for example:

We have compiled a comparison of the illnesses covered by each insurer.

Go here to find out which serious illness cover provider in best in 2024

While lots of illnesses are covered, many more aren’t.

And some of those would keep you out of work for quite a while, e.g. mental health and musculoskeltal issues are not covered (but they are covered by income protection)

Likewise, not all policies cover the same illnesses.

Generally though (I stress the ‘generally’), all of the insurers cover strokes, heart attacks, cancer, heart disease, MS, major organ transplants, and brain tumours.

Most policies also include partial Serious Illness Cover for your children.

It’s between New Ireland and Zurich Life.

New Ireland covers a bigger number of serious illnesses.

Zurich Life has better definitions of some illnesses making it easier to claim.

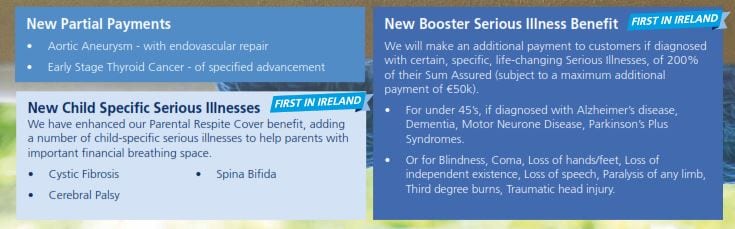

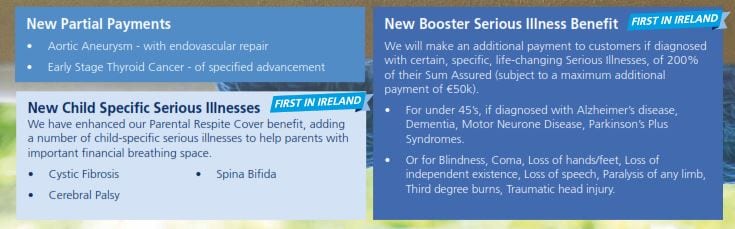

They also offer Booster Payments and Child Specific Illness Cover:

In the end, it may come down to the premium

Zurich usually run discounts on illness cover that aren’t available through other providers.

You can get an instant quote here

You should consider getting Serious Illness Protection if you have no other cover for ill health

e.g. sick pay entitlements through work or income protection.

It’s also useful if you’re between jobs or unemployed as you could struggle to pay for the best treatment should illness strike.

Lastly, if you have dependents who rely on your income, Serious Illness Cover makes sense.

Is it worth getting illness cover?

Yes, but only if you can’t get income protection.

Using a car insurance analogy, think of serious illness cover as your third party fire and theft in that it covers you for specific claimable events.

On the other hand, income protection is like comprehensive car insurance, which covers your car for any damage caused to it.

Serious illness cover – specific, defined illnesses only (third party, fire and theft).

Income protection – any illness or accident that stops your working (comprehensive insurance).

If you do have to make a claim, the insurer will pay out if you meet three conditions (of course, there are conditions):

Okay, so you might be tempted to roll your eyes at the T&Cs, scoff and say, “ah, sure they’ll find a way of not paying out”.

But guess what percentage of serious illness claims are paid each year.

Would you be surprised if I said it was 90 per cent?

Yes, 9 in 10 claims are paid.

Only 1 in 10 doesn’t meet the T&Cs or if refused due to non-disclosure (lying on the application form)

Health Insurance covers things like hospitalisation expenses, maternity benefits, surgery, or treatments.

Generally, the more expensive your plan, the more that’s covered.

Serious Illness pays out a tax-free lump sum if you’re diagnosed with one of the specific illnesses or disabilities that your policy covers.

Health Insurance is one of the most expensive types of insurance you can get – because there are so many claims.

There’s a pretty high chance that you’ll get sick at some point during your cover.

It is what it is.

With Irish Life Health, the cheapest basic cover starts at around €40 a month, while the enhanced cover costs over €300 a month.

With VHI, the current cheapest cover starts at €44 a month and rises to €85 for basic cover.

The cost of Serious Illness Cover will depend on the amount of cover, your age, health, whether you smoke, and how long you want to insure yourself for.

€30,000 cover is enough for most people, provided they also have income protection.

You can read more on the maths of that here, but it boils down to giving you the financial security to be able to quit working for a time to focus on getting better.

Get a quote; you’d be surprised how little Serious Illness actually costs.

It’s often much less than you’d expect – maybe the cost of a couple of pints, or whatever you’re having yourself, across the month.

Some insurance companies offer benefits on top of the policy, though generally, you’ll pay more for them.

Extra benefits include:

Don’t add Serious Illness Cover to your Mortgage Protection policy unless you’re comfortable with the bank getting any pay-out on a Serious Illness claim.

Instead, buy Serious Illness Cover on an accelerated basis (see below) as part of your Life Insurance policy (provided you’re not using your life insurance as security for a mortgage).

There are three ways to buy specified serious illness cover:

1. Standalone/Independent:

Here, you simply buy a separate Serious Illness policy.

Should you get one of the illnesses, your policy pays out the sum insured.

The one big danger in buying on a standalone/independent basis is the “Survival Period.”

A serious illness survival period is the length of time you must live after being diagnosed with a critical illness. Only if you make it through the survival period will the policy payout. It is usually for 14 days.

I know it sounds gruesome; why would the insurers add such a sick clause?

They designed critical illness payouts to help you financially if you get sick and have to quit working for a while and suffer a drop in income.

According to their boffins, serious illness cover is not insurance against death.

That’s what life insurance is for.

2. Accelerated:

Or you can add Accelerated Illness cover to your life insurance policy.

Your policy will pay-out should you get a serious illness, but the insurer will reduce your remaining life cover by the amount of the claim paid.

3. Additional:

Finally, you can buy Additional Cover.

The difference being your life cover amount is unaffected by a Serious Illness claim.

Here’s a blog post that explains the difference between Accelerated and Additional Illness cover in detail and recommends which one is best.

In case you couldn’t be arsed to read that piece…Accelerated is the way to go.

To help this make total sense, let’s look at a scenario.

Peter Parker is a 25-year-old man with a penchant for red suits and spider webs.

He’s got a Life Insurance policy for €100,000 and €50,000 Serious Illness Cover.

If Peter has an accelerated serious illness cover policy, he will get €50,000, and if he dies, Mary Jane, his other half, would receive the remaining sum, i.e. the €50,000.

However if he paid extra for additional serious illness cover, he’d receive the €50,000, and if he dies, Mary Jane will receive the full life insurance policy, i.e. the €100,000, additionally.

As with Life Insurance, you can’t buy Serious Illness Cover for a child, but they are covered automatically on their parent’s policy.

Again, the amount of free cover depends on the insurer you choose:

Don’t worry; you still have some options available, like Cancer Only Cover and Multi Claim Protection Cover.

Cancer Only Cover is available to anyone aged 18 to 60.

It will pay you a cash lump sum if you’re diagnosed with cancer, as defined by your policy, during the term of the plan.

Types of cancers that would ordinarily be covered include:

Cancer Only Cover is an insurance policy that will pay out should you contract a certain type of cancer.

The cancer definition is the same one as can be found on a Serious Illness policy.

This gives you the peace of mind that a cancer claim payable under a Critical Illness policy will also be met on a Cancer Only policy.

Okay, so why not buy Serious Illness Cover instead?

Cancer Only Cover is available even if you have been refused Serious Illness, or you think you would be refused Serious Illness protection due to a pre-existing health condition.

This includes people with a medical history of:

• Heart attacks.

• Angioplasty.

• Angina.

• Valvular disease.

• Stroke.

• Obesity.

• Diabetes.

• Kidney problems.

• Multiple Sclerosis.

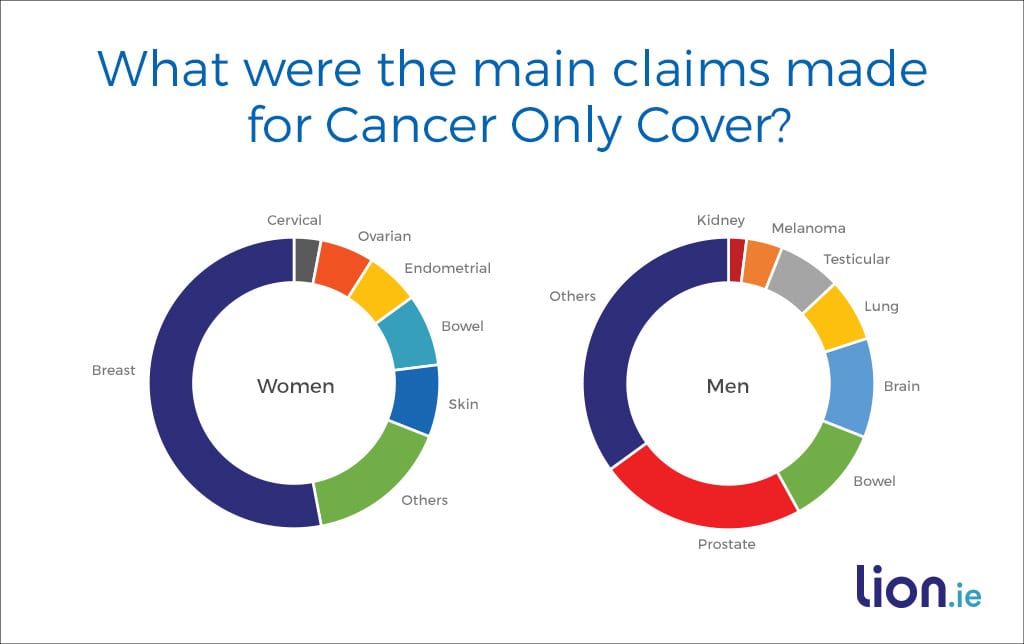

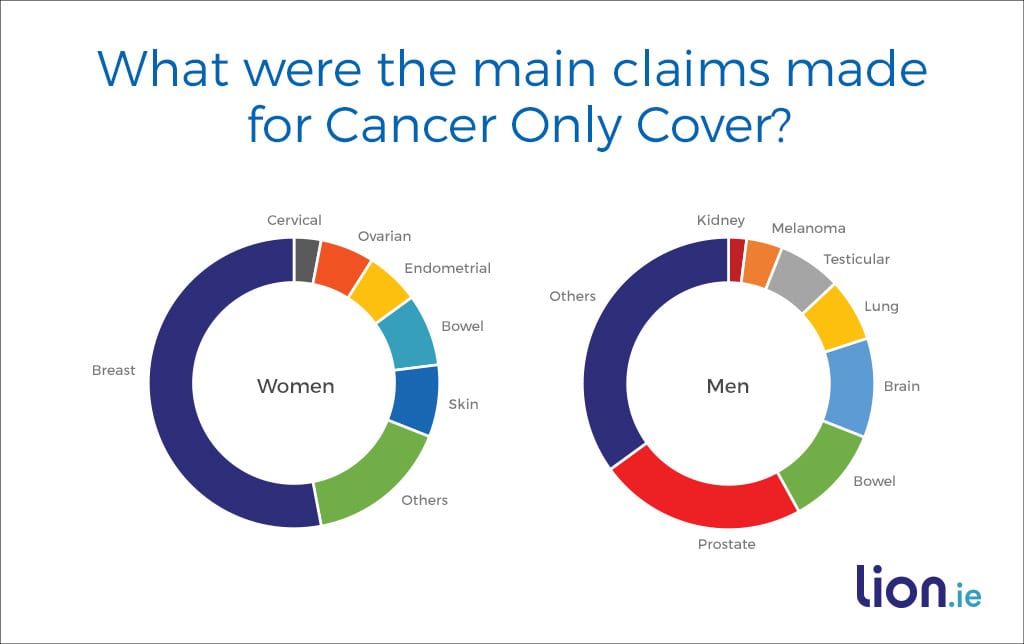

For women, the main causes of claims over the past 12 months were as follows:

• Breast: 53 per cent.

• Bowel: 8 per cent.

• Skin: 8 per cent.

• Ovarian: 6 per cent.

• Endometrial: 6 per cent.

• Cervical: 3 per cent.

For men, they were:

• Prostate: 23 per cent.

• Brain: 11 per cent.

• Bowel: 11 per cent.

• Testicular: 7 per cent.

• Lung: 7 per cent.

• Melanoma: 4 per cent.

• Kidney: 2 per cent.

No, the underwriting is much simpler for Cancer Only Cover than Serious Illness Cover, so it’s an easier process.

I’ll quote for a 40-year-old, non-smoker, €250,000 life cover over 25 years.

With €50,000 Serious Illness Cover, the monthly premium is €60 per month.

With €50,000 cancer cover, the premium is €45 per month.

So you get a decent discount because only cancer is covered.

Here are six superb reasons why you should buy serious illness cover when you’re young and before your health goes down the toilet.

Here is a list of the illnesses future you are most likely to get.

Let’s go through them in more detail.

You might be asking what autoimmune diseases are?

Instead of trying to explain each one, in turn, look at this chart instead; how many have you heard of?

I regularly see applications from young people (in their 20s/30s) who have suffered from one of these illnesses.

Autoimmune disorders are indiscriminate bastards who can strike at any time, at any age.

With remarkable consistency, every single one of the illnesses listed in that chart is most likely to happen when you’re 30 years old. Half of all customers with those ailments will get them in their 20s, the other half in their 40s and 50s. They are not illnesses of the elderly.

Once you have contracted an autoimmune disorder, it makes it harder to get serious illness cover.

You don’t need an athletic build to get the normal price for serious illness cover.

But as you get older, your metabolism slows down, so your once toned physique can start to get a bit, well, flabby.

If we don’t watch ourselves, all of a sudden, we’re at a BMI that causes a problem for serious illness cover.

So before the old waistline begin to expand even further, apply for serious illness cover. Simply waiting 12 months could mean the difference between getting the normal price and paying 50% more.

The third reason to take out serious illness cover now is family history.

This is the next most common barrier to getting the normal price for serious illness cover.

The longer you wait to get cover, the more potential there is for family history events to cause problems.

Stephen used the example of a lady, Sarah, whose mother had breast cancer in her early 50s. Sarah can get serious illness cover including cancer cover.

However, if Sarah had applied after her sister was diagnosed with breast cancer, she will face a cancer exclusion.

Get cover in place before family history events start to arise.

The longer you leave it, the more chance your parents, brothers, or sister suffer an illness that will affect your application.

Let’s move on to reason number 4 – tests/investigations.

Buy serious illness cover before you start to get symptoms that result in your GP referring you for tests

Back in the day, you went to your GP with a headache, and he’d send you home with some Anadin.

Nowadays, if you even look crooked at your doctor, they will send you off for some sort of screening.

Now I’m not saying buy serious illness cover if you have been referred for a screening or test.

Because at that stage it’s too late.

Instead, buy critical illness cover long before your GP has any reason to send you for such a screening.

Let’s move on to reason number 5:

There’s an awful lot of sugar consumed in Ireland these days and because of this Type 2 Diabetes is common and will be more prevalent in the future….at ever earlier ages.

You can’t get serious illness cover or income protection once you have been diagnosed with Type 2 Diabetes.

And your life insurance premiums will be significantly higher than normal.

But you can still get cancer cover.

Unfortunately, many of you reading this article (or your loved ones) will develop Type 2 Diabetes.

If you think you’re at risk, you should get serious illness cover while you still can.

And remember, your children are included in your policy.

Zurich Life payout if they get Type 1 Diabetes.

And finally, here’s reason number 6 not to put off serious illness cover any longer.

Cast your eyes back up to the autoimmune illnesses chart, and there are two illnesses in particular that you should note:

The reason I have highlighted these two is that they are claimable illnesses on a serious illness contract.

We see many applications from customers who have been diagnosed with multiple sclerosis in their 20s and 30s.

If only they had taken out serious illness cover before their diagnosis, they would have received a payout on their policy.

We, as an industry, are doing young people a disservice if we don’t try to get them cover before these illnesses strike.

Congratulations on getting this far, that was a whopper!

Hopefully, you found that useful, especially if you’re sitting on the fence about buying serious illness cover.

If this spurs you on to pull the trigger on serious illness cover, then I’ve done my job.

I pray you never suffer a specified illness, but if you do, you’ll look back on this article as the most important article you have ever read.

If you’d like me to make a recommendation for you, please complete this questionnaire, and I’ll be right back.

Thanks for reading

Nick

Editor’s Note | We published this blog in 2018 and have updated it regularly since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video